The BaaS opportunity

The banking sector is in transition. Historic pressures and the transformational arrival of fintechs mean the financial services marketplace is undergoing significant reconfiguration. This has left many traditional banks with a portfolio of uncompetitive, inadequate, poorly integrated products and services, as well as a static, costly IT legacy infrastructure, making them vulnerable to new entrants with compelling offerings and a flexible cost base.

As a result, banks must develop alternative income streams to replace those being eroded. This is not necessarily easy, especially for smaller banks that lack capital or size to efficiently scale. But it is difficult even for larger institutions that are often held back by a mountain of legacy IT.

BaaS is one way for licensed banks to bridge the gap between where they are and where they need to be. To do so, they can replace their internal processes and legacy systems by sourcing products via BaaS. Alternatively (or additionally), banks can provide non-bank businesses with an end-to-end package of financial processes, operations, and application programming interfaces (APIs) connectivity.

These options can allow non-banks to offer their own branded accounts, debit cards, loans, and payment services to customers, which they could not otherwise do without becoming a bank themselves.

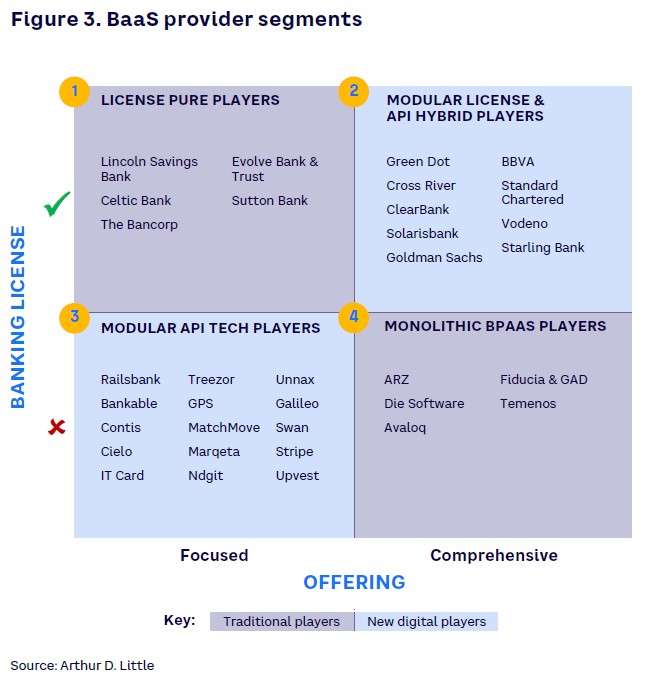

End consumers enjoy a seamless experience with no awareness of a bank’s behind-the-scenes involvement, thanks to the use of APIs that act as a technological bridge between the BaaS-providing bank and business users (see Figure 1).

While Internet as a service (IaaS), software as a service (SaaS), and business process as a service (BPaaS) provide technology and processes, BaaS enables banks and non-banks to offer a host of completely new financial products to their end customers. Without having to commit the time and resources to developing all offerings in-house, BaaS-using banks are able to cut time-to-market of new products by as much as 10 times. So, BaaS has a crucial role to play in enabling traditional banks held back by legacy IT to reinvent themselves with a more competitive offering.

For non-banks (like consumer brands or even business process outsourcing players) that use BaaS, it is a simple way to extend and build out their potential customer pool through diversification and improve revenue from cross-selling, while simultaneously deepening their relationship with existing customers and enjoying significant cost savings from new economies of scale. For those users that take the plunge into BaaS early, it is a good way to gain first-mover advantage in a specific revenue pool.

For banks that use BaaS, new levels of cost reductions open up as they can completely restructure their cost base — reducing the cost base overall and turning the remainder into a much more variable cost. In the case of a digital bank in the EMEA region, for example, overall costs were found to be 50% lower than for traditional banks (according to analysis by Capstone Partners and ADL). Traditional banks can come close to these cost structures by using BaaS. Having such a cost structure would put them at a clear competitive advantage, forcing large incumbent banks to redesign their operating model.

