Claims handling can be a complex, challenging process that requires specialized knowledge, skills, and resources. When it comes to commercial multi-risk insurance products, a wide range of internal and external factors accentuates the difficulties insurers face. This Viewpoint looks at how insurance companies can effectively tackle the five biggest challenges when it comes to multi-risk business and small and medium-sized enterprise (SME) claims handling.

Commercial insurance protects enterprises from unwanted risks. It is used as a safeguard against property damages and income loss due to unexpected situations such as temporary closure, legal issues, or civil liability. According to Research and Markets, the global commercial insurance market was valued at US $793 billion in 2022 and is expected to grow at a 6.86% CAGR during 2022–2028, mainly boosted by the expansion of SMEs.

Despite this optimistic outlook, insurers face a number of complexities stemming from unique product characteristics, increasingly demanding customers, an agent ecosystem that is not easily balanced, and a changing regulatory environment. Faced with this, insurance companies must be proactive about ensuring they can effectively handle a wide variety of business claims and maintain a positive reputation by consistently meeting the needs of customers of all sizes.

This Viewpoint highlights five strategies that can help insurers improve their current processes:

-

Consider controls for inflation.

-

Adjust data flow.

-

Address variability.

-

Increase digitization.

-

Leverage untapped synergies.

CONSIDER CONTROLS FOR INFLATION

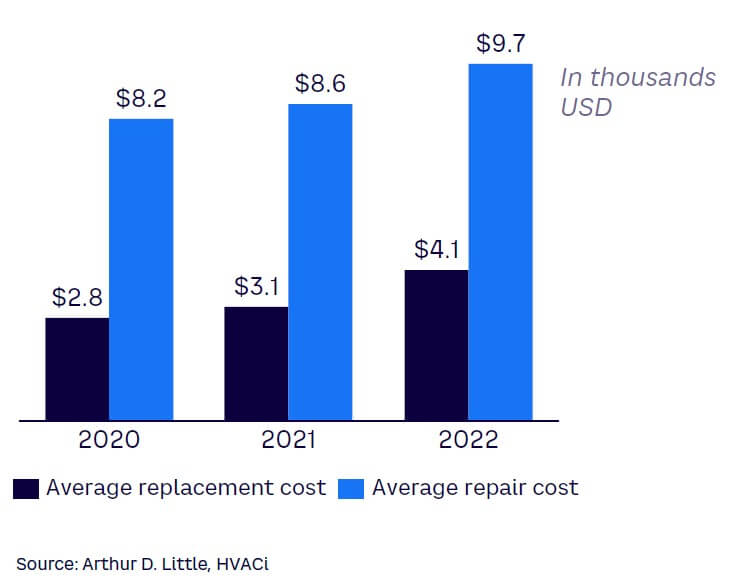

Inflation has a direct effect on materials and labor prices, both of which are in short supply as a result of market and supply chain disruptions due to the Russia-Ukraine war and the pandemic. Costs of repairs and replacements have increased considerably, to the point where the value of many properties is no longer reflective of their true reinstatement cost in the market, putting businesses at risk of being underinsured (see Figure 1).

At the very least, insurers need to conduct regular policy reviews and update valuations to ensure customers have the appropriate level of coverage. They may want to take it step further by investing in technology and data analytics to help identify potential risks and develop more accurate risk models, reducing the risk of financial losses.

