Demand switch to low-sulfur fuels has been uneven across the globe, but environmental and engine regulations are pressing sulfur specs to extremely low limits. Refiners need to act accordingly since there will not be place to sink high-sulfur fuels anymore.

Demand for ultra-low-sulfur on-road fuels rose more than a decade ago in regions on the forefront. Late-comers are pushing towards this tendency and will catch up sooner or later; marine fuel is also playing its part on a global scale. Pressure is rising on refiners and their capacity to almost eliminate sulfur from their products.

1. Environmental drive from multiple angles

Energy-related emissions, and from oil combustion in particular, have been facing stricter and geographically broader limitations for the past decade, and the tendency keeps accelerating.

Pressure is not only coming from populations with greater environmental awareness, preaching for a world of clean energy and clean fuels, but also from environmental institutions and governments, which are following population demand.

This rise in environmental concern has supported many initiatives in the land mobility sector, such as:

- Fuel efficiency of on-road fleets: driven mainly, but not only, by engine and powertrain efficiency and vehicle bodywork design

- Installation of cleaner-fuel urban transportation systems and interurban corridors

- Growing penetration of electric vehicles (EVs) supported by subsidies: still incipient but threatening petroleum products demand almost exclusively in certain regions

- Changes in mobility behavior (car-sharing, car-pooling): mostly promoted in metropolitan areas, with the aim ofalleviating on-site emissions and traffic congestion

In addition, other petroleum-fuel-demand segments have seen “dirty” products such as fuel oil, the largest destiny of refinery sulfur, displaced by natural gas, which reduces its market size and price. This fact also affects the share of petroleum products in the global energy matrix.

More than 98 MM BPD (million barrels per day) of refined products are consumed in the world, and said consumption keeps growing at around 1 percent annually. Increasing share of natural gas and non-traditional renewable energy sources, plus the strong trend of increasing the use of electricity, have been moderating petroleum products’ demand growth and will continue to do so. This is such that, contrary to what we have believed for decades, peak oil will come from the demand side instead of from the supply side.

Although difficult to predict, both the potential displacement of up to 3 MM BPD of oil products globally by 2030 due to EVs and the availability of larger naphtha volumes of feedstock from the petroleum upstream will challenge refining capacity and product mix, deepening expected relative shortage of diesel.

This EV penetration will, however, be uneven across the globe and more aggressive in countries where bans on sales of fossil fuel cars have been announced. However, these announcements are meant to be effective from 2025 to 2040, and fossil fuel vehicle fleet replacement will take some years to be significant, and challenge mainly gasoline consumption.

Those 98 MM BPD of oil products will continue to have a market, but a large portion of them will need to be much “cleaner” than today to be tradable.

On-road vehicles: stricter limits for ~40 MM BPD

Regulation for reduced emissions is driving development of more demanding automotive engine technology and playing a preponderant role in the push for clean fuels. The impact is immediate for the countries or regions where the engines are produced locally (i.e., Euro V/VI). However, sooner than later, when late-comers discontinue production of less restrictive engines, they will need to adjust their fuel quality regardless of local regulation. Even though regulators are the ones redefining local specs on fuels, it ultimately is the adoption of new engine technology that requires low sulfur fuel to operate in working conditions.

For instance, for diesel-fueled vehicles, the chosen systems for gas exhaust treatment are EGR 2 and SCR 3 , the latter of which requires regular urea refills. The major difficulty for this treatment is the trade-off between NOx and particulate matter emissions. To help this equation, the fuel needs to be almost clear of sulfur, a state known as ultra-low sulfur. Otherwise, engine corrosion and catalyst fouling occur, and the soot (particulate matter) increases in volume.

In addition to this technical-based demand, there is also a commercial drive, which means changes in tendency according to what customers demand.

In order to fully eliminate or reduce sulfur from oil products, new refinery units need to be installed. However, these units emit significant greenhouse gases, so in the end, it is a trade-off between greenhouse gases at refineries (which, in some cases, are located close to cities) and contaminant gases and particles spread over the cities and roads.

