DOWNLOAD

DATE

Contact

The traditional forecourt model is at its inevitable end. Electric vehicles (EVs), autonomous cars, data analytics, and the Internet of Things (IoT) are only a few of the emerging technologies threatening the classic fuel-station customer experience. What will the next-generation forecourt scene be like?

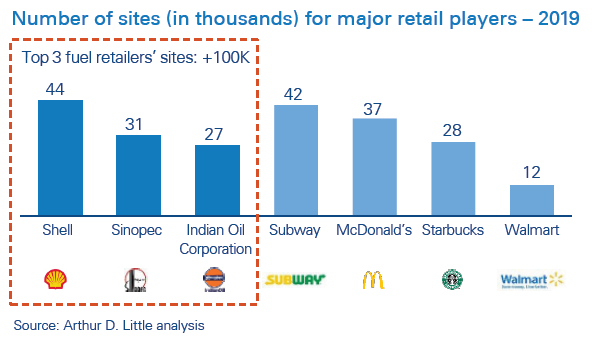

Transformation of the fuel retail business should not be underestimated. Its huge dimension (over 300,000 sites globally) implies that it will not only impact existing players, but also revolutionize its customers and adjacent markets.

When predicting the near future at local fuel stations, key trends concerning how we commute, eat and shop will be the core drivers that ultimately shape the forecourt.

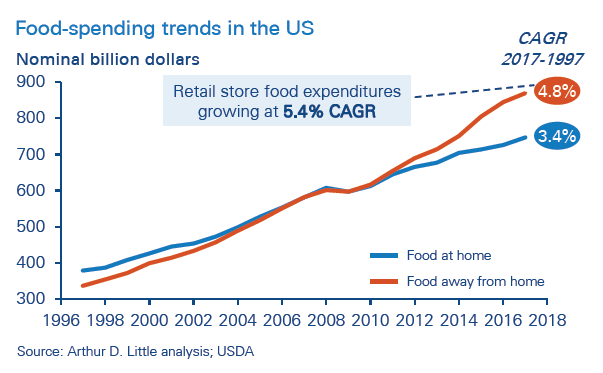

Increased demand for grab-and-go eating – As the world becomes faster paced, time and efficiency are becoming a game changer for retail businesses. Busy agendas demand that services become quicker and better. People now eat a lot less at home, which makes convenience shopping and “graband- go” eating a major global trend. In the US, food spending away from home has surpassed that for food consumed at home since 2010. Particularly, customers now prefer healthier food alternatives to the usual fast-food burger or doughnut. Additionally, more people are working and interacting outside of formal office settings, traveling to provide services, and alternating sales with administrative tasks “on the road” – taking advantage of fuel retail sites for higher efficiency.

A shift in the mobility energy mix – The transport sector is shifting. It is leaving behind a petroleum-dominated segment and looking towards cleaner sources of energy, such as gas, hydrogen, and electricity.

Demand for eco-friendly outlets – Awareness has been growing among consumers about their carbon footprints, which is making their purchasing choices greener. In response, retail sites are adapting their buildings into eco-friendly layouts, pushing for sustainability and minimalism, and publicly committing to more conscious use of energy and materials.

Hyper-connected customers – Smartphones have become indispensable in our lives. We rely on them for almost everything: choosing routes, estimating travel times, ordering and paying online. The trend is irreversible. Users’ ability to perform a variety of tasks over their smartphones is not only beneficial for them, but also for businesses, as the businesses can access enormous amounts of data generated every minute by consumers. The stream of information leaves us hyperconnected, which allows for new features in the retail world, such as omnichannel and individually targeted mobile marketing.

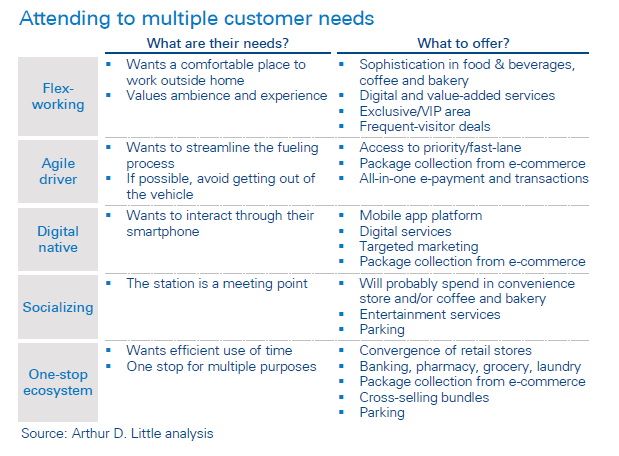

Quest for easier living – Fuel retail has been commoditized, with consumers choosing between one retailer and another by price, location and availability of specific services. People are more likely to decide on one station over another for compelling reasons, and while location will remain a key factor, the presence of diverse convenient services is becoming more important as a differentiator. Consumers are reaching out to services that ultimately make their lives easier, but preferences are not the same for everyone.

