12 min read

Corporate sustainability – Using your ecosystem to sustain the ecosystem

Sustainability has now risen to the top of the business agenda, with a combination of technology, financial backing, and greater government and consumer pressure all making it an imperative for every organization. Our lead article explains how taking a business ecosystem approach is crucial to sustaining our natural ecosystems.

It has been nearly 25 years since the Brundtland Report introduced the modern concept of sustainable development, highlighting its three fundamental components – the environment, the economy, and society. Yet since then, despite the many global, regional, and local goals, pledges, and initiatives, society has been largely ineffective in transforming discussions around sustainability into concrete and strategic actions.

The latest UN Sustainable Development Goals (SDGs) are unlikely to be met. Even before COVID-19, it was unlikely that global poverty would be eradicated by 20301, as the world saw $23.6bn in direct economic losses from natural disasters in 2018. Global average temperatures have already risen by one degree above the pre-industrial baseline, sea levels are at a record high, glaciers and polar ice are retreating and the last four years were the warmest on record. However, as this article explains, conditions have now changed. We explore the reasons why sustainability is now genuinely at the top of the business agenda, and why a “partner ecosystem”-led approach is the key to sustaining the “environmental ecosystem”.

THE NEW DRIVERS FOR CHANGE

Despite the lack of progress to date, today various factors around technology, finance, government actions, and consumer expectations are for the first time converging to enable real change.

Technology as an enabler

We are now seeing the fruits of innovation and research programs begun over the last decade. Areas as diverse as solar, EV/batteries, waste recycling, air/water treatment, and green hydrogen (see The role of hydrogen in building a sustainable future for automotive mobility in this issue of Prism) are now maturing, bringing down costs, enabling scale, and opening up new opportunities. For example, the cost of solar photovoltaic energy dropped by 82 percent between 2010 and 20192, while efficiency saw a fivefold increase. Essentially, this makes being sustainable more accessible to businesses.

Wider digital transformation also enables sustainability – for example, the integration of 5G and the Internet of Things (IoT) can enable business use cases that impact areas such as real-time monitoring of emissions reduction, safety improvement, and other SDG targets. Technology advances are unlocking further drivers for sustainability and creating new expectations of corporate action on sustainability performance.

Greater government action

As part of rebuilding the economy post-COVID-19, governments are investing heavily in various initiatives, including sustainability infrastructure, in order to “build back greener”. This has created significant interest in the private sector. In the US, President Biden unveiled a $2 trillion infrastructure plan, while the EU’s Green Deal Recovery Plan and China’s latest Five Year Plan all put sustainability at the core of investment decisions. Gaining access to these funds requires businesses to adopt and demonstrate sustainability within their operations.

This is not limited to countries heavily impacted economically by the pandemic. Although Australia avoided recession in 2020, it is looking to rebalance its economy moving forward. For example, the state of Tasmania is supporting extensive hydroelectric power infrastructure, while the world’s largest solar farm is being built in Darwin and will supply 20 percent of Singapore’s electricity needs via underwater cables by 2027.

Governments are also competing to position their economies for a sustainable future. For example, Germany’s plan for a 65 percent cut in carbon emissions by 2030 is a voluntary 10 percent greater than the rest of the EU. This is designed to spur its companies to innovate and build leadership positions that capture value from new circular and net-zero economy businesses and replace jobs in fossil fuel sectors.

Increasing financial services sector and investor pressure

COVID-19 has accelerated the pace of green investment. Many initiatives that link funding to sustainability have now been announced, such as the Net-Zero Banking Alliance3. Created by banks responsible for $28.5 trillion in assets, this has set 2030 and 2050 targets, essentially looking to ensure that all their clients are sustainable businesses. The EU Taxonomy4 has been developed to classify economic activities and show whether they are environmentally sustainable. It is being used to guide decisions on where money from the EU Green Deal will be invested. Further examples can be found in The Green Gambit – Investing for corporate strategic advantage in the post- COVID-19 world (Prism Issue 1, 2021).

