In preparing the fifth edition of the “Future of Mobility” Report, Arthur D. Little (ADL), in a joint effort with BVA Xsight and POLIS, conducted a quantitative global survey to explore the experiences, achievements, and future outlooks of mobility leaders. The study included representatives from local/regional authorities, public transit authorities (PTAs), public transport operators (PTOs), micro and shared mobility service providers, and investors across various geographies. This Viewpoint shares key highlights from the wider research, offering insights into successes, required transformations, and the perceived strategic agenda for mobility leaders.

MAIN ACHIEVEMENTS

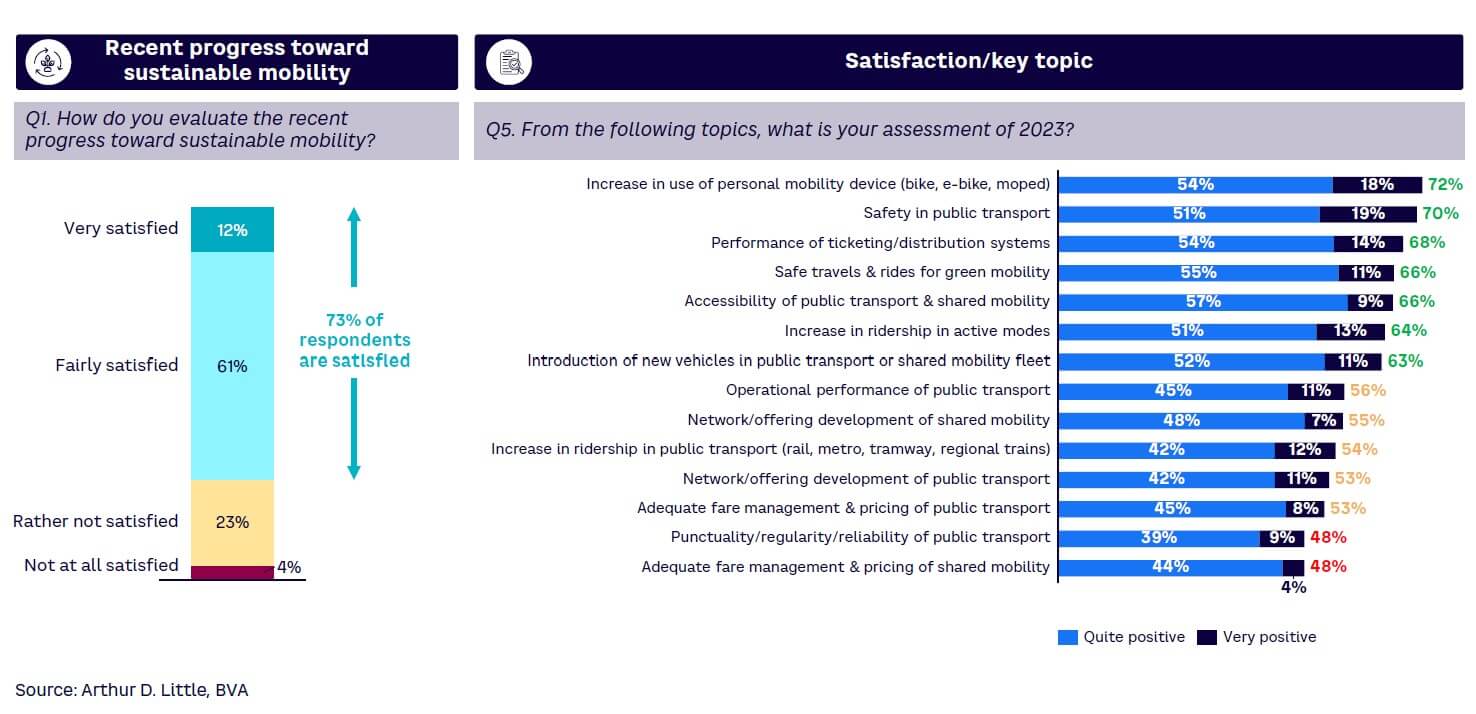

The study revealed a cautiously optimistic outlook among mobility leaders regarding the progress made in 2023; 73% of survey respondents reported satisfaction with the advancements made toward more sustainable mobility (see Figure 1). Personal mobility device use, public transport safety measures, and the performance of ticketing/distribution systems were deemed most satisfactory in terms of progress; respondents were less enthusiastic regarding fare management/pricing, punctuality/regularity/reliability of public transport, and network/offering development.

