AI adoption by companies is gathering pace, but initial use cases naturally tend to focus on optimization and efficiencies around internal use cases instead of novel AI-enabled products, services, and business models. In this Viewpoint, we use examples from a range of industries, exploring why companies should ensure they are positioned to seize long-term, revolutionary, and client-centric AI opportunities.

WHERE WE ARE TODAY

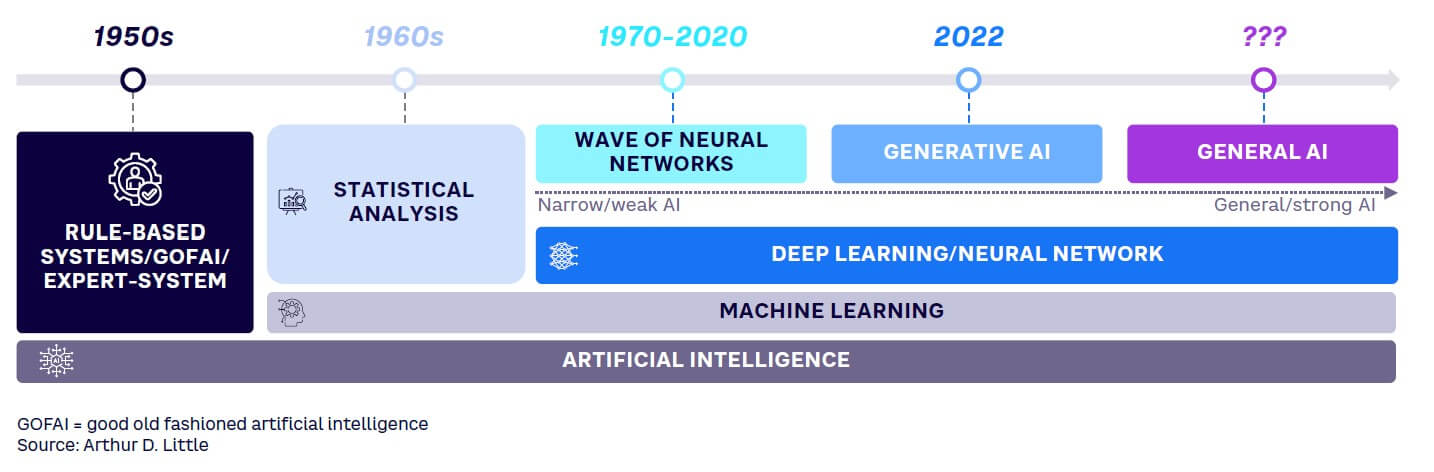

A year and a half has passed since OpenAI launched ChatGPT and kickstarted the widespread use of generative AI (GenAI). It’s worth remembering that AI itself is nothing new, dating back to the expert systems of the 1950s (see Figure 1).

In fact, AI is a great example of an exponential technology. Confident predictions were made in the 1960s that general AI with greater-than-human intelligence would be available by the end of the 1970s. But there were some “AI winters” ahead in the 1980s and 1990s, initially because of limiting algorithm patterns, and then because of scarce computing power. It was only the confluence of maturing digital and data transformation technologies that led to the GenAI breakthroughs of a couple of years ago and the sharp acceleration we see today.

Yet industry gurus, such as Sam Altman of OpenAI, are keen to remind us that we are still very much in the early stages of discovering the true potential of how AI can disrupt business. In November 2023, the US Census Bureau reported that only 3.8% of US businesses used AI to produce goods and services. The adoption by the IT and telecom sectors, as well as by professional services, is further advanced, as indicated below.

Nvidia reported in 2023 that 38% of telecom companies had been using AI for more than six months, with only 5% either not using or not planning to use it.

Telecoms’ experience with past disruptions like cloud computing (e.g., Amazon, Google) and over-the-top content (e.g., Netflix) is one reason they are ahead of other industries.

