DOWNLOAD

DATE

Contact

Telco operators are facing declining profitability from a combination of stagnant or negative revenue growth resulting from competition and increasing CAPEX/OPEX caused by increasing user traffic. While operators have always run efficiency programs, traditional methods are no longer sufficient to meet current financial constraints and future market evolution. This Viewpoint explains how successfully managing costs requires a new, more granular, holistic approach.

MAXIMIZING PERFORMANCE WHILE OPTIMIZING INVESTMENT

The changing pressures on telcos

Telecom operators play a critical role in a world that depends on ubiquitous connectivity and demands data traffic and services. However, rising costs and increasing competition have impacted their overall profitability. Providers understand the urgent need to transform themselves by developing an ecosystem approach that moves beyond traditional connectivity and provides both B2C (business-to-consumer) and B2B2x (business-to-business-to-any-end-user) customers with platform-based products.

Technology innovation is the essential lever for this transformation. Adopting open, modern, software-based architectures that are modular, reusable, cloud-native, AI-ready, and made of standardized components will transform company culture and enable new operating models and go-to-market and partnering approaches. Given the investments required and current financial pressures, there is a clear need to prioritize areas with the highest returns.

When prioritizing network investments, operators tend to focus on traditional metrics like speed. Although meeting customer needs is central to success, two other critical key performance indicators (KPIs) focus on customer expectations/experience and sustainability strategies:

-

Network reliability and quality. Currently, customers are generally satisfied with modern networks that deliver speeds of 50Mbps or higher and offer reliable coverage, so they are unlikely to perceive or value any future improvements. Operators therefore have to focus on reliability and quality. The recent Opensignal Global Reliability Experience Report highlights the relevance of reliability to retention and revenues; CTOs and chief network officers should reshape the investment mix by shifting from coverage and speed to pursuing network resilience based on three key pathways:

-

Achieving operational and infrastructure-led excellence. Focusing on the quality and reliability of services to maximize customer experience is critical when planning and operating network infrastructure.

-

Running service-centric operations. End-to-end (E2E) service orchestration and automation are essential to delivering the next generation of telecom services.

-

Becoming an ecosystem provider. By exposing their network to partners through application programming interfaces (APIs), telcos can create an ecosystem and increase their service offerings.

-

-

Network sustainability. As highlighted in the Arthur D. Little (ADL) Viewpoint “Enabling a Sustainable Telco Ecosystem,” operators must ensure their technology investments support the objective of running a more sustainable network. To deliver this, many telcos have modified their CAPEX appraisal process. For instance, they set aside ring-fenced funds for projects that offer sustainability benefits.

Factors behind need for greater efficiency

Four key factors drive the gap between stagnant revenues and greater required investment:

-

Regulatory pressure. Regulatory interventions are increasing to support various objectives, such as creating more competitive markets with lower customer costs (e.g., termination costs in the EU) and providing them with higher-quality services and experiences (e.g., fiber rollout in the Middle East).

-

Growing technology complexity. Rapid evolution adds new layers and network components, which increases the need for CAPEX spending to compete with rivals, while assets must be monetized in shorter time frames.

-

Market hyper-competition. Competition, especially in Europe, is lowering average revenue per user (ARPU) as operators offer generous deals to attract customers. Consequent low margins reduce resources to reinvest in the network and generate alternative dynamics in the telecom landscape (e.g., NetCo-ServCo separation, TowerCo, network sharing, mergers).

-

Mounting data traffic volumes. Data traffic is constantly growing, due to streaming, 5G devices, fixed wireless access (FWA), and fiber. Huge capacity expansions are required to maintain the same quality of service, necessitating higher CAPEX for investments and OPEX spending on maintenance.