Greater consumer demand for sustainability Consumers, particularly younger generations, are increasingly focused on sustainability and driving growth. This covers sectors as diverse as tourism (where the market is expected to grow by a CAGR of 14 percent between 2021 and 2027 to $334 billion) and consumer packaged goods (CPG). For example, a recent study by Stern found that between 2015 and 2019, sustainability-marketed CPG in the US grew over seven times faster than products not marketed as sustainable while enjoying a price premium of nearly 40 percent.

THE GROWING BENEFITS OF SUSTAINABILITY

The benefits to businesses of embedding sustainability have been often stated in the past, but have significantly increased in recent years.

1. Reduced risk/better risk management.

Embedding sustainability principles within risk management strategies facilitates their timelier identification, allowing them to be addressed consistently across the organization. Demonstrating this, many insurers and re-insurers have created Sustainability Risk Frameworks that they use to assess the social and environmental risks of their transactions, even refusing coverage in some instances (for example, German energy company RWE was dropped by insurer AXA over its coal operations6).

2. Greater attraction and retention of talent and partners.

Innovation, growth, and value generation rely on the skills of an organization’s people and partnerships within the wider ecosystem. An increasing number of potential staff choose their employers based on a clear sense of meaning and sustainable purpose and are more productive and loyal to such organizations. Morale has been shown to be typically higher in genuinely sustainable companies. The same principles apply to the partnering strategies. For example, Tesla won’t partner with firms it considers not to be committed to sustainability – and recently announced it would no longer accept bitcoin due to the environmental impact of mining the cryptocurrency.

3. Lower cost of attracting funding

Not only are there an increasing number of funds targeting sustainable opportunities, but sustainable businesses can also lower the cost of attracting capital due to investor demand. For example, energy company Enel, which adopted a sustainability business model in 2015, received a premium price for its sustainability bonds, saving itself a reported 20 basis points compared to a conventional bond.

4. Competitive advantage

Embracing sustainability enables organizations to create new, differentiated competitive positioning. Flavorings company McCormick is focusing on Purpose-led Performance to set itself apart from its rivals, which has resulted in it being ranked as the most sustainable food company in the Corporate Knights 2021 Global 100 Sustainability Index.

Benefits are not limited to the consumer space. Chemicals giant Solvay applies its Sustainable Portfolio Management (SPM) tool, which assesses comprehensive and forward-looking “sustainability performance” to all its products. This enables it to take strategic decisions that drive higher growth. It found that solutions that scored well on the SPM delivered a superior average annual growth rate of 9 percent, versus -3 percent below average for solutions with negative assessments.

WHAT HAS BEEN HOLDING COMPANIES BACK?

Despite the drivers and benefits, there have been multiple barriers preventing companies from making progress in sustainability.

- In the past, there has been a lack of knowledge within management teams and board members about the subject and where to start and a prevailing company culture that was not conducive to the sort of changes required.

- Companies and their shareholders have often been poor at taking a perspective beyond the short term. This is sometimes characterized by a fear of cannibalizing the incumbent business by moving “too fast” towards sustainability. For example, this was recently shown by BP’s board and shareholders rejecting a proposal from activists to publish more aggressive short-, medium, and long-term targets to reduce emissions.

- In some territories (such as Australia and parts of South-East Asia), governments have not set clear net-zero targets, which means companies operating in these markets lack regulatory incentives to change.

- Achieving a meaningful impact in terms of sustainability is not easy for companies in isolation. Today, large companies exist in often complex global value chains from raw material through to consumption and disposal. There are typically many interconnections, interactions, and unforeseen direct and indirect impacts with multiple parties involved. This means that solutions may be complex and difficult to realize in practice.

BECOMING SUSTAINABLE TODAY

Overcoming these barriers is the starting point for becoming truly sustainable. Despite the accumulated wisdom over decades and the more recent shared realization of the urgency to take action, for some companies there is still a need to educate the board and senior managers about what a sustainable mindset really means – looking beyond the next three to five years, rethinking the mission and setting concrete objectives.

It is vital to turn strategies and plans into action, building sustainability governance models that cover the wider ecosystem and supply chain, as well as the company, its products, and its operations, for example:

- Enel achieves this by embedding its Creating Shared Value (CSV) concept into its entire value chain, led by its central Innovability function.

