DOWNLOAD

11 min read • Strategy

Realizing the potential of the Internet of Things with 5G

Despite the hype, the Internet of Things (IoT) has yet to deliver its promised benefits to industrial companies. The advent of 5G removes many of the technical barriers to its successful adoption, accelerating digitalization. However, as this article explains, realizing the potential of the IoT requires businesses to focus first on their needs and then on the available options to implement the best solutions for future success.

Despite our living in a world where more and more devices are connected, the Internet of Things (IoT) is still far from living up to its full promise in many industries. This is set to change as 5G enables many of the technical requirements that have previously been lacking. It will unleash significant industrial potential and enable realization of Industry 4.0 – Arthur D. Little estimates the value of 5G-enabled IoT to be USD 1.5 trillion by 20301. So now is the time for companies to set their IoT strategies, and we believe investing in private networks is important for companies to consider as 5G becomes a reality. How should companies go about this?

5G will enable a broad range of advanced IoT use cases

The IoT has been a buzzword for quite some time – we have all heard (repeatedly) how “everything will eventually become connected.” Although the number of connected things has increased exponentially over the past few years, the fact remains that in most industries the full potential of the IoT remains unproven and the major promised gains have yet to materialize.

Several factors have influenced this:

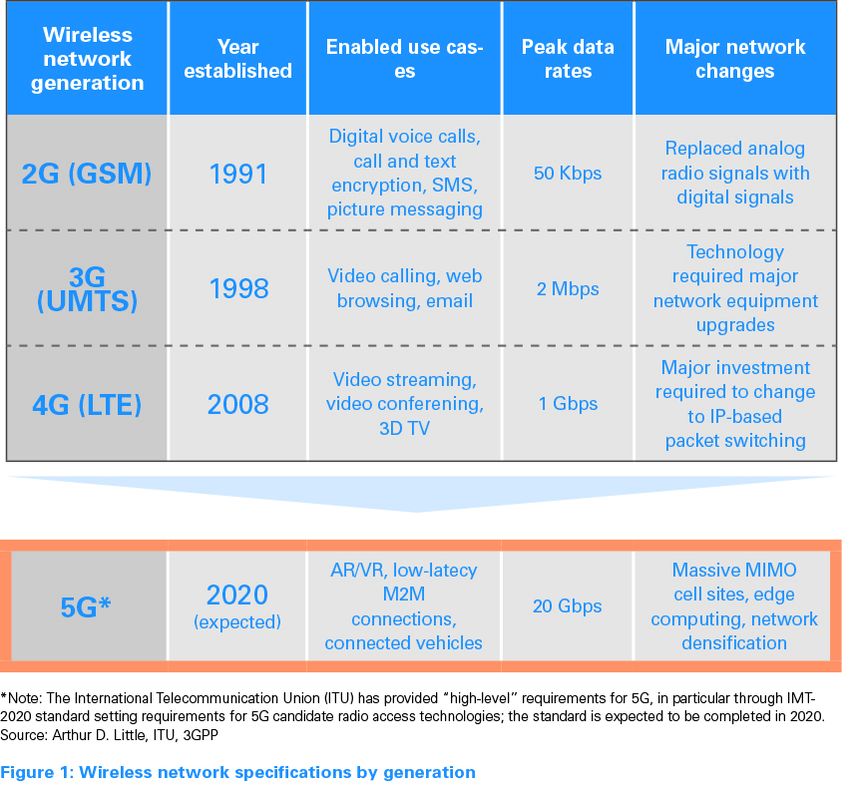

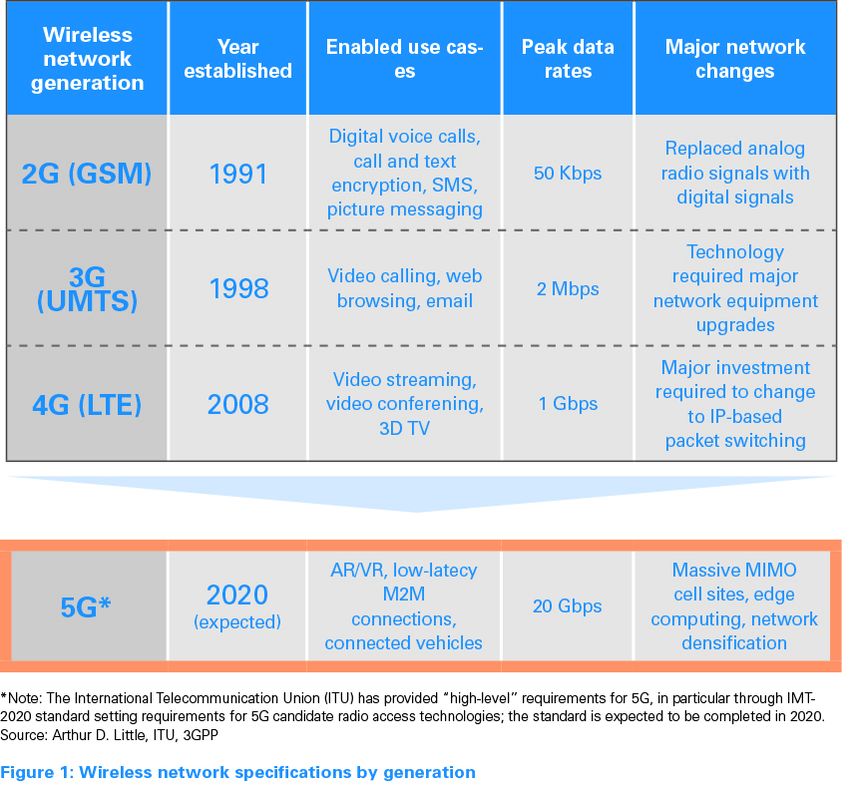

- For a long time, supporting technology and infrastructure solutions were lacking. (See Figure 1 for key changes between selected wireless network generations.)