Why CAPEX-intensity ratios are increasing

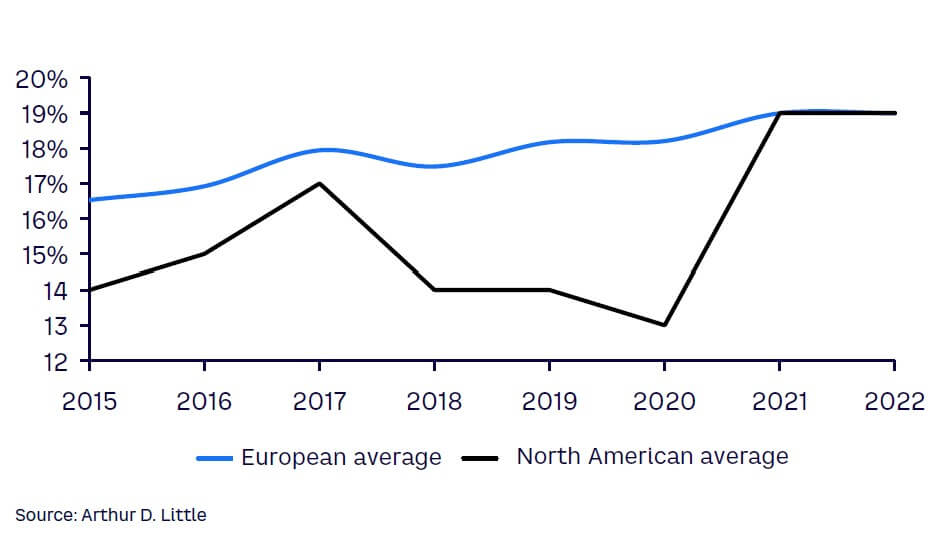

The above factors are expanding telco CAPEX-intensity ratios, which measure CAPEX against revenue (see Figure 1). Telcos are investing more in their network and IT infrastructures to support businesses and customers but are unable to fully monetize these investments. The main drivers for CAPEX intensity are a need to deliver a greater number of services, cope with technology evolution, and pay for higher energy consumption while data provision becomes commoditized. Compared to traditional players, new entrants are less constrained by a need to keep CAPEX-intensity ratios manageable, adding to competitive pressures.

In terms of technology, these growing CAPEX costs span:

-

Fixed and mobile network fiberization

-

Maintaining legacy copper infrastructure with fewer retail end customers

-

Rolling out 5G networks and virtualization

-

Continued network densification

-

Huge investments to maintain high network quality across growing data traffic volumes

-

Maintaining legacy 2G and 3G networks

-

Rising IT maintenance costs

INTRODUCING NEW INVESTMENT PARADIGM

Telcos are under pressure to increase investment while revenues plateau; over the long term, this is financially unsustainable. Traditional telco efficiency programs that focus only on cost reduction through analyzing costs and budgets, redesigning processes, and adopting automation are no longer enough.