The forecourt of the future

In order to remain relevant and thrive in such a context, the forecourt of the future should consider the following key topics.

Diversification of energy offering

Forecourts of the future will have to offer a wider range of sources (electricity, natural gas/CNG, gasoline, diesel, LPG, biofuels, hydrogen). This will require adjusting their real estate layouts (tanks, batteries, pumps, etc.) and coming up with smart strategies to provide smooth fueling services to different customers. In Japan, for example, cars are fueled from hoses coming down from the ceiling, with no pumps occupying space on the forecourt. We expect “no petrol” stations to emerge, and countries such as Germany, UK, Japan and Korea will lead hydrogen supply growth.

Traditional offering adapted to a broader set of customers

Stations have evolved from fuel-exclusive businesses to mini supermarkets or convenience stores where consumers can buy snacks or even full meals. The forecourt of the future should maintain the traditional offering, while adapting to cater to a broader set of customer requirements. Some customers might rush in to refuel, some may enjoy cups of coffee while they wait for their EVs to charge, some will stop by for quick lunch breaks, and others could settle at tables and work for a few hours. Fuel stations will act as meeting points for various types of consumers, each having a different purpose.

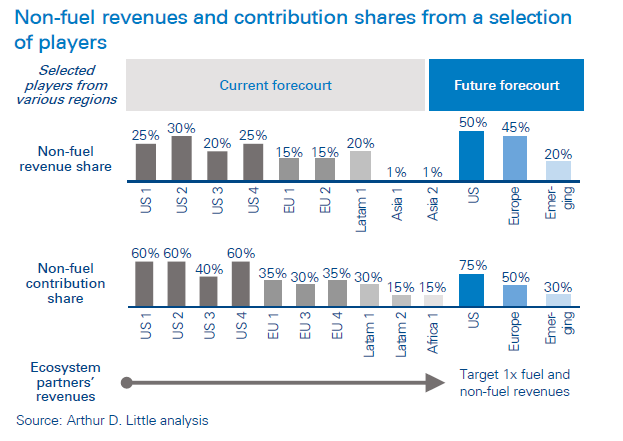

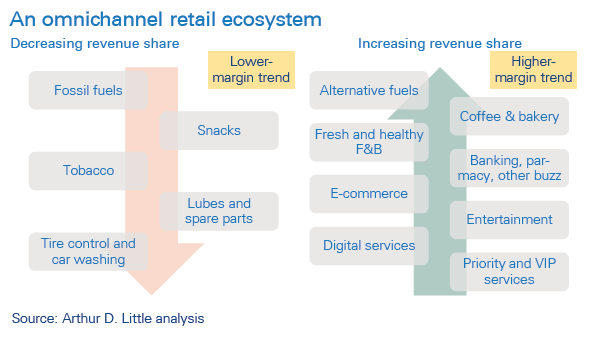

Developed countries are already experiencing about half of their fuel stations’ profits being non-fuel related. Emerging countries still have lower non-fuel contributions, but will eventually catch up because non-fuel sales is a faster-growing segment. (For example, China’s Sinopec and CNPC are undergoing 20 percent plus annual growth.) The petroleum-dominated retail world is fading. Shell has set an ambitious target of reaching 50 percent non-fuel profits globally by 2025.

As the customer experience becomes ever more complex, retailers will have to modify their infrastructure into modern, clean buildings with innovative interior designs, using environmentally friendly materials and smart technologies to create pleasant micro-climates for people to enjoy. Fuel stations will convert into multi-use ecosystems, with separate relaxing spaces for those who want to read or work, clean and bright areas for eating, and even green terraces for social gatherings. Bigger parking lots will also be necessary to cater for larger crowds that stay for longer periods. Fuel stations possess a key asset which retailers can leverage to build a new ecosystem containing multiple businesses: real estate. In this context, customers will be able to enjoy a wider set of services. Entering the e-commerce world is a likely scenario as well, and the presence of omnichannel transactions will be a key feature for the future of fuel retail forecourts.

Fuel stations play a critical role as infrastructure enablers in facilitating the EV transition. Availability of charging points is one of the main drivers of EV adoption. While retailers offering charging points will certainly push the EV market, their own businesses could contribute by capturing higher margins for EV charging than for fuel. Station owners will need to revisit their business models and consider whether to enter the electric market independently or by partnering with third-party chargepoint operators (CPOs).

Yet, oddly enough, the forecourt will no longer be the only place for fuel filling. As digitalization moves forward and enables better logistical services, it is no longer consumers approaching businesses, but rather, the other way around. This is also true for fuel retail: some retailers already provide fuel delivery. Shell’s TapUp application offers scheduled fueling at customer locations. This opportunity is being seized by new entrants that sell on-demand fuel at competitive prices, such as Zebra Fuel in the UK, as well as WeFuel, Filld and FuelMe in the US.