- Mobile network operator (MNO) models for pricing and performance were not adapted to the needs and requirements of enterprises looking to implement and scale IoT solutions.

- Many enterprises weren’t quite ready to adapt to digitized business and operating models.

All of this is now rapidly changing. Sensors are becoming smarter, cheaper, and smaller – thus enabling broader usage and establishment of device ecosystems. Corporations are increasingly digitized and have systems in place that IoT solutions can connect to or be integrated into. Network operators (both traditional and alternative providers) have also realized that there is an unmet need for IoT-specific solutions and services; many have consequently established businesscentric and/or IoT-centric divisions and offerings, such as Sprint’s Curiosity and Telia Company’s Division X.

As digitization increases, networking requirements increase as well. The emergence of the IoT has led to a need for different characteristics and technical capabilities in cellular networks, which have continued to develop and will, with the emergence of 5G, address the key needs of the IoT. 4G LTE, the latest iteration of the fourth generation of mobile cellular networks, has already enabled numerous new IoT solutions. However, while a combination of cabling and WiFi enabled many early industrial IoT use cases, 4G didn’t fully deliver in four areas:

- It failed to provide speeds comparable to those of fixed broadband.

- It did not meet significant bandwidth requirements.

- Latency was not adequate for mission-critical applications.

- It did not manage device density, which is key for a number of applications.

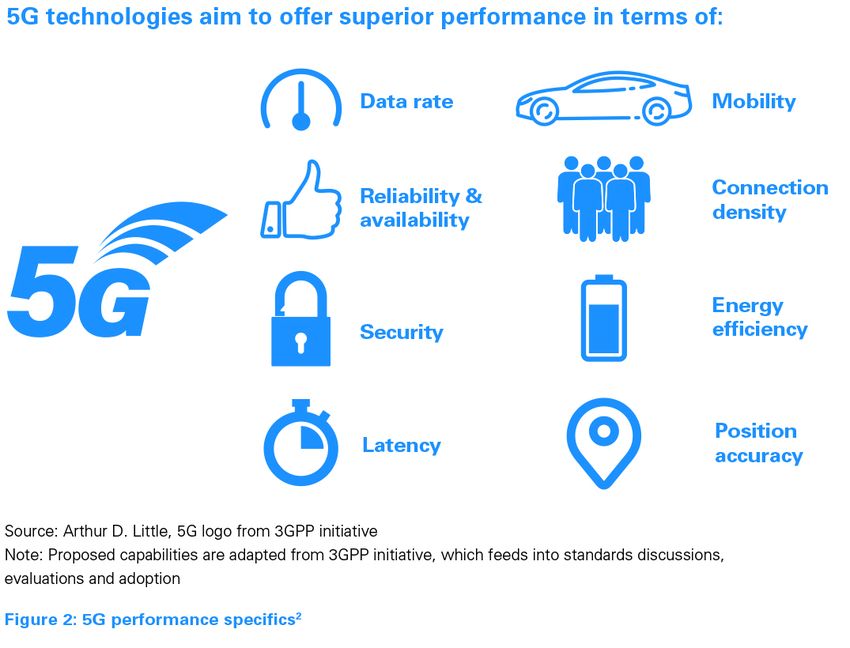

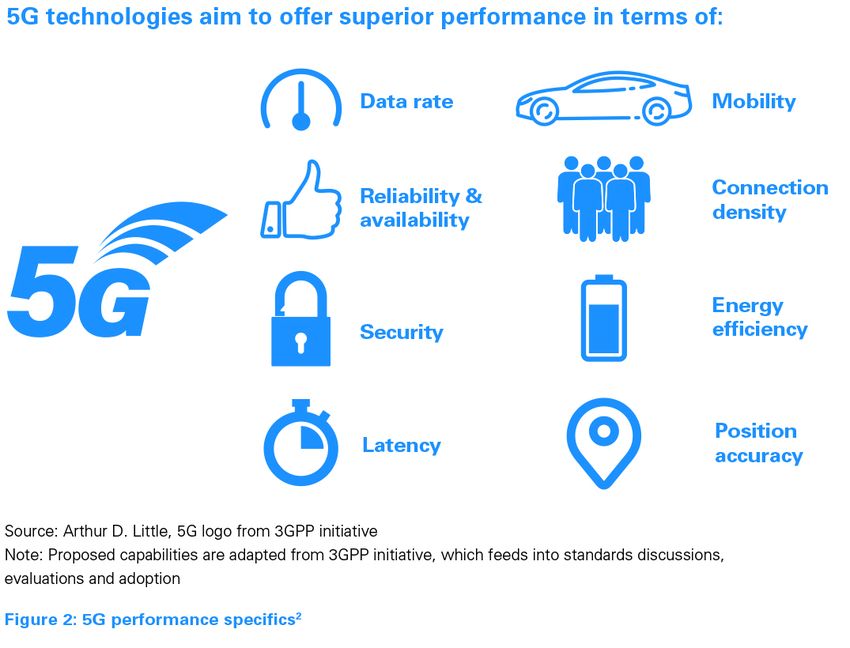

The next “evolutionary step” will be provided through broad implementation of 5G. In addition to being much faster than previous generations, 5G has a number of additional properties that will open up new mobile-data use cases – lower latency, improved reliability, higher connection density, low-cost and low-power capabilities, and enhanced positional accuracy. With 5G, wireless performance will be on par with fixed-line connections in many instances. (See Figure 2.)