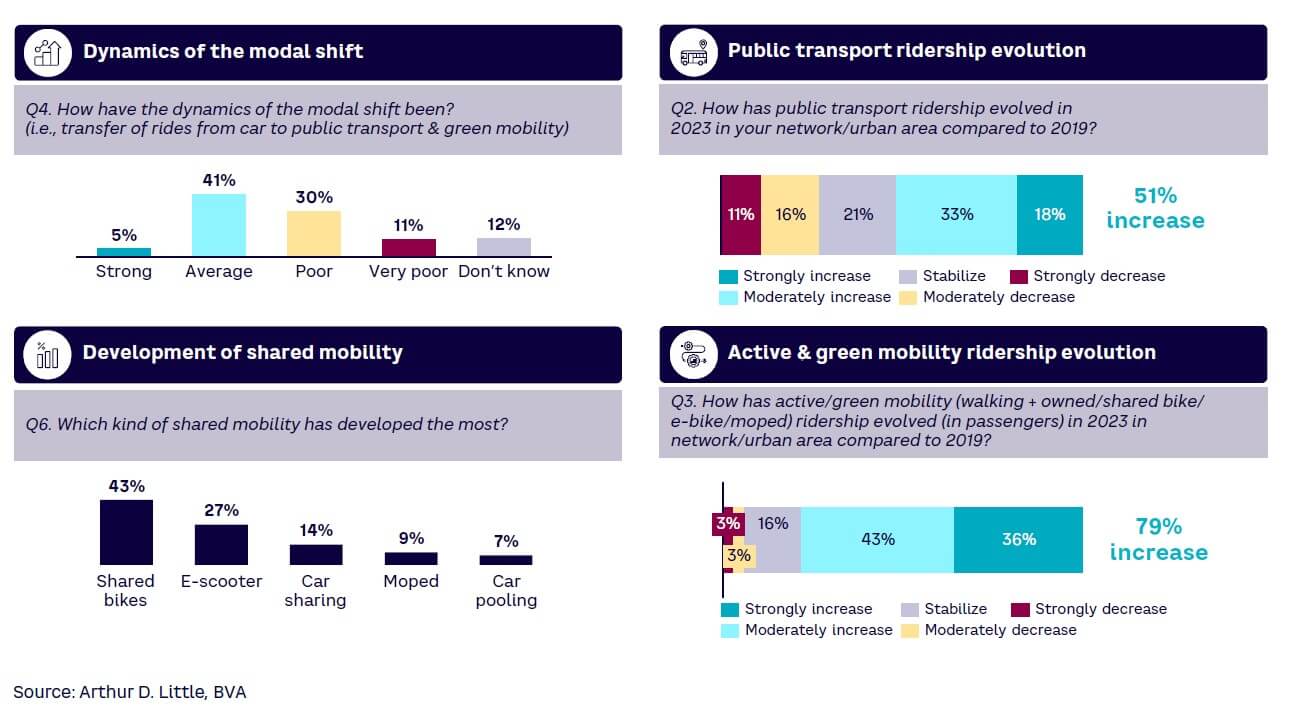

Mass transit ridership saw moderate progress (see Figure 2), with only 51% of leaders reporting an increase in ridership within their mobility system(s) compared to 2019. While 33% noted a moderate increase of 1%-5%, 18% observed a stronger growth exceeding 5%. However, a concerning 27% of respondents reported a decline in ridership, highlighting the ongoing challenges in encouraging a modal shift.