- AENA, one of the largest airport operators in the world, recently published a Climate Change Action Plan that establishes an ambitious objective of reducing emissions per passenger by 94 percent by 2030, backed by a detailed set of measures, setting the basis for achieving net-zero by 2040. It has also strengthened its governance model to be more accountable for sustainable performance. Recognizing the need to influence the broader aviation ecosystem, the plan also includes measures for airlines and handling companies.

- US carpet tile manufacturer Interface set out (and has already reached) a 25-year goal of having a net-zero impact on the planet.

To demonstrate the benefits that sustainability is delivering, organizations must ensure they are able to quantify and monitor the value they create, beyond simple savings in compliance costs. Metrics should be defined and monitored to show the business impact of being sustainable and highlight how the organization is going beyond compliance to differentiate itself.

Companies should build a strong culture around sustainability through a common sustainability “language” that is used by the entire organization. This enables management to engage the wider business, set parameters for what is acceptable, and make targets relevant and real for all employees, partners, and other stakeholders.

THE IMPORTANCE OF THE STAKEHOLDER SYSTEM

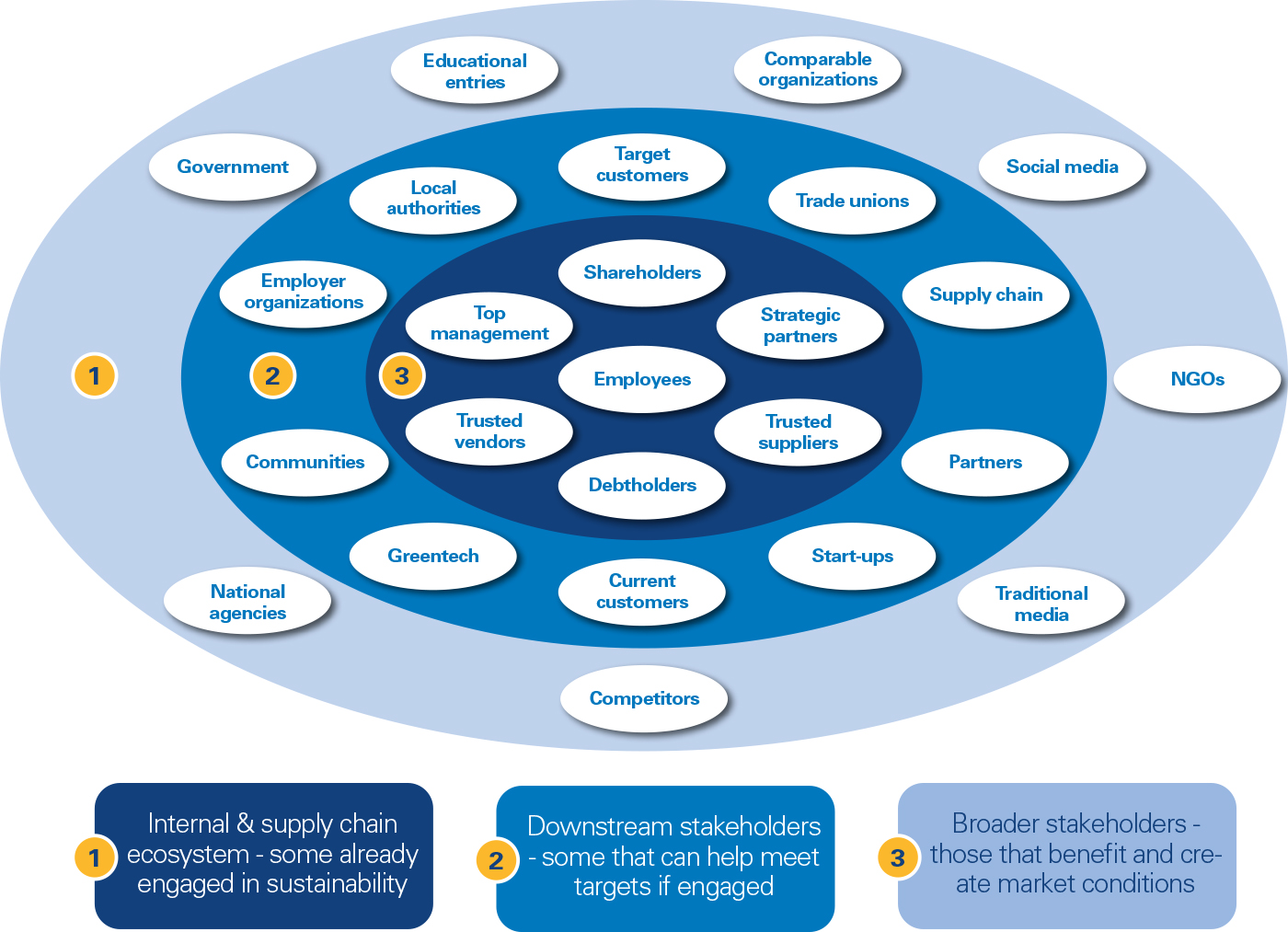

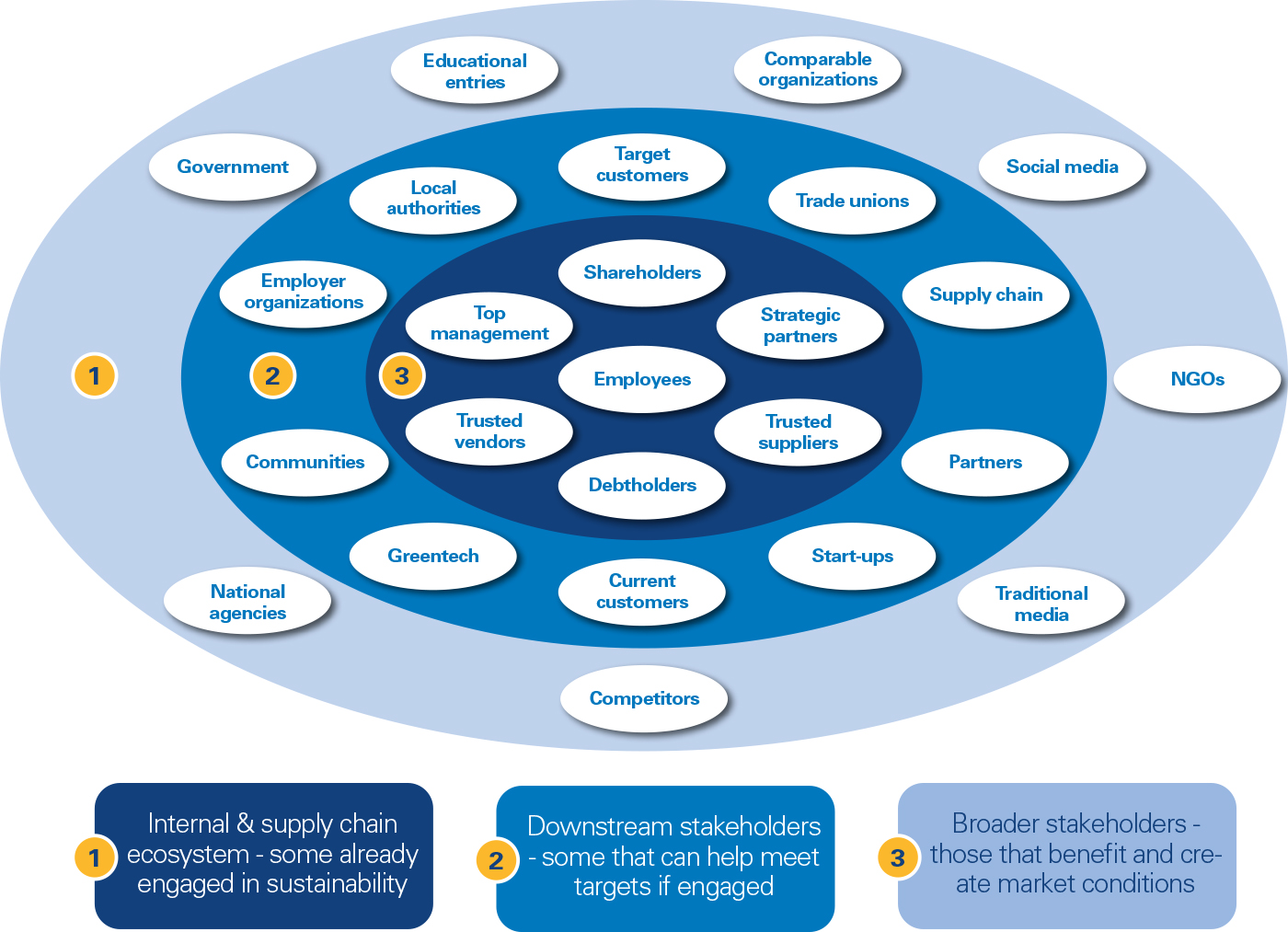

Apart from the above basic prerequisites, it is especially important today that in setting sustainability strategies, businesses take a wider ecosystem view based on understanding all stakeholders (see Figure 1), and go beyond engagement to enablement.

This means listening to current and target customers, investors, NGOs, local communities, employees, and supply chain partners to learn what is important to them and enable change. This may not just be reducing greenhouse gas emissions – it could be areas such as giving back to communities, lowering water consumption, reducing waste, or focusing on social issues such as child labor, bribery, and addressing the digital divide. Businesses must then use this information constructively as part of the strategy-setting process.