One key feature of 5G which will significantly enable the IoT is ultra-low latency (the time it takes for data to be sent and/or received). Standards of 5G aim to reduce latency to a millisecond (ms), compared to approximately 50 ms for 4G. This might seem like a small difference, but if we compare it to human reaction times, a 50 ms lag is discernable, while less than a millisecond is faster than a human can react. If we consider an autonomous car responding to a pedestrian in its path or a connected drill reacting to unexpected vibration patterns, that millisecond can be the difference that saves the pedestrian’s life or prevents a collapse in a mine.

5G is also expected to be “ultra-reliable”, which will mean nearly no dropped calls or lost connectivity. It will thus allow for mission-critical use cases, such as those related to digital health, connected cars, and emergency response.

Industries increasingly deploy and use connected sensors to monitor various assets in real time. Doing this economically requires devices that operate at low power levels and networks that offer low-cost connectivity options.

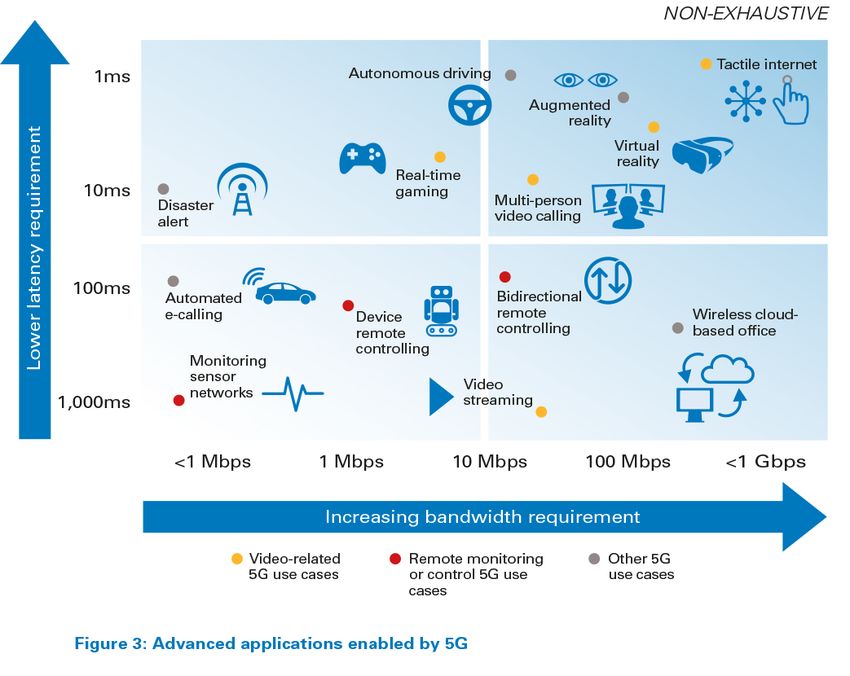

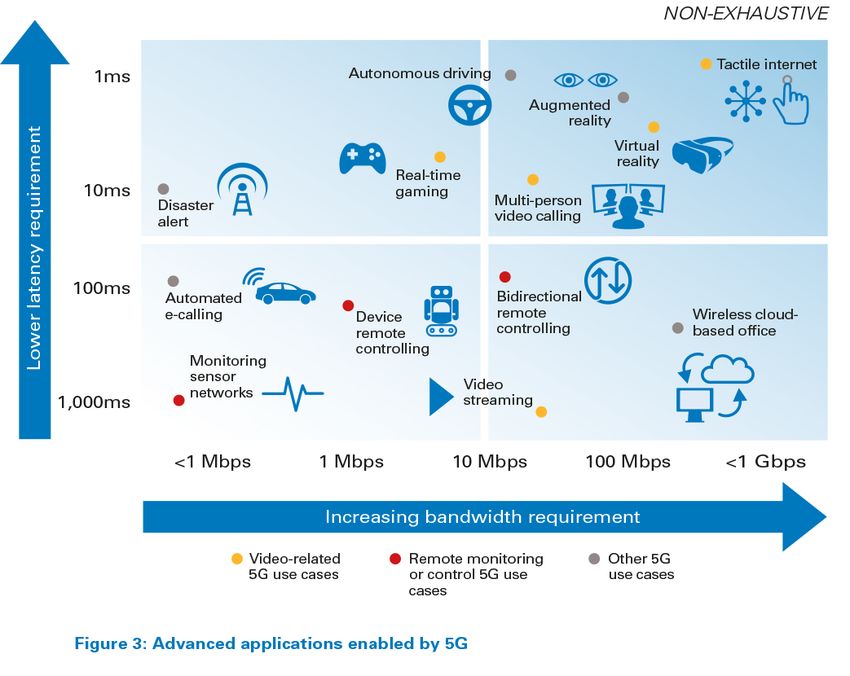

With more and more “things” being connected, thus leading to significantly higher connection density, the risk of interference increases. This has been another historical challenge to the IoT that will be addressed by 5G. All this means 5G will enable an entirely new range of applications. (See Figure 3.)

