55 min read • Strategy

INDIA: Surmounting the economic challenges of COVID-19

A 10-point programme to revive and power India’s post COVID-19 economy

Executive Summary

The economic and social impact of COVID-19 could be devastating in the long term if the recovery from it is not wellmanaged. In this report, we offer an assessment of the impact and a 10-point programme to manage the recovery and lessen the pain, particularly for India’s most vulnerable groups, and put the economy back on a growth path.

COVID-19 involves multiple variables with highly volatile values. They fall into four key categories, and their interplay will define the impact on society, business and the economy.

- Epidemiological forecasts for COVID-19 are still evolving and they will depend upon on key factors such as R0 – or “R-naught” for the local population, that is, the average number of additional cases one patient can cause, immunity period for infected people, infectious period, proportion of asymptomatic cases, effectiveness of treatment and likelihood of rebound in subsequent flu seasons.

- The sudden cessation of economic activities in a lockdown disrupts supply chains and economic ecosystems immediately and in the medium term.

- Containing COVID-19 requires key behavioral changes, especially in an external social setting – work, travel, social functions and leisure activities. A large part of India is still traditional and religious congregations, festival celebrations and thronging of public spaces are not conducive to social distancing norms.

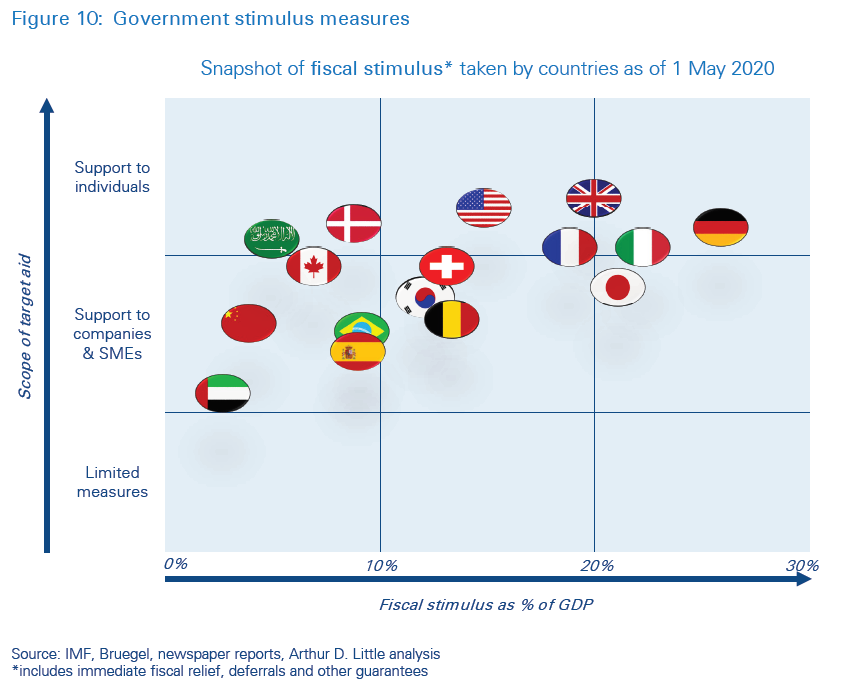

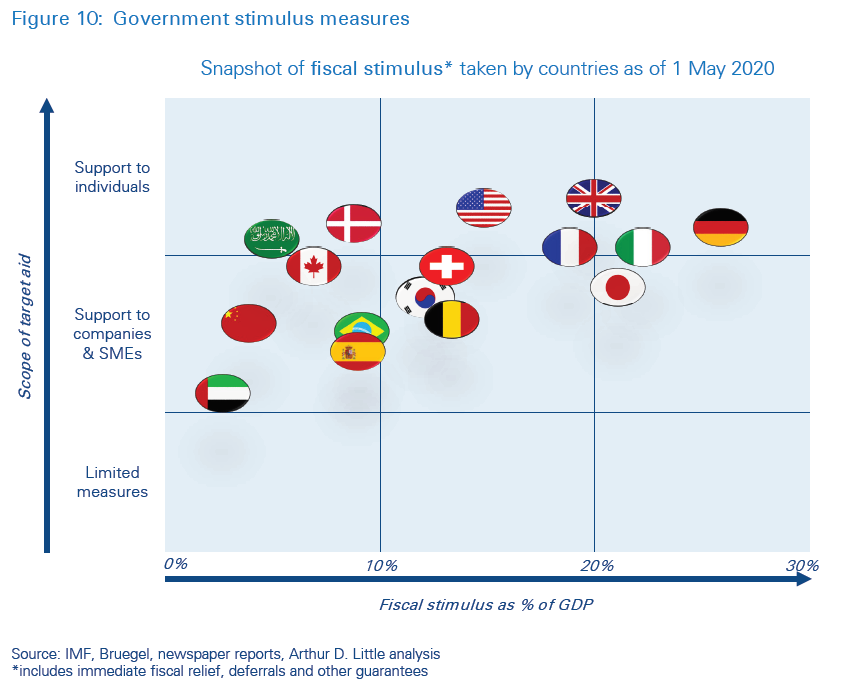

- The economic recovery will be deeply influenced by the nature and level of government interventions, which could be direct transfers to individuals, support for businesses, and expansion of national credit availability. The Indian government has thus far committed the equivalent of 1% of GDP as compared to the 10-30% of GDP committed by several advanced economies.

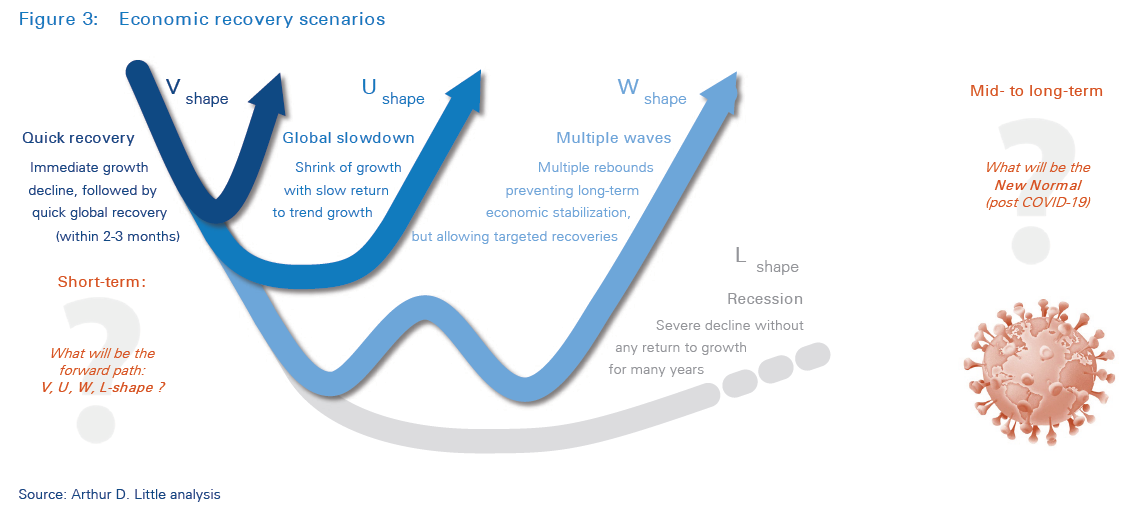

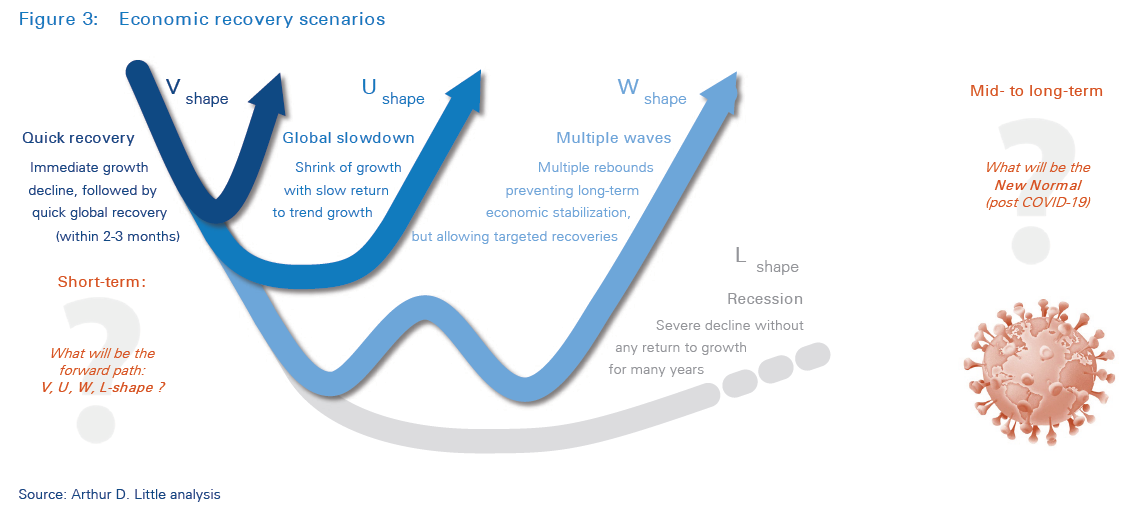

The interplay of the uncertainties described above will determine the recovery pathways.