Shared mobility experienced more robust growth, with nearly 80% of leaders indicating an increase in the use of personal mobility devices, such as bikes, e-bikes, and mopeds, within their mobility systems. This suggests a growing acceptance and integration of micromobility solutions within urban transport systems, contributing to a greener and more diverse mobility ecosystem.

Despite these successes, the dynamics of the modal shift remain a significant challenge in most mobility systems. The transition from a car-centric mobility system where the private car is used for all trips by default toward more virtuous mobility systems in which a “multimodal lifestyle” is fostered (i.e., making usage of different transport modes depending on the specific needs and use cases, including evolution from ownership to usage for some of those modes) is widely recognized as essential for reducing carbon emissions. However, only 65% of survey respondents believe their local ecosystems are ready to support this critical shift, underscoring the need for further efforts in this area.

PERSPECTIVE ON TRANSFORMATION FOR VIRTUOUS MOBILITY

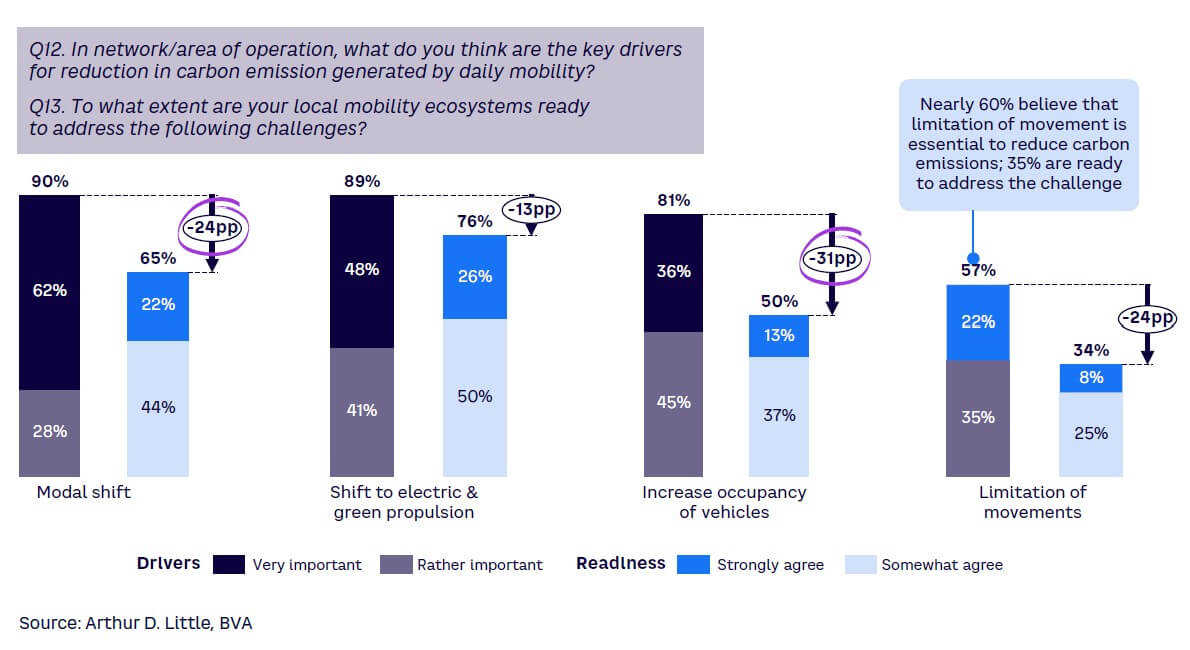

To build on the progress made so far, mobility leaders believe that we need improvements in several key areas to shift gear and accelerate the transition toward more virtuous mobility systems (i.e., a more sustainable, resilient, safe, inclusive, efficient, and human-centric mobility system). To support this transition, respondents view modal shift as a critical challenge and believe the move to electric is a driving force (see Figure 3). Respondents consider the limitation of movements (i.e., transport demand reduction) a secondary topic.

