DOWNLOAD

DATE

Contact

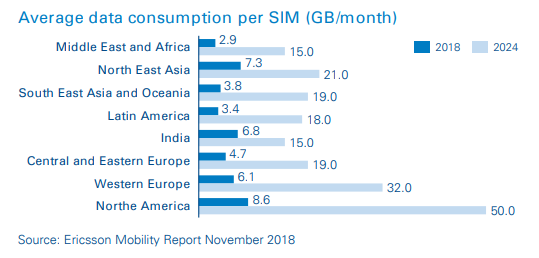

The telecom industry is standing at a crossroads, with increasing users, rapid technology shifts, usage shifts to content services, exponential growth in data usage, and ever-increasing competition. Global trends for mobile services show that average revenue per user (ARPU) is declining, whereas data consumption per SIM is increasing. For operators to be future commercial winners, they must provide a higher quality of service and offer larger data packs bundled with added features to increase the price elasticity of demand. They must then use their increased elasticity to drive higher demand for data by lowering the price per gigabyte (GB). In parallel, they must leverage technological advances to reduce their cost-per-GB-toserve data, which will ultimately result in sustained or higher profits.

More usage but lower average spend

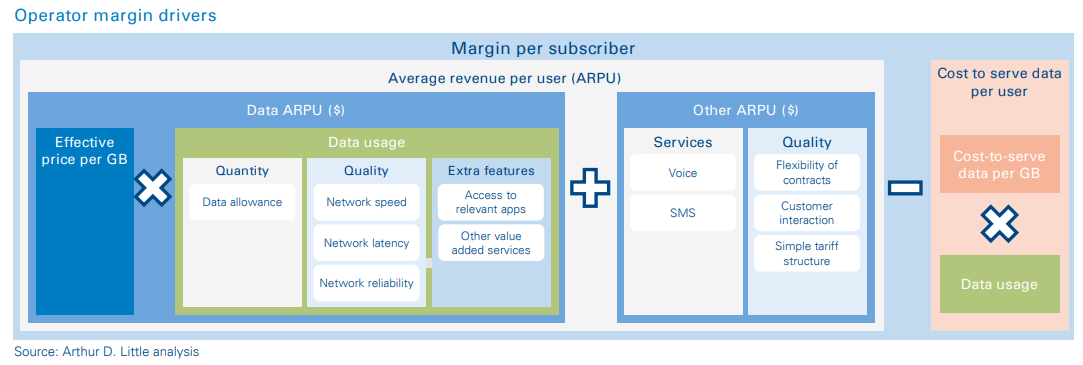

Global mobile data consumption per smartphone increased at a CAGR of 60 percent to reach 5.6 GB per month in 2018, from 2.2 GB per month in 2016. However, ARPU decreased at a CAGR of 2 percent to hit €9.4 per month in 2018, compared with €9.7 per month in 20161 . The pressure on ARPU (and margins) is due to stiff competition, OTT substitution and commoditization of traditional voice & SMS services, and importantly, inability of operators to monetize the increase in data consumption. It is imperative for operators to understand the underlying drivers of margins per subscriber, and then leverage them to dynamically price mobile tariff plans, to stave off the threat of ARPU or margin decline. The figure below illustrates these drivers, and this paper delves deeper into the single-most important driver, data ARPU. The key learning is that operators must focus on forward-looking, competition- and cost-driven pricing and they must play on cost elasticity of serving data being steeper than price elasticity.

Increase data ARPU despite lower price per GB

We are witnessing four global trends with regard to the “data” component in mobile tariff plans:

- Bigger data allowances.

- Lower price and revenues per GB.

- Better quality of service.

- More features offered with data plans.

a. Bigger data allowances

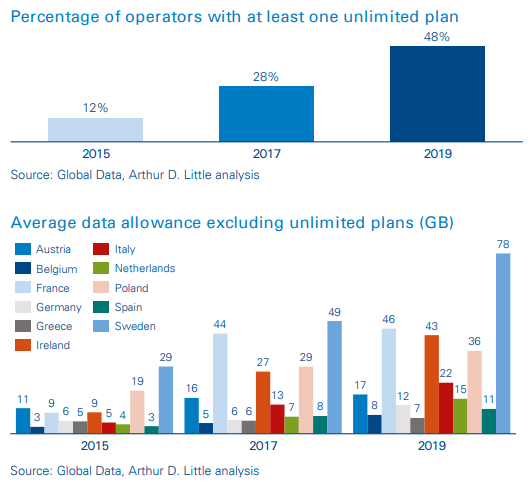

Our analysis of a sample of operators (from 18 European countries) shows that the percentage of operators offering at least one unlimited plan has increased rapidly over the years. Operators have also been consistently increasing their average data allowances across tariff plans.