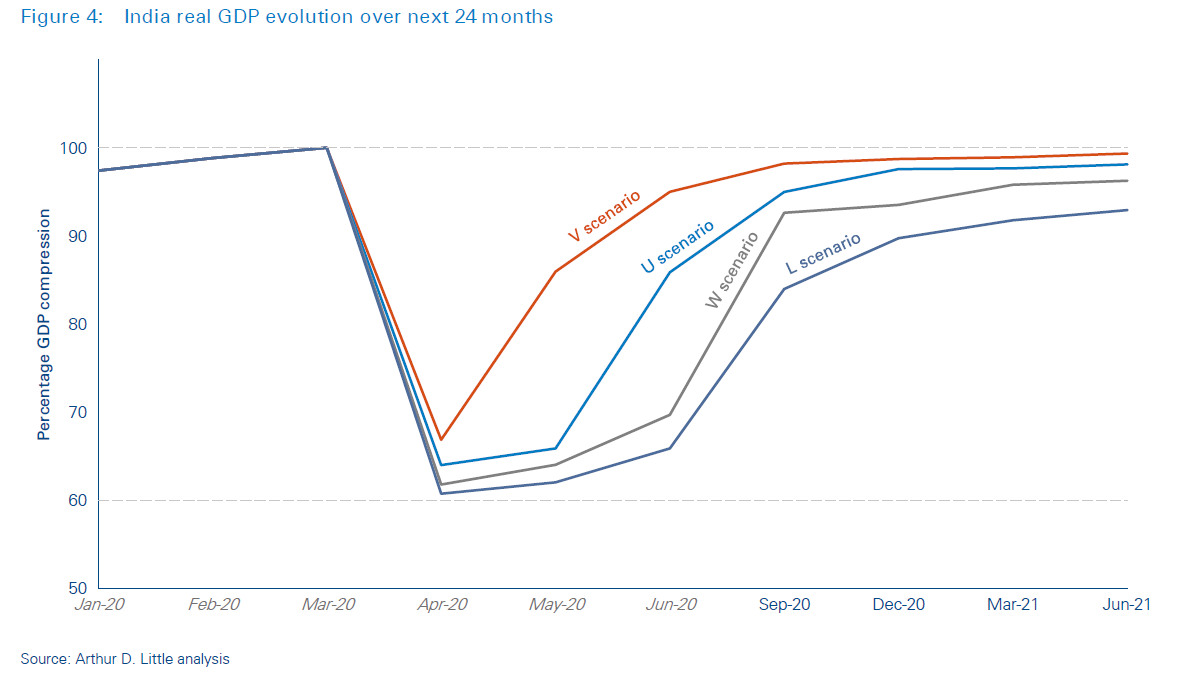

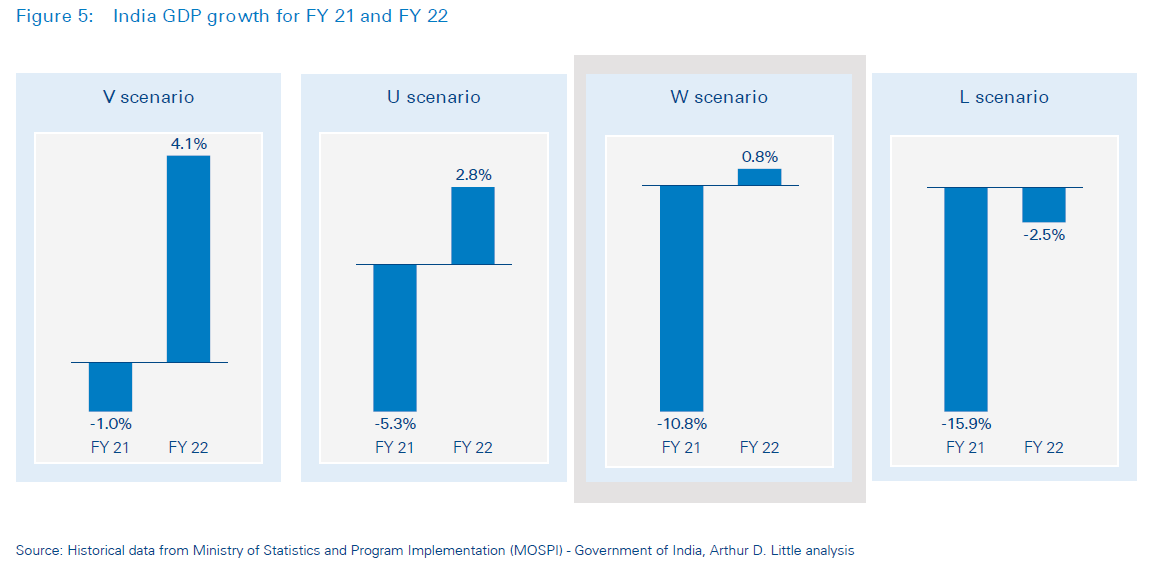

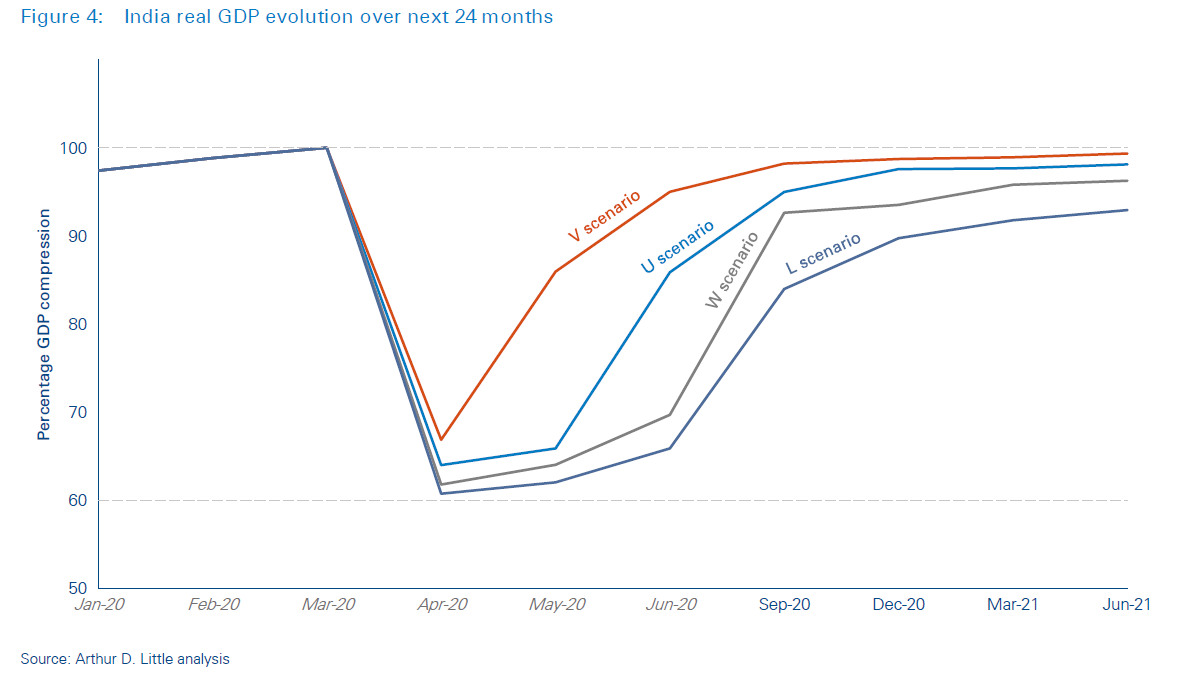

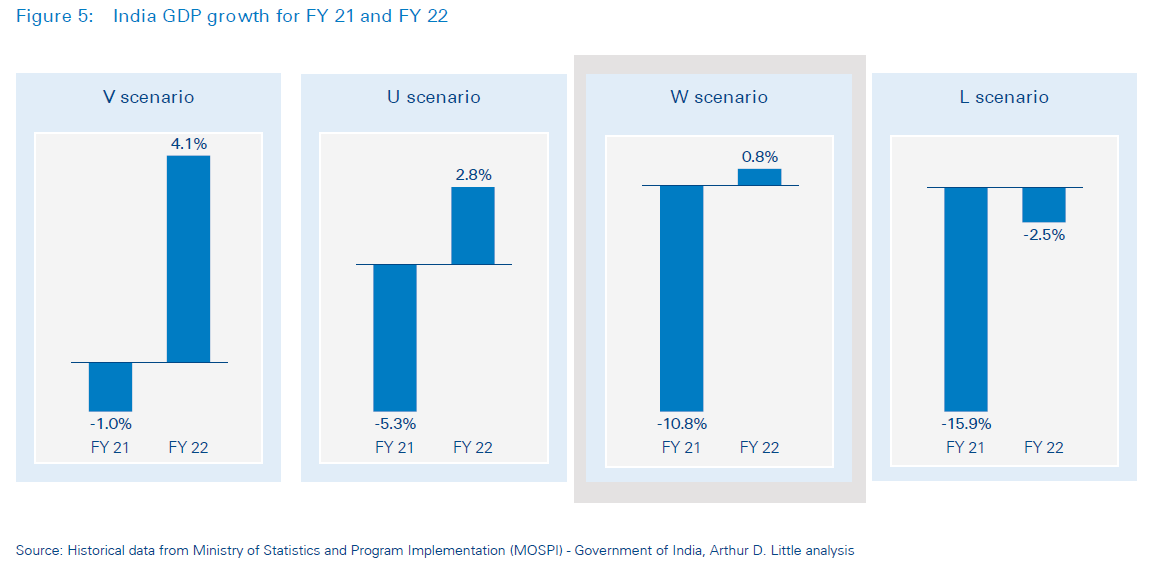

Given the continued rise of COVID-19 cases, we believe that a W-shaped recovery is the most likely scenario for India. This implies a GDP contraction of 10.8% in the Financial Year (FY) 2020-21 and GDP growth of 0.8% in FY 2021-22.

A W-shaped recovery could be India’s trajectory, assuming continuing regional/containment zone lockdowns into the autumn and winter. A continued rise in COVID-19 cases in the summer and a winter relapse at the end of the third quarter of FY 2020-21 (that is, around December 2020) could drive this scenario. With the current limited scope of stimulus measures, growth could resume in the third quarter of FY 2020-21 but then slow down or contract over the next five quarters with a few intermittent rebounds and a final recovery in FY 2021-22 as the vaccine becomes available.

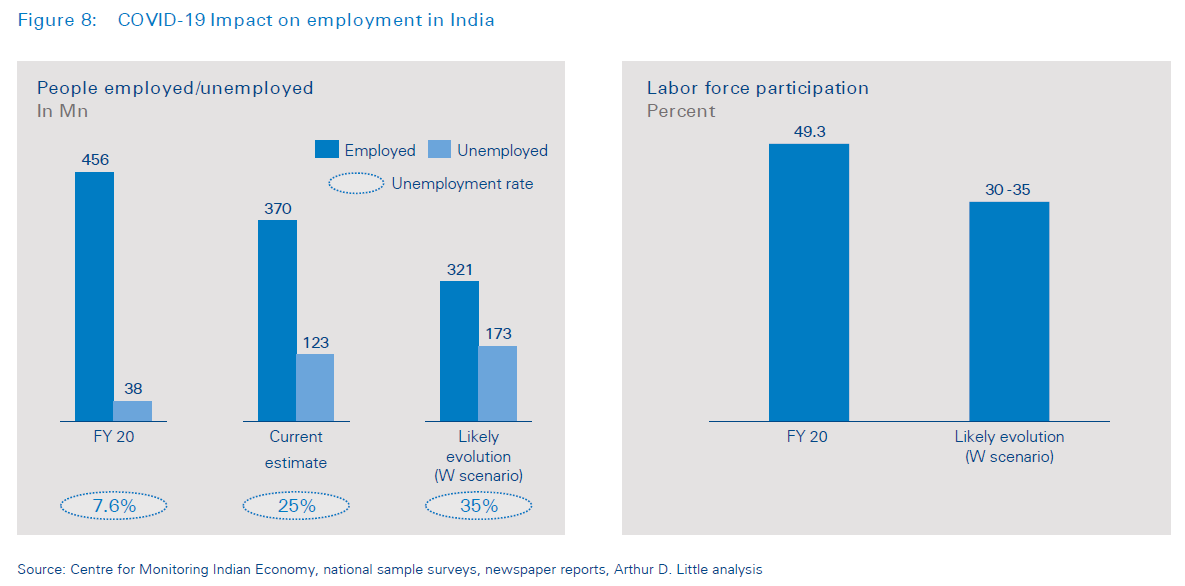

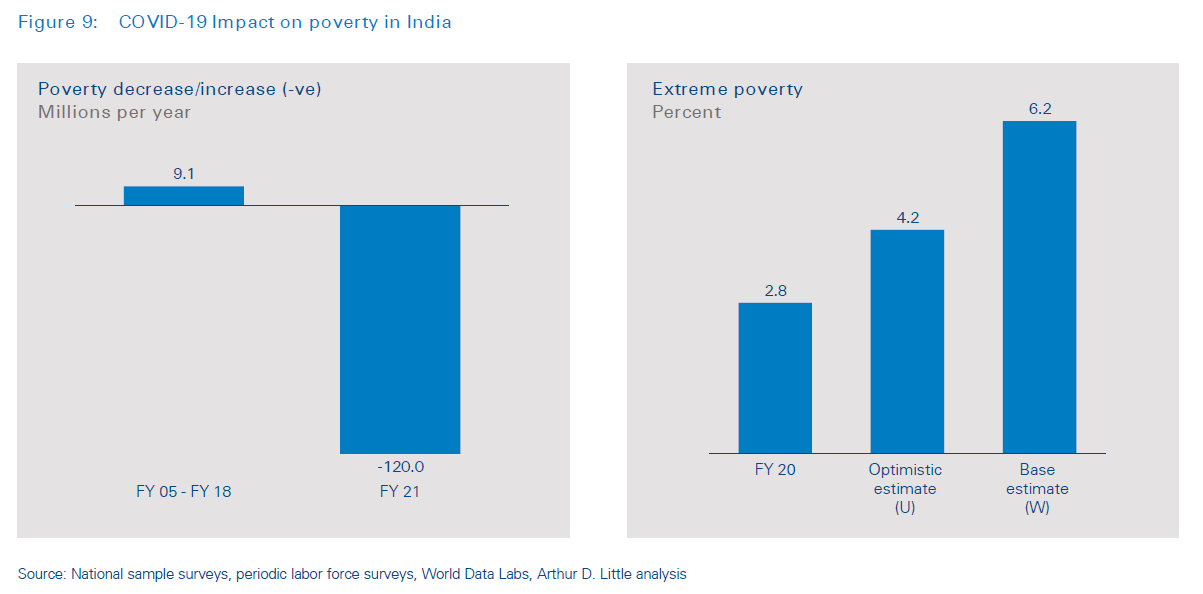

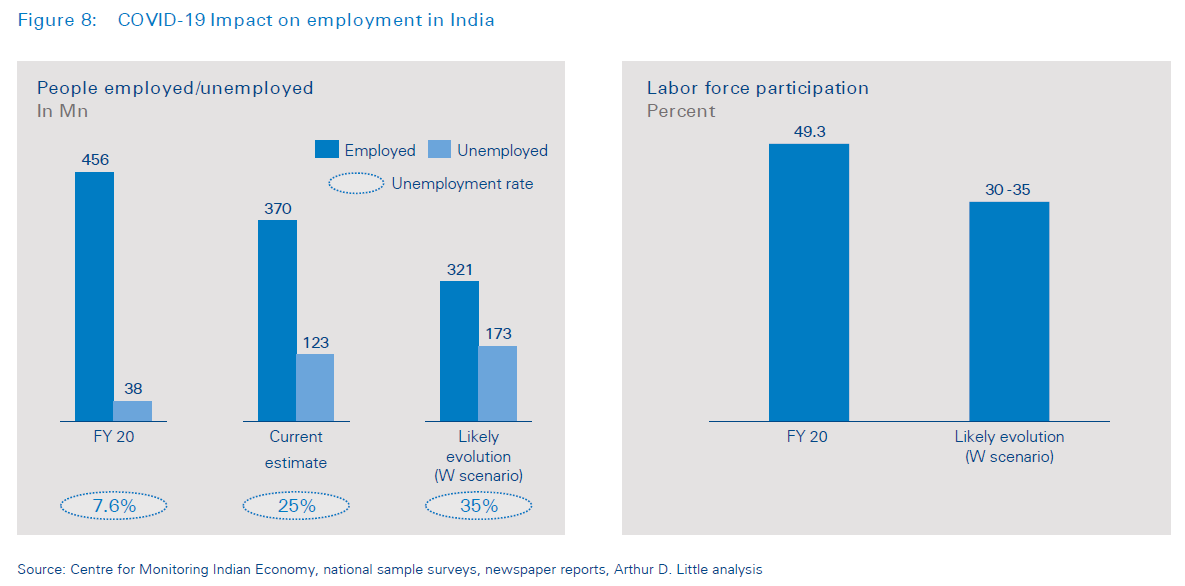

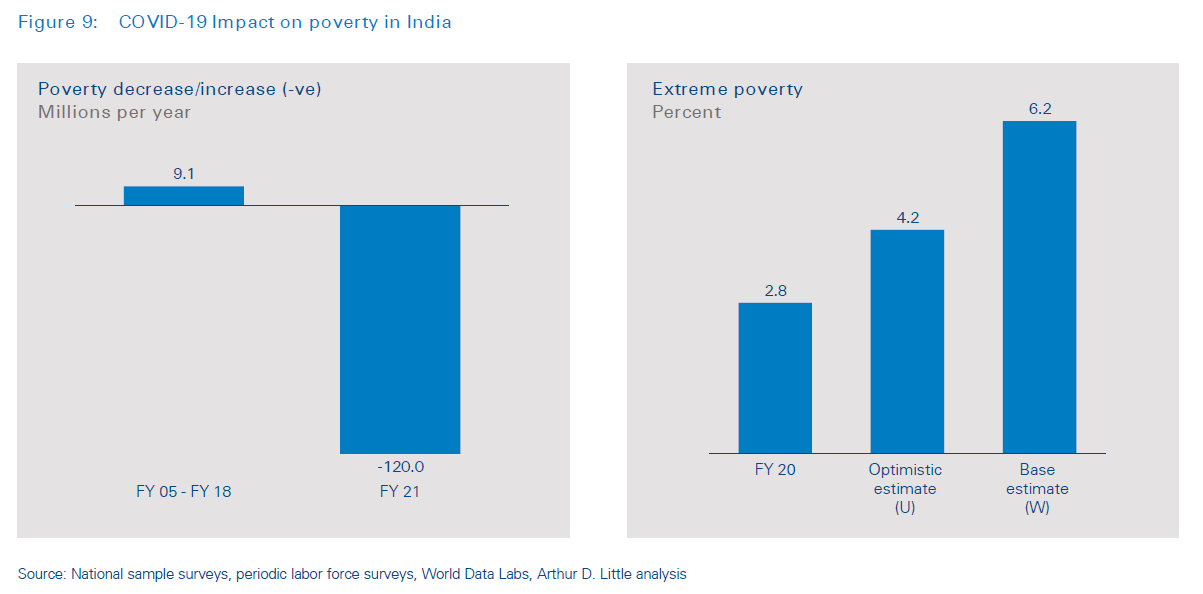

The “collateral damage” of the forecasted GDP slowdown, that is, the second-order impact, will be felt most acutely in employment, poverty alleviation, per capita income and overall nominal GDP. Unemployment may rise to 35% from 7.6%, resulting in 136 million jobs lost and a total of 174 million unemployed. Poverty alleviation will receive a set-back, significantly changing the fortunes of many, sending 120 million people into poverty and 40 million into abject poverty. Per capita income may drop by more than 10%, reducing overall consumer demand and savings. COVID-19 could create an opportunity loss of up to USD 1.0 trillion of nominal GDP.