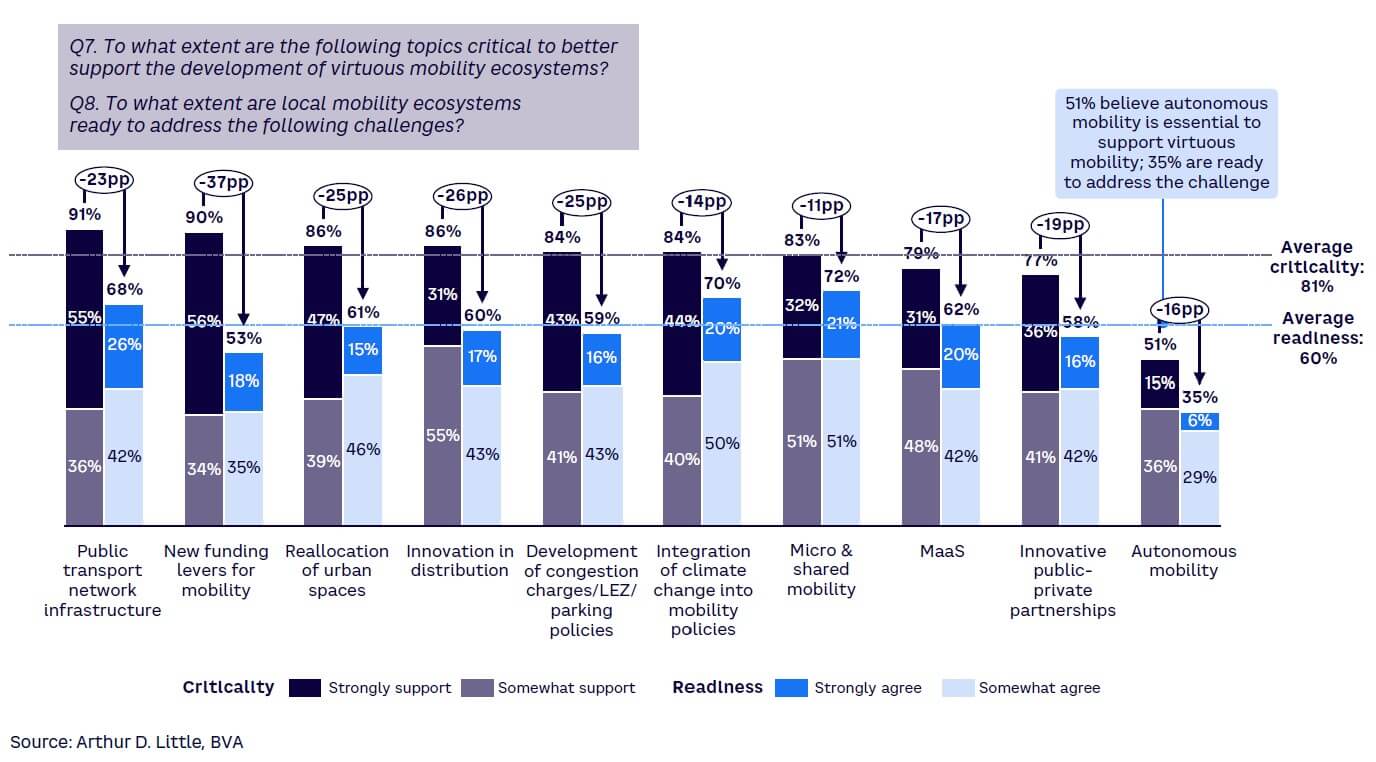

Looking at some sub-elements of the virtuous mobility system, infrastructure and funding emerge as top drivers (see Figure 4). The development of robust mass transit infrastructure is deemed critical by more than 90% of survey respondents, yet only 68% feel their ecosystems are prepared to meet this challenge.

There is a clear need for increased public investment and innovative funding mechanisms to support the expansion and modernization of transport networks. Coincidentally, 90% of respondents claim new funding levers for mobility is essential (and 56% consider it “very important”), reflecting the sector’s active search for sustainable financing solutions.