The time to invest is now

Generational migrations from 2G to 3G and 3G to 4G required widespread upgrades of virtually all networking equipment. These upgrades were extremely costly, but consequently provided the required capabilities across an operator’s entire footprint for it to compete in an evolving market. The migration from 4G to 5G, however, will not follow the same paradigm, as many 5G functionalities are already feasible on 4G infrastructure, which means a complete network overhaul is not required. In addition to lower migration costs to operators, this means companies that are considering investments in the IoT do not need to wait for full 5G to become available before they start to build out IoT application infrastructure. Core IoT capabilities and first use cases can be built on existing infrastructure and then gradually upgraded or improved as 5G capabilities become available.

How can they achieve this? Industrial IoT usage drives a greater need for cellular and 5G private network infrastructure. As a result, we see industries moving to localized cellular networks because of their ability to scale, future proof, and evolve over shared network infrastructure. Industrial players will therefore need to decide whether and how to play in private networks.

Private networks offer an attractive alternative for corporates. Today, the number of private networks is fairly low – expert estimates indicate 300–400 worldwide. However, Arthur D. Little estimates that the global market size will reach 60–70bn3 by 2025. Technology infrastructure provider Nokia believes the opportunity could be twice as big as its current business of building wireless networks for operators4.

The advantages of a private network are many, with security and customization as the main drivers:

- Full control of network investments, including CAPEX and OPEX, with flexibility for ad hoc expansion.

- Better security as the data stays within the private network.

- Full coverage where needed, even where it would not be economical for a traditional wireless service provider.

- Decentralized architecture with multi-access edge computing (MEC) for low-latency applications

The key question for industrial players to answer is whether they should rely on operators or vendors (such as Ericsson and Nokia) or new entrants (such as AWS) – or build the networks themselves. The solution deployed will depend on companies’ business needs (including security and flexibility requirements), as well as the availability of regional spectrum for corporates or the regulatory reality around using unlicensed spectrum. In Germany, where spectrum has been made available locally (namely, for private-network use), multiple corporations are developing their own private networks. In the US there is the opportunity to use unlicensed spectrum released from the Citizens Broadband Radio Service (CBRS), while in other regions, an operator or another unlicensed spectrum will be required.