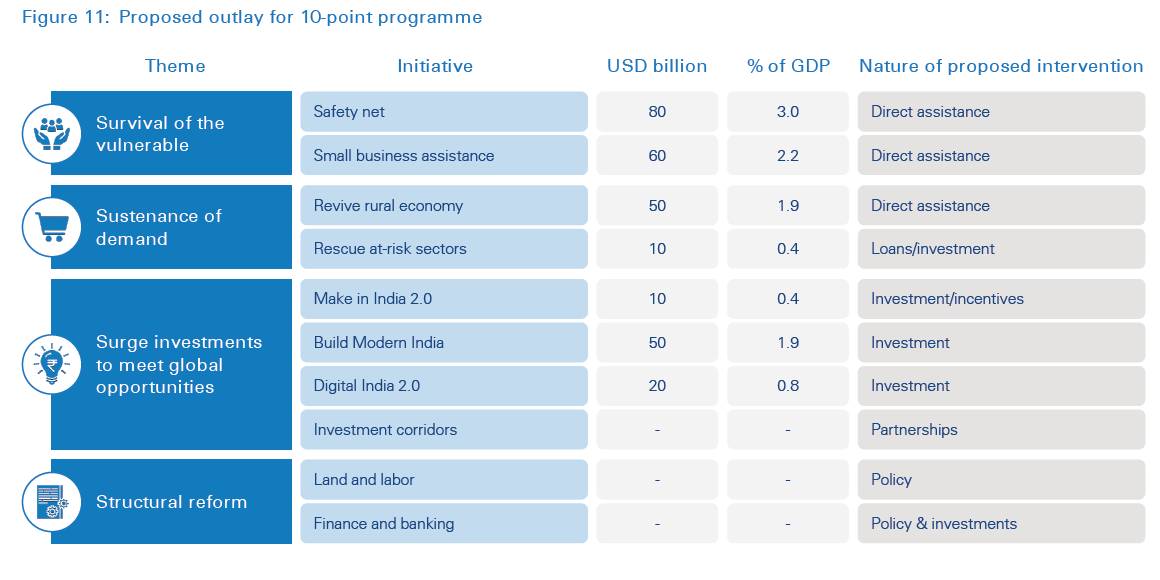

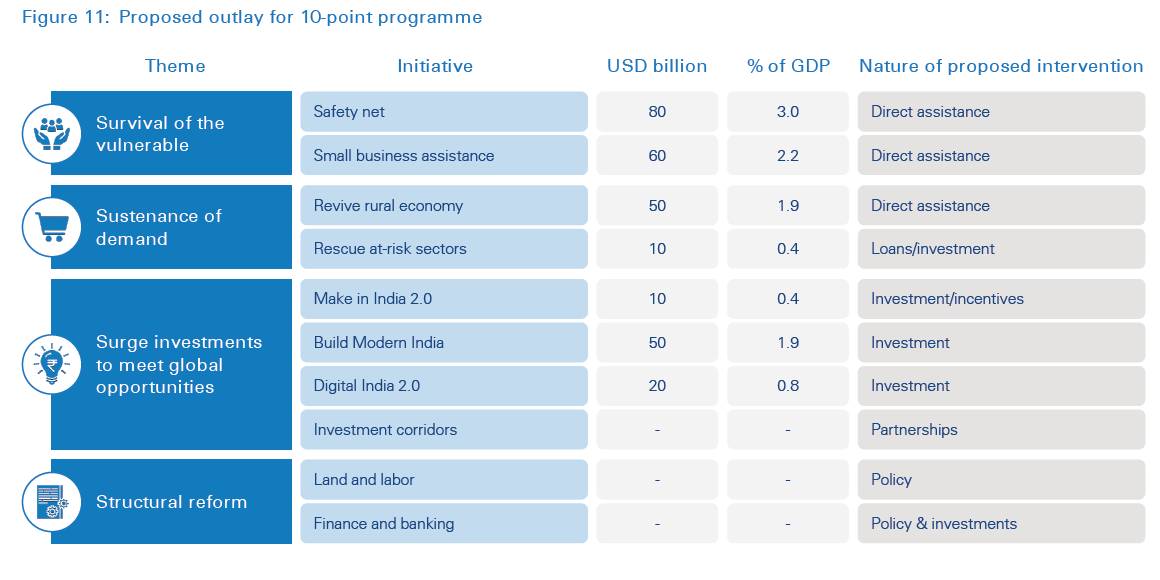

The Indian government moved fast to counter the impact, announcing a fiscal stimulus of USD 22.6 billion, while the Reserve Bank of India slashed the repo rate by 75 basis points and announced liquidity support of over USD 49.8 billion on an aggregate basis. However, a far more assertive approach may be required given the magnitude of the lost economic output. We suggest a 10-point programme to accelerate the recovery:

- Strengthen the “safety net” significantly for the most vulnerable: The government could consider expanding the scale and duration of direct benefits for the poor by transferring an additional INR 15,000 to INR 18,000 per head to 300 million Indians under the Prime Minister’s Garib Kalyan Yojana (welfare-for-the-poor plan) and providing other forms of support such as universalizing social security, increasing the monthly pension payout for senior citizens to INR 1,000 per month, and universalizing healthcare. The total proposed outlay involved could be around USD 80 billion.

- Enable survival of small and medium businesses: Provide direct assistance covering 70% of the payroll of small businesses, with a Small Business Corpus of USD 60 billion. The government could also consider deferring tax liabilities, including GST, for a period of six months.

- Restart the rural economy: Increase the maximum support price of critical crops, particularly priority cereals and pulses, and boost the funding and scope of the employment guarantee to all rural districts, with an increased budgetary outlay of USD 10 billion. This could be supported by a 6-mouth moratorium on agricultural loans, advance disbursal of fertilizer subsidies through direct benefit transfer and provision of special concessionary interest rate loans to farmers with a good credit history.

- Provide targeted assistance to at-risk sectors: The government should devise sector-specific “rescue and revival packages” structured as five- to eight-year convertible loans for several capital and labor-intensive sectors such as manufacturing, retail, hospitality, healthcare, travel and automotives, with a proposed outlay of USD 50 billion.

- Launch “Make in India 2.0” to capture global opportunities: With a focus on export-oriented industries such as pharmaceuticals, electronics, renewables, medical devices, food processing, electricals, precision components, heavy engineering, chemicals and textiles, a renewed push should be made to attract investments and improve the ease of doing business. With the changing geopolitical environment, the government could explore opportunities of moving up the value chain in existing manufacturing (for example, active pharmaceutical ingredients) and prioritize technology-intensive manufacturing, supported by attractive financial incentives. The government could consider creating a USD 10 billion corpus for providing initial seed financing, capital and payroll subsidies, for select flagship investments.

- Build “Modern India”: We suggest the creation of a USD 1 trillion infrastructure buildout fund to create a modern India across several sectors such as smart cities, urban water supply and distribution, mining, oil and gas, logistics, cold chain and modern freight transport. Multilateral low-cost funding can be accessed from countries such as Japan, the US, the UK and the EU, and the government should consider seeding up to 5% (USD 50 billion) of the mega investment fund to kick-start these efforts. The government can consider new measures to increase private participation in infrastructure projects by sharing risk equitably, proposing new Special Purpose Vehicle structures and simplifying dispute resolution and contract enforcement mechanisms.

- Accelerate Digital India and innovation: We propose that the government catalyze a “Digital Team India” initiative along with leading global technology leaders and select local players to implement digital collaboration and cybersecurity solutions for Indian companies. The government should also catalyze the creation of an “India Cloud”, a digital alliance of data centers to host India-specific data locally and launch “Start-up India 2.0” to focus on new areas such as Artificial Intelligence, blockchain-based tracing and quantum computing. In addition to reducing compliance costs for start-ups and funding support from the Small Industries Development Bank of India, the government could consider becoming the anchor customer for start-ups of these nascent industries. Separately, the government could accelerate deployment of high-speed fiber-based broadband and accelerate India’s transition to 5G. We propose that the government allocate USD 20 billion for funding these initiatives.

- Strengthen global investment corridors with the US, UAE, Saudi Arabia, Japan and the UK: The government could capitalize on growing international efforts to diversify manufacturing bases and global supply chains by creating dedicated country-to-country or government-to-government investment vehicles. The focus should be on working closely with international Sovereign Wealth Funds focused on creating priority manufacturing, infrastructure and technology assets for India and strategic international allies.

- Debottleneck land and labor: New laws and codes are needed to structurally reform the land and labor markets, to enable timely acquisition of non-agricultural land for manufacturing and infrastructure, while ensuring adequate compensation for landowners. The government could lay down a roadmap for labor reform, enabling businesses to manage their workforce in line with international norms. The simplification/consolidation of the over 40 labor codes into the proposed four laws could be prioritized and the proposed enactment of the Industrial Relations Code should be accelerated.

- Transform banking and financial markets: We propose the prioritization of banking sector reform through further consolidation and massive recapitalization (including from public equity markets). At the same time, the RBI could play an active role in bridging the financing crisis by expanding open market operations and stepping up “reverse sterilization” to compensate for foreign outflows, and expanding the RBI balance sheet to support the government. The government could consider amending the Fiscal Responsibility and Budget Management Act to allow for new metrics (debt-to-GDP ratio instead of fiscal deficit) and a relaxation of norms for the central government and the states.

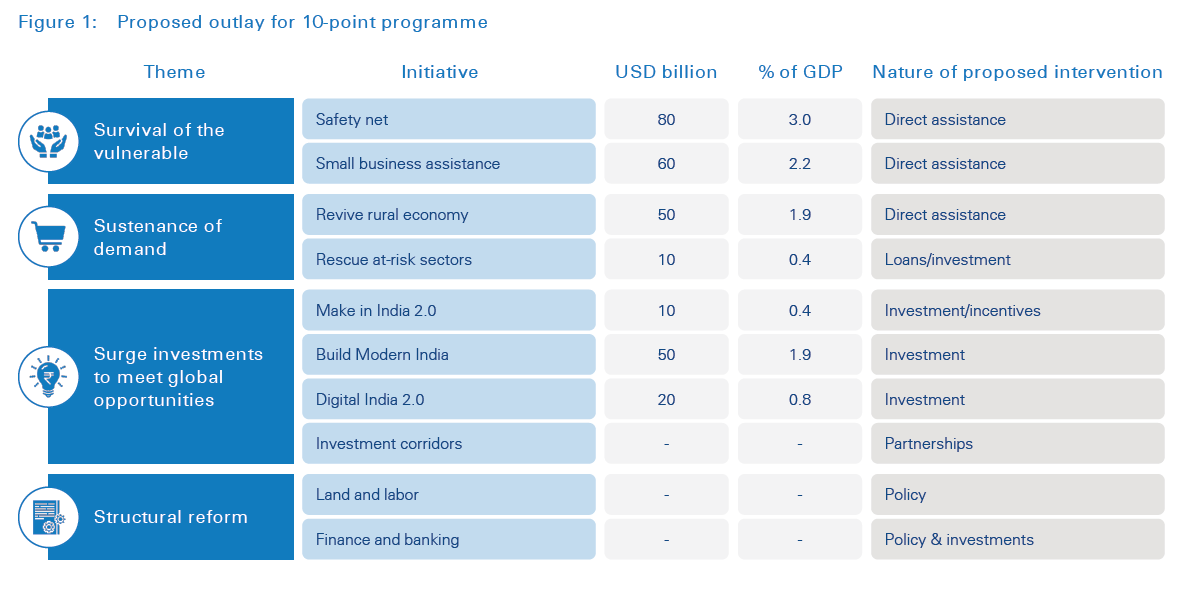

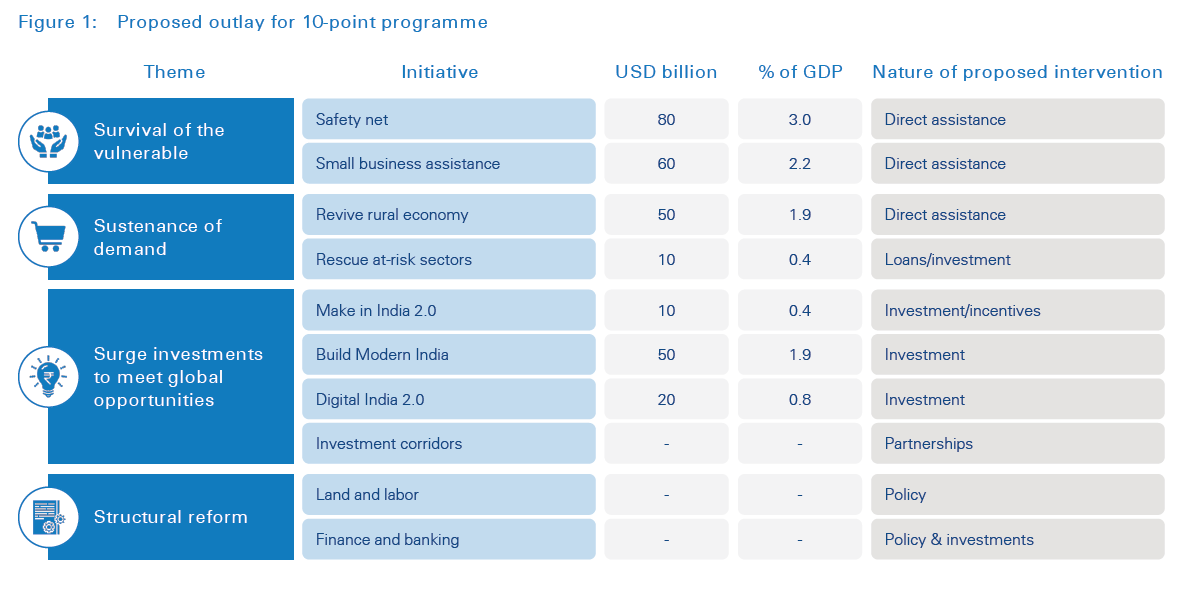

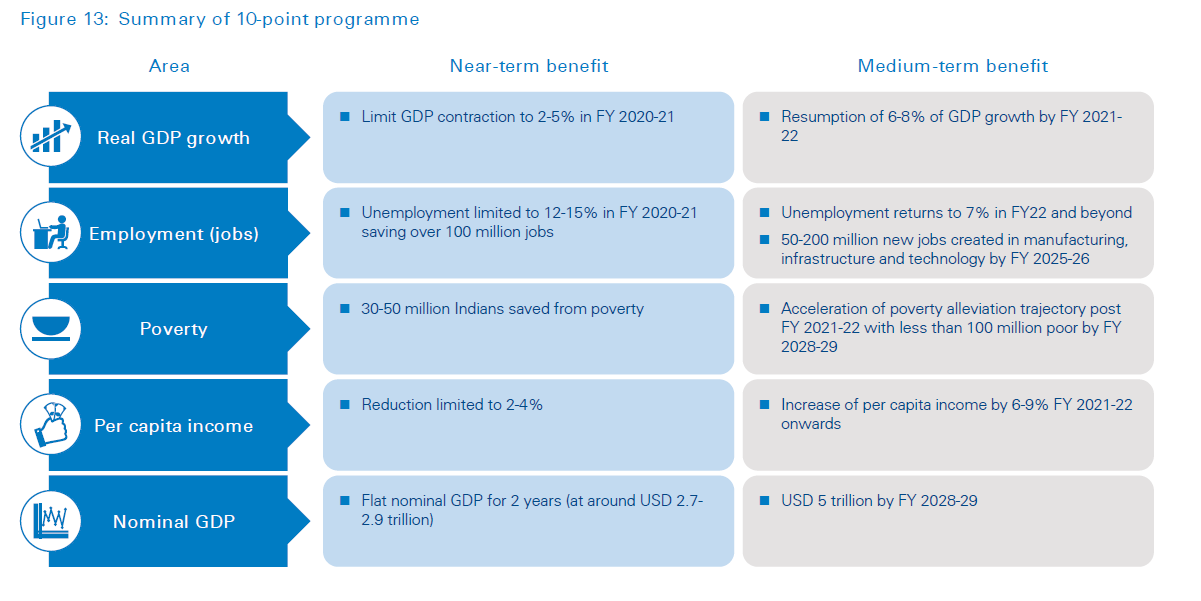

The proposed outlay for these 10 initiatives would be around USD 280 billion and represents an investment of over 10% of India’s GDP to jumpstart the economy (summarized in the table below).