Nonetheless, even in the telecom industry, initial use cases focus heavily on business they already know, through optimization (60%), cost reduction (44%), customer engagement (35%), and meeting revenue targets (31%). Examples of early AI applications include customer care enhancement, sales/marketing analytics and personalization, and network optimization. It is also worth bearing in mind that some current claims of AI-driven innovation are really little more than a rebranding of ongoing digitalization efforts.

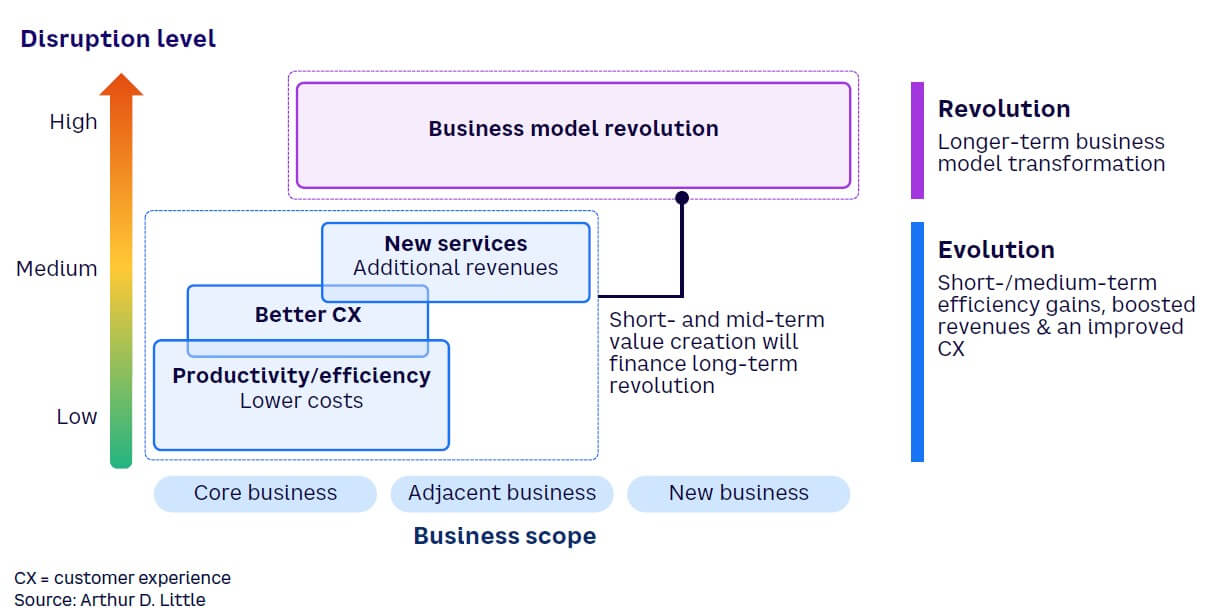

However, it is clear that AI has disruptive potential way beyond productivity and efficiency. Similar to how digital transformation remade business models over the last two decades by disintermediating the value chain and putting the customer at the center of business processes, AI will lead to new opportunities within and even beyond the current value chain. In this Viewpoint, we look at current, state-of-the-art applications, and what AI will soon bring to business value, not just for efficiency and productivity but also for growth and business model innovation — in other words, AI is evolutionary as well as revolutionary.

