DOWNLOAD

DATE

Contact

In light of accelerated industrial digitalization, there is a consensus that the IoT market has significant, yet untapped, potential. This potential seems more reachable with the arrival of 5G capabilities such as vastly improved speeds and reduced latency, all of which are poised to accelerate the adoption of IoT solutions across industry sectors. Over the next few months, Arthur D. Little will publish a series of viewpoints with insights on how to capture and scale this opportunity. In this first publication, we present a framework for operators and solution providers to prioritize and execute on IoT investments. In subsequent viewpoints we will analyze the opportunities per industry vertical in further detail.

Acceleration ahead

We are entering a new phase of digitalization driven by multiple converging digital enablers, such as robotics and artificial intelligence, as well as new digital interfaces and ways of working, including mixed and virtual reality.

The rollout of 5G will make possible many IoT use cases that have been previously unattainable or difficult to scale. In this new phase, digital enablers will not only support and improve existing use cases, but also enable the development of entirely new solutions to industry problems.

The IoT in the 2020s – From digitally supported to digitally driven

Although IoT use cases in the IoT 1.0 world were often developed to digitize previously analogue processes, the true value of IoT lies in its ability to generate new business models, internal processes, and ways of working, i.e., digitalization.

For example, since 2015, Progressive Insurance has offered an optional “Pay as you Drive” program, in which its customers can plug IoT devices into their vehicles’ onboard diagnostic ports, thereby enabling Progressive to monitor driving behavior and offer customized insurance rates based on this. We are now seeing new business models significantly expanding upon this early IoT model. Progressive itself is offering a smartphone app for continuous monitoring of driver behavior (speed, trip regularity, etc.) and Jooycar is developing a telematics platform that will allow insurance companies, automotive manufacturers, and fleet owners to create new usage-based program policies. By leveraging data collected from onboard diagnostics devices and other sources, insurers can not only employ variable pricing models or reward policyholders based on driving behavior, but also lower maintenance expenses and generate fleet management insights.

As adoption is increasing for customer-oriented applications, there is also widening applicability for IoT around operations and resource management. One example of this is the LoRa-based water management solution that retailer Costco has adopted in many of its buildings. By placing sensors throughout a site’s water infrastructure, Costco can better monitor water usage and has, on average, observed a 20 percent reduction in water consumption and 22 percent savings on water bills.

This shift from digitally supported to digitally driven will heavily impact many industries going forward. As IoT development will radically affect the financial outlook and value creation across industries, it is crucial for management teams to prioritize investments in IoT solutions and infrastructure.

Next-generation connectivity – An entry ticket for operators?

On one hand, we have industry verticals exploring opportunities to both secure new revenues and lower costs, but confronted with challenges to enable and scale IoT solutions. On the other hand, we observe operators contemplating their own digital journeys and taking the responsibility to carry forward the very fundamental digital enabler – connectivity – for their customers. The rollout of 5G mobile networks is now in full flight across most of the globe, with much being made of how next-generation connectivity will outperform current standards. Mobile connectivity will be the cornerstone of enabling digital solutions across industries, and operators may be better positioned than before to capture shares of the market.

The demand for bandwidth will continue beyond anything we have previously seen, driven by the compounded effects of more connections, greater data rate per “thing”, and longer communication distances. Fiber deployment is vital, as it contributes to securing backhaul capabilities for 5G. In fact, connectivity is expected to take a giant leap in the next few years. As shown in Arthur D. Little’s report, “The race to gigabit fiber”, fiber is being deployed at an impressive pace, with 8+ countries already reaching more than 90 percent fiber coverage. In addition, public cloud has become the natural landing zone for consumer and enterprise data. Major cloud services suppliers have experienced staggering CAGR of above 50 percent between 2014 and 2018 and show no signs of slowing down.

Many of the new IoT use cases will also drive increasing demand for high-performance connectivity beyond pure bandwidth. Arthur D. Little has analyzed over 400 use cases and found that more than 50 percent of them will be significantly enhanced with 5G – which will drastically advance performance in latency, speed, and capacity. Moreover, in a more digitally connected world, with implantable sensors and robots supporting mission-critical business activities, dependability and reliability become vital. For such areas as health care, for which loss of connectivity could mean the difference between life and death, the IoT market will not reach its full potential unless safety and reliability can be assured.