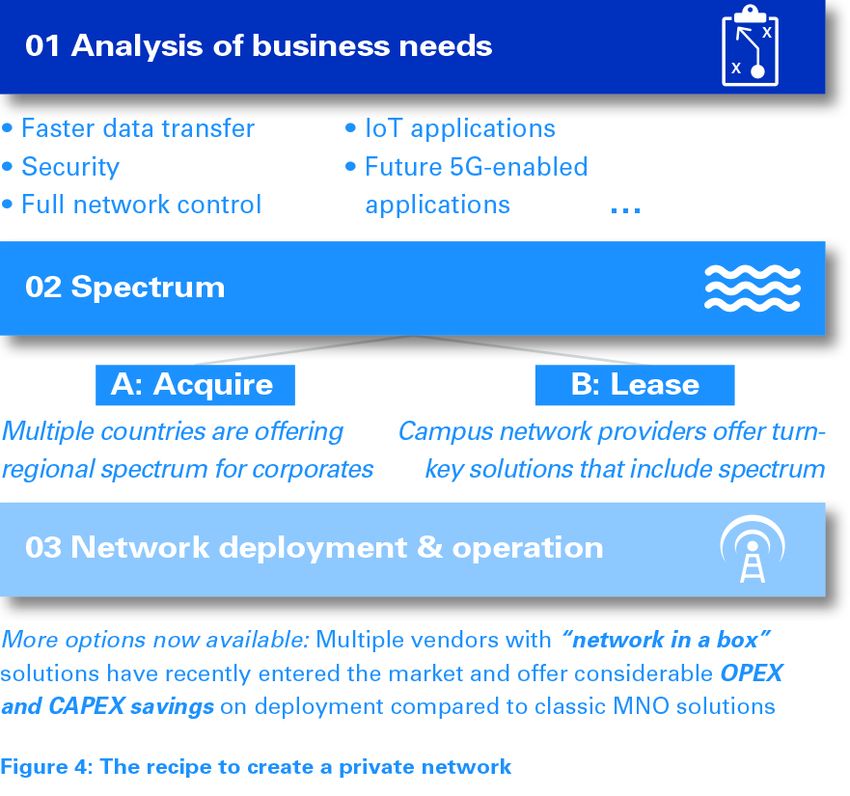

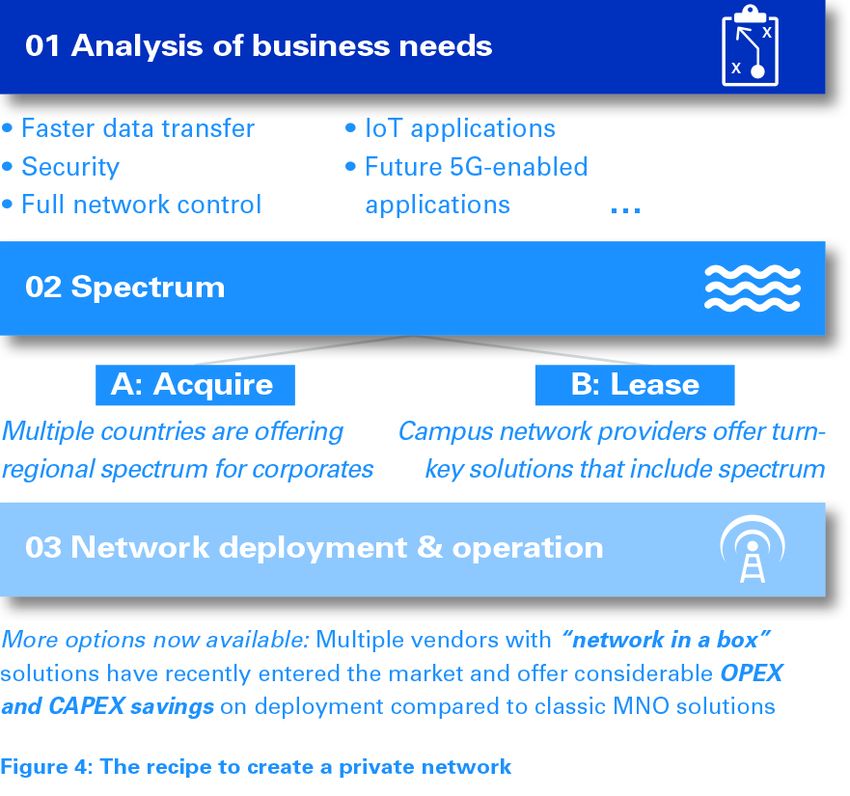

For industrial players looking to build private networks, there are now a number of options available because multiple players in the ecosystem have spotted this opportunity to serve them. (See Figure 4.) Telecom operators, traditional wireless equipment vendors and new entrants alike are offering attractive solutions.

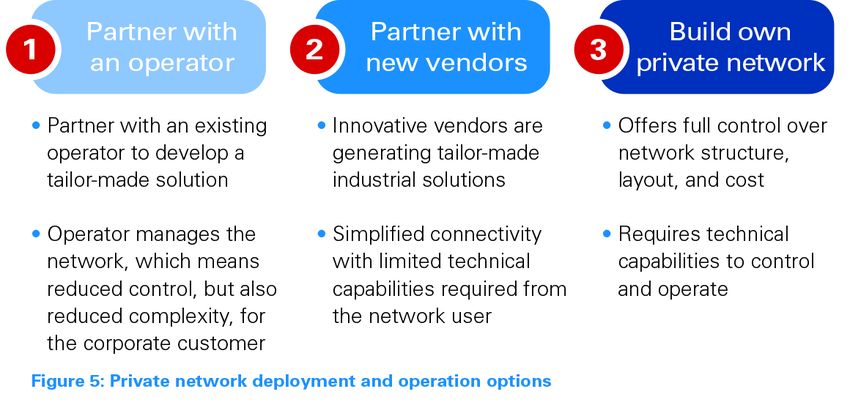

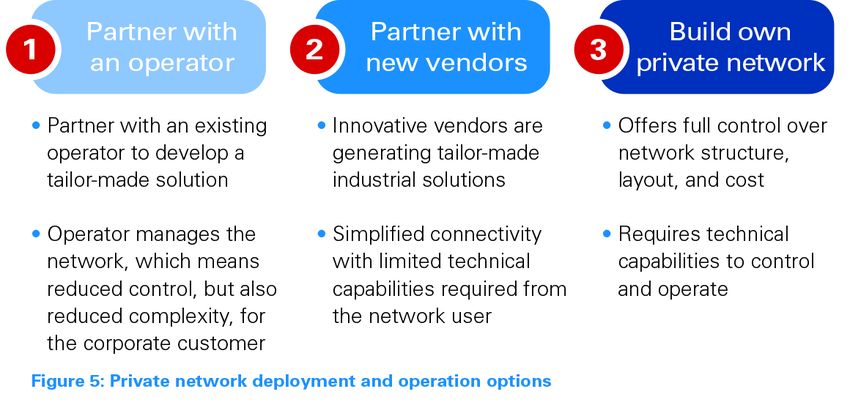

Given the availability of multiple service providers we see three main options for companies seeking to create a private network. (see Figure 5)

Option 1 – Partner with an operator: The first option is perhaps the most straightforward – partner with an existing operator to develop a private network solution. (See Box 1.) Here the operator typically takes end-to-end responsibility for building the network and on-campus infrastructure, including bringing in the right technology partners and, once the private network is up and running, managing its operations. This means the level of complexity for the corporate customer is similar to what it would have been had it used a public network.

However, this also means the opportunity to control the network is reduced and the corporate customer is dependent on the operator for network changes and adaptations.

Box 1 – OSRAM used its existing telco operator to provide tailored campus network solutions

With the end goal of enabling implementation of automated (and AI-controlled) guided vehicles (AGVs) as a stepping stone towards Industry 4.0, OSRAM commissioned a campus network in its Schwabmünchen factory to prototype and test mobile robotics solutions. OSRAM’s existing telco operator, Deutsche Telekom, provides and manages a dualslice campus network solution that combines the public LTE network in the wider area of activity with a private LTE network layer within OSRAM’s campus, for which Ericsson provided system technology. In addition to the campus network, a local edge cloud is being deployed, which shifts complex computing processes from a remote data center to a computer on the shop floor to enable faster data processing. This means data from the AGV’s sensors can be transformed into control data so the transport system can react autonomously in real time.