FROM EVOLUTION TO REVOLUTION

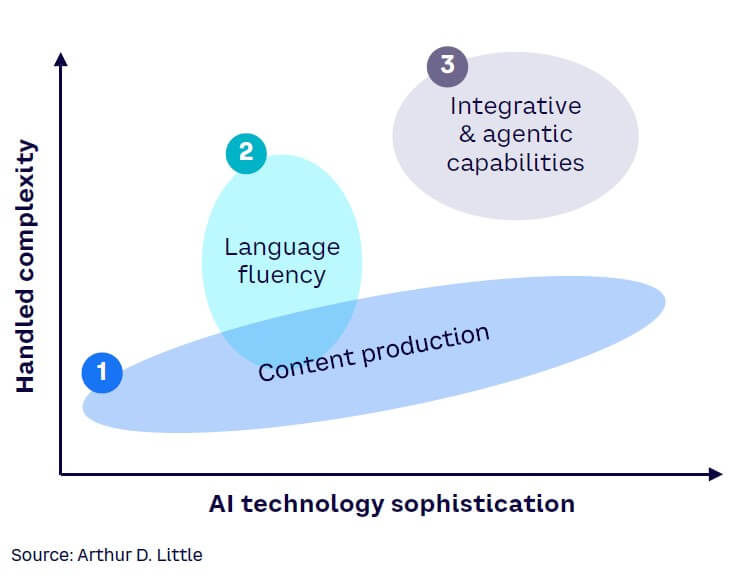

If we map current GenAI applications in terms of task complexity and technology sophistication, it is apparent that most of the focus remains on the first stage (content production), where advances in accuracy rates, levels of control, and task coverage are proceeding rapidly (see Figure 2).

In the next few years, improvements in natural language fluency will evolve into the second stage and allow the deployment of more direct, generalized human-machine-human interfaces, enabling the commercialization of new products and services with far greater personalization, interaction, and ever-improving accuracy (e.g., “user in the loop” services).

The third stage, which some optimistic commentators believe could be only three years away, will involve seamless integration between systems, allowing autonomous agents to orchestrate complex tasks and pilot parts of the business. This will have profound implications for business and society.

Today, most companies’ use cases are in the first stage, which focuses on productivity and efficiency (see Figure 3). In the short term, keeping the attention on productivity and efficiency is a good way to experiment while investing in solid technology, talent, and governance foundations. However, some companies are already moving toward using AI to generate new services within the existing business; significantly more disruptive business model transformation is anticipated in the longer term. Below, we look at some actual examples of AI evolution and revolution in practice.

ACHIEVING AI-BASED PRODUCTIVITY & EFFICIENCY GAINS

There are already many great case examples of major AI-based productivity and efficiency gains. Of these, Klarna and GitHub are good illustrations of what AI can achieve:

-

Stockholm-based Klarna is one of the world’s leading providers of “buy now, pay later” online banking and services. In February 2024, it launched an OpenAI-developed AI assistant. Available in 23 markets, the AI assistant communicates in more than 35 languages and offers better 24/7 client support, personal financial assistance, and refund/return management services. Klarna claims it has reduced repeated client requests by 25%, reduced average problem-solving time from 11 minutes to two minutes, and achieved levels of client satisfaction similar to human operatives. It has achieved some US $40 million cost savings, largely through replacing approximately 10% (700 employees) of the workforce with AI. After several loss-making years, this cost-cutting measure was essential to make the company profitable.

-

Microsoft subsidiary GitHub, one of the world’s leading open source software development platforms, launched its AI-based Copilot for business in December 2022. Copilot, an AI coding assistant, suggests code completions as developers type and turns natural language prompts into coding suggestions based on the project’s context. It has already become the world’s most-adopted AI developer tool, allowing developers to code 55% faster, with a close to 90% perceived increase in productivity. Nearly three-quarters of users report that they can now focus on more satisfying work. Copilot has already led to a 30% increase in paid GitHub accounts versus the last quarter of 2023.

However, these game-changing case examples of productivity and efficiency are not yet as widespread as anticipated. A survey of Fortune 500 companies by Andreessen Horowitz in early 2024 confirmed that the vast majority of use cases were around internal productivity, with most companies still preferring to have humans in the loop before interacting directly with customers. The same survey indicated a huge increase in planned spend on GenAI in 2024 (2.5x the spend in 2023), with budgets equally reallocated from IT, R&D, and business units. Despite these budgetary shifts, just over half of the companies had not yet precisely measured the ROI gain, although it was generally expected to be positive. Around 30% of use cases focused on cost savings, but only 9% on new revenue opportunities.