Connected cars and automation

Although it could take decades before autonomous vehicles become a common sight on our roads, car manufacturers are already embracing big changes as more and more models benefit from “connected services”. Payment will not be the only automated service; so will some of the core forecourt processes, such as pumping fuel and car maintenance.

Your future car will be able to locate your nearest station as you run out of fuel, going so far as to check whether the station has the type of fuel you usually buy in stock, or even how long the waiting time will be. Cars and pumps will work together. Cars will be able to transmit the required fuel volume upon arrival, the pump will autonomously start filling, and with a one-click, in-vehicle payment, there will be no need to leave the car! Even vehicle maintenance services could be automated, such as checking engine oil, tire air pressure and lubricants.

Shell has partnered with Jaguar Land Rover in the UK and GM in the US, offering an in-car payment system at its stations. This allows its customers to pay for their fuel from their cars’ touchscreens, without having to swipe credit cards or use their phones.

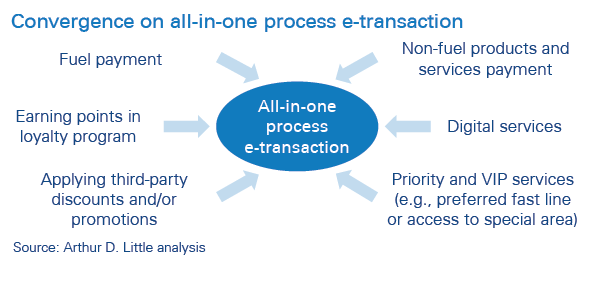

All-in-one process e-payment

The world is shifting towards easier and quicker payment solutions using mobile applications, and fuel stations won’t be left out. Retailers will develop their own apps with multiple mobile payment alternatives, which will allow customers to control their fill-up experiences through their smartphones. These apps will also have convenient features such as feedback, receipts, transaction history, rewards through loyalty programs, and third-party discounts, also processed automatically.

Shell has been a pioneer in this area, with its “Fill Up & Go” app in the UK, which is powered by PayPal and now accepted at more than 1,000 stations. ExxonMobil has launched its “Speedpass” app, available at more than 6,000 stations across the United States. These enable customers to link the apps to their loyalty programs and earn reward points with every purchase. Alternatives have also been introduced, such as QR codes.

Behavioral analytics for one-to-one marketing and service level

Connected cars plus data analytics will lead to predictive customer behavior, tailor-made services and targeted promotions. Loyalty programs will become highly effective. By using machine-learning technologies, customers will be able to prepare their fuel recharges, groceries or even coffee pre-orders easily – and access better prices customized for these. In the US, the GasBuddy app brings targeted offers to consumers who drive past stations subscribed to this service. This is facilitated using location-based marketing, and boosts retailers’ c-store sales.

Data analytics creates the opportunity for retailers to profit from increased revenues by cross-selling with advanced one-to-one marketing strategies and dynamic pricing. It also allows them to reduce operational costs with automated stock management and maintenance.

One-of-a-kind service station models

We believe fuel stations will adopt some of the aspects mentioned above. However, we recommend each retailer identify its strengths and competitive advantages, as well as consider its location and the type of community it is engaging with in order to define the most suitable business model in these new market conditions. These types of service stations have already started to converge around a few main models (listed below), but other models will materialize.

- Community center station – full service, a wide range of fuels, a meeting point for multiple customer segments (omnichannel)

- Urban express c-store – a small convenience store with basic groceries and snacks and a limited fuel offering (for example, one EV charging point and one fuel pump)

- Multi-use highway station – spacious and modern stores with multiple areas and fuel-based revenues

- Long-haul station – resting and service areas for drivers and maintenance, as well as other fleet management services for trucks

Although this might turn out to be a medium-term trend, we believe service stations will stretch their business models further, becoming ever more tailor made for their types of audiences. Better customer segmentation with a targeted offering will allow each station to run a model of its own.

Insight for the executive

- Take the lead in industry convergence – leverage real estate assets and long-lasting relationships with dealers to attract new players.

- Find a strategy to steer customer-purchasing decisions, involving both own and third-party products.

- When partnering (e.g., for loyalty programs), make sure to gain full access to the generated customer data.

- Customer experience is key – cross-selling to increase share of wallet from the fuel customer’s total daily spending.

- Revisit potential for a new customer base – create the right service station model for the needs of various clusters.

How can Arthur D. Little support key players?

- Reviewing and optimizing fuel (and non-fuel) portfolio

- Planning fuel distribution and retail network transformation

- Defining future retail-model types and scope of services for return-on-capital optimization

- Technology selection and business cases

- Supporting partner selection and developing collaboration strategies