Banks that provide BaaS open up a new income stream with minimal capital expenditure. It also provides a new channel for gathering data from digital transactions and extracting value from that data, something with which banks historically have not excelled. Using BaaS in this way thus enables banks to become two to three times more profitable. Developed alongside a bank’s core business, BaaS becomes a solid platform from which it can start to rebuild lackluster market valuations, pleasing investors as a result.

BaaS clearly is far different from traditional outsourcing, which does not involve the use of APIs and is aimed at improving cost efficiency, largely confined to simple or back-office processes.

The BaaS potential

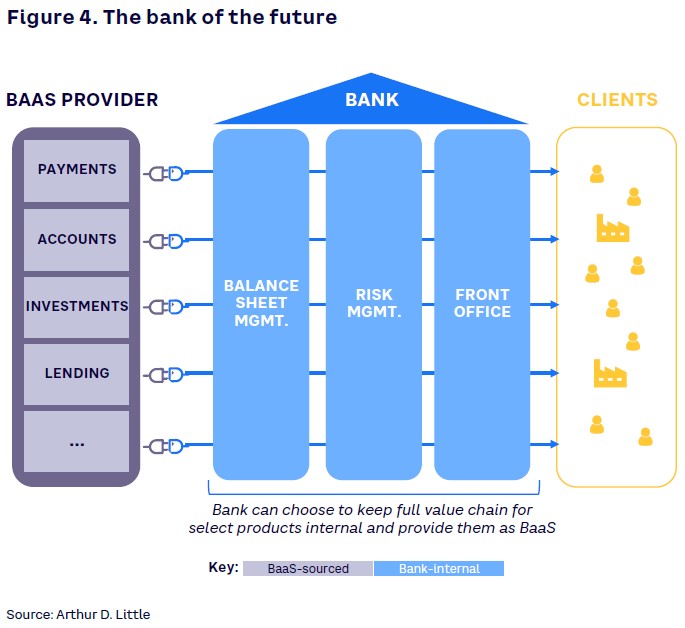

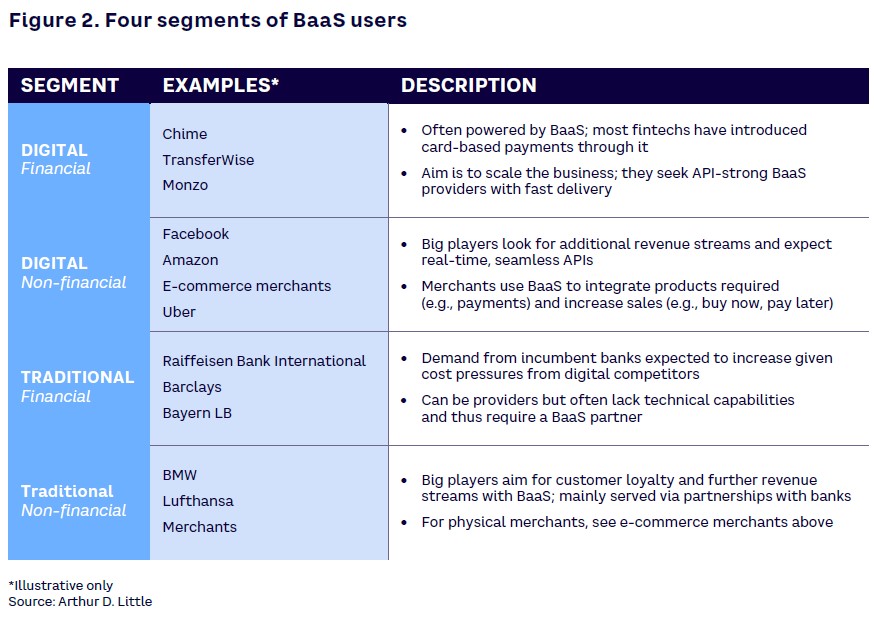

To date, the BaaS market has remained relatively small and largely the preserve of digital banks and fintechs like Green Dot and Vodeno on the providing side, and digital nonfinancial platforms such as Amazon and Uber among the users (see Figure 2).