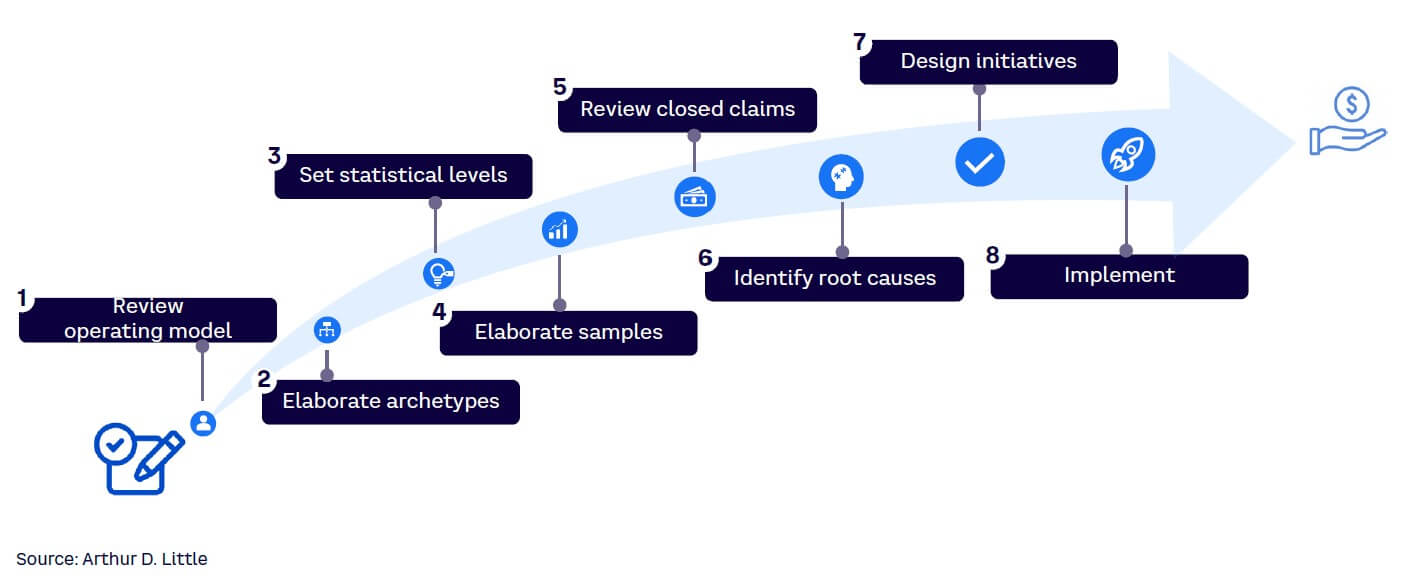

Because increasing costs are putting an extra strain on insurers’ claims-handling processes, they should optimize their claims expenditure and work to reduce claims leakage. A common approach to finding potential weaknesses in claims handling is revisiting a random sample of closed claims. A pragmatic, detailed analysis of a random sample of processed claims lets insurers identify pain points in the claims-handling process, leading to prioritization of savings opportunities (see Figure 2). This view can be augmented with data-driven approaches like process mining (an automated mapping of “lived” processes based on enterprise resource planning data) to identify weaknesses and actual process variants.