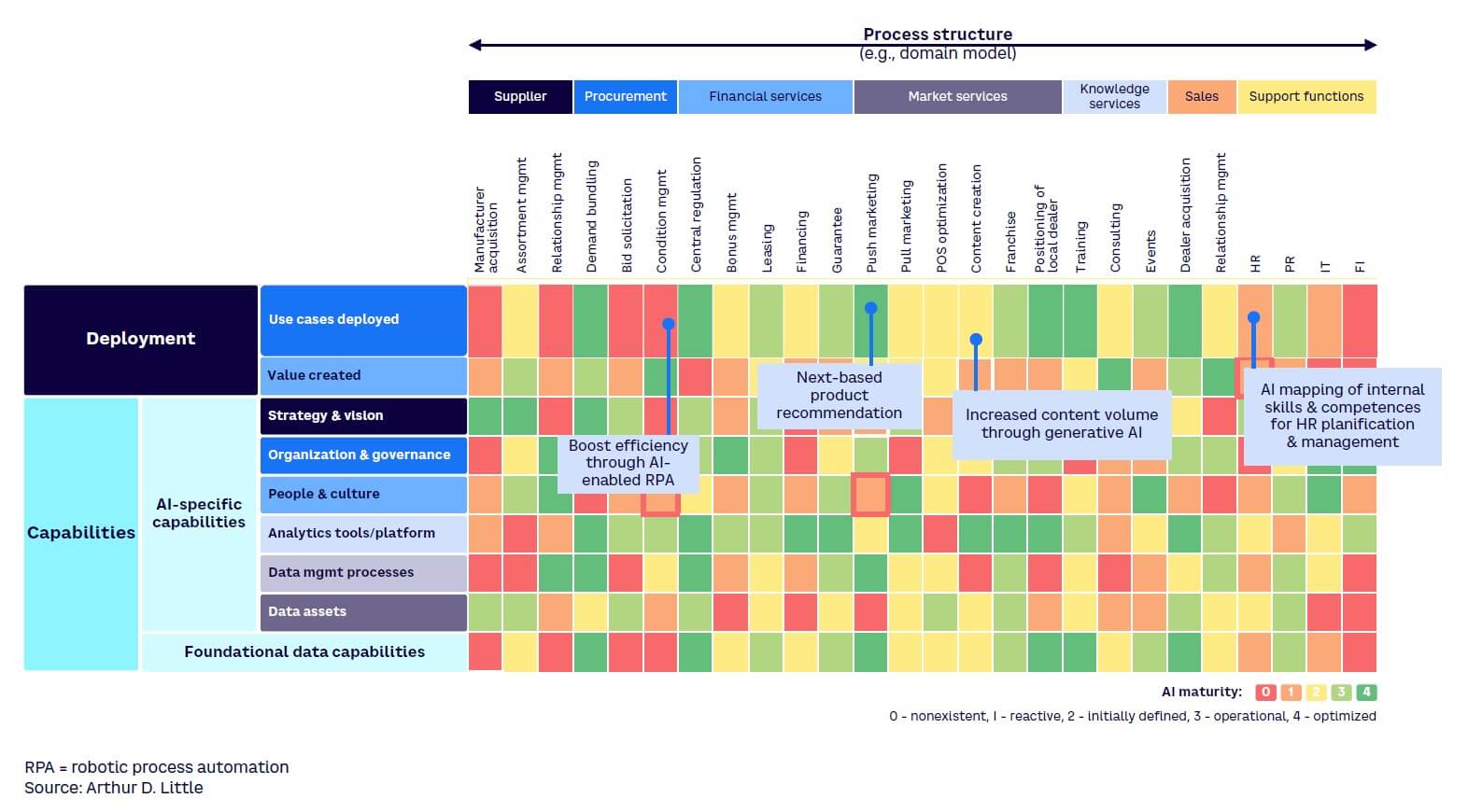

The current shortfall in demonstrable results is likely because new AI initiatives are often launched as a technology proof of concept, but they do not determine the true nature of the ROI gain (e.g., productivity, efficiency, quality) and do not adequately consider scaling up across the whole enterprise. There is also a lack of foundational capabilities, such as proper data to train the AI engine. Companies are still building applications in-house, given the limited availability of battle-tested enterprise AI apps on the market. Knowing where the weaknesses are, and where to focus AI investment for the greatest impact, is a major challenge for large companies. Developing an AI maturity heat map is one effective way to begin tackling these challenges (see Figure 4).