There is a sizable opportunity for operators with the right positioning

Arthur D. Little has estimated that the global IoT revenue opportunity for ICT players across the value chain will increase from 1,277 bn USD in 2020 to 2,530 bn USD by 2025, should the market embrace and fully leverage the industry digitalization potential in the upcoming decade. In this new landscape operators must understand how they can empower their organizations to build successful models in a B2B2X context, as well as fully embrace digital tools and techniques within their own organizations. This is more thoroughly explained in Arthur D. Little’s recent reports on the telecommunications industry: “Major strategic choices ahead of TelCos: Reconfiguring for value” and “Delivering the digital dividend.”

To become trusted partners and secure business in the digital transformations of industry verticals, operators are faced with a choice – establish positions today and grow with the market or risk losing relevance as their current technology, go-to-market, and delivery models become outdated. The value created by these transformations is shaped by specific opportunities and challenges – each vertical unlike the other.

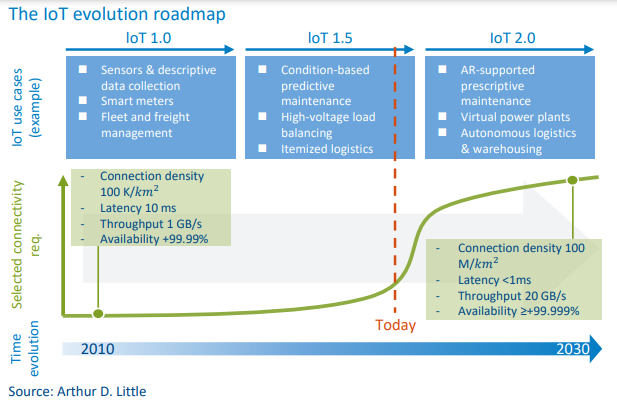

Ensuring a sustainable business will require moving from IoT 1.0 (simple data collection) to IoT 2.0 (optimization). This can be illustrated by the IoT evolution roadmap in the figure below. The basic, enabling infrastructure is, to a large extent, built in the first set-up. Operators that are not participating in IoT 1.0 and IoT 1.5 will find it difficult to enter the market in IoT 2.0. This emphasizes the necessity to start cementing the right position today, gradually adding value to use cases by expanding offerings and building larger businesses in the process.

Multiple pathways to secure a winning position

Many operators have already begun paving the way for successful digital businesses of tomorrow, founded on current IoT practices.

For example, Australian operator Telstra has established and grown a successful business in connected stadiums by offering end-to-end in-stadium experiences. As such, Telstra will be positioned to monetize future use cases from an existing customer base with 4K live streaming, mobile spectator services, and immersive experiences.

Ultimately, operators must define their fields of play based on a solid definition of their strategic goals, deep understanding of local market conditions, and honest assessments of internal capabilities. Connectivity and infrastructure provisioning are the home turf, where the business begins and, for most operators, where it ends.

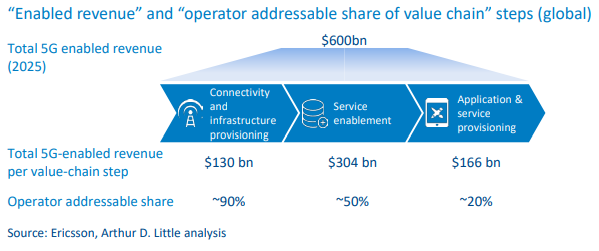

Operators can go beyond providing only connectivity to become enablers of solutions, capturing a larger share of wallet and, by extension, a more sizeable revenue pool. This might mean providing IT platforms and end-user applications. The value of service enablement, including application and service provisioning, is estimated to reach 470 bn USD in 2025 (see figure below), which makes this an already-appealing, and sometimes successful, investment area for some operators, but a “greenfield” for the majority. However, it may provide a blue ocean for an organization that can identify a strategic fit in the value chain and develop suitable end-to-end offerings.