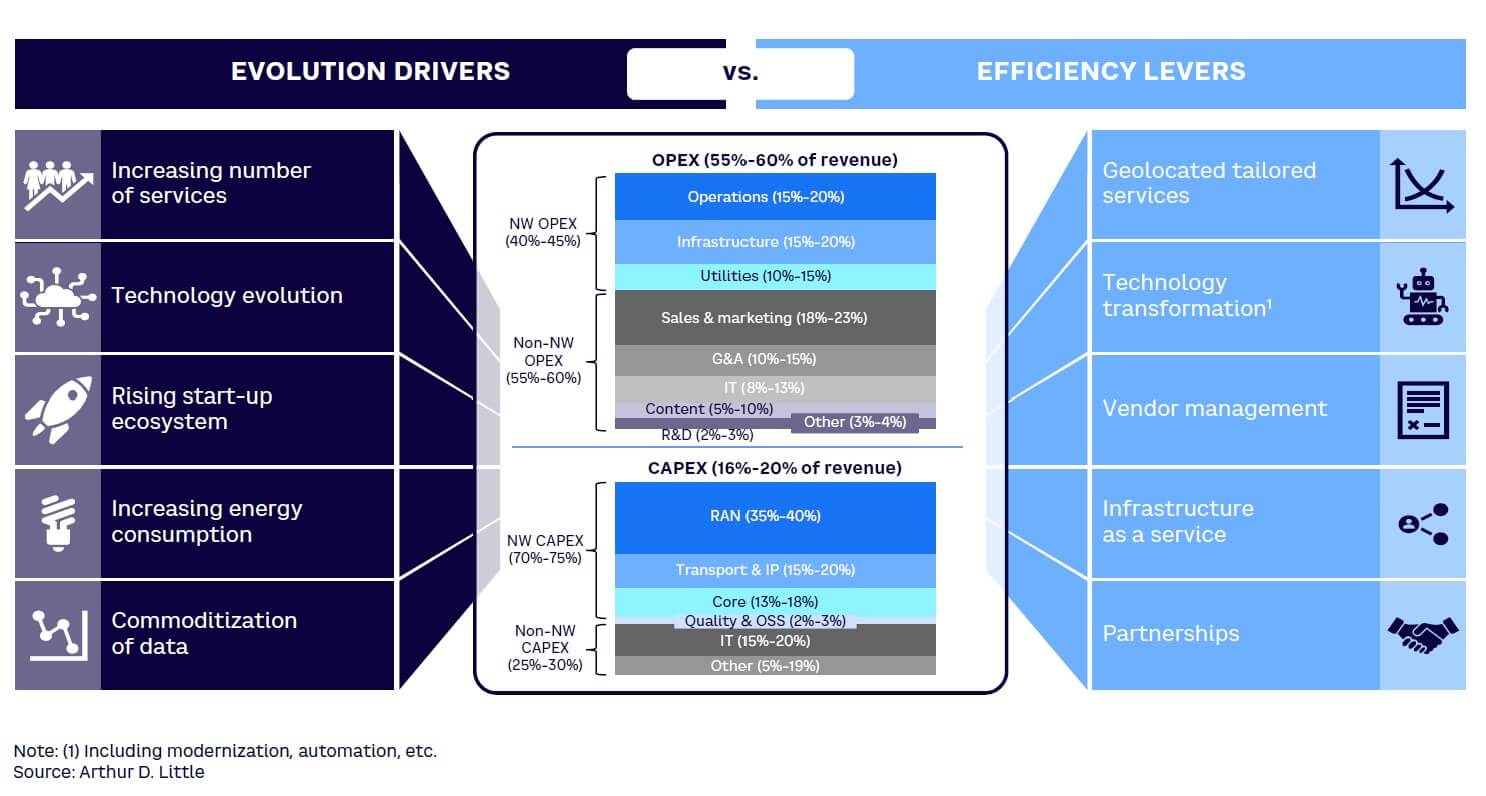

Operators need a new framework to guide CAPEX/OPEX spending to ensure ROI. There should be less emphasis on spending reductions and more on targeting investments to drive ROI. These investments must be correctly allocated geographically and over time. As illustrated in Figure 2, new efficiency levers can build on existing programs to deliver transformative improvements.