One good example of this in action is Ferrovie dello Stato, the Italian transport and infrastructure group.

Ferrovie dello Stato (FS) Italiane Group operates in four key sectors in Italy and across Europe – rail, road and sea transport of passengers and cargo; rail and road infrastructure and sea link services; real estate; and other services (finance, certification, ICT). It began its sustainability journey in 2008, following a three-step approach:

- Define the corporate ambition: To be a sustainability leader.

- Define the group vision: “To be the company to implement an integrated and sustainable mobility and logistics service that is safe, uses shared infrastructures and creates value in Italy and abroad.”

- Translate this vision into strategic areas of intervention, with goals and targets across economic, social, and environmental dimensions, and a longer-term roadmap up to 2050.

To help achieve its aims, FS Italiane Group worked extensively with stakeholders to define long-term goals, including carbon neutrality by 2050, as well as integrating the principles of social, environmental, and economic sustainability into its current business plan. This includes linking GHG emissions targets to senior management’s remuneration policies. The group was the first railway operator in Europe to issue green bonds, in order to invest in highly energy-efficient and recyclable trains. It has extended ideas of the circular economy across its assets – for example, turning over 300km of disused railway lines into cycle tracks and green routes. “FS Italiane Group’s vision – defining the long-term projection of the group’s role in the economic, social and environmental context in which it operates – incorporates the ambition of building transport works and services that create long-term value for the stakeholders by driving a shift towards intermodality” [Lorenzo Radice, Head of Sustainability for the FS Italiane Group]