Option 2 – Partner with new vendors: In the second option, the company partners with one of the new innovative service providers that have started offering private network solutions. (See Box 2.) Similarly to operator-run solutions, this offers customers simplified connectivity and limits the technical capability demands on the customer’s organization. Service providers such as AWS also typically offer lower prices and could be a good compromise for smaller companies that need the capabilities of a private network within limited budgets.

Box 2 – Amazon Web Services corporate network in a box

Together with three partners – Athonet, Ruckus, and Federation Wireless – Amazon Web Services (AWS) is offering corporates in the US a private LTE solution hosted in its cloud. The solution consists of BubbleCloud, a mobile core designed for private mobile networks, a Citizens Broadband Radio Service (CBRS) 3.5 GHz indoor LTE access point, and massive CBRS shared spectrum. It also includes full integration with the AWS IoT and plug-and-play experience, which makes it easier to connect, monitor, and manage IoT assets at scale. AWS created this solution to take advantage of “the upcoming launch of unlicensed spectrums globally, including CBRS in the USA (and later MulteFire globally), sXGP in Japan, and LAA in France.” The four partners are marketing their solution as a lower-cost, more efficient way of building a private mobile CBRS network.

Option 3 – Build own private network: The third option is to turn to a technology vendor such as Ericsson or Nokia to build a proprietary private network. (See Box 3.)This option gives the customer full control over the network structure, layout, and cost. However, the technical requirement for the organization is higher – having the right technical capabilities in place within the organization becomes imperative to ensure network operations. Corporates with high or very specific technical demands on their networks, as well as the organizational capabilities to design, control, and operate their networks, should consider this option.

Box 3 – Ambra Solutions, together with Ericsson, provided the deepest private LTE network in the world at Agnico Eagle Mines in Canada

Agnico Eagle commissioned an LTE network to work at a depth of three kilometers in the LaRonde mine in Canada to improve communication, safety, and operations. Deployed by Ambra Solutions, a provider of wireless technologies for remote areas, and Ericsson, it runs in the low-frequency 850 MHz spectrum band to allow better propagation.

With the network in place, a single LTE radio was able to cover six kilometers of tunnel, effectively replacing up to 60 active Wi-Fi access points.

In addition to establishing reliable communications, data and voice-mobility services, even in the remotest areas of the mine, the network enabled a number of critical IoT solutions, such as connected sensors that monitor air quality and remote-controlled operation of machinery. This enables more efficient operations and a safer working environment for miners.

Insight for the executive

The time to accelerate your digitization journey is now. For industrial enterprises, 5G will solve many technical limitations impeding IoT development, and with its advent, new opportunities for IoT use cases will open up. While we are still some time away from full 5G deployment, enterprises planning to build or scale up IoT applications need not wait to invest. In order to gain first-mover advantage, IoT solutions can be built on existing 4G LTE networks and scaled up, or updated once full 5G capabilities are available.

Executives need to take a broad prospective with regard to the IoT in their planning. We envision four key questions to consider in this evolution:

- What is your digital vision? The starting point is the corporate enterprise’s vision for digitalization. Which elements of the customer engagement journey, unique production environment (whether physical or virtual goods), and internal decision-making processes and procedures are to be digitized?

- What roles do the IoT and network play in realizing the vision? Next, consider the role that the IoT and network performance play in enabling the digital vision. These are necessary steps which should be rooted in improving and/ or enhancing customer experience, operational efficiency, and improved speed and efficacy.

- What, therefore, are the requirements for corporate network and IoT performance? Not all devices and network operations require the same levels of security, speed, bandwidth, and responsiveness. An assessment of the desired performance attributes will show which use cases can be initially enabled and justified. It can then be determined whether public network/operator solutions are sufficient, or a more controlled, high-performance and secure internal network is necessary.

- What is a cogent implementation approach? There is typically no one-size-fits-all approach – building a greenfield, private IoT corporate network from scratch may be ill advised. Instead, consider incremental use case-driven approaches to leverage technology (such as 4G initially, and then evolving to 5G) to address specific enterprise or customer use-case solutions. Typically, the next stage of investment use cases can leverage existing investments by building on shared infrastructure to enhance financial, operating and customer performance.

Once the executive team has evaluated these four steps, you can then consider how best to move forward with IoT and private network options, balancing internal capabilities, business requirements and willingness to invest.

Despite the hype, the Internet of Things (IoT) has yet to deliver its promised benefits to industrial companies. The advent of 5G removes many of the technical barriers to its successful adoption, accelerating digitalization. However, as this article explains, realizing the potential of the IoT requires businesses to focus first on their needs and then on the available options to implement the best solutions for future success.

Despite our living in a world where more and more devices are connected, the Internet of Things (IoT) is still far from living up to its full promise in many industries. This is set to change as 5G enables many of the technical requirements that have previously been lacking. It will unleash significant industrial potential and enable realization of Industry 4.0 – Arthur D. Little estimates the value of 5G-enabled IoT to be USD 1.5 trillion by 20301. So now is the time for companies to set their IoT strategies, and we believe investing in private networks is important for companies to consider as 5G becomes a reality. How should companies go about this?

5G will enable a broad range of advanced IoT use cases

The IoT has been a buzzword for quite some time – we have all heard (repeatedly) how “everything will eventually become connected.” Although the number of connected things has increased exponentially over the past few years, the fact remains that in most industries the full potential of the IoT remains unproven and the major promised gains have yet to materialize.

Several factors have influenced this:

- For a long time, supporting technology and infrastructure solutions were lacking. (See Figure 1 for key changes between selected wireless network generations.)