Reallocation of urban space is another crucial area, with 86% of respondents emphasizing the need to redesign cities to prioritize public, active, and shared mobility over private car usage. This includes developing congestion charges, low-emission zones (LEZ), and parking policies that incentivize more sustainable transport modes like mass transit, walking/cycling, and shared mobility.

The integration of climate considerations into mobility policies is also seen as essential. With 84% of respondents highlighting this need, there is a growing recognition that urban mobility systems must be resilient to climate impacts. This involves adapting infrastructure to withstand extreme weather events and promoting green propulsion technologies (e.g., electric and hydrogen-powered vehicles).

EXECUTIVE AGENDA FOR THE COMING YEARS

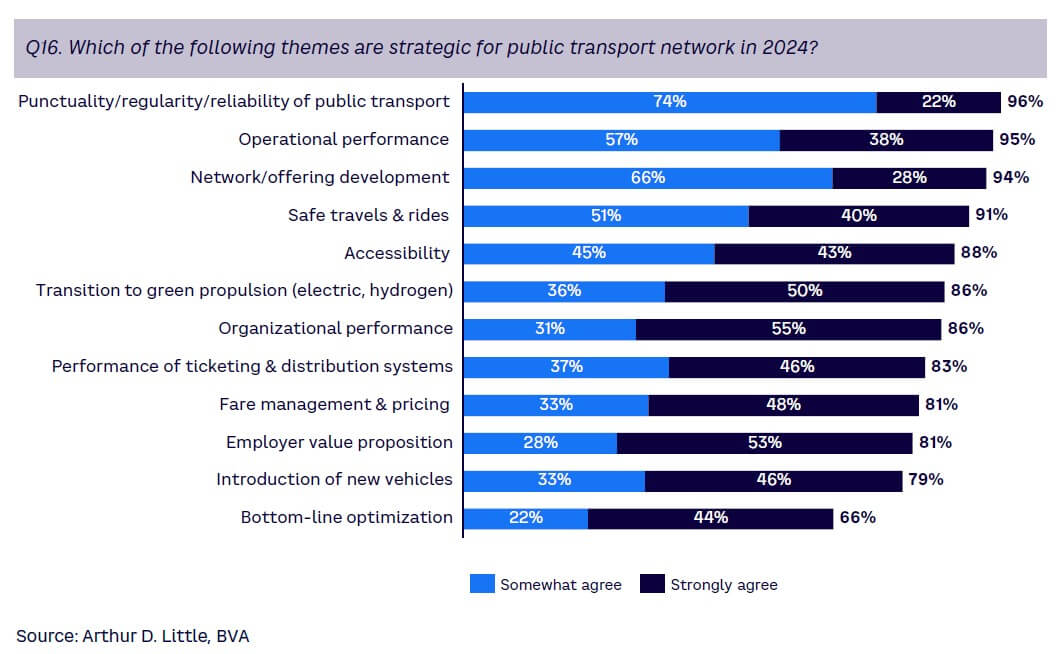

As mobility leaders prepare to accelerate the mobility transition, the executive agenda should focus on several strategic priorities aimed at enhancing the performance and sustainability of urban transport systems (see Figure 5).

While accelerating the transition to more virtuous mobility is certainly a key concern, improving the performance of the system is by far the top concern for mobility leaders, with 96% of respondents prioritizing improvements in the frequency, punctuality, and time competitiveness of public transport, and 95% prioritizing operational performance.

These factors are critical to increase the attractiveness of mass transit in comparison with other options.

Network expansion and safety are also high on the executive agenda. Expanding transport networks to underserved areas and enhancing the safety of both mass transit and shared mobility are essential steps in increasing ridership and public trust in these systems. Safety improvements, in particular, were highlighted by 91% as a key area of focus.