INSIGHTS FOR THE EXECUTIVES

Taking a long-term, the ecosystem-focused approach is key to successfully managing the shift to sustainability in today’s new environment.

1. You cannot be sustainable alone

While species evolve or perish, ecosystems are intrinsically sustainable. Take an ecosystem approach that not only covers all of your activities (customers, processes, technology, and investments) but also involves your suppliers and start-ups. Ensure everyone around you thinks the same – to both learn from and pass on your own practices. For example, airports need to work towards the sustainability of aviation, even if they are only directly responsible for a small fraction of the industry’s total environmental impact.

2. Understand your position in your ecosystem

Your sustainability role and focus will depend on where you sit in the ecosystem, your size, and your activities. For example, if you are not a large emitter but rely on materials that are not produced sustainably, your role will be to educate suppliers and enforce the need for change, rather than leading overall efforts. Equally, companies that create products responsible for large-scale emissions will increasingly be held responsible for downstream usage of their products, as the recent successful legal challenge to Shell’s sustainability targets demonstrates.

3. Set a vision and translate it into a wider, long-term (30-/40-year) roadmap

Understand and plan for the long-term consequences of today’s actions/investments, rather than solely focusing on short-term business plans. This is a major change from existing business planning, but necessary to deal with the longer-term horizon for sustainability.

4. Set connected short-term and long-term (20-/30- /40-year) goals

Operationalize your vision in your goals. Balance the two and be ambidextrous – don’t settle for incremental targets alone.