Geolocated tailored services

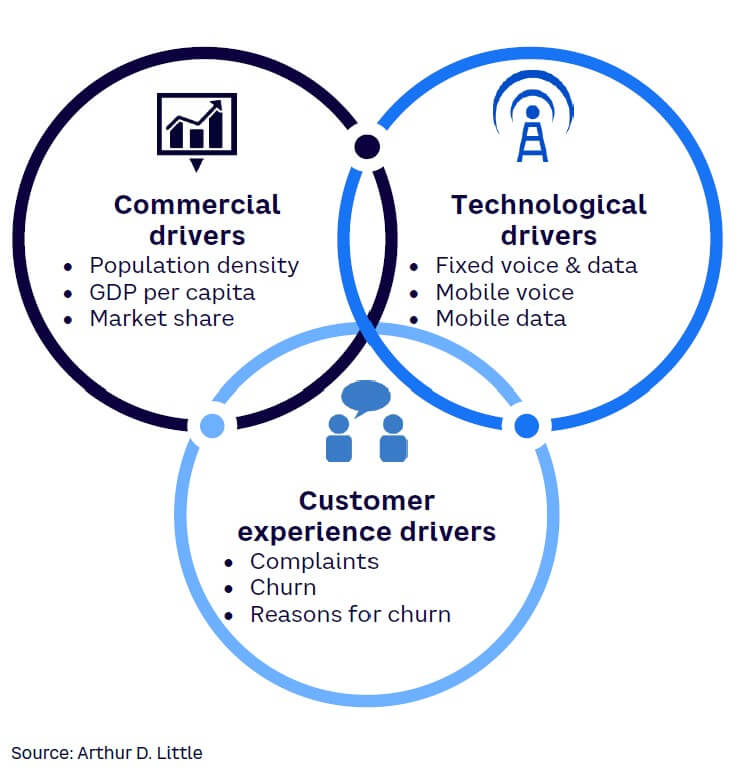

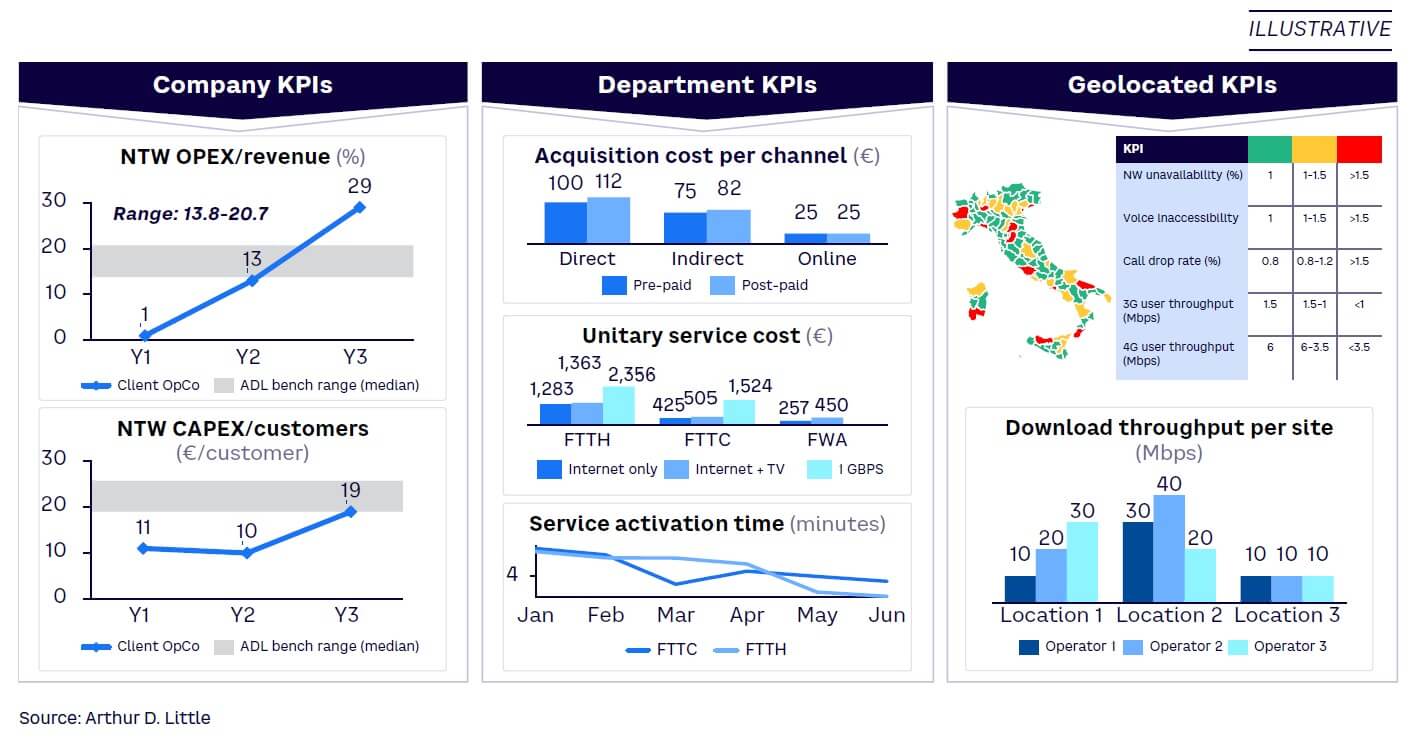

Instead of a blanket approach to network CAPEX, operators are evaluating their spending on a geographical basis, centered on the three KPIs of commercial, technology, and customer experience (see Figure 3).

They also must evaluate their complete service offering portfolio on a geographical basis. Both fixed and mobile operators should tailor the quality of service (including throughput and latency) and the portfolio itself at an access node level (i.e., the mobile site or access point for fixed-line networks). This analysis should be based on a financial evaluation of required CAPEX/OPEX versus expected revenues generated by the forecast customer base, competition, and customer requirements and expectations.