The heat map uses two dimensions to summarize a company’s AI maturity. On the value side, the heat map helps companies start prioritizing investment and skills development based on greatest impact, looking at the picture from both an external and internal perspective. On the enabling side, the heat map helps companies identify and structure foundational capabilities that are imperative to sustainable success over the longer term (e.g., data sourcing, AI governance, and talent acquisition). As such, it works great as both a blueprint for the AI landscape in a company and as an executive communications tool.

What seems clear is that taking action on AI development and integration — even if it’s only pilots and experiments to start with — is essential for companies to build knowledge and capability. However, in addition to pilots, quick wins, and low-hanging fruit, it is also important to adopt a more strategic perspective that looks further ahead. This helps ensure that the full potential of AI is realized, and companies are not left behind by further sudden accelerations during the coming years.

MOVING TOWARD AI REVOLUTION

As stated earlier, AI has the potential to (1) revolutionize business models within companies’ existing value chain and (2) provide opportunities for companies to enter the AI value chain as more than mere technology users. The first point is especially the case when AI can be integrated into novel products and services, opening up new revenues through fully autonomous systems, hyper-personalization, or seamless product convergence and integration. The latter occurs when companies intend to monetize some of the AI capabilities they have developed (not only in-house, but also through M&A, corporate partnerships, and ecosystem investment). As such, they can invest in each step of the AI value chain, which consists of infrastructure (e.g., GPUs, super calculators, data centers), foundation models (e.g., large language models [LLMs], speech models), and applications (e.g., chatbot interfaces, enterprise software).

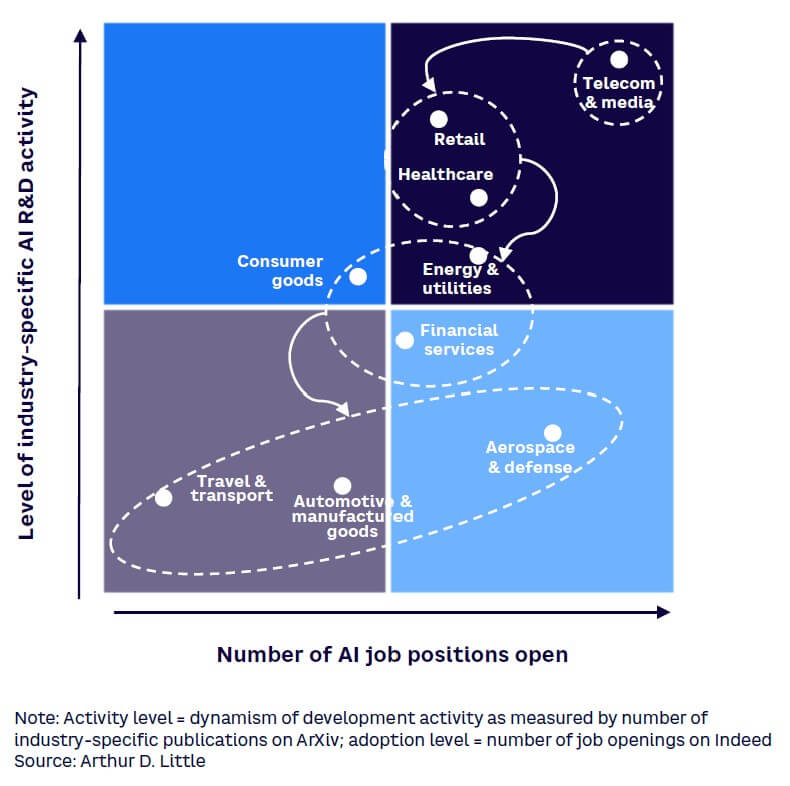

Given the adoption level of AI, which is still in its early stages, existing use cases of “AI revolution” still tend to focus more on new services within existing business models, rather than adjacent or entirely new business models. However, we expect the adoption of AI across industries to differ from one industry to the other (see Figure 5).