b. Lower price per GB

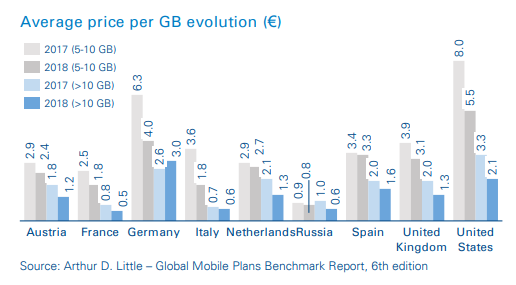

In parallel, operators across markets are reducing average price per GB drastically. (See the below results from a sample.)

Looking at recent trends, operators launching 5G are pricing 5G data plans at similar prices as their 4G plans (e.g., Italy, Austria, Finland), or even at discounts to 4G (e.g., South Korea), to promote data consumption. For example - TIM Italy has introduced two new 5G plans, with data allowances of 50 and 100 GB, at prices per GB of €0.6 and €0.5 – this is in line with the price per GB it currently charges for its 4G plans. In this manner, the company is motivating consumers to use more data.

c. Better quality of service

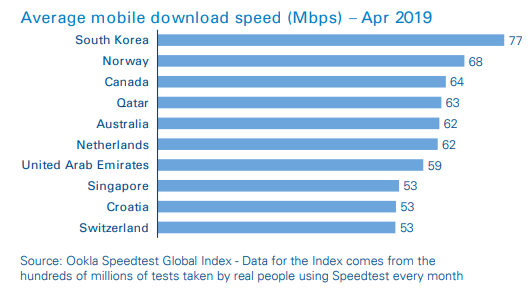

Tech advancements have resulted in operators being able to offer higher data speeds and improved network latency and reliability. More than 10 countries now have average mobile download speeds greater than 50 Mbps. With the advent of 5G, further significant improvements to QoS are expected.

d. More features offered with data plans

Operators continue to add features such as:

- Carrying over unused data to the next month.

- Data sharing – flexibility of sharing data among family or friends.

- Public Wi-Fi allowance.

- Offers with digital propositions and OTT/content:

- Subscription of OTT services and zero-rating has become main-stream, with the majority of operators offering such services in their premium plans. The idea is to encourage customers to switch to premium plans and project superior product value. One or multiple services from the below are typically offered:

- Entertainment Apps – VOD, live TV streaming, gaming, music streaming , e.g. Netflix, Amazon Prime, Spotify, Apple Music.

- Connectivity Apps – Social media, messenger apps, video calling and VOIP services, e.g., Facebook, Twitter, Instagram, WhatsApp.

- Others, such as e-books, maps, and traffic apps.

Offer from T Mobile US – T Mobile created immense value for travelers by offering unlimited data roaming at select destinations.

Offer from 3 UK – Video & music data pass – A video/ music data pass covers zero-rated data on a wide selection of video and music apps. In some instances, limitedduration subscriptions to these services are also included.

The above four trends have led to rapid growth in data usage across markets; 11 operators around the globe report greater than 10 GB of data consumption per SIM from January to September 2018. Ten operators more than doubled their data usage consumption in 2018 compared with 20172 . Nearly half of all operators were able to convert this increase in data consumption into an ARPU increase by steering the price per GB decline systematically.

Usage per SIM is expected to continue to increase with new, data-intensive use cases driven by 5G. Based on a global 5G survey3 , consumers are expected to show a steep increase in data consumption due to enhanced video entertainment, including real-time interactive and immersive video, gaming, and AR-/VR-based experiences. In South Korea, customers who used 8 GB per month on 4G, and have now moved to 5G, are using 26 GB per month4 . Operators must thus prepare for the widespread adoption of unlimited data plans, in which they will not be able to monetize based on data volume tiers. They will have to differentiate their products through quality of service by identifying individual usage patterns and charging a premium for speed, reliability or latency for effective monetization. For example, gamers would be happy to pay a premium for latency, and professionals would pay extra for reliability.