ADJUST DATA FLOW

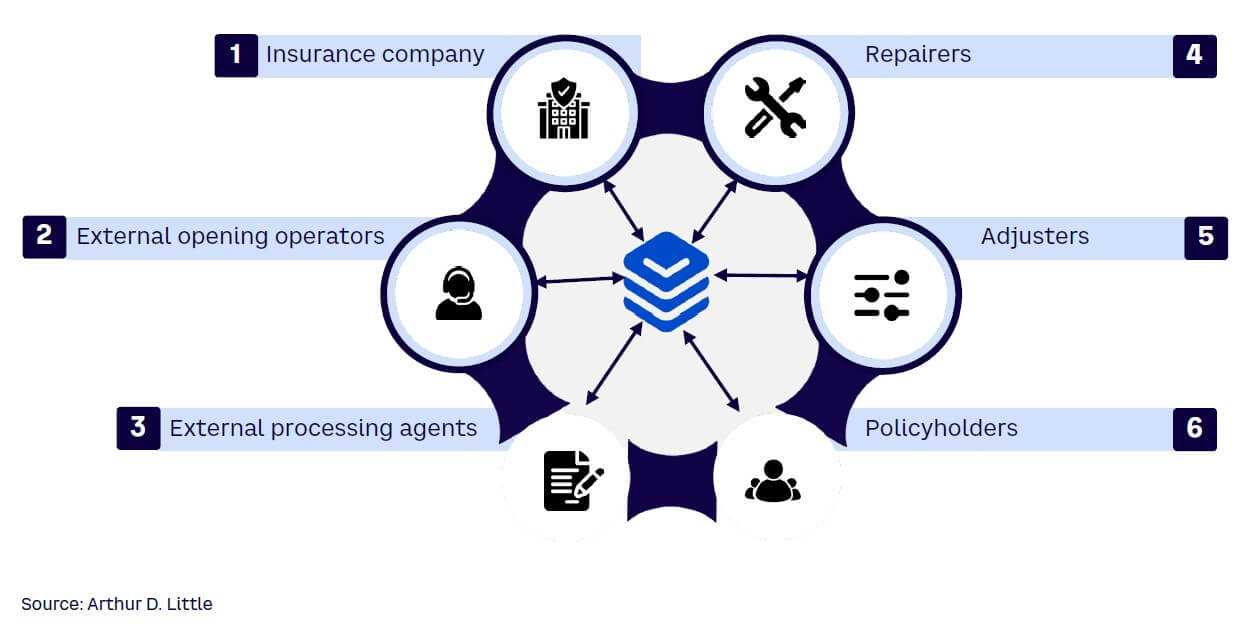

The business and SME multi-risk claims-handling process involves multiple stakeholders with various roles and responsibilities, including claim-opening and processing agents, repairers, and loss adjusters. Adding complexity, claims processing can be done in-house or outsourced to a claims management company. Moreover, repairers can work for a property and casualty (P&C) claims management company or be self-employed.

To ensure efficient claims handling, insurance companies must ensure the information flowing between stakeholders is as real-time and accurate as possible. This requires seamless, synchronized data flow between the claims company, the repairers, and other relevant stakeholders (see Figure 3). Unfortunately, this is not always the case, as claims handlers use their own digital tools and repairers may find it difficult to adapt to the company’s immediate digital needs. Here are some options to address this issue:

-

Build an easy implementable API to directly connect IT systems of claim companies (especially relevant for large service providers).

-

Offer an easily accessible platform for data exchange (e.g., cloud).

-

Offer an app-based solution to let stakeholders directly interact with the insurer to ensure full data integrity.

ADDRESS VARIABILITY

Typically, business claims are more complex and involve higher payouts than other claims. Moreover, customers often demand tailored products and services to meet their specific needs and preferences. Customized products can help customers feel more secure and confident in their coverage, leading to increased loyalty and satisfaction, but this inevitably leads to claim portfolios of products with vastly different coverages, increasing claims-processing complexity.

To mitigate this, some insurers divide agents into specialized teams according to the nature and type of claim (e.g., teams dedicated to electrical claims, water damage, or civil liabilities). Specialized teams know which questions to ask and the items they need to delve into, enhancing triage abilities and reducing the number of claims rejected at later stages. This improves claims handling while boosting customer satisfaction. To address the potential drawbacks of this type of specialization (e.g., unclear responsibilities in the case of multiple dependent claims), clear cross-team governance mechanisms and transparency must be established.

Insurers should also strive to maximize their teams’ productivity through:

-

A focused work setup (e.g., avoiding unnecessary disruptions like inbound phone calls).

-

Highly intuitive, well-connected tools offering a 360-degree view of all required information.

-

Leveraging of data and advanced analytics/machine learning to avoid wasted effort and maximizing the value of claims experts (e.g., automated routing to the right team or data-driven triage recommendations)

-

Access to periodic training and regular cross-team experience exchange (e.g., Agile retrospective meetings, short brown-bag workshops).

By implementing these measures, claims departments can boost efficiency by 8%-15% (and sometimes more, depending on their current baseline), according to our estimates.