In general, we see that the industries impacted first are those that can leverage the benefits of the most accessible forms of GenAI: telecom and media, retail, consumer goods, healthcare, energy, and financial services. The more manufacturing-heavy industries need greater integrative and agentic AI capabilities, also referred to as “system of systems” (including production floor robotics and supply chain management) to leverage its full power, which is still emerging and will undoubtedly come over time. Highly regulated sectors like aerospace and defense, as well as travel and transport, are also limited by the need for absolute accuracy and the sensitivity of the data needed to train models.

Below we provide some concrete, revolutionary examples of AI across a range of industries, some of which are already deployed and some that are in the conceptual stage.

Telecoms: Vertically integrating along AI value chain

In 2022, SK Telecom in South Korea announced its vision to become an “AI company,” vertically integrating to cover the three main steps in the AI value chain. This included direct investment in new data centers for AI, direct development of its own multi-LLM, and development of an “AI-as-a-service” offering. The company has also invested in the AI ecosystem, putting $100 million into Anthropic and establishing partnerships with CMES, MakinaRocks, Scatter Lab, FriendliAI, and others, transcending the traditional telecom business model.

Iliad, headquartered in Paris, France, is Europe’s sixth-biggest telecom operator and has declared its intention to become a “European AI champion.” It has invested across the AI value chain, including a €100 million investment in data center infrastructure, a €100 million investment in two Nvidia AI supercomputers, and a €100 million investment in the AI laboratory Kyutai, which will contribute to the development of models in an “open science” mode. Iliad also entered into a partnership with quantum computing start-up Quandela to commercialize “quantum computing as a service.” In addition, Illiad’s founder, Xavier Niel, founded business incubator Station F, which has raised €250 million to fund AI start-ups.

MobileX is a US-based commercial wireless services start-up. In addition to selling fixed plans, MobileX offers a personalized plan that uses an AI tool to learn user behavior and predict how much data is needed and promises to deliver a dramatic reduction in cost for consumers who don’t need more than 30 GB of data per month, while ensuring reliable speed and service. MobileX’s fully personalized bundle offers customers free service for up to 10 days while the AI tool learns their data usage, after which they load what the app recommends or any amount they choose.

Healthcare: New personalized health services

Though AI has been deployed for clinical diagnostic assistance for several years, disruptive future applications are pending and include AI-based drug discovery, public health management, and personalized healthcare. Regarding the latter, AI has already enabled large amounts of data from wearables to be correlated and analyzed, allowing for personalized analysis and accurate healthcare diagnoses, cutting out the intermediary in the value chain to directly interact with the patient. In some cases, this analysis is more valuable than a one-off snapshot during a doctor’s visit. Welltory, a digital health company, offers a good example. In March 2024, Welltory announced the addition of natural language processing capabilities to its Apple Watch app. The company claims to have undergone a major GenAI-based shift since 2023, using it to analyze various data points, including sleep patterns, activity levels, and heart health to craft personalized wellness advice. It uses proprietary models for translating users’ health data into actionable guidance using a GenAI-driven assistant, AI Coach.

Utilities: New AI-based, real-time grid-balancing capabilities

AI applications in customer-facing functions are already becoming well established in the utilities sector. However, more transformational applications are in development. For example, real-time grid-balancing utilizes AI to provide the necessary means to handle very large data sets requiring complex calculations. AI continuously monitors energy consumption and generation, applying algorithms to continuously learn and adapt to changing circumstances, predicting load peaks and troughs, and optimizing energy supply. This ability will be particularly valuable as power sources become increasingly distributed. Utility players can revolutionize their business model by taking an active role in AI application development and/or electricity-market-specific LLMs — or even going one step further and combining it with proprietary AI infrastructure, given the sovereignty requirements for some of these critical infrastructure companies.