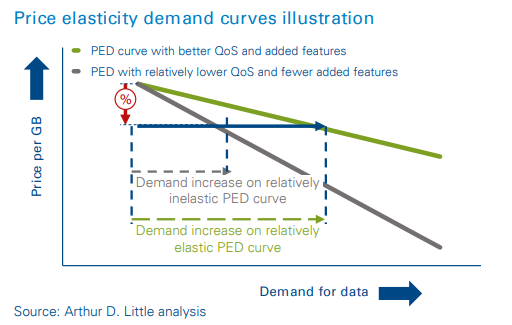

Operators can increase the price elasticity of demand (PED) by offering better QoS and creating more value through added features in their tariff plans. Operators achieve higher elasticity by moving the market from the relatively inelastic gray curve to the more elastic green curve. As demonstrated in the next figure, this helps operators achieve higher increases in data demand as reactions to price decreases. In parallel, operators can decrease the price in a calculated way: if the factor of increase in data demanded is higher than the factor by which the price per GB is reduced – this will result in an increment in ARPU.

Reduce cost to serve with technology advancements

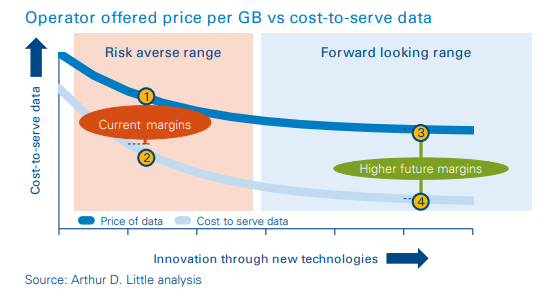

As the shift towards LTE-A and 5G happens, cost-to-serve data drastically reduces. Operators that continue to reduce cost-toserve data will achieve a cost-elasticity curve that is steeper than the price elasticity-of-demand curve.

Case study – Elisa

Elisa is a model example of how to translate larger data packages at lower costs into increased ARPU. Elisa executed mobile-centric “unlimited everything” strategies and developed its OTT offerings in parallel to fuel data consumption. For example, the company introduced Elisa Mobile Video, its unlimited-time and -traffic, self-operated OTT platform. Based on self-made content (Elisa Viihde) and cooperation with content providers, Elisa integrated HBO, SF Kids and live sports broadcasts. In parallel with fueling data growth, the company rapidly decreased price per GB in its plans while recording 7 percent annual growth in ARPU from 2016 to 2018.

The figure below shows how operators can leverage steeper cost-elasticity curve to increase margins per GB. Companies should operate at a low-price, low-cost “3-4” position, which essentially means they should price their plans so the price per GB is around position “3” and reduce their cost-to-serve data so the cost per GB is at position “4”. One might argue that operating at a high-price, low-cost “1-4” position seems a better strategy, wherein the operator decreases its costs to position “4” but keeps charging its customers a high price per GB in line with position “1”. However, this strategy is not viable in a competitive market; as customers will discover lower prices and the operator with a “1-4” strategy will lose market share.

Operators that move swiftly to a “3-4” strategy will be able to capture market share from their competitors that are still in the ‘risk-averse’ range. This is what happened in the Indian market, where Jio was able to snatch 100 million subscribers from incumbents such as Airtel and Vodafone in 90 days by offering a much lower GB price-point (versus competition), supported by a lower cost-to-serve data, which was made possible due to a modern efficient network.

Insight for executives

Operators can still reduce unitary prices without destroying value, by carefully playing with the drivers listed above instead of reactively dropping prices in response to competitive moves.

Dynamic, forward-looking price alignment with costs – Operators shouldn’t solely focus on competition and price plans through a reactive mechanism. They must also look internally, aligning their pricing with evolving cost-to-serve data. Operators must set up dynamic cost accounting that can measure and foresee developments for cost of production, and then translate them into pricing and dynamic KPIs for the organization.

Extra features as part of the core strategy – Operators should make added features, such as OTT/content (including AR/VR experiences, cloud gaming), lower latency and higher reliability, a core part of their strategies. This would increase consumer data demand, support a lower price per gigabyte, and enhance mobile revenues.

Reduce cost to serve data – Operators must focus their efforts to deliver the degression curve of cost-of-GB production by leveraging advancements in spectral efficiency and traffic capacity, e.g. LTE-Advanced is 3x more spectrally efficent than LTE. This will help them stay ahead of competition by enabling them to deliver data at lower prices, without hurting their margins.