INCREASE DIGITIZATION

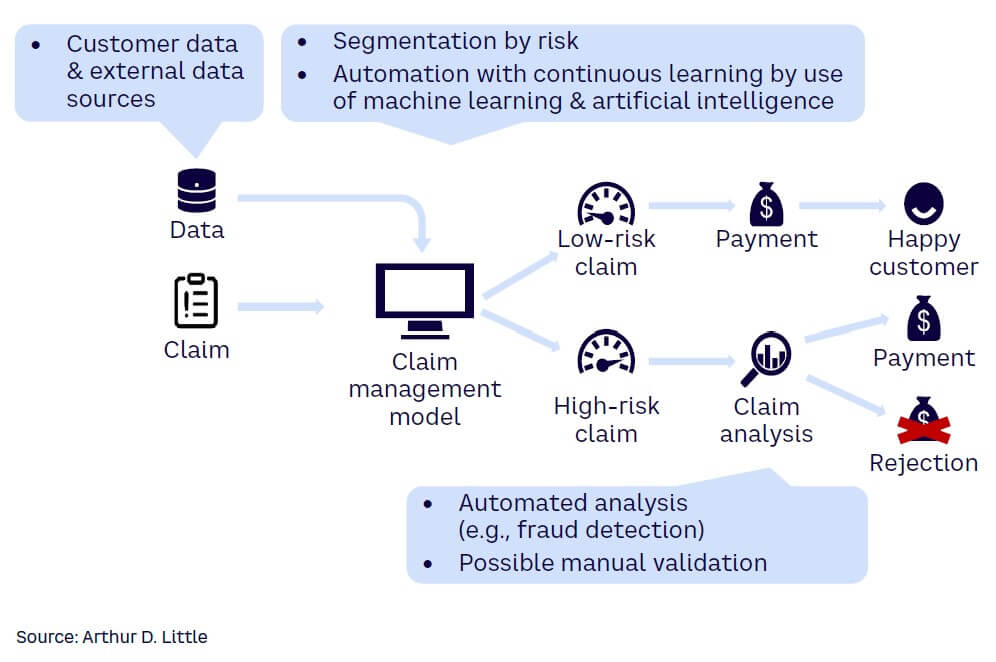

Although some insurers have fully embraced digital technologies, the majority are still in the early stages of adopting digital tools and processes. Digitizing an insurance company can provide numerous benefits, provided it is properly designed and implemented (see Figure 4):

-

Improve data access and quality of the information provided by customers. This could include an app that checks data/photo quality before submission, provides hints to the claim manager, and/or uses language models like ChatGPT to facilitate more efficient claims processing.

-

Improve efficiency by implementing data-driven claims prioritization. For example, triaging claims to avoid time-consuming activities on claims with a low probability of fast resolution.

-

Avoid manual processes by automatically routing claims to the correct team and developing full automation for simple claims.

-

Support decision quality with automated initial risk evaluation and recommendations for complex claims.

Digitization also lets insurers collect, store, and analyze large amounts of data, continuously improving their ability to make informed decisions and optimize their business processes.

However, enabling a high level of digitalization and a focused leverage of big data is not a one-time effort. Insurers must establish capabilities in iterative digitalization, data management, and advanced analytics. This includes: (1) the right technology infrastructure, governance policies, and competencies; and (2) a culture of continuous adaption and improvement.

LEVERAGE UNTAPPED SYNERGIES

Many insurers entered the SME segment relatively recently, creating segment-specific process from scratch. That approach increases operating complexity and, typically, cost. Nevertheless, reality can be much easier as insurers can share functions across products by leveraging commonalities between different insurance products.

A very common case is subrogation. Usually, subrogation processes are well-defined and highly automated for other lines of business, such as motor or home in the retail segments. By making use of the established processes and protocols, insurance companies not only save time but can reduce the number of resources employed to build new procedures. Other applicable examples are quality reviews or claims prosecution.

Conclusion

CALL TO ACTION

The challenges currently facing insurers can, and should, be seen as an opportunity to streamline processes and eliminate inefficiencies while continuing to meet customer needs. However, it’s important that each project phase be accompanied by effective change management to ensure acceptance among stakeholders. In the insurance sector, efficient change management requires a systematic approach that includes clear communication, stakeholder engagement, risk assessment, and ongoing monitoring and evaluation. By following the five strategies outlined in this Viewpoint, insurance companies can effectively manage a multitude of business claims, meet customer demands, and retain a good reputation.