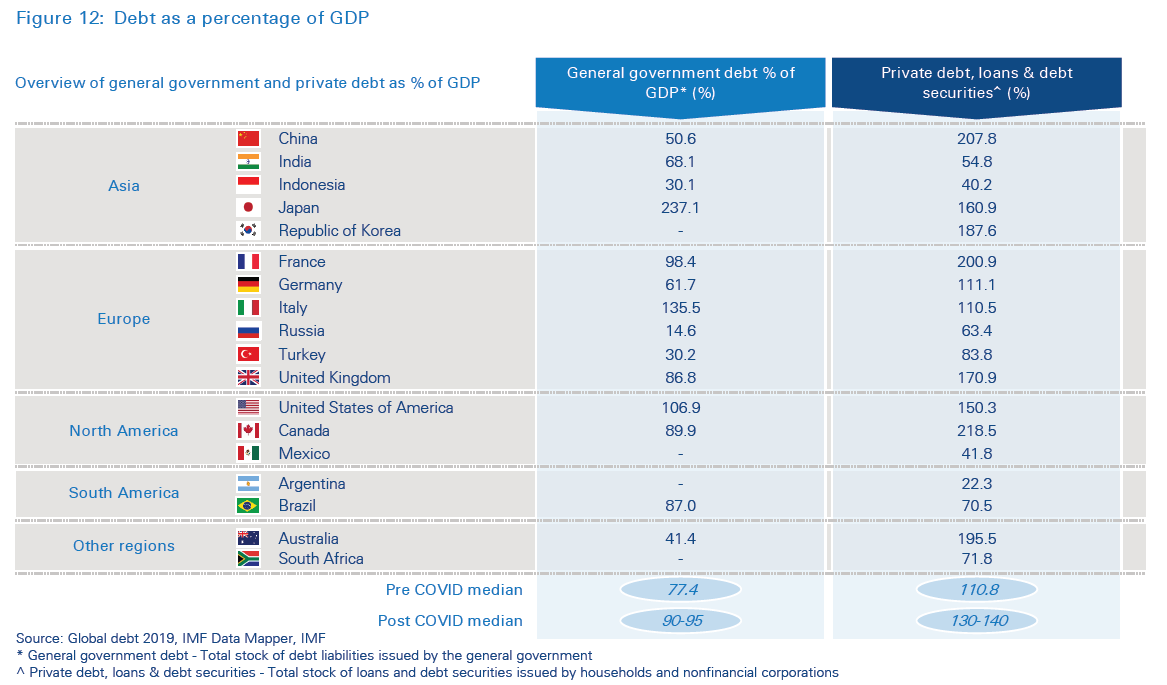

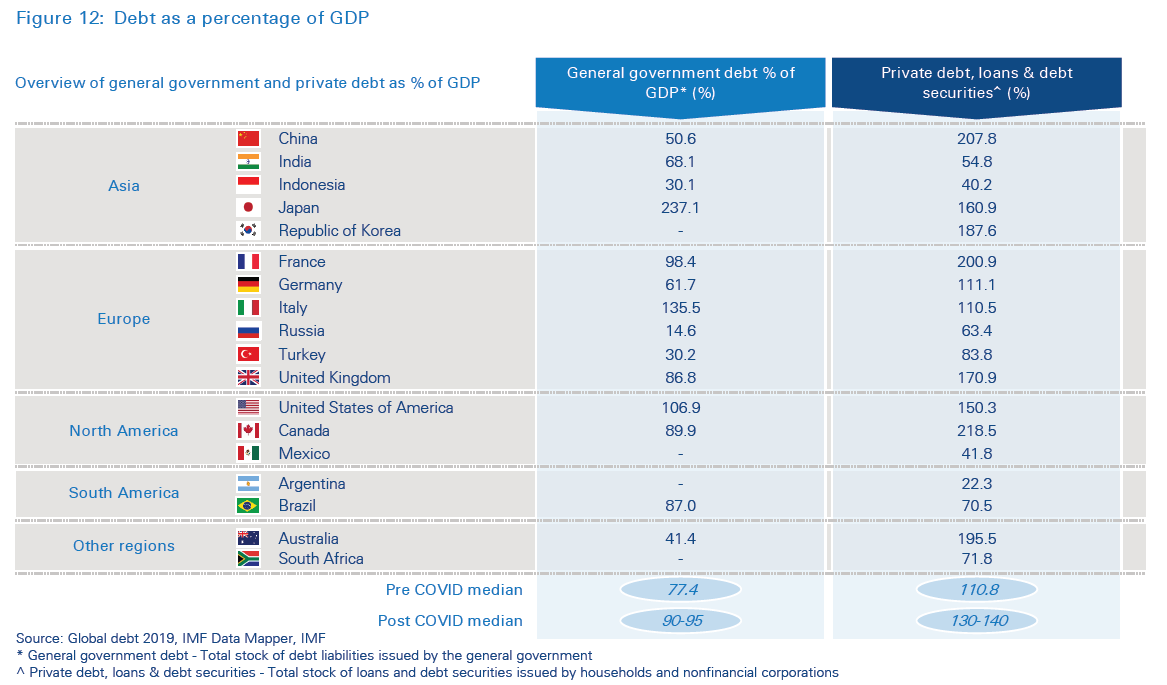

Concerns raised by fiscal conservatives that such spending is excessive, will create hyperinflation and will increase the risk of a sovereign ratings downgrade, are overstated. It is our belief that the economic shock will structurally reduce demand and employment, and hence will be deflationary in nature. As a result, international investors will understand and appreciate that extraordinary times require bold steps. Also, since these investments will be spent in the short term, India’s sovereign ratings may not be affected significantly, provided India releases a robust medium-term fiscal consolidation roadmap post COVID-19. The proposed outlay will increase India’s public debt-to-GDP ratio to 80-85%, in line with the G20 pre COVID-19 average. In fact, several large economies such as France, Germany, Italy, Japan, the UK and the US are investing 10-15% (if not 25-30%) of GDP on economic recovery (breaching the 100% mark for public debt-to-GDP ratio).

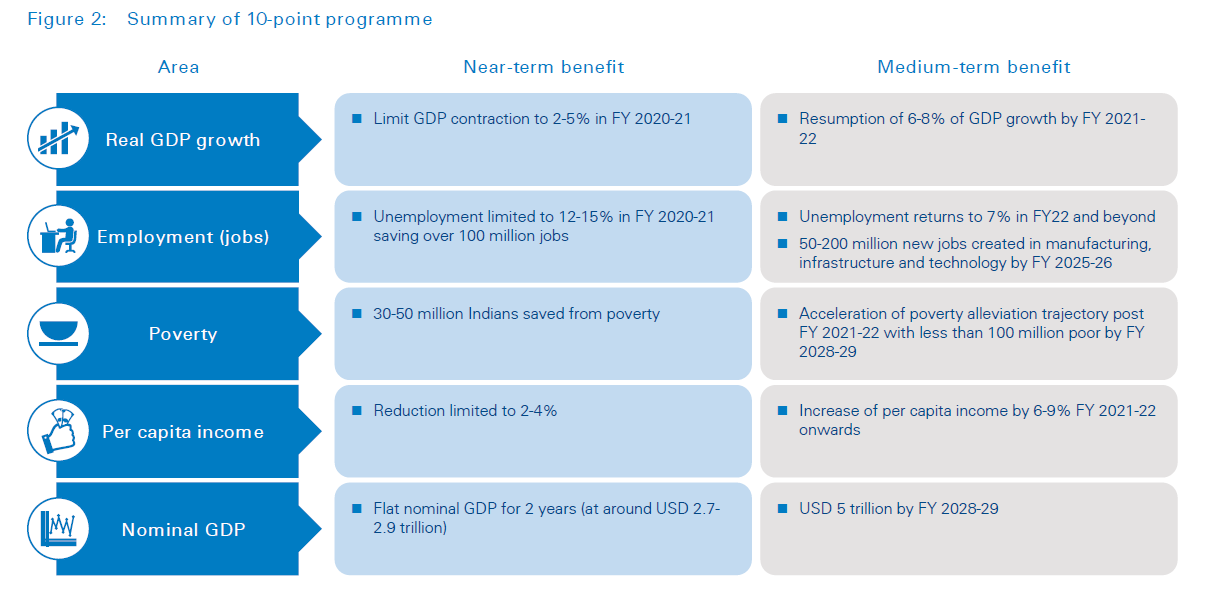

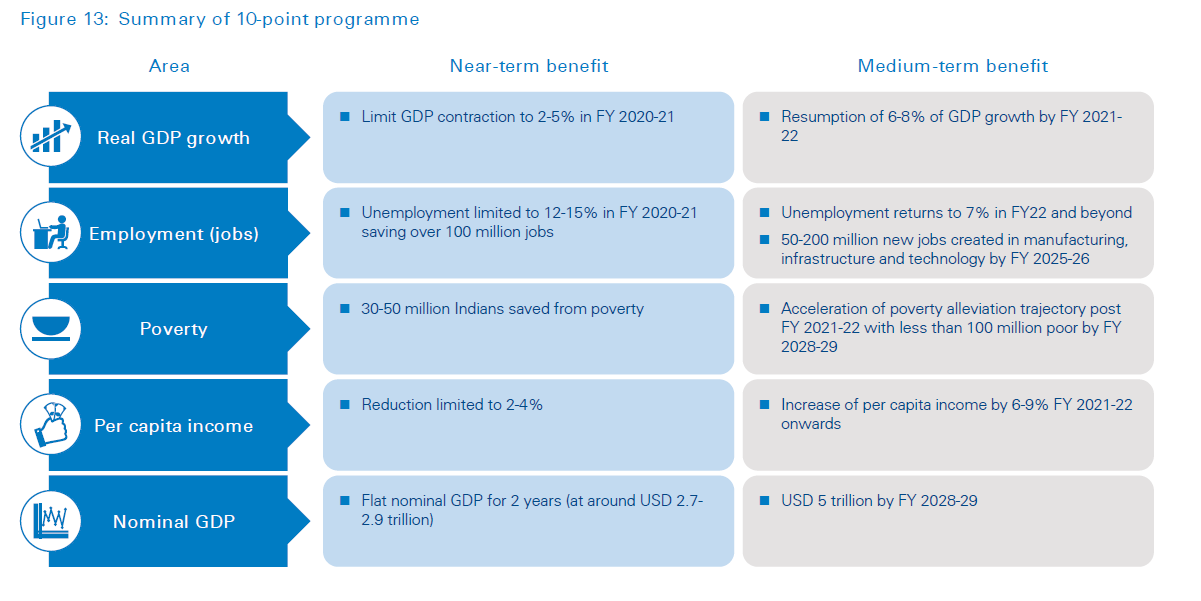

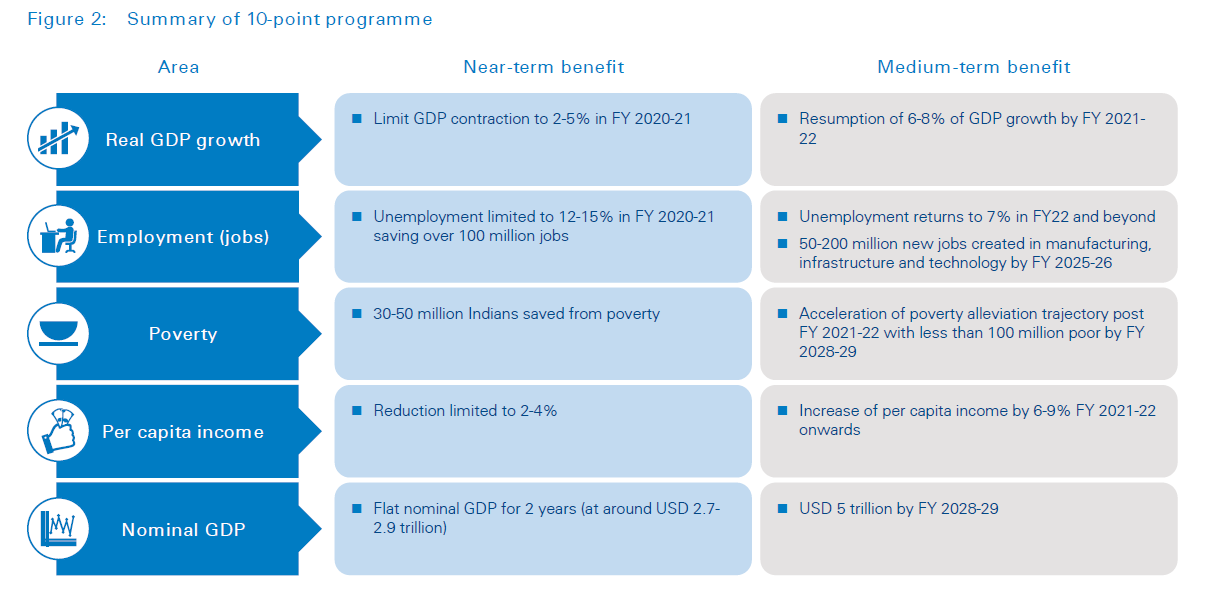

It is our belief that the cost of inaction is greater, with an anemic stimulus creating the risk of an economic tailspin from which India could take five to ten years to recover. The threat to India’s most vulnerable in terms of lost livelihoods, poverty and hunger cannot be emphasized enough if there is a 10% contraction of GDP in FY 2020-21. In fact, it is likely that, a “wait and watch” approach will shrink GDP, destroy capacity and lead to hyperinflation. The proposed programme is a way to invest in India’s future with immediate benefits (summarized in the table below) of GDP stimulus, job loss prevention and poverty alleviation, and the long-term potential to recover 50% of the investment at reasonably attractive rates of return.

COVID-19 presents a grave threat to India’s economic potential, and at the same time, is equally an opportunity for India to reexamine all the obstacles that lie in its path to greater prosperity. The government should immediately consider bold measures to secure a sustainable economic future for 1.3 billion Indians. These famous words were never truer than today: “There is a tide in the affairs of men, which, taken at the flood, leads on to fortune.”