However, as their traditional markets and margins come increasingly under threat from disruptors, we believe that BaaS will be the route to salvation for many incumbent banks. There are already signs that BaaS is being adopted by small and midsize banks operating at subscale and, as more do, we expect to see this segment of the market grow at a compound annual growth rate (CAGR) of approximately 25%. That would mean that, by 2025, revenues in Europe from BaaS would stand at US $60-$80 billion.

Following this expansion, a secondary growth spurt is likely (with CAGR increasing to 35%-40%), driven by the arrival of larger incumbent banks that have concluded that to remain competitive they, too, need to use BaaS solutions. This new impetus should see BaaS revenues reaching $300-$350 billion by 2030, which would amount to about 20%-25% of total European banking income.

At the center of the initial growth will be payments and accounts, since these products can be most easily embedded — as PayPal and Stripe, two of the first-ever digital movers, have shown. This will likely be followed by movement into consumer lending, as products such as “buy now, pay later” gain more traction.

Who are the BaaS players?

We can categorize providers into four primary segments, differentiated by banking license and breadth of offering (see Figure 3):

- Category 1: license pure players. These providers are primarily traditional regional banks in the US, typically with weak technology and API capabilities. They provide their license to digital banks or BaaS partners.

- Category 2: modular license and API “hybrid” players. These providers have strong technology, API capabilities, and a banking license, which is how they can offer BaaS.

- Category 3: modular API tech players. Because they are focused on a particular area, such as payments or cards and have strong APIs and technology proposition, these are attractive partners for BaaS license providers.

- Category 4: monolithic BPaaS tech players. With their focus is on BPaaS, these are the providers of traditional core banking systems that give banks their technology backbone.

Only those in categories 2 and 3 can really be considered modern BaaS providers.

Implementing BaaS

While we see BaaS as the future of banking, the uniqueness of incumbent banks means that each must carefully evaluate whether it would benefit from BaaS — either as a user or a provider — and identify any potential obstacles that might affect implementation.

Some incumbent banks may be hesitant about using BaaS because of concerns about the service robustness of a third-party provider or a loss of independence. For instance, it might be contractually difficult to add new features to a product or to discontinue it. They may also be required to share fees with a technology provider.

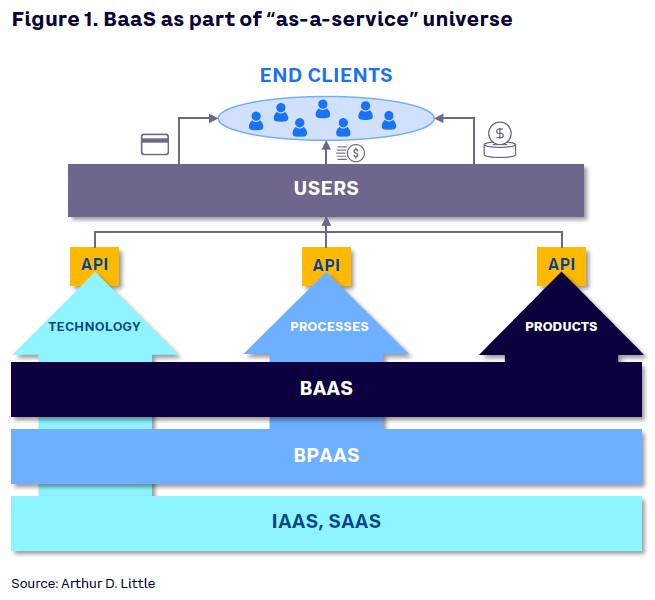

However, such concerns are often overstated and are far outweighed by the benefits that come from being able to focus on core capabilities — front office and the management of balance sheet and risk management — because responsibility for non-core areas has been passed to the most competent provider.