A customer-centric approach to capturing the IoT opportunity

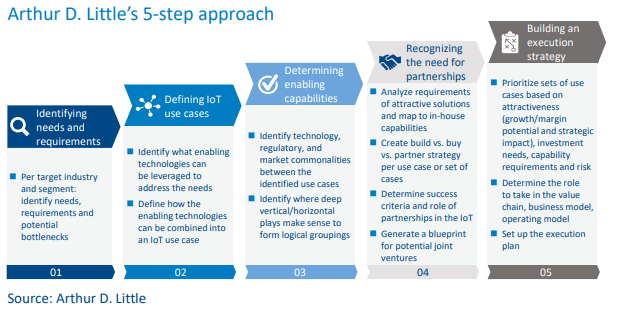

Securing a winning position requires a structured approach with a clear understanding of customer needs. Based on our years of experience supporting industry players and service providers, Arthur D. Little has developed a five-step approach that defines a complete, yet pragmatic, way for operators and other IoT solution providers to prioritize where to play in the IoT space. (See figure below.)

Step 1: Identify needs and requirements

A customer-centric approach necessitates starting with identifying the needs and requirements of target industries, segments, and leading industrial players. For instance:

- What are current unmet industry needs?

- Where is there room/need for cost reduction, efficiency improvements or improvement of customer experience?

- How can IoT solutions be leveraged to meet those needs?

- What is the industry’s willingness to pay?

Once these underlying needs have been identified, business needs can be translated into technical needs, including:

- Connectivity parameters such as data rate, latency, security, position accuracy, connection density, and mobility.

- Application environment such as public or private settings.

- Other requirements such as cloud infrastructure, IT middleware, data management and analytics, and application platforms.

Step 2: Define IoT use cases

On the technical side, operators need to understand what key value-added technology satisfies the identified customer needs in Step 1. IoT use cases are then defined by combining those key technologies.

Step 3: Determine enabling capabilities

Faced with a plethora of possible IoT use cases and multiple alternative technology routes, operators need to determine their strategies – and pursue either a vertical or horizontal approach, or combinations of both.

Traditionally, most operators have chosen a vertical approach, i.e., to focus their efforts per industry where they intend to establish commanding market positions as trusted providers of IoT solutions (e.g., B2B2x).

This approach, however, poses challenges for operators’ resources and capabilities due to the diversification of IoT solutions. For example, smart manufacturing use cases can require a range from IoT mass sensoring to mission-critical robotics and high-density video streaming.

On the other hand, the horizontal approach is to group digital use cases with similar functionalities and/or requirements for technical, commercial and marketing capabilities across multiple industries. Many IoT start-ups choose this model – building one technical solution and then identifying use cases across verticals.

The benefit is that the investment in network and IT enablers can thus be shared over a larger market base, effectively increasing the rate of return. It allows reusing and building on sales approaches, engagement and delivery processes, and commercial know-how to more effectively convert use cases into business cases. Capabilities are replicated, and operators will add only incremental costs while scaling from one use case to the next and/or from one industry to the next.

There are also limits to a purely horizontal approach, especially in industries with specific regulatory requirements such as healthcare or financial services. Hence, it is important for the commonality analysis to also consider regulatory and market commonalities.

In reality, a mix of vertical and horizontal groupings is often appropriate.

Step 4: Recognize the need for partnerships

This IoT opportunity is realized by identifying the commercial and technical challenges across a solution category and developing capabilities to meet them. Key questions to consider include:

- Which capabilities should we develop in-house and which should we procure from others?

- Which partners should be engaged to build an ecosystem in which use cases can be delivered successfully?

Step 5: Build an execution strategy

Once the previous steps have been completed, preparations have to be made for successful execution, for example:

- Which sets of use cases should be prioritized?

- Where in the value chain should we position ourselves in order to best play to our competitive strengths?

- What regulatory constraints need to be considered and overcome?

Arthur D. Little’s five-step approach provides a structured, customer-centric path to navigate this new world.

In its upcoming series of Industry IoT viewpoints, Arthur D. Little will explore IoT opportunities per industry vertical and exemplify how these opportunities are seized with a customer-centric approach.