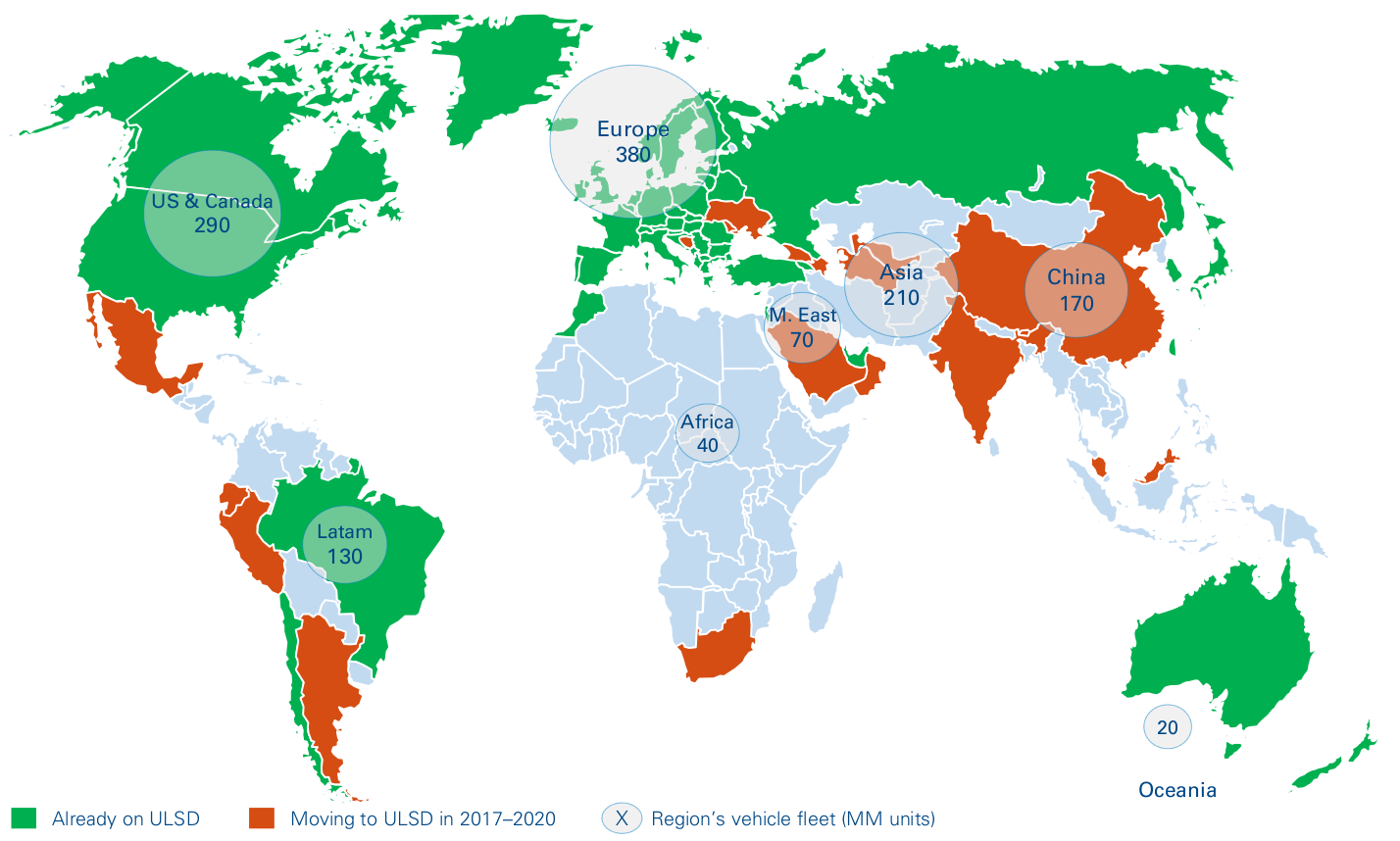

Local regulations are distributed unevenly across the globe, and while some regions have been operating exclusively on ultra-low-sulfur fuels for more than a decade, lagging regions still offer markets for high-sulfur ones. These regions (mostly Asia, Africa, the Middle East and Latam) have been and still are playing the role of “sulfur sink”. However, the clock is ticking for them, as the era of high-sulfur fuel is running its course.

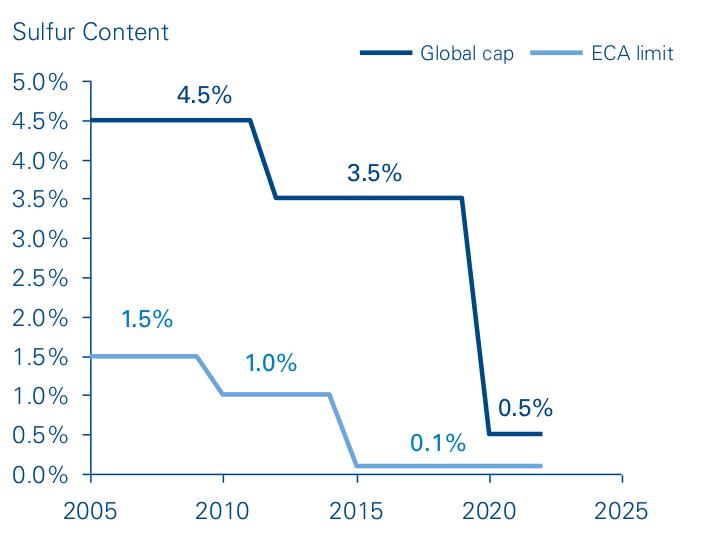

Marine fuel: ~4 MM BPD subject to IMO regulations

In October 2016 a global regulator, the International Marine Organization (IMO) committee, set January 1, 2020 as the starting date for the new MARPOL 4 regulation. This regulation limits marine fuel sulfur levels to 0.5 percent (m/m – mass over mass) in marine fuels outside the already-much-stricter emission control areas (ECAs). Current marine fuel regulation demands a maximum of 0.1 percent sulfur content inside ECAs and 3.5 percent outside them.

Moreover, international marine trade is expected to continue growing at a 3–4 percent annual rate, as international trade usually surpasses GDP growth and about 90 percent of world trade is transported by ship.

Figure 1: Local sulfur specs for on-road diesel

Figure 2: Marine fuel sulfur content limit – percent of m/m

Fuel oil (the major destiny of refinery sulfur) finds about 40 percent of its market as a marine fuel (~3 MM BPD), which means this oil product will be severely restricted. However, even though its use for propulsion in the sea may be very limited, high-sulfur residues are withstanding and dodging reconfiguration in some places where there are still captive markets for industrial use and power generation with lighter specs than marine fuel. Nevertheless, both uses will get incremental participation of natural gas and renewable sources, motivated to some extend to meet with Paris Agreement 5 commitments.

Industrial use and power generation: ~12 MM BPD still dodging regulations

The industrial and power generation sector, which is not as strictly regulated as mobility fuels, has been adjusting the sulfur content of what it burns unevenly across the globe. These have been the places of disposal for high-sulfur fuels. However, sooner or later, the SOx emission limits will reach larger, stationary engines, and even if some are located far from urban centers, the industrial and power sector will no longer be able to burn the amount of sulfur it burns today.