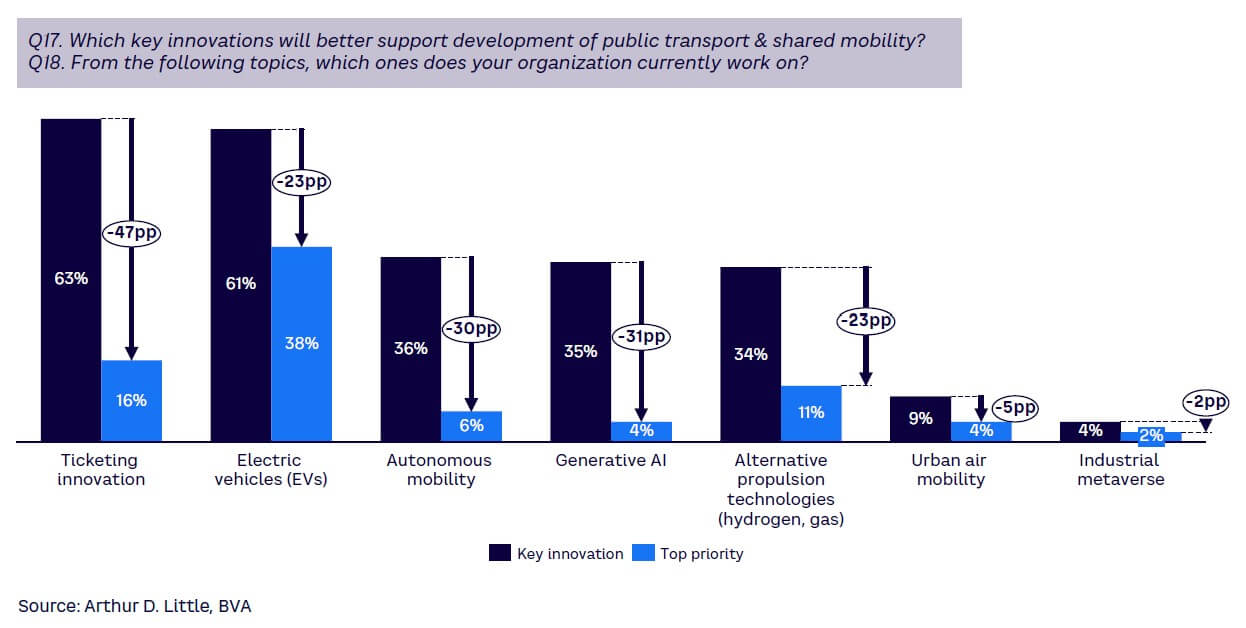

Innovation continues to be a driving force of shared mobility, with a strong emphasis on new technology adoption, including ticketing mechanisms (see Figure 6). Respondents view electric vehicles, in particular, as the highest top priority, while autonomous mobility and generative AI (GenAI) are also at the forefront of this innovation push. GenAI, in particular, is a promising tool for optimizing transport planning, enhancing customer service, and improving network design.

However, HR challenges pose a significant obstacle. The difficulty in hiring and retaining skilled staff, particularly drivers and technicians, was cited by 46% of survey respondents. Only 11% feel fully prepared to address these challenges in 2024, indicating a need for more robust HR strategies, including better training programs and improved knowledge management.

Future of Mobility 5.0 framework

The convergence of global trends has led to the development of new mobility services and business models with the promise of improving our mobility systems.

To explore the impact of these trends, the challenges hindering their progress, and recommendations for overcoming them, the study undertook eight deep dives into promising solutions, including concepts, policies, and services (see Figure A).

Conclusion

ACCELERATING MOBILITY TRANSITION IN 2024 & BEYOND

The move to more sustainable mobility saw little progress in 2023, exemplified by the limited modal shift toward more sustainable transport modes. Leaders recognize that, at best, we can talk of an evolution toward more sustainable mobility but certainly not a revolution. But CxOs are optimistic in their capacity to face future challenges despite their organizations’ limited levels of readiness:

- Moving forward, mobility leaders must shift gear and accelerate the transition toward more virtuous mobility systems. Mobility leaders must improve their own operations as well as the overall performance of the system.