- Mobile network operator (MNO) models for pricing and performance were not adapted to the needs and requirements of enterprises looking to implement and scale IoT solutions.

- Many enterprises weren’t quite ready to adapt to digitized business and operating models.

All of this is now rapidly changing. Sensors are becoming smarter, cheaper, and smaller – thus enabling broader usage and establishment of device ecosystems. Corporations are increasingly digitized and have systems in place that IoT solutions can connect to or be integrated into. Network operators (both traditional and alternative providers) have also realized that there is an unmet need for IoT-specific solutions and services; many have consequently established businesscentric and/or IoT-centric divisions and offerings, such as Sprint’s Curiosity and Telia Company’s Division X.

As digitization increases, networking requirements increase as well. The emergence of the IoT has led to a need for different characteristics and technical capabilities in cellular networks, which have continued to develop and will, with the emergence of 5G, address the key needs of the IoT. 4G LTE, the latest iteration of the fourth generation of mobile cellular networks, has already enabled numerous new IoT solutions. However, while a combination of cabling and WiFi enabled many early industrial IoT use cases, 4G didn’t fully deliver in four areas:

- It failed to provide speeds comparable to those of fixed broadband.

- It did not meet significant bandwidth requirements.

- Latency was not adequate for mission-critical applications.

- It did not manage device density, which is key for a number of applications.

The next “evolutionary step” will be provided through broad implementation of 5G. In addition to being much faster than previous generations, 5G has a number of additional properties that will open up new mobile-data use cases – lower latency, improved reliability, higher connection density, low-cost and low-power capabilities, and enhanced positional accuracy. With 5G, wireless performance will be on par with fixed-line connections in many instances. (See Figure 2.)

One key feature of 5G which will significantly enable the IoT is ultra-low latency (the time it takes for data to be sent and/or received). Standards of 5G aim to reduce latency to a millisecond (ms), compared to approximately 50 ms for 4G. This might seem like a small difference, but if we compare it to human reaction times, a 50 ms lag is discernable, while less than a millisecond is faster than a human can react. If we consider an autonomous car responding to a pedestrian in its path or a connected drill reacting to unexpected vibration patterns, that millisecond can be the difference that saves the pedestrian’s life or prevents a collapse in a mine.

5G is also expected to be “ultra-reliable”, which will mean nearly no dropped calls or lost connectivity. It will thus allow for mission-critical use cases, such as those related to digital health, connected cars, and emergency response.

Industries increasingly deploy and use connected sensors to monitor various assets in real time. Doing this economically requires devices that operate at low power levels and networks that offer low-cost connectivity options.

With more and more “things” being connected, thus leading to significantly higher connection density, the risk of interference increases. This has been another historical challenge to the IoT that will be addressed by 5G. All this means 5G will enable an entirely new range of applications. (See Figure 3.)

The time to invest is now

Generational migrations from 2G to 3G and 3G to 4G required widespread upgrades of virtually all networking equipment. These upgrades were extremely costly, but consequently provided the required capabilities across an operator’s entire footprint for it to compete in an evolving market. The migration from 4G to 5G, however, will not follow the same paradigm, as many 5G functionalities are already feasible on 4G infrastructure, which means a complete network overhaul is not required. In addition to lower migration costs to operators, this means companies that are considering investments in the IoT do not need to wait for full 5G to become available before they start to build out IoT application infrastructure. Core IoT capabilities and first use cases can be built on existing infrastructure and then gradually upgraded or improved as 5G capabilities become available.

How can they achieve this? Industrial IoT usage drives a greater need for cellular and 5G private network infrastructure. As a result, we see industries moving to localized cellular networks because of their ability to scale, future proof, and evolve over shared network infrastructure. Industrial players will therefore need to decide whether and how to play in private networks.

Private networks offer an attractive alternative for corporates. Today, the number of private networks is fairly low – expert estimates indicate 300–400 worldwide. However, Arthur D. Little estimates that the global market size will reach 60–70bn3 by 2025. Technology infrastructure provider Nokia believes the opportunity could be twice as big as its current business of building wireless networks for operators4.

The advantages of a private network are many, with security and customization as the main drivers:

- Full control of network investments, including CAPEX and OPEX, with flexibility for ad hoc expansion.

- Better security as the data stays within the private network.

- Full coverage where needed, even where it would not be economical for a traditional wireless service provider.

- Decentralized architecture with multi-access edge computing (MEC) for low-latency applications

The key question for industrial players to answer is whether they should rely on operators or vendors (such as Ericsson and Nokia) or new entrants (such as AWS) – or build the networks themselves. The solution deployed will depend on companies’ business needs (including security and flexibility requirements), as well as the availability of regional spectrum for corporates or the regulatory reality around using unlicensed spectrum. In Germany, where spectrum has been made available locally (namely, for private-network use), multiple corporations are developing their own private networks. In the US there is the opportunity to use unlicensed spectrum released from the Citizens Broadband Radio Service (CBRS), while in other regions, an operator or another unlicensed spectrum will be required.

For industrial players looking to build private networks, there are now a number of options available because multiple players in the ecosystem have spotted this opportunity to serve them. (See Figure 4.) Telecom operators, traditional wireless equipment vendors and new entrants alike are offering attractive solutions.

Given the availability of multiple service providers we see three main options for companies seeking to create a private network. (see Figure 5)

Option 1 – Partner with an operator: The first option is perhaps the most straightforward – partner with an existing operator to develop a private network solution. (See Box 1.) Here the operator typically takes end-to-end responsibility for building the network and on-campus infrastructure, including bringing in the right technology partners and, once the private network is up and running, managing its operations. This means the level of complexity for the corporate customer is similar to what it would have been had it used a public network.