5. Demonstrate the benefits of sustainability

Quantify and monitor the value you create – this increases buy-in and momentum within the organization, and hence accelerates the shift.

6. Be bold and move ahead fast to reap the benefits

Understand the pace of your own organization and investors to bring them with you. Always err on the side of the active – the pace of innovation means even the most seemingly ambitious goals can be suddenly within reach due to technological breakthroughs. Don’t use local government inactivity as an excuse. For example, although Australia has not committed to a net-zero target date, it is seeing renewable energy grow at a per capita rate 10 times faster than the world average.

As the world recovers from pandemics with a sharply renewed sense of mankind’s connectedness and vulnerability, sustainability is taking center stage. Taking a broad perspective that includes all the stakeholders in your ecosystem is the key to ensuring that your company’s sustainability efforts will really make a difference.

12 min read

Corporate sustainability – Using your ecosystem to sustain the ecosystem

Sustainability has now risen to the top of the business agenda, with a combination of technology, financial backing, and greater government and consumer pressure all making it an imperative for every organization. Our lead article explains how taking a business ecosystem approach is crucial to sustaining our natural ecosystems.

DATE

It has been nearly 25 years since the Brundtland Report introduced the modern concept of sustainable development, highlighting its three fundamental components – the environment, the economy, and society. Yet since then, despite the many global, regional, and local goals, pledges, and initiatives, society has been largely ineffective in transforming discussions around sustainability into concrete and strategic actions.

The latest UN Sustainable Development Goals (SDGs) are unlikely to be met. Even before COVID-19, it was unlikely that global poverty would be eradicated by 20301, as the world saw $23.6bn in direct economic losses from natural disasters in 2018. Global average temperatures have already risen by one degree above the pre-industrial baseline, sea levels are at a record high, glaciers and polar ice are retreating and the last four years were the warmest on record. However, as this article explains, conditions have now changed. We explore the reasons why sustainability is now genuinely at the top of the business agenda, and why a “partner ecosystem”-led approach is the key to sustaining the “environmental ecosystem”.

THE NEW DRIVERS FOR CHANGE

Despite the lack of progress to date, today various factors around technology, finance, government actions, and consumer expectations are for the first time converging to enable real change.

Technology as an enabler

We are now seeing the fruits of innovation and research programs begun over the last decade. Areas as diverse as solar, EV/batteries, waste recycling, air/water treatment, and green hydrogen (see The role of hydrogen in building a sustainable future for automotive mobility in this issue of Prism) are now maturing, bringing down costs, enabling scale, and opening up new opportunities. For example, the cost of solar photovoltaic energy dropped by 82 percent between 2010 and 20192, while efficiency saw a fivefold increase. Essentially, this makes being sustainable more accessible to businesses.

Wider digital transformation also enables sustainability – for example, the integration of 5G and the Internet of Things (IoT) can enable business use cases that impact areas such as real-time monitoring of emissions reduction, safety improvement, and other SDG targets. Technology advances are unlocking further drivers for sustainability and creating new expectations of corporate action on sustainability performance.

Greater government action

As part of rebuilding the economy post-COVID-19, governments are investing heavily in various initiatives, including sustainability infrastructure, in order to “build back greener”. This has created significant interest in the private sector. In the US, President Biden unveiled a $2 trillion infrastructure plan, while the EU’s Green Deal Recovery Plan and China’s latest Five Year Plan all put sustainability at the core of investment decisions. Gaining access to these funds requires businesses to adopt and demonstrate sustainability within their operations.

This is not limited to countries heavily impacted economically by the pandemic. Although Australia avoided recession in 2020, it is looking to rebalance its economy moving forward. For example, the state of Tasmania is supporting extensive hydroelectric power infrastructure, while the world’s largest solar farm is being built in Darwin and will supply 20 percent of Singapore’s electricity needs via underwater cables by 2027.

Governments are also competing to position their economies for a sustainable future. For example, Germany’s plan for a 65 percent cut in carbon emissions by 2030 is a voluntary 10 percent greater than the rest of the EU. This is designed to spur its companies to innovate and build leadership positions that capture value from new circular and net-zero economy businesses and replace jobs in fossil fuel sectors.

Increasing financial services sector and investor