Technology transformation

Technology surely drives costs up; however, technology can also bring costs down. Automation, AI adoption, and equipment modernization are fundamental levers to speed up processes, reduce operational costs, and improve customer experience, as explained in previous ADL publications (“Operations 4.0” and “Extracting Network Operations Efficiency in the Post-COVID-19 Era”).

Vendor management

Effectively managing vendors is a classic approach to delivering cost savings. However, often more can be done. Well-structured sourcing and negotiation strategies built on a thorough analysis of strengths, weaknesses, opportunities, and threats (SWOT) should form the foundation of strong vendor management, especially when operators must rebalance costs and revenues.

Infrastructure as a service

Many mobile and fixed operators in Europe and Asia have implemented physical or virtual company separations, splitting themselves into a network company (NetCo) and a service company (ServCo). The NetCo can generate new revenue streams by offering its infrastructure as a service more widely to other telcos and non-telcos. Though physical separation can be disruptive for operators, it delivers major financial advantages. Based on our experience, it provides a 3%-4% growth in EBITDA and 10%-20% enterprise value improvements.

Partnerships

Establishing partnerships with vendors or market players enables operators to create an ecosystem where they can cost-effectively offer a wider portfolio of services to their customers or increase volumes to decrease costs through economies of scale. Opening their network to other companies through APIs allows operators to create an ecosystem where third-party developers and businesses can leverage their infrastructure, leading to increased innovation, expanded service offerings, and enhanced customer experiences.

AN INTEGRATED, SUSTAINABLE FRAMEWORK TRANSFORMS EFFICIENCY

To meet their pressing needs, operators must move beyond traditional efficiency measures. Instead, they must adopt a geolocated approach that delivers a service heat map to maximize revenue and minimize CAPEX/OPEX spending. Essentially, they must redefine the classic top-down planning process, which is normally determined by engineering factors rather than investment considerations. CAPEX planning, in today’s 5G era and in the future with 6G and beyond, must operate at unprecedented pace, scale, and precision with seamless workflow across the entire organization.