However, this also means the opportunity to control the network is reduced and the corporate customer is dependent on the operator for network changes and adaptations.

Box 1 – OSRAM used its existing telco operator to provide tailored campus network solutions

With the end goal of enabling implementation of automated (and AI-controlled) guided vehicles (AGVs) as a stepping stone towards Industry 4.0, OSRAM commissioned a campus network in its Schwabmünchen factory to prototype and test mobile robotics solutions. OSRAM’s existing telco operator, Deutsche Telekom, provides and manages a dualslice campus network solution that combines the public LTE network in the wider area of activity with a private LTE network layer within OSRAM’s campus, for which Ericsson provided system technology. In addition to the campus network, a local edge cloud is being deployed, which shifts complex computing processes from a remote data center to a computer on the shop floor to enable faster data processing. This means data from the AGV’s sensors can be transformed into control data so the transport system can react autonomously in real time.

Option 2 – Partner with new vendors: In the second option, the company partners with one of the new innovative service providers that have started offering private network solutions. (See Box 2.) Similarly to operator-run solutions, this offers customers simplified connectivity and limits the technical capability demands on the customer’s organization. Service providers such as AWS also typically offer lower prices and could be a good compromise for smaller companies that need the capabilities of a private network within limited budgets.

Box 2 – Amazon Web Services corporate network in a box

Together with three partners – Athonet, Ruckus, and Federation Wireless – Amazon Web Services (AWS) is offering corporates in the US a private LTE solution hosted in its cloud. The solution consists of BubbleCloud, a mobile core designed for private mobile networks, a Citizens Broadband Radio Service (CBRS) 3.5 GHz indoor LTE access point, and massive CBRS shared spectrum. It also includes full integration with the AWS IoT and plug-and-play experience, which makes it easier to connect, monitor, and manage IoT assets at scale. AWS created this solution to take advantage of “the upcoming launch of unlicensed spectrums globally, including CBRS in the USA (and later MulteFire globally), sXGP in Japan, and LAA in France.” The four partners are marketing their solution as a lower-cost, more efficient way of building a private mobile CBRS network.

Option 3 – Build own private network: The third option is to turn to a technology vendor such as Ericsson or Nokia to build a proprietary private network. (See Box 3.)This option gives the customer full control over the network structure, layout, and cost. However, the technical requirement for the organization is higher – having the right technical capabilities in place within the organization becomes imperative to ensure network operations. Corporates with high or very specific technical demands on their networks, as well as the organizational capabilities to design, control, and operate their networks, should consider this option.

Box 3 – Ambra Solutions, together with Ericsson, provided the deepest private LTE network in the world at Agnico Eagle Mines in Canada

Agnico Eagle commissioned an LTE network to work at a depth of three kilometers in the LaRonde mine in Canada to improve communication, safety, and operations. Deployed by Ambra Solutions, a provider of wireless technologies for remote areas, and Ericsson, it runs in the low-frequency 850 MHz spectrum band to allow better propagation.

With the network in place, a single LTE radio was able to cover six kilometers of tunnel, effectively replacing up to 60 active Wi-Fi access points.

In addition to establishing reliable communications, data and voice-mobility services, even in the remotest areas of the mine, the network enabled a number of critical IoT solutions, such as connected sensors that monitor air quality and remote-controlled operation of machinery. This enables more efficient operations and a safer working environment for miners.

Insight for the executive

The time to accelerate your digitization journey is now. For industrial enterprises, 5G will solve many technical limitations impeding IoT development, and with its advent, new opportunities for IoT use cases will open up. While we are still some time away from full 5G deployment, enterprises planning to build or scale up IoT applications need not wait to invest. In order to gain first-mover advantage, IoT solutions can be built on existing 4G LTE networks and scaled up, or updated once full 5G capabilities are available.

Executives need to take a broad prospective with regard to the IoT in their planning. We envision four key questions to consider in this evolution:

- What is your digital vision? The starting point is the corporate enterprise’s vision for digitalization. Which elements of the customer engagement journey, unique production environment (whether physical or virtual goods), and internal decision-making processes and procedures are to be digitized?

- What roles do the IoT and network play in realizing the vision? Next, consider the role that the IoT and network performance play in enabling the digital vision. These are necessary steps which should be rooted in improving and/ or enhancing customer experience, operational efficiency, and improved speed and efficacy.

- What, therefore, are the requirements for corporate network and IoT performance? Not all devices and network operations require the same levels of security, speed, bandwidth, and responsiveness. An assessment of the desired performance attributes will show which use cases can be initially enabled and justified. It can then be determined whether public network/operator solutions are sufficient, or a more controlled, high-performance and secure internal network is necessary.

- What is a cogent implementation approach? There is typically no one-size-fits-all approach – building a greenfield, private IoT corporate network from scratch may be ill advised. Instead, consider incremental use case-driven approaches to leverage technology (such as 4G initially, and then evolving to 5G) to address specific enterprise or customer use-case solutions. Typically, the next stage of investment use cases can leverage existing investments by building on shared infrastructure to enhance financial, operating and customer performance.

Once the executive team has evaluated these four steps, you can then consider how best to move forward with IoT and private network options, balancing internal capabilities, business requirements and willingness to invest.