Suitable ecosystem partnerships could make sense for transmission and distribution system operators as a means of extending their value chain roles, given the energy transition challenge and the similarity of grid business models internationally. In the shorter term and on a smaller scale, the combination of energy transition and AI is opening up a new market for smart energy solutions to optimize and balance companies’ and families’ energy production, storage, and consumption. Numerous start-ups exist in this growing market for both B2B and B2C usage, including Ampere, Fluence, GridX, and Spectral.

Financial services: AI-driven innovations

In 2023, Bloomberg announced BloombergGPT, a finance-oriented GenAI system powered by its in-house LLM, specifically trained on the enormous archive of the company’s available financial data. Researchers assembled a thorough 363-billion-token data set made up of English-language financial documents. This proprietary model (not available to the public) has shown promising results in various tasks from providing lighting-fast research to determining the financial impact of headlines.

In early 2024, State Bank of India (SBI) announced plans to develop a banking-specific LLM, in an attempt to reduce the dependency on existing open source models. Without announcing specific use cases for the LLM, SBI considers this the next step after building the foundational capabilities: substantial, recent experience with AI, an established AI governance, adequate available data, already-existing AI models, and access to a skilled workforce.

It should be noted, however, that the use and enablement of AI in the financial services industry is restricted in some geographies. In Europe, for instance, authorities have heavily regulated the access and use of financial services customer data — a key enabler for several AI applications. It is also obligatory in Europe to guarantee explainability of credit-scoring decisions, which throws AI technology out of the game. This explains why we don’t see financial services noted as a first industry in the AI revolution chain reaction.

Automotive: Moving into AI infrastructure manufacturing

Stellantis, headquartered in Amsterdam, the Netherlands, is the world’s fourth-largest carmaker based on its 2023 sales. Last year, Stellantis formed SiliconAuto, a joint venture with electronics manufacturer Foxconn, to design and market semiconductors for not only its own line of vehicles but also other players in the auto industry. New digital and AI technologies have enabled the creation of novel products: a new generation of electric vehicles to function more like smartphones, supporting regular over-the-air updates and offering such features as turn-by-turn navigation, voice assistance, payment services, and an e-commerce marketplace. Similarly, Ford entered into a strategic partnership with GlobalFoundries in late 2021 to develop its own chips, motivated by the increasingly complex features enabled by AI and the need to safeguard the security of its supply.

Manufacturing & industrial: AI & the Industrial Metaverse

The use of digital twins is already well established in many large manufacturing and industrial companies, aimed mainly at optimizing plant operations and maintenance. Together with advances in Internet of Things (IoT), data visualization, complex system modeling, and computing capability, AI has the future potential to enable digital twins not just of individual plants, but entire operations, supply chains, and their environments. This takes the potential of digital twinning to an entirely new level, where it can be used for strategic decision-making and not just plant-level optimization. For example, Schneider Electric uses its IoT platform Ecostruxure to share its data and insights with customers and third-party service providers. Ecostruxure’s introduction to the market has created new revenue sources beyond Schneider’s renowned physical electrical appliances, which has been instrumental to the company’s financial performance.

Conclusion

AN ENTREPRENEURIAL APPROACH TO AI ADOPTION

As today’s use cases demonstrate, companies need to take full advantage of the short-term efficiency and productivity opportunities offered by AI while building the right foundations for the future. The maturity heat map presented earlier is a great tool for identifying where to start, which foundation to build, and the sequence of events to navigate AI.

The mid-to-long-term future holds many uncertainties, and we are surely still only seeing the tip of the iceberg of AI’s disruptive potential for business. Companies should therefore adopt an active, entrepreneurial approach to these longer-term opportunities and be aware of different future scenarios, how they are developing, and the resulting “no-regret” moves they could make in the meantime.

This is what it takes to win in an AI-driven future — a future that is arriving faster than most businesses expect.