1

The report by numbers

-10.8% FY 2020-21 likely real GDP growth

0.8% FY 2021-22 likely real GDP growth

136 million incremental job loss

From 7.6% to 35% unemployment

From a 10 million annual decrease in India’s poor to a 120 million increase

From 2.8% to 6.2% in abject poverty

10% reduction in per capita income

USD 1.0 trillion opportunity loss of nominal GDP in FY 2021-22

USD 280 billion cost of transformation package

7% (assistance) + 3% (investment) breakdown of programme (as % of GDP)

2

Putting humanity at the forefront of India’s economic response

Counterpoint from Ashwini Deshpande, Anisha Sharma and Aparajita Dasgupta

Centre for Economic Data and Analysis (CEDA), Ashoka University

The report focuses on the economic and social impacts of the COVID-19 pandemic and resultant lockdowns. The costs of seriously diminished economic activity are going to be substantial everywhere, but developing economies with large informal sectors, such as India, are going to be particularly vulnerable.

The report highlights that we are dealing with a high level of unpredictability and uncertainty. Thus, even the most comprehensive analysis will have to be updated almost daily, incorporating new information as soon as it becomes available. The report groups uncertainties into four major categories: epidemiological evolution of COVID-19; disruption of supply chains and business ecosystems; the possibility of behavioral change; and the specifics of government response. Based on a likely interplay of the many elements of these four uncertainties, the report predicts a W-shaped recovery, which means that the lockdown will result in a decline in economic activity, followed by a rise as lockdowns ease, again followed by lockdowns and decline in economic activity due to a renewed surge of the disease, to be followed by easing and renewal of economic activity. The report talks about several alternate scenarios including a V and U-shaped recovery, which assumes effective pandemic control by end-May 2020 and a relatively fast economic recovery, and an L-shaped recovery, which assumes continued challenges in pandemic control resulting in diminished economic activity until a vaccine is developed and scaled-up.

Our response can be summarized as follows:

- India’s economic recovery may follow a series of recurring W-shaped cycles of sudden dip in economic activity following a lockdown, and some renewal following a relaxation of lockdown. Furthermore, the likelihood of an L-shaped recovery will become clearer over the next two weeks depending on the actual experience of renewal of economic activity in the orange and green zones.

- The medium- and long-term prognosis for the Indian economy matters because a reversal or even a halt in its growth and poverty alleviation agenda would push millions into poverty, with serious consequences for their lives as well as for the possibilities of economic recovery.

- The recovery programme proposed has two components – to provide a comprehensive safety net for vulnerable sections and to jumpstart the economy. This is ambitious and requires a sizeable outlay, notably 10% of GDP as proposed in the report. But, in view of the magnitude of the crisis, we agree that the cost is worth it and fiscal sustainability should not be a concern right now.

- Support for micro, small and medium enterprises, which comprise the backbone of the Indian economy, is critical for an economic recovery. However, details of the intended scope and support need to be worked out with care.

- Lockdowns and a decline in economic activity affect different social groups differently. Measures directed specifically at groups including women, children and vulnerable minorities, who have been subjected to even more violence than usual at this time, are essential to prevent large-scale social breakdown and its economic consequences.

- A population in poor health cannot contribute to fast economic recovery, even if other economic conditions for recovery are in place. Recognizing that health interventions and economic policy are complementary, urgent steps are needed to safeguard the health of all, including non COVID-19 patients, the well-being of our medical staff and the continuance of preventive interventions that are at risk of being neglected in the current situation.

- Clear policy announcements, comprehensive safety nets and decentralized systems of governance will be essential to not only flatten the curve but also enhance disaster readiness going forward.

In the rest of this section, we expand on the major conclusions described above.

India has experienced one of the most stringent lockdowns globally. In an international comparison of 73 countries, including countries much worse affected by COVID-19, India gets the maximum score of 100 on stringency. Another international comparison reveals that, while India is very high on stringency, it is spending barely 1% of GDP on safety net policies.

The medium- and long-term prognosis for the Indian economy matters for several reasons. One, given the relatively robust growth rates of the economy until 2016, India was seen as a major contributor to global growth. Two, India’s relatively young population meant that, with the right set of policies, this demographic dividend could propel the economy towards an even higher growth path. Three, the country had been making sustained progress in poverty reduction since 1991, a process that needed to be strengthened and accelerated. A reversal or even a halt in this process would push millions into poverty, with serious consequences for their lives as well as for the possibilities of economic recovery. Four, despite decent growth, the Indian economy has not been able to weaken inequalities along various axes – caste, gender, religion, tribal status, region and language. The link between growth and inequality is not straightforward (i.e., both higher and lower growth could increase inequalities); however, persistence or sharpening of inequalities without growth is a recipe for massive social discontent and turmoil. Thus, the derailing of growth due to COVID-19 and associated lockdowns, growth that had already been faltering since 2016, is extremely worrisome.

Will the decline in economic activity follow a W-shape or an L-shape?

In the CEDA policy brief we argue that a vaccine is unlikely to be available in a scaled-up version for at least 18-24 months. This implies that a W-shaped scenario is likely for several economic activities, even if the spikes are small. However, there is every likelihood that, instead of a single W, there might be a series of recurring W-shaped cycles of sudden dip in economic activity following a lockdown, and some renewal following a relaxation of lockdown. Whether it is a W or an L will become clearer over the next two weeks depending on the actual experience of renewal of economic activity in the orange and green zones. A lockdown is a good “off” switch, but a lifting of the lockdown is not an automatic “on” switch. As we stress below, economic activity in India is heavily labor-dependent: the initial 40-day strict lockdown has seen a surge of migrant workers heading back to their villages, as they are out of work and on the verge of starvation. It is unrealistic to expect them to move thousands of kilometers back and forth at every lockdown/relaxation.

We bucked earlier recessions. Why not now?

A key lesson from earlier global recessions (2001 or 2008- 2009) is that relatively strong domestic demand insulated the Indian economy to a large extent and prevented a drastic decline in GDP growth. This factor is not going to cushion the Indian economy in the pandemic-induced recession. For one, growth was already slowing down before the pandemic for many reasons, including two large back-to-back negative economic shocks due to demonetization and the new GST regime. Both of these had already resulted in a sharp fall in domestic demand, leading to low and sluggish growth. The crisis of demand was already in place before the pandemic hit. The drastic fall in economic activity means job and income losses for an unprecedented number of people, further exacerbating the demand crisis.

All hands need to be on deck at this time. The government should utilize the large reservoir of expertise and scientific knowledge (doctors, scientists, economists, epidemiologists, public health specialists) both in India and abroad. This would be a good time to address the lack of data in the public domain and to encourage independent research in order to plan well and build accountability.

Who will be the worst hit?

The report classifies industries by their likelihood of being worst hit and least hit. The industries most likely to be affected due to lockdowns and demands of social distancing will be aviation, hospitality and tourism. Construction, especially in the urban areas, will also be hit badly. It goes on to alert us to high unemployment and a massive increase in poverty. It correctly highlights that a policy framework needs to focus on the most vulnerable. The paper goes into a fair amount of detail, dealing with a stimulus package targeting small business, providing targeted assistance to at-risk sectors, and so on. It makes a bold recommendation for an outlay of USD 280 billion or roughly 10% of India’s GDP in order to jumpstart the Indian economy. This outlay has two components – one is to provide a comprehensive safety net to the vulnerable sections and the other is to jumpstart the economy. This is ambitious but, given the magnitude of the crisis, we agree with the view that the cost is worth it and fiscal sustainability should not be a concern right now.

Targeting the MSME sector is vital and has to be done right

The creation of a USD 60 billion fund to support small and medium enterprises, which comprise the backbone of the Indian economy, is a critical step in supporting the economic recovery. However, details of the intended scope of this proposal and how to transfer the money to firms need to be worked out with care. Two suggestions have been made in the report: the first is that the government consider payroll support of the kind extended in the US and several European countries, so as to allow firms to retain up to 75% of their workers at a cost to the government. The scope of this proposal in India, however, is necessarily limited to a small set of firms. There are an estimated 63 million micro, small and medium enterprises that employ a total of 110 million workers. The large majority of these firms are microenterprises, which employ fewer than two people on average. Financial support based on worker retention is essentially meaningless for own-account workers and household enterprises. On the other hand, 300,000 small and medium enterprises employ 3 million workers and could, in theory, benefit from payroll support. In practice, given the high incidence of casual and informal workers in these firms, it may be less administratively onerous to link financial support to their tax filings rather than to their payroll.

The second suggestion in the report is that firms be offered a subsidy through deferred GST payments. Some flexibility in delaying GST payments has already been extended to firms by the government, but we believe the extent of support needs to be much more ambitious. One suggestion put forward is that government could transfer cash to firms by buying “pseudo equity” stakes in them, to be recovered through higher taxes on profit in subsequent years rather than through deferred GST liabilities. These recoveries should begin only when conditions return to normal, which could be at least a year later. Again, such schemes can be extended only to the 13 million firms that are registered with the government and which file taxes.

The 107 million own-account workers and household workers who largely comprise the microenterprises should be supported through more straightforward mechanisms, for example, direct cash transfers to their bank accounts and the removal of supply chain bottlenecks and, where possible, restrictions on movement.

Lockdowns have unequal impacts

The main point to recognize is that large segments of economic activity, especially in urban areas, run on the backs of workers employed informally or casually, often on daily wages, who are circular migrants. These workers are either wage workers (construction or factory workers, shop helpers, workers in the transportation sector, hospitality, etc.) or self-employed (small shopkeepers, running dairy, poultry, livestock businesses, or eateries, barbers, tailors, electricians, plumbers, etc.). The sudden closure of economic activity means that they no longer earn an income, with no certainty about when and in what form economic activity can resume. They also live in extremely inhospitable, congested and unsanitary environments in cities, where concepts such as social distancing and the recommended hygienic practices are meaningless, and therefore, expecting a massive behavioral change is not realistic.

However, even within economically vulnerable populations, social identity matters. Therefore, it is equally important to recognize that lockdowns and decline in economic activity affect different social groups differently.

Gendered impacts of lockdown

Many impacts of the pandemic are gendered. Women are over-represented among essential workers, who are vital but underpaid. Frontline health workers, such as Accredited Social Health Activists, primary health care workers and nurses are mainly female and are under-supplied with personal protective equipment and underpaid. Lockdowns impose unequal burdens of housework and care work on men and women everywhere, but disproportionately more in societies such as India, where women spend much more time on domestic chores and care work.

UN Women has focused attention on the “shadow pandemic”: women calling helplines because they or their children are being abused at home, with or without physical violence. The lockdown provides the perfect opportunity to the abuser to practice “intimate terrorism” – dictate and control all actions and movements of women, with violence if needed.

The increased violence is not just a result of frustration due to physical confinement. The pandemic has brought in its wake a global slowdown, massive economic dislocation, closed businesses, the spectre of looming unemployment, often accompanied by the threat of hunger and poverty, for what seems to be the indefinite future. While both men and women are affected by the economic downturn, there is evidence that violence against women increases during episodes of high unemployment. Reaching women in distress needs to be classified as an essential service, to be treated with the highest urgency by the police.

Another concern is reduced access to contraceptives due to the shutting down of condom manufacturing units. Previous research has found that natural disasters have led to significant increases in childbirth rates, leading to significant challenges such as reduced investments in children, particularly girls, and adverse effects on women’s health.

Economic recovery and health policies are intertwined

The complementarity of health and economic policy needs to be exploited for a faster recovery path. Behavioral initiatives can only work if there is clear communication to minimize stigma around the disease and increased voluntary testing. We also need to note the toll of the crisis on emergency health care services in the country. We are close to a virtual breakdown of essential preventive healthcare services such as routine checks for TB, spraying for dengue/malaria, nutrition service in schools and anganwadis (playschools), vaccination for children, distribution of iron and folic tablets for anaemia and supply of blood in blood banks to name a few. Admissions for non COVID-19 critical illness under the Ayushman Bharat programme (a flagship government scheme to provide free health coverage at the secondary and tertiary level to the bottom 40% poor and vulnerable populations) have come down drastically. A population in poor health cannot contribute to fast economic recovery, even if other economic conditions for recovery are in place.

Relief measures and policies need to be announced in advance

One of the defining aspects of the global pandemic is the fundamental uncertainty associated with it. In these difficult times, it is even more important that government not add further uncertainty. When we wrote this first, it seemed obvious, almost trite, but given that this is consistently missing from policy announcements at the national level, we feel compelled to repeat that there must be a pre-established, forward-looking policy framework in place that commits to providing a safety net to vulnerable people.

Policy needs to take a comprehensive view of the vulnerabilities, both material and psychological, that vast sections of the population will be exposed to, in the event of repeated lockdowns. As debilitating as the material consequences of scarcity are, the psychological damages that it produces are equally striking.

A few states such as Kerala and Odisha have shown how clear policy announcements, comprehensive safety nets and decentralized systems of governance can not only flatten the curve immediately, but also enhance disaster readiness going forward.

Pandemic containment should not be at the cost of widening social schisms

The pandemic has seen ugly, vicious expressions of racist and communal hatred, in the spread of which mainstream media has taken an active part. Government machinery, particularly the police, must be vigilant in preventing discrimination and ensure that relief, assistance and materials reach everyone, irrespective of their caste, religion, or tribal status.

The pandemic will abate one day. But if it leaves behind a large population that is unhealthy because of being deprived of minimum subsistence, India’s growth potential will be adversely impacted for several years to come. If unbridled bigotry is allowed to flourish under the “new normal”, the resulting discrimination will result in large parts of India’s vast reservoir of labor remaining under-utilized and incorrectly rewarded.

As we battle a grave health and economic crisis, we need to put humanity center-stage. That is the only way to devise a long-term policy framework that alleviates human suffering, especially of the most vulnerable.

3

A perfect storm: Interplay of COVID-19 uncertainties will define impact

India is faced with tackling the economic and social impact of COVID-19, which will be more dire than anyone has ventured to imagine. But forewarned is forearmed and an unflinching assessment of the impact, accompanied by pragmatic measures to mitigate that impact, is the only way forward. We offer that assessment in this report, as well as a 10-point programme to lessen the pain, particularly for India’s most vulnerable groups, while restoring the economy to the best health possible.

India reported its first COVID-19 case on 29 January 2020, a medical student studying in Wuhan who had returned to Kerala on 24 January. On 21 March 2020, as the total confirmed cases in India reached 332, the country went for a voluntary one-day curfew on 22 March 2020. It was followed by a 21-day nationwide lockdown from 25 March to 14 April, later extended to 3 May 2020 and subsequently extended to 17 May 2020 with a few relaxations. As of 10 May 2020, India had reported over 65,000 cases and more than 2,000 deaths. Infections and the death toll will keep rising and so will the damage to people and businesses. Containing the virus needs to be the primary focus. But a priority alongside should also be estimating the impact of the pandemic and associated public health measures on the Indian people and the economy – particularly on growth, jobs and unemployment, and overall poverty.

COVID-19 is a classic case of a highly dynamic uncertain situation. The high number of unknown variables and the highly volatile expected values of those variables, will significantly affect economic outcomes. Hence, we have taken an uncertainty-driven approach to create scenarios of COVID-19’s impact on India. The major uncertainties can be grouped into four key categories, as described below. The interplay between them will define the impact on society, business and the economy.