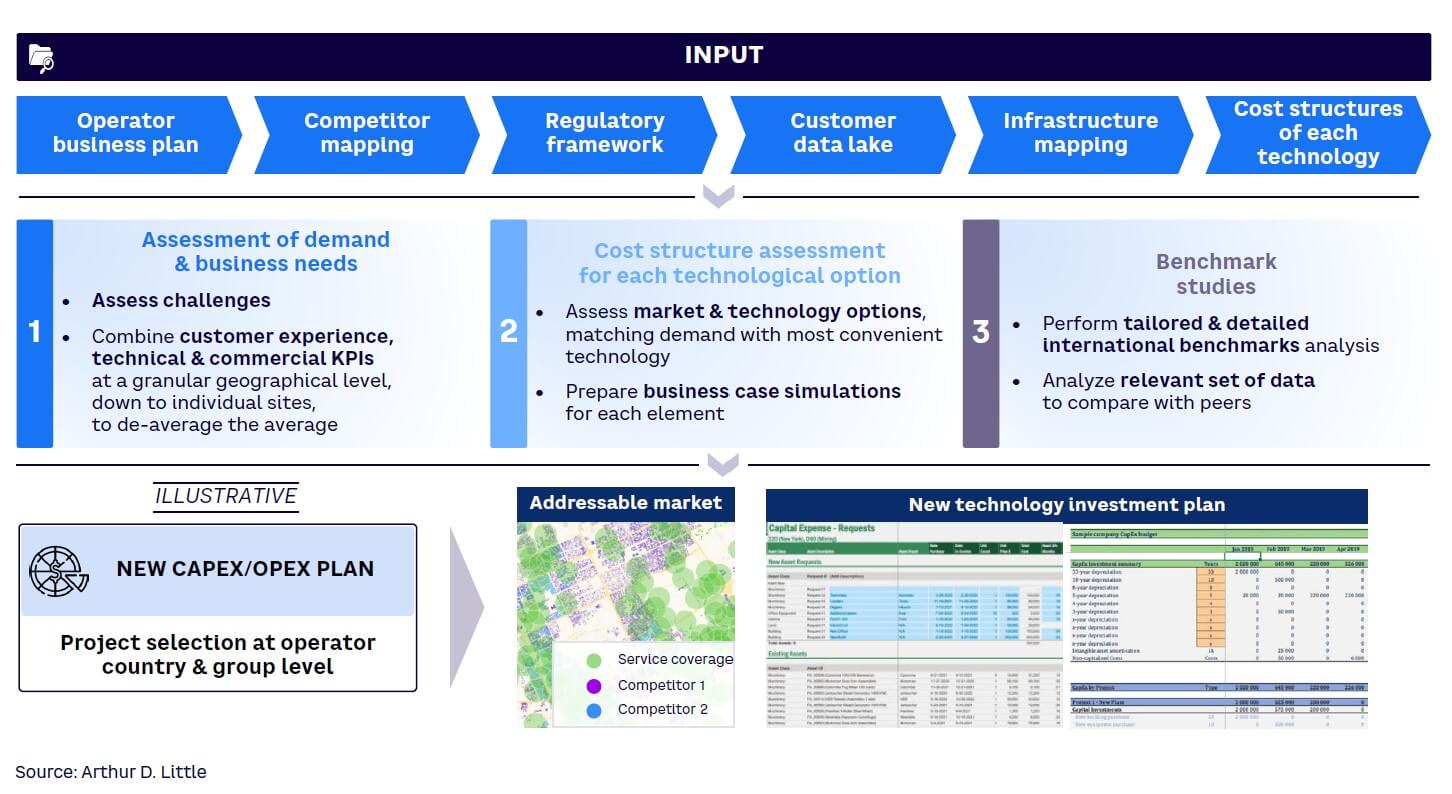

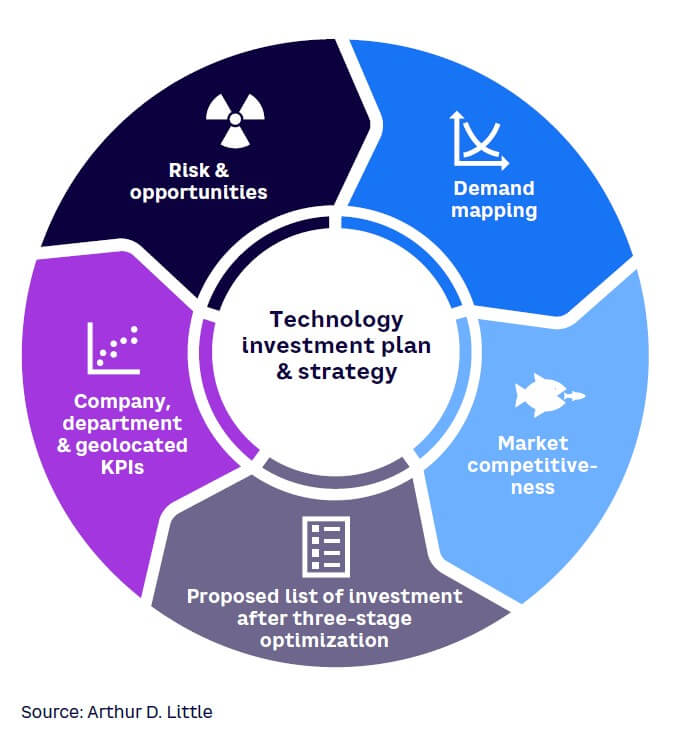

Achieving this requires a framework that unites efficiency levers and embraces a customer-centric perspective (see Figure 4). It starts by analyzing multiple inputs, including:

-

Operator’s current business plan and service/product portfolio

-

Competitor mapping

-

Regulatory rules and constraints

-

Customer data

-

Technology infrastructure mapping

-

Cost structures for each technology

Combining these inputs and the outcomes of the analysis guides operators to the next three steps:

1. Assess demand & business needs

Operators can assess and challenge demand from business departments by integrating it with a deep dive into technical and commercial/market competitiveness KPIs at a geographical level, ideally around individual access nodes. This enables operators to identify what customers need customers in a specific location.

The outcome of the demand analysis includes:

-

Geolocation of addressable market within site range

-

Prospect and customer base addressable per point of presence (PoP)

-

ARPU per service estimation

-

Incremental cost per customer calculation based on distance from PoP

-

Potential penetration estimation

Market competitiveness factors comprise:

-

Competitive analysis to support revenue projection

-

Definition of offer positioning

-

Competitor churn and gross adds estimation

-

Churn and gross addition versus competitor estimation

-

Revenue risk analysis

-

Calculation of potential market share per PoP

Delivering the above at a local, granular level requires analyzing enormous volumes of data, which is only possible by harnessing dedicated, automated AI/ML (machine learning)–powered tools built on an automated workflow from input to output. The framework outlined above has been developed to meet these requirements and can be customized on a case-by-case basis to tailor analysis to an operator’s specific needs and objectives.