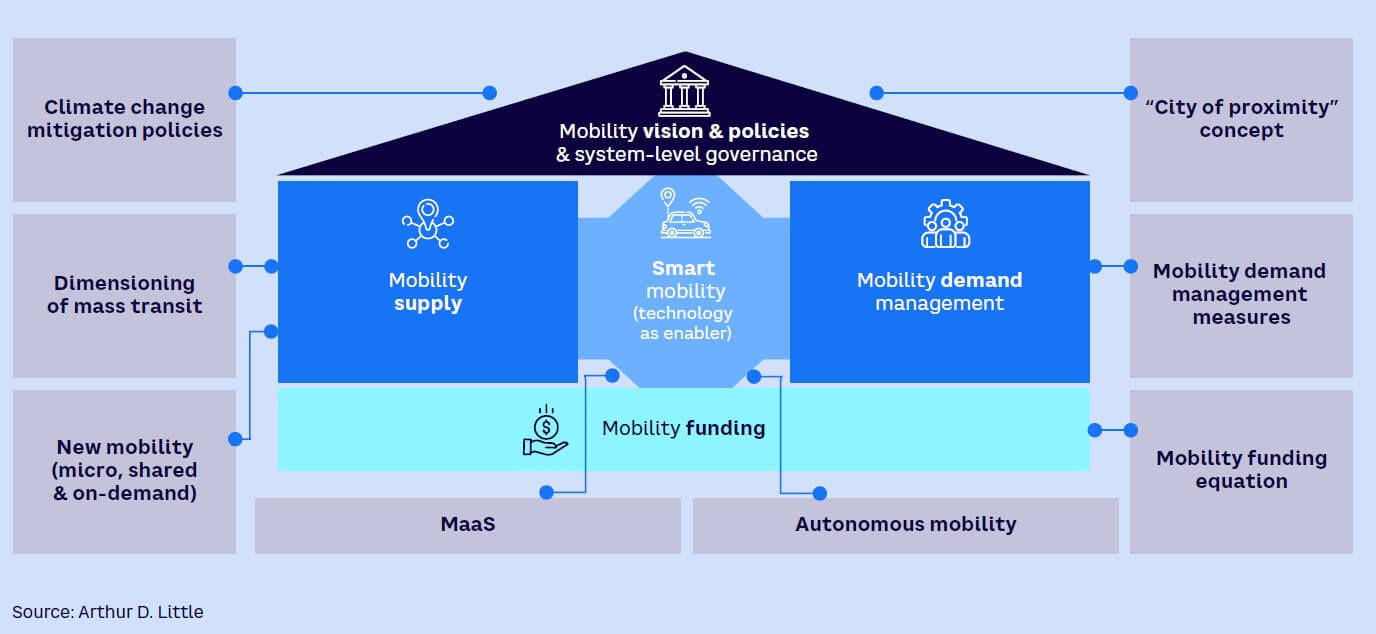

- Leaders should navigate the complexity of urban mobility by adopting a holistic, system-level approach. This involves addressing simultaneously the five interconnected pillars of the virtuous mobility system framework (see sidebar). In this framework, the mobility system is guided by vision, policies, and governance. Supply and demand are both actively managed. Smart mobility acts as an enabler for the system, and adequate funding is made available through a range of mechanisms.

- ADL’s “The Future of Mobility 5.0” offers concrete approaches based on this framework. The study delves into eight solutions (see sidebar) currently at the forefront that, if implemented, could potentially double the share of sustainable urban mobility by 2040 — from around 30% to 60% and identifies 10 game changers that we believe are critical for mobility systems players to shift gear and accelerate progress.

- Making change happen will demand political and organizational capacity as well as the courage to change direction and a determination to keep a steady course. Increased collaboration among public and private stakeholders within the extended mobility ecosystem, including government agencies, private operators, technology providers, and the public, will be key. Transport authorities in cities and regions, in particular, play a crucial role in accelerating the shift.