Uncertain epidemiological evolution

As of 10 May 2020, COVID-19 had infected more than 4.1 million people with more than 280,000 fatalities globally. The number of cases, on average, that an infected person will cause during their infectious period is defined by the US’s Centers for Disease Control (CDC) as R0 (“R naught”). For COVID-19, an early estimate of the median value is 5.7. For reference, the SARS outbreak in 2002-03 had an original R0 of approximately 2.75, which later dropped to below 1 due to quarantine measures.

Epidemiological forecasts for COVID-19 are still evolving and will depend on key factors such as R0 for the local population, immunity period for infected people, infectious period, proportion of asymptomatic cases, effectiveness of treatment and likelihood of rebound in subsequent flu seasons. These uncertainties will likely persist until a vaccine is developed and deployed at scale to the population. However, the timeframe of development and availability of vaccines is at least 18 to 24 months, meaning the earliest time one will be available is the autumn of 2021.

Measures such as lockdowns have helped flatten the curve, that is, slowed the rate of increase in number of total cases, and lowered the burden on the healthcare system. A preliminary report by researchers associated with the Indian School of Business, Indian Statistical Institute, Delhi, and the US’s Brookings Institute suggests that, without the lockdown, total COVID-19 cases in India would have exceeded 3.4 million (cases doubling every 3 days) instead of the 33,062 confirmed on 29 April 2020 with the lockdown.

Conversations with several experts suggest that the increase in COVID-19 cases in India is expected to continue late into the autumn (mid-September). Furthermore, a resurgence of the virus is likely in the winter of 2020 in conjunction with the flu season. Accordingly, it is sensible to assume that India will likely see physical restrictions and hot-spot isolation strategies until herd immunity is achieved or a vaccine is deployed at scale. Along with another series of national lockdowns later in the year if the isolation strategy is not effective, this bodes further adverse outcomes for India.

Significant disruption of critical supply chains and business ecosystems

A dramatic closure of economic activities in a lockdown creates immediate and medium-term disruptions in supply chains and economic ecosystems. For example, access to labor and capital is constrained and so are logistics. Volatile consumer demand further complicates the supply chain and ecosystems. In the medium term, there could be more dramatic consequences including a structural drop in labor force availability and the bankruptcy of important ecosystem players and supply chain intermediaries.

In India, key economic centers of the country and urban population clusters, such as Delhi, Mumbai, Bengaluru, Chennai, Kolkata and Hyderabad, are reeling under escalating COVID-19 cases. Even after the national lockdown is lifted, many industries may face selective isolation measures over the next few months.

The government has created guidelines for gradually restarting operations in special economic zones, export-oriented units, units outside municipal limits/rural areas and industrial estates and townships. However, the Federation of Indian Export Organizations has said that many protocols suggested by the government are difficult to implement and will significantly increase compliance costs for medium to small enterprises. The absence of migrant labor and other labor working extensively in supply chains, which will not easily return to work, will be a major challenge to achieving optimal output. Moreover, India’s reliance on import of components for key product categories is likely to exacerbate supply chain challenges to achieving full economic output.

Resistance to behavioral change

One of the biggest challenges in managing COVID-19 spread is the key behavioral changes required, especially in external social settings – work, travel, social functions and leisure activities. Apart from the usual resistance to such changes, a large part of India is still traditional and averse to changing unsafe habits. Spitting in public, for example, is a common and intractable behavior. The Prime Minister’s condemnation of this practice and announcement of a national campaign to stop it is a big step in the right direction. But it will require strict enforcement, which so far has not been a strength for India. Adoption of health precautions and hygiene practices also verges on the dismal. Data from the last National Family Health Survey (NFHS) conducted in 2015-16 show that regular hand washing with soap and water is not a common practice in the majority of rural households. Hand hygiene among families headed by those without any education is alarmingly poor, with only 43% washing their hands with soap and water. In contrast, in households headed by those with at least 12 years of schooling, 85% wash hands with soap and water. Water shortages in many rural and urban areas make the practice almost impossible.

In the social sphere, religious congregations, festival celebrations and thronging of public spaces are such an established feature of life that it will take a gargantuan effort to impose distancing norms in India.

Evolving government response

Global experience suggests that the economic recovery will be deeply influenced by the nature and level of government interventions. Governments have planned initiatives across three broad areas – direct transfers to individuals, support for business, and expansion of national credit availability. The size of these interventions varies greatly, with economies like the US, UK and Germany investing between 15-30% of their annual GDP on economic stimulus and recovery measures.

The Government of India has responded proactively towards containment of the crisis. Very few countries of India’s economic size have resorted to such extreme measures as a total lockdown so early in the spread of the COVID-19 pandemic. The government had introduced a stimulus upwards of USD 28 per head to provide relief and mitigate pain for the poor, who are likely to be impacted severely by the lockdown. The central bank has also introduced measures to increase liquidity in the economy. The government is planning several more measures, which will be subsequently announced. The quantum of these measures currently stands at around 1% of GDP and there is a likelihood of mitigated economic downside as bolder and aggressive measures are announced and implemented.

Emergent recovery paths

The interplay of the uncertainties described above will determine the recovery pathways for India. We discern the possibility of four broad pathways:

- V-shaped recovery: This assumes that the pandemic is brought under control by mid-May at the latest and that minimal disruptions occur of ecosystems, supply chains and social behavior. It also assumes that government interventions have reduced structural damage to the economy, and that a high-growth trajectory resumes within a few weeks of the national lockdown’s end. Given the current pandemic trajectory, this scenario seems unlikely.

- U-shaped recovery: This assumes a few medium-term negative effects of the national lockdown which ends in May 2020 and a recovery phase for supply chains and business systems to get back to normal. Residual hotspots of the virus would delay the recovery of full pre COVID-19 economic output by one or two quarters.

- W-shaped recovery: This assumes that the pandemic will persist in several economic hotspots for three to six months beyond the national lockdown. It also assumes a possible resurgence of the virus in the winter season, creating the need for further national and regional lockdowns. These intermittent lockdowns will create intermittent disruptions in recovery, and so it will take three to four quarters to get back to full economic output.

- L-shaped recovery: This assumes that national lockdowns become a part of life in India until a vaccine is developed and deployed at scale (unlikely before the autumn of 2021). There will be large-scale disruptions of the supply chain and social behavior, and consumption will be drastically reduced. While effective government interventions could prevent a sustained free-fall in economic activity, the entire economy will operate at significantly lower utilization levels for at least the next year and a half.

We believe that a W-shaped recovery is the most likely outcome for India, given the current state of dramatically increasing COVID-19 cases and the conservative economic stimulus measures.

4

Plotting the course: Four recovery scenarios for India

India – the world’s seventh largest economy – has been relatively immune to global recessions, with annual real GDP growth rate falling but never turning negative. Even in the global slowdowns of 2001 and 2008-09, the GDP growth rate fell to 3.84% and 3.89%, from 8.85% and 9.8% respectively, but recovered impressively to reach 7.86% and 8.48% within the next two years. Two key factors aided India’s ability to withstand global shocks: 1) the limited impact of global trade, with non-oil imports and exports amounting to less than 15% of India’s GDP; 2) strong domestic demand. Under the new economic series data with 2011-12 as base year, India’s real GDP grew by an average of 6.89% between FY 2015-16 and 2019-20. However, GDP growth slowed to 6.12% for FY 2018-19. Looking at GDP trends per quarter, real GDP growth fell to 4.7% in the third quarter of FY 2019-20. Therefore, the Indian economy was facing headwinds before it got engulfed in the COVID-19 pandemic.

As a result of this, and of COVID-19 measures and their impact, India could see any one of four scenarios unfold:

V-shaped recovery: In this scenario, there will be a quick downturn in the first quarter of FY 2020-21 and a recovery from the second quarter onwards. A government stimulus will have the strongest impact, helping kickstart sectors such as construction and manufacturing. This hinges on the reduced spread of COVID-19 and minimal use of social distancing measures. The recovery in 2001 from the recession caused by the tech bubble of 1999/2000 is an example of a V-shaped recovery, with a sharp fall in GDP followed by strong growth. Our analysis shows that, in this type of recovery, GDP in India will contract by 1.0% in FY 2020-21 and then expand by 4.1% in FY 2021-22.

U-shaped recovery: Estimates in this scenario suggest that the downturn will extend to the end of the second quarter of FY 2020-21. Subsequently, growth will gradually recover over the next five quarters. These estimates also assume positive government support and a comprehensive containment of the spread of COVID-19 by the end of summer. In this scenario, we assume the containment/lockdown impact on daily economic activity will not extend beyond May. The recession of 2008 is an example of a U-shaped recovery. In FY 2008-09 there was a sharp fall in GDP, followed by a few quarters of further slowdown, before a strong recovery as government measures took effect. Based on our calculation, in this type of recovery, we expect GDP in India to contract by 5.3% in FY 2020-21 and grow by 2.8% in FY 2021-22. We believe that this scenario has a likelihood of playing out only if the lockdowns are discontinued after May 2020.

W-shaped recovery: A combination of three factors – rise in COVID-19 cases in the summer, a relapse in winter that peaks around December 2020, and limited further stimulus – will lead to a W-shaped recovery. In this case, growth will resume in the third quarter of FY 2020-21 but then contract over the next five quarters with a few intermittent rebounds and a final recovery in FY 2021-22 as the vaccine becomes available. A global example of W-shaped recovery is the debt crisis in the European Union (EU) in 2010. Our analysis indicates a 10.8% contraction of GDP in India for FY 2020-21 and a growth of 0.8 % in FY 2021-22. This scenario is highly likely to be India’s trajectory, assuming continuing regional lockdowns beyond May 2020.

L-shaped recovery: This is the most pessimistic recovery curve. In this scenario, growth falls and does not recover for many quarters. The closest example of an L-shaped recovery is in Japan, which took more than 10 years to emerge out of the market crash and credit crunch of the 1990s, mainly due to a series of ineffective policy actions. Based on our calculation, in this type of recovery, GDP in India will contract by 15.9% in FY 2020-21 and by 2.5% in FY 2021-22.

Given the current state of the lockdown and expected increase in COVID-19 cases until early autumn, we believe that India is likely to experience a W-shaped recovery. This implies a base case forecast for India of a GDP contraction of 10.8% in FY 2020-21 and GDP growth of 0.8% in FY 2021-22.