2. Assess cost structures for each potential technology option

Upon quantifying demand, operators need to identify the optimal technology combination for building their new technology investment and business plan. This must factor in PoP, service coverage, market potential, and CAPEX/OPEX costs. There should also be an assessment of market and technology options to match demand with the most convenient technology. Starting from the individual access points, business case simulations should be run for each element, based on the best combination of technologies, service offerings, and related quality of service and costs. Once optimized, they should be aggregated, first to the core network level and then to the transport nodes. This iterative approach ensures a positive business case. The outcome of the process should be an optimal combination of interventions mixing different technologies and services at the local level to meet customer needs.

3. Benchmark to ensure best practices

The optimal combination should then be validated by comparing its outcomes to international and local benchmarks to identify any final changes and highlight risks. The operator needs to compare its plan with its competitors and international best practices to fine-tune the quality of services to meet customer needs and expectations (see Figure 5).

For example, if a competitor provides a service that meets customer expectations, with KPIs below those of the planned option (e.g., delivering 50Mbps download speeds on a 4G network), investing in better-quality services is unnecessary and inefficient. CAPEX can then be redeployed to deliver a competitive advantage. Similarly, comparing an operator’s KPIs to its peers helps identify potential risks to the customer base if a comparatively lower-quality service is provided.

The results of the benchmark analysis are crucial to fine-tuning the previous analyses and business case. Operators will be able to define the optimal scenario around PoPs, service coverage, market potential, and cost, which will form the foundation of the technical new CAPEX/OPEX plan and the company’s new business plan that integrates revenues and spending.

APPLYING NEW INVESTMENT PARADIGM IN THE MIDDLE EAST

Countries across the Middle East are actively building digital economies with far-reaching transformation programs, such as Saudi Arabia’s Vision 2030, Kuwait’s Vision 2035, and Bahrain’s Vision 2030 and Sixth National Telecommunications Plan. The digital agendas in these countries aim to accelerate economic diversification, promote sustainability, and enhance citizen satisfaction by implementing innovative technologies and creating smart cities, next-generation healthcare and education, smart government, and advanced mobility options.

Telco regulators are supporting these transformations by mandating quality and performance standards and boosting service availability. However, operators face challenges from the combination of rising costs and static revenues, which limit investment resources. It is vital for Middle Eastern telcos to adopt new frameworks for CAPEX/OPEX planning and efficiency.

5 KEY BENEFITS OF SUSTAINABLE TELCO SPENDING

Applying the framework described above supports the development of both a future-proof business plan and a new, modular, integrated strategy that reduces cost, increases revenue, and better engages with the operator ecosystem (see Figure 6). This plan simultaneously creates five benefits:

-

Expense optimization — identifying efficiencies and the best allocation of CAPEX/OPEX

-

A future-proof plan — selecting future-proof technologies with a flexible and localized approach, focused on customer needs

-

Commercial commitment — gaining company-wide support for the strategy to enhance financial results

-

An outward-looking perspective — scouting for potential partnerships, involving external stakeholders, and highlighting NetCo and M&A opportunities

-

A transparent and reliable strategy — creating a robust approach built on business drivers and data analysis, making the decision-making process transparent and reliable

Conclusion

AN INTEGRATED FRAMEWORK DELIVERS SUCCESS

Telcos need to rethink their business models and quickly adopt a new, bottom-up, data-driven framework to address the widening gap between stagnant revenues and increasing CAPEX/OPEX investments. Critical factors to consider include:

-

Business demand, required CAPEX/OPEX spending, and revenues should be highly granular and closely correlated at a geographical level.

-

The service offering portfolio and quality of service required will vary between locations.

-

The service offering portfolio and quality of service must be tailored and geolocated to customer needs and competitor offerings.

-

The new technical and business plan will ensure operators stay within budget while maximizing expected revenues and increasing ROI.