The bank of the future, as illustrated in Figure 4, will focus on its core capabilities. The best BaaS partner in the market will provide most products, enabling the bank to deliver the best possible client experience and move to a variable cost model that will reduce overheads significantly.

Lending products are a good starting point for product and service offerings from most incumbent banks since they are generally a core capability. These products also require a full banking license, which means there is less competition than when offering payments for which an electronic money institution (EMI) license suffices.

Of course, banks first must determine whether they can offer BaaS at all. Most banks, for instance, would need to heavily upgrade their APIs (banks often lack the real-time connectivity and seamless APIs that are so essential for BaaS delivery) and improve their outdated systems (their legacy technology is generally monolithic and cannot provide the functionality required to deliver a first-class BaaS product).

If a bank’s internal systems, modularity, and connectivity are already strong, or they are willing to improve them, choosing to create an in-house BaaS solution might be the right choice. However, for most, partnering with an appropriate third-party technology provider that can develop a BaaS offering will be the better option.

Alternatively for those with deeper pockets, rather than working with a tech partner, a bank could acquire one, as did Société Générale when it bought Treezor, a one-stop shop for payments, electronic money management, customer identification, fraud risk management, and other services.

Finding the right partner and conducting a diligent implementation

Choosing a BaaS provider is something that requires serious thought, as such relationships don’t come without risk. There is always the chance, for instance, that a partner may not fulfill its obligations, maintain agreed service levels, or even meet technological expectations. That can be particularly problematic when a bank is committed to a single provider. Therefore, banks must ensure they have the flexibility to move to a more cutting-edge provider or, from the outset, use multiple partners with different strengths in specific capabilities.

To mitigate risks, banks should have strategically flexible contracts that allow for provider switching, a strong compliance control framework, a clear partnership governance model, and a strong API management process, as well as perform rigorous due diligence up front. Running pilot projects to eliminate potential disruptions can also ensure implementation goes as smoothly as possible.

Two core market options

In terms of market positioning, there are two routes to BaaS success. The first is for a bank to become a global specialist that focuses on high-quality delivery of a narrow range of products and services. A good example is Railsbank, which allows others, both in and outside financial services, to use its EMI license to issue international bank account numbers, receive and send money between accounts, and issue branded credit cards.

The second route is for a bank to turn into a full-scale regional provider with a banking license, able to offer a full spectrum of BaaS products across a restricted geography. An example is Solarisbank, which is focused on Europe because it expects half of the 800 million accounts that are currently held there with incumbent banks to transition over to nontraditional players. Trying to be a regional specialist is unsustainable because of an inability to scale. Similarly, attempting to be a global, full-scale provider is problematic because of the cost and complexity involved.

How BaaS increases value

BaaS has the potential to reignite the interest of investors who have become disinterested in banks’ investment potential, a fact reflected in banks’ subdued market performance, particularly in Europe. Railsbank, which is now seeking a new funding round that would see it valued at $1 billion, and Solarisbank, which has quadrupled its valuation in little over a year, have certainly seen the benefits.

However, those looking to follow in these banks’ footsteps must ensure they have three components in place:

- First, have onboard enthusiastic early investors willing to provide strategic advice and fund expansion. In our experience, this is the single biggest predictor of success for startups and challengers.

- Second, ensure customer acquisition and the seamless integration of products and services are core competencies. These are essential characteristics in the fintech space, and they are equally important when it comes to BaaS.

- And third, to create value, it’s essential to achieve leadership in a specific aspect, such as product or price.

Conclusion

Insight for the Executive

The expansion of the “as-a-service” model has the potential to fundamentally change both banks and those looking to offer financial services to their clients. In fact, we believe BaaS will soon be at the heart of every successful bank. While this will involve a fundamental shift in resources, it will allow banks to improve their customer service levels and to strengthen their core capabilities, both of which will be essential for them to protect themselves from the increasing incursions of fintechs and major digital platforms.