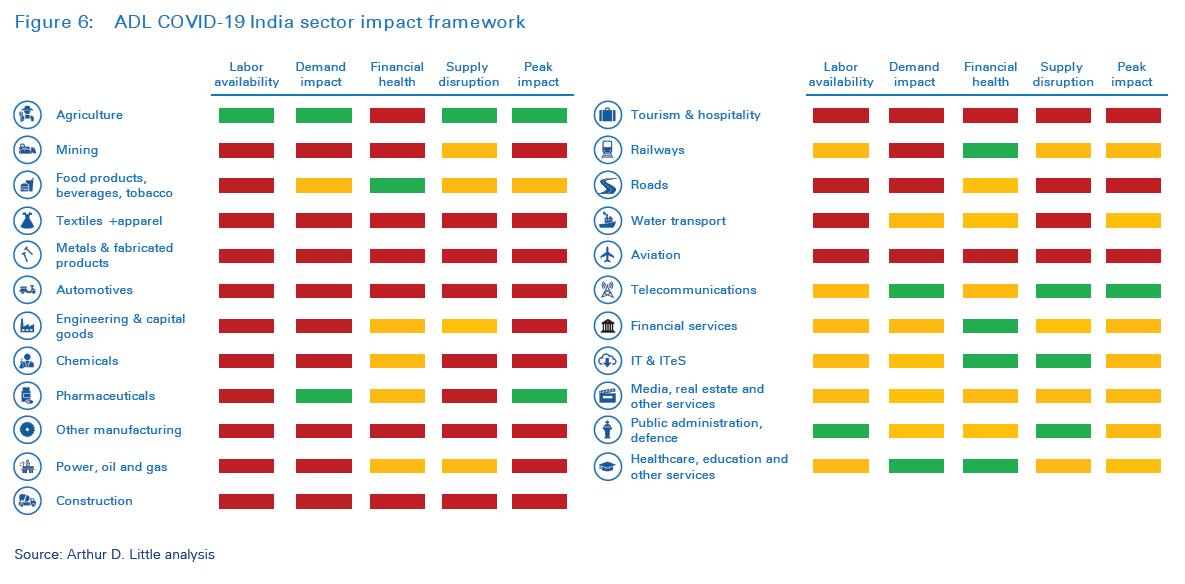

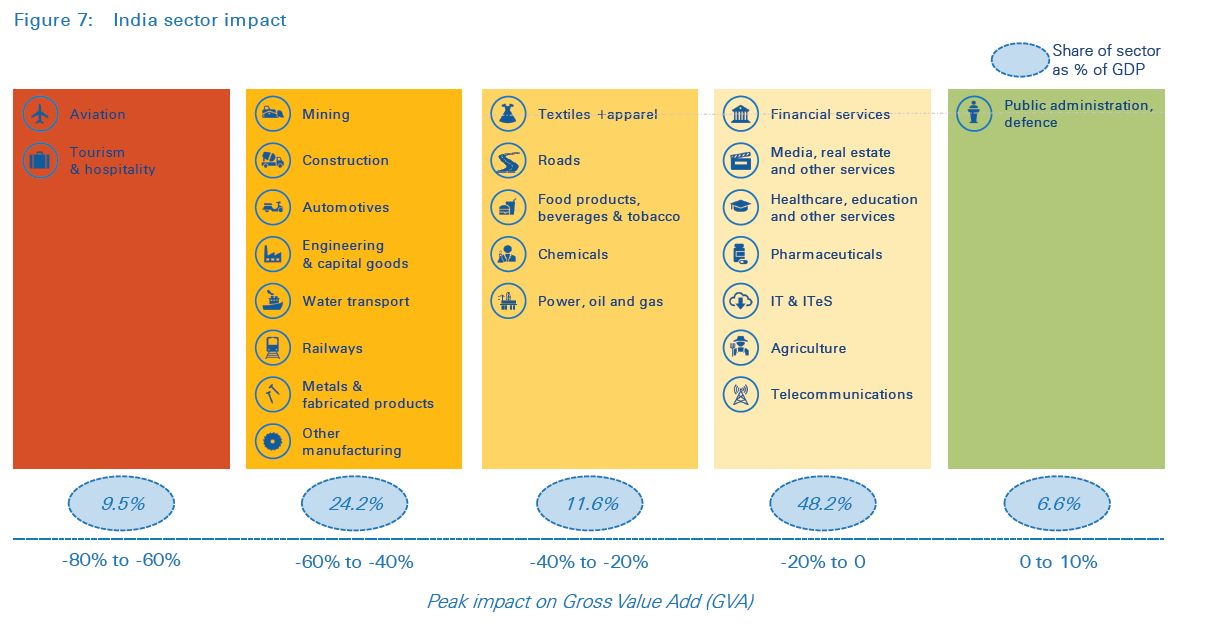

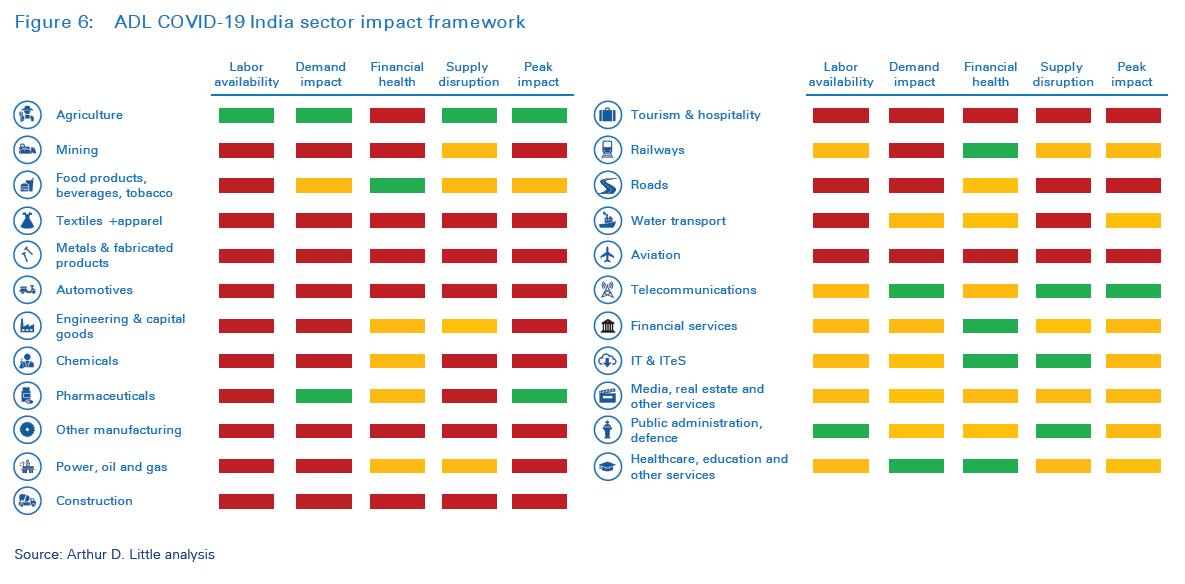

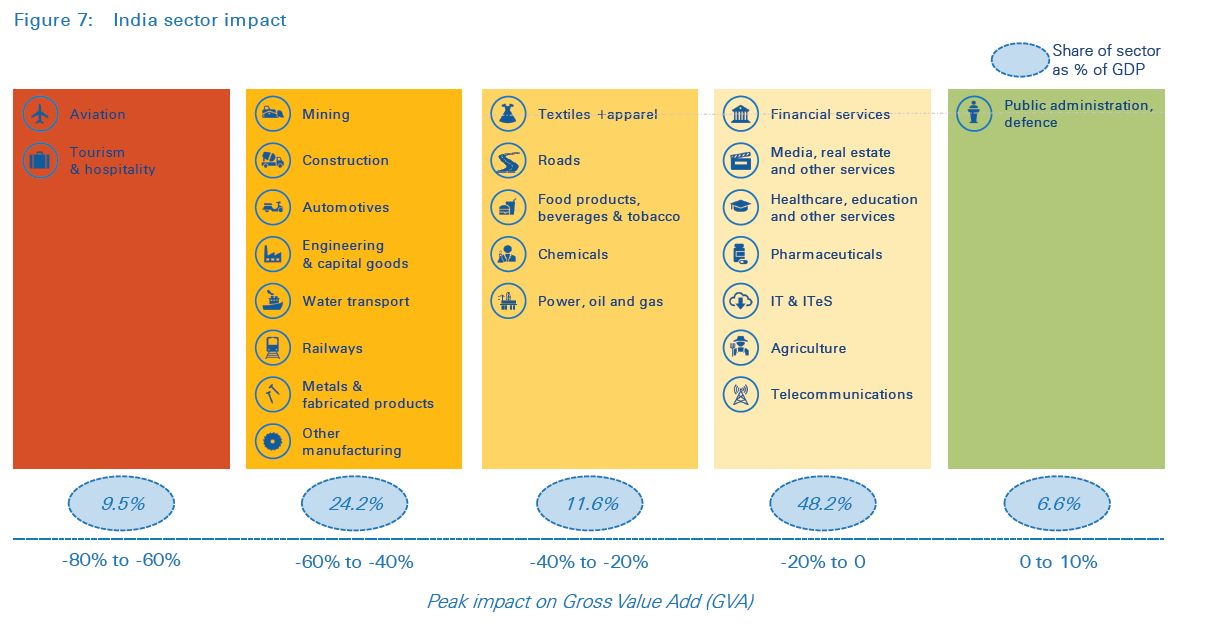

COVID-19 will hit several key sectors severely

An in-depth analysis of the impact of lockdowns and social distancing on output and demand in different parts of the economy suggests worrying trends for many sectors. Not surprisingly, aviation, tourism and hospitality will be the worst hit, losing more than 80% of business in the first quarter of FY 2020-21, and growth will keep falling throughout 2020-21; our analysis suggests that growth will decline in these sectors in FY 2021-22 as well.

Construction is also likely to be severely affected by COVID-19 measures. Under our W-shaped recovery forecast we expect steep negative growth rates for the sector in the first and second quarters of FY 2020-21. Construction contributes close to 8.4% of Indian GDP and is one of the highest employers of migrant labor. Commercial real estate construction, especially of retail malls, is likely to be stressed by challenges of financing and declining demand due to COVID-19 related measures. Emerging reports suggest that many retailers are moving from fixed rentals towards a revenue-sharing model as in-bound consumer traffic is very difficult to predict.

Sectors such as manufacturing are likely to experience a painful first quarter but then see a moderate rebound in the second quarter onwards. Disruptions of the global supply chain, especially from Europe, continued supply chain disruptions due to “hot spot” containments, and domestic demand are key factors affecting their growth.

Sectors that will be the least affected are healthcare, pharmaceuticals, education, IT, telecom and agriculture. Telecom stands to benefit as users continue to consume more content online as well as more value-added services. Media, on the other hand, while seeing increased viewership during the lockdown, is looking at a contraction in the first quarter due to a wide collapse in advertising revenues. Healthcare, pharmaceuticals and education could also experience a doubledigit contraction and agriculture could lose between 1% to 4% of economic activity in the first quarter of the new fiscal year starting April 2020.

Note on GDP modeling approach

The methodology for estimating GDP scenarios is based on a robust two-tiered approach. A bottom-up economic model was created and used to evaluate the positive and negative growth rates for key sectors in the economy due to the COVID-19 lockdown. A supplementary qualitative framework was also created to ascertain the impact of lockdown and COVID-19 on sectors in the short term (less than four quarters) and long term (more than four quarters). Side-by-side weights were allocated to key sectors based on estimates of their past GDP contribution. Past performance, global and domestic impact of lockdowns, social distancing, easing of government restrictions, supply chain impact and change in consumer demand were key factors in the approach towards modelling sector growth on a month-on-month basis, which was later extrapolated on a quarter-on-quarter and finally a year-on-year basis. The output suggested was stress-tested against the traditional top-down approach comprising historical GDP growth rates over the last 15 years, as well as against historical changes to private final consumption expenditure, gross fixed capital formation, government expenditure and trade during preand post-recession periods.

5

Facing the vortex: The second-order impact could be devastating for many

The forecasted GDP slowdown will have a second-order impact on several vital parameters, notably employment, poverty, per capita income and overall nominal GDP.

Unemployment may rise to 35% resulting in 135 million jobs lost

The Centre for Monitoring Indian Economy estimates that unemployment had risen from 7.5% pre COVID-19 to around 24% in April 2020. In the US, jobless claims have spiked to more than 30 million and unemployment has touched 15% by early May 2020. Since job loss always lags economic output reduction and economic output is expected to drop for at least two more months (in the optimistic scenario) or a few quarters, it would be reasonable to estimate a sustained unemployment rate of 35% for the next few months, which translates to 174 million unemployed Indians. This means incremental job losses of around 136 million jobs at the peak of the downturn. We estimate that over 70% of the job losses will be in four sectors – construction, tourism/hospitality, industrials/capital goods and media. Over 85% of the labor force works in the informal sector with no wage or job guarantee and social security and 95% of the job losses will occur in this sector.

Another second-order impact of prolonged economic uncertainty is a fall in the overall labor participation rate in the medium term. Given the mass labor migrations away from the centers of economic activity, we estimate a drop in the labor participation rate of 15-20% in a W-shaped scenario, reducing the available labor force by 150-200 million, further dampening economic recovery.

India may face a big set-back in the war on poverty

India has had an impressive track record of poverty alleviation since 2005, uplifting more than 9 million people out of poverty every year. Since 2014, government initiatives such as The Pradhan Mantri Gram Sadak Yojana (PMGSY), Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), and National Food Security Act (NFSA) have accelerated the trend. Nevertheless, there are more than 250 million people below the poverty line today. The economic downturn and loss of jobs is likely to hit India’s vulnerable sections the hardest. In fact, daily wage earners and the “urban poor” will face over 60% of the job losses. As a result, in FY 2020-21, India may add 120 million more people below the poverty line, representing a stunning reversal of fortunes for many Indians. Even more worrying, abject poverty is also likely to grow for the first time in decades. We estimate that it may double from 3% of households to over 6%, pushing nearly 40 million Indians into abject poverty.

Per capita income may drop by over 10%, reducing overall consumer demand and savings

India’s nominal per capita income grew by more than 9% per annum over the past five years. Preliminary analysis suggests that it could drop by more than 10% over FY 2020-21. This would significantly reduce consumption, further slowing the economic recovery of sectors such as retail, auto, apparel, and professional services. There may also be a decline in household savings in financial assets, which fell as a percentage of GDP from 14.7 % in FY 2012-13 to 10.3% in FY 2017-18. A drop in economic activity is likely to bring this down further and can adversely impact funding availability for capital-intensive sectors such as infrastructure, manufacturing and logistics.

COVID-19 could create an opportunity loss of up to USD 1.0 trillion of nominal GDP

India’s nominal GDP is likely to remain stagnant in FY 2020-21 and FY 2021-22, with nominal GDP forecasts of USD 2.5 trillion to USD 2.7 trillion for both years. The resultant opportunity loss of up to USD 1.0 trillion could indefinitely delay reaching the goal of USD 5 trillion. India may also face a sharp structural devaluation of its currency (12-15% in FY 2020-21). In fact, we believe that a fundamentally new economic roadmap may be required to achieve the USD 5 trillion economy.

6

Reaching safe harbor: A 10-point programme to revive and power India’s post COVID-19 economy

Several governments around the world have taken aggressive measures to mitigate the impact of COVID-19 and the social distancing and lockdown measures required. Mitigation measures have included fiscal stimulus, as well as monetary support. In the US for example, the Federal Reserve dramatically cut the policy rate to 0% and committed to additional liquidity support of over USD 3.5 trillion. The fiscal measures initiated by the governments cover three broad areas – direct benefits to individuals, support to small businesses and support for targeted sectors and companies. Fiscal stimulus measures have been ambitious, ranging from 10-15% of GDP for most advanced economies such as the UK, US and Germany and, in some cases, approaching 20% as in Japan.

A 10-point programme will ensure a humane and effective recovery

The Indian government was fast off the blocks, announcing a fiscal stimulus of USD 22.6 billion (INR 1.70 lakh crore) while the Reserve Bank of India slashed the repo rate by 75 basis points and announced liquidity support of over USD 49.8 billion (Rs 3.74 lakh crore) on an aggregate basis. However, the intensity and duration of the economic hardship suggest that a far bolder and more assertive approach may be required. Analysis suggests that the government should consider four broad themes of economic rejuvenation: 1) survival of the most vulnerable; 2) sustenance of demand and availability of important services; 3) surge investments in recovery-focused global opportunities and 4) structural reform. Within these areas, we propose 10 imperatives for the government to consider. While by no means comprehensive, these imperatives cover critical areas of the economy that need support and have the potential to accelerate India’s economic recovery. They are intended to be the starting point of a discussion on shifting the discourse from a reactive strategy of managing downside risk to a more proactive approach of protecting and enhancing livelihoods, while creating the springboard for the next decade of economic prosperity for India.

Survival of the most vulnerable

The GDP forecast scenarios for FY 2020-21 suggest that more than 136 million Indians may lose their livelihoods due to economic reversals. This risk to livelihoods can be mitigated by bold action, as proposed below:

1. Strengthen the “safety net” significantly for the most vulnerable:

The government should consider expanding the scale and duration of direct benefits provided to the poor. The announced direct transfer of INR 300 billion under the Prime Minister’s Garib Kalyan Yojana (welfare-for-the-poor plan) is a good beginning. We recommend that the government scale up this direct individual assistance 15-fold to INR 5,000 per month for three months; this will help provide vulnerable groups access to food, clothing and shelter. Simultaneously, the government could consider universalizing social security pensions and increasing the monthly payout to INR 1,000 per month. In fact, the government could also consider transferring three-month advance pensions to the most vulnerable. The Aadhar and Jan Dhan accounts can be used to transfer these benefits. The government could also consider doubling the allotment of basic food available through the Public Distribution System and enhance its coverage in the vulnerable districts. These mechanisms will ensure speedy relief for the neediest.

The proposed measures might be expensive, amounting to USD 80 billion or 3% of GDP, but have the potential to alleviate the economic distress of a large section of the population. The expenditure would be comparable to similar measures in the UK and US, where direct assistance initiatives add up to 6-8% of GDP. In the US, as part of the CARES ACT, direct assistance of up to USD 3,400 per family to eligible families is being provided through the IRS, involving a proposed outlay of up to USD 1.8 trillion.

2. Enable survival of small and medium businesses

Small and medium businesses are the lifeblood of the Indian economy. Several estimates suggest that they account for over 42.3% of non-agricultural employment in India. As in other countries, small businesses are the most affected by lockdowns and social distancing, with most estimates indicating that over 70% could permanently close due to the lockdown. Consequently, governments around the world have determinedly stepped in to save small businesses, devising bold measures to allow to them to stay afloat and maintain payroll. Notably, the United States of America’s USD 671 billion Paycheck Protection Program extends forgivable loans to meet the payroll and employee costs of small businesses, amounting to more than 3% of GDP. Similarly, Germany has introduced a “limitless” loan program for small and medium sized companies. Under this program, the government will guarantee 100% of loans of up to Euro 800,000 for companies employing between 11 and 250 people.

In India, the government has announced several measures to ensure the solvency of small and medium enterprises. These include a three-month moratorium on term loans, extension of working capital loans, concessional rates for future loans and faster processing of tax refunds. We propose that the government consider direct assistance covering 70% of the payroll of small businesses, effectively protecting the livelihood of 200 million families, with a Small Business Corpus of USD 60 billion. The assistance can be a loan that is forgivable if the employer maintains full payroll, or a subsidy that could be offset against future tax payments. The government could also consider deferring tax liabilities including GST for a period of six months to further strengthen the economic viability of these businesses. The immediate cost of this support would amount to 2.2% of nominal GDP.

Sustenance of demand and availability of important services

The national lockdown has jolted consumers, suppressing demand across several sectors of the economy. It has also pushed several sectors to the brink of financial unviability. As the national lockdown scales down, and as the Indian economy increases its resource utilization, economic recovery could be accelerated by spurring rural demand and ensuring that the worst affected sectors such as aviation, hospitality, retail, automotives, healthcare and manufacturing are “open for business”. This will entail the following imperatives:

3. Restart the rural economy

India had been facing falling rural demand for a few quarters before the COVID-19 crisis. Our estimates suggest that, despite higher agricultural output, lower demand will depress the rural economy for several quarters. To mitigate this, we propose two bold measures: i) consider increasing the maximum support price of critical crops, particularly cereals and pulses; ii) boost funding (by up to 30%) and scope of the rural employment guarantee (under the Mahatma Gandhi National Rural Employment Guarantee Act) to all rural districts. This could be supported by a six-month moratorium on agricultural loans, advance disbursal of fertilizer subsidies through direct benefit transfer, and provision of special concessionary interest rate loans to farmers with a good credit history. The increase in budgetary support for agriculture and rural spending would be USD 10 billion; if done in a targeted and effective manner it could kick-start the rural economy after several quarters of distress

4. Provide targeted assistance to at-risk sectors

Several capital- and labor-intensive sectors such as manufacturing, retail, hospitality, healthcare, travel and automotives will be pushed to the brink of financial unviability during the course of the national lockdown. The government could consider several measures to rescue these sectors, firstly by developing sector specific “rescue packages”. These rescue packages could be structured as five- to eight-year convertible loans with terms and conditions to ensure sensible usage of funds. Such rescue packages could be supported by extending further bank credit, a moratorium on term loans and deferral of tax liabilities by six months. We estimate that the government may need to create individual sector rescue packages of USD 7 billion to USD 10 billion, with a total funding corpus of USD 50 billion, fully recoverable from the sectors over a five- to eight-year period. Furthermore, the government could consider providing a five-year tax holiday for all green-field investments in these critical sectors, provided such investments are completed in a five-year time frame. The upfront investment of nearly 1.9% of GDP in these at-risk sectors would result in several benefits and we believe that the government could recover a significant portion of these investments in a five-year time period.

Surge investments in recovery-focused global opportunities

COVID-19 will redraw international priorities and trade flows. Changing views on diversification, manufacturing and supply chains create unique opportunities for India. Over the past few years, India has made impressive strides in manufacturing and international investments. However, as the world evolves to the new normal in the post COVID-19 scenario, the government needs to act proactively to capture the opportunities, as described below.

5. Launch “Make in India 2.0” to capture global opportunities

The government has seen success with the Make in India initiative launched in 2014. Proactive government initiatives have moved India higher on the Ease of Doing Business Index, the Global Competitiveness Index and the Logistics Performance Index, making it one of the leading countries attracting foreign direct investment. The initiative has led to a resurgence of manufacturing in India. Foreign direct investment into India increased by more than USD 26 billion between 2014 and 2019, exceeding the USD 60 billion annual FDI flows in 2017. That said, several opportunities for acceleration remain, notably in removing structural barriers of labor, land and infrastructure and taking a targeted approach to leveraging India’s advantages over other manufacturing destinations in North Asia and Southeast Asia.

We propose that the government launch a “Make in India 2.0” focused on export-oriented industries such as pharmaceuticals, electronics, renewables, medical devices, food processing, electricals, precision components, heavy engineering, chemicals and textiles. The focus of this renewed push should be manufacturing world-class products with an attractive investment attraction regime, an enhanced “Ease of Doing business” framework, fast-track approval and clearance, and attractive incentives including a potential five- to ten-year tax holiday for all new investments in manufacturing. The renewed thrust should focus on areas with a strong domestic market and an ability to move up the value chain given the existing ecosystem. At the same time, the government could prioritize and incentivize investments in high technology areas. To this end, the government could consider creating a USD 10 billion corpus for providing initial seed financing, capital and payroll subsidies, for select flagship investments.

6. Scale up physical infrastructure to “Build Modern India”

India has accelerated the pace of infrastructure buildout in the past five years. Road construction has increased at the compounded annual rate of more than 20% between FY 2013- 14 and FY 2018-19. Several marquee projects such the Bharat Mala, Bullet train, Dedicated Freight Corridor, Udan, and Sagar Mala (an initiative to enhance the performance of the country’s logistics sector by unlocking the potential of waterways and the coastline) have been proceeding at record pace. Going forward, we propose that the government create a USD 1 trillion infrastructure buildout fund to “Build Modern India”. Multi-lateral low-cost funding can be accessed from countries like Japan, the US, the UK and the EU, and the government should consider seeding up to 5% of the mega investment fund corpus to kickstart these efforts. This would mean an outlay of USD 50 billion or around 2% of GDP.

Private participation from domestic and international investors should be the cornerstone of the new “Build Modern India” initiative. To achieve this, the government could implement mechanisms to share project risk equitably, debottleneck access to debt funding and fast-track financial closures. At the same time, private participation should be invited for brownfield projects, real estate trusts and investments in new areas such as smart cities, urban water supply and distribution, mining, oil and gas, logistics and the cold chain. Simplifying dispute resolution, contract enforcement and proposing new guidelines for Special Purpose Vehicles could also be considered.

7. Accelerate Digital India and innovation

COVID-19 is likely to transform the future of work and the new normal will accelerate the journey to digital for companies. In fact, digital technologies are likely to be at the forefront of customer interactions, supply chain management, workforce management and stakeholder engagement. This creates a unique opportunity for India to accelerate adoption of digital technologies in the economy. We propose that the government catalyze a “Digital Team India” initiative along with leading global technology leaders such as Microsoft, Google, Cisco and select local players to implement digital collaboration solutions, teleworking solutions such as video conferencing and cybersecurity solutions for Indian companies, without charge (up to one month for large companies and three months for small businesses).

This could be enabled by a “Digital Starter” funding scheme for small businesses, providing up to INR 10,000 or USD 133 in loans for adopting digital collaboration, enabled by the Mudra mechanism. At the same time, several innovation bootcamps or hackathons could be conducted with small and medium enterprises to help illustrate digital collaboration solutions. The government could also consider encouraging virtual training and online education solutions for employee training and corporate learning by providing a platform for companies to access such solutions.

At the same time, this could be the opportune moment to blueprint the creation of an “India Cloud”, forming a digital alliance of data centers to host India-specific data locally and in a secure environment. Finally, India could launch Startup India2.0 to create its next generation of technology unicorns focused on new areas such as Artificial Intelligence, digital collaboration, blockchain-based tracing, cybersecurity and quantum computing, with funding for R&D and industryacademia- government collaboration. In addition to reducing compliance costs and regulatory burden, the government could consider becoming an anchor customer for these new technologies. Separately, the government could accelerate deployment of high-speed fiber-based broadband and accelerate India’s transition to 5G. The government could create a USD 20 billion fund to finance these new Digital India initiatives and seed investments in these new technologies (by investments in Alternate Investment Funds including category 2 funds).

8. Strengthen global investment corridors with the US, UAE, Saudi Arabia, Japan and the UK

India has a unique opportunity to take advantage of a geostrategic realignment of the world order. At the same time, several economies will have access to surplus funding due to liquidity measures and will enjoy near-zero-interest lending costs. The government could use its growing international support to create dedicated country-to-country or governmentto- government investment vehicles partnering closely with international Sovereign Wealth Funds. The government should work with international investors to create strategic manufacturing, infrastructure and technology assets focused on serving domestic customers and fulfilling global demand. The proposition to international investors and governments is the potential of a fast transforming economy, superior returns and potential to diversify manufacturing bases and global supply chains, as well as access to a dynamic startup ecosystem building technologies of the future.

Structural reform

COVID-19 has magnified several structural weaknesses of the Indian economy. The time is opportune for the government to accelerate efforts to launch and accelerate the next phase of economic reform, particularly related to land, labor and financial sector transformation.

9. Fundamentally debottleneck land and labor

We propose that the government initiate and accelerate the framing of new laws and codes to structurally reform the land and labor markets in India. Several analysts have proposed actionable ideas to set the ball rolling. A notable one is amendments to the restrictive Land Acquisition Act of 2012 to enable timely acquisition of non-agricultural land for manufacturing and infrastructure, while ensuring adequate compensation for landowners (at a sensible premium to prevailing market rates). On the labor front, the government could lay down a roadmap for labor reform, enabling businesses to manage their workforce in line with international norms. The proposed simplification and consolidation of the over 40 labor codes into the proposed four laws could also be prioritized. The government could accelerate the enactment of the proposed Industrial Relations Code and potentially increase the number of workers that can be retrenched without government permission to 500-1,000, which could then be adopted at the state levels.

10. Transform financing, starting with an accelerated banking reforms timetable

The government has initiated several reforms to transform the banking sector, including banking consolidation and recapitalization. It is now imperative to accelerate structural measures to inject vibrancy into the banking sector, as the share of banking credit will likely grow several-fold due to proposed government stimulus measures. The Reserve Bank of India needs to step up and play a pivotal role in shepherding the transformation. We propose that the banking sector reform measures proposed in the budgets of 2019 and 2020 be prioritized and an accelerated roadmap on further consolidation and massive recapitalization (including from public equity markets) be executed. At the same time, the government may consider selecting fundamentally insolvent NBFCs for liquidation under the new bankruptcy code and process. Simultaneously, RBI could play an active role in bridging the financing crisis by expanding open market operations, stepping up “reverse sterilization” to compensate for foreign outflows and expanding the RBI balance sheet to support the government. The RBI could also consider dramatically reducing the real interest rate to below 2.0% to facilitate further credit availability to the economy. Finally, the government may need to amend or suspend the Fiscal Responsibility and Budget Management Act to allow for new metrics (debt-to-GDP ratio instead of fiscal deficit) and a relaxation of norms for the central government and the states.

Gaining a secure economic footing justifies the total outlay

The steep costs of the programme we propose are more than justified by the secure footing it will provide to the Indian economy post COVID-19 and its benefits to the Indian people, particularly the poor. The total outlay of these 10 initiatives amounts to around USD 280 billion and represents an investment of over 10% of India’s GDP in jumpstarting the economy. As described in the table below, around two-thirds of these investments are targeted at the most vulnerable, through direct benefits to the poor and pensioners, increased outlay for the MGNREGA, payroll assistance for small businesses, and protecting the livelihoods of daily wage earners. One-third of the proposed stimulus is structured as investments into the future of India, focused on the near term (rescue/revival packages for at-risk industries) and the long term (manufacturing, infrastructure and digital). The government could recover most, if not all, of the investments while creating several hundred million new jobs in the post COVID-19 world.

Fiscal conservatives have raised concerns about the quantum of stimulus. In fact, media reports suggest that several experts are proposing a USD 60 billion limit on fiscal stimulus (2.2% of GDP), fearing hyperinflation and a resulting sovereign ratings downgrade. We believe these concerns are overstated. Firstly, the economic shock will lead to a contraction in demand, which will be further accentuated by a reduction of per capita income and potential industry contagion. Secondly, the labor market will see severe job losses and a likely reduction in labor force participation. Thirdly, we do not expect food inflation to spike since India has adequate food grain stocks and a normal monsoon is expected. Finally, despite an exchange rate shock with a likely devaluation in the rupee, the increase in the import bill would be offset by low crude oil prices. Hence, food and energy inflation will be limited. In all likelihood, the economic shock will be deflationary in nature.

In any case, international investors will understand the extraordinary nature of the situation and will recognize the need for these short-term measures. To assuage the concerns of external stakeholders, the government could propose a robust post COVID-19 fiscal consolidation roadmap with tangible goalposts and timelines. Our analysis suggests that the proposed outlay will increase India’s public debt-to-GDP ratio to around 80-85%. This is in line with the G20 pre COVID-19 average. Notably, several large economies such as France, Germany, Italy, Japan, the UK and the US have breached the 100% mark for this ratio, investing 10-15% (if not 25-30%) of their GDP in the economic recovery.

We believe that the cost of inaction is catastrophic. An anemic stimulus creates the risk of an economic tailspin that will set India’s growth back by five to ten years. The threat to India’s most vulnerable in terms of lost livelihoods, poverty and hunger cannot be emphasized enough considering the likelihood of a 10% contraction of GDP in FY 2020-21. In any case, with a prolonged depression, India’s debt-to-GDP ratio could easily breach 80-90% with no likely path to an accelerated recovery. In fact, a “wait and watch” approach will likely lead to a cascading chain of demand contraction, supply chain disruption, financing shortage and, in the medium term, destruction of economic capacity. Continued fiscal conservatism will set India onto a L-shaped recovery path with over 15% GDP contraction and medium-term economic capacity shrinkage, paving the path to structural hyperinflation – the very outcome fiscal prudence seeks to avoid at the outset. The proposed stimulus (as described in the table below) is an efficient and effective way to invest in India’s future with immediate benefits of GDP stimulus, job loss prevention and poverty alleviation, and the long-term potential to recover 50% of the investment at reasonably attractive rates of return.

COVID-19 presents a grave threat to India’s economic potential but is equally an opportunity for India to reassess all the obstacles that lie in its path to greater prosperity. We urge the government to seriously consider these bold imperatives to secure a sustainable economic future for 1.3 billion Indians. By boldly implementing these and other imperatives, India can shape its economic recovery to something closer to a U- or even a V-trajectory and accelerate the journey towards a USD 5 trillion economy. An ambitious program of this sort is perhaps the only way to surmount the obstacles COVID-19 has placed in India’s growth path and push onward to prosperity. These famous words were never truer than today: “There is a tide in the affairs of men, which, taken at the flood, leads on to fortune.”

DOWNLOAD THE FULL REPORT

55 min read • Strategy

INDIA: Surmounting the economic challenges of COVID-19

A 10-point programme to revive and power India’s post COVID-19 economy

DATE

Executive Summary

The economic and social impact of COVID-19 could be devastating in the long term if the recovery from it is not wellmanaged. In this report, we offer an assessment of the impact and a 10-point programme to manage the recovery and lessen the pain, particularly for India’s most vulnerable groups, and put the economy back on a growth path.

COVID-19 involves multiple variables with highly volatile values. They fall into four key categories, and their interplay will define the impact on society, business and the economy.

- Epidemiological forecasts for COVID-19 are still evolving and they will depend upon on key factors such as R0 – or “R-naught” for the local population, that is, the average number of additional cases one patient can cause, immunity period for infected people, infectious period, proportion of asymptomatic cases, effectiveness of treatment and likelihood of rebound in subsequent flu seasons.

- The sudden cessation of economic activities in a lockdown disrupts supply chains and economic ecosystems immediately and in the medium term.

- Containing COVID-19 requires key behavioral changes, especially in an external social setting – work, travel, social functions and leisure activities. A large part of India is still traditional and religious congregations, festival celebrations and thronging of public spaces are not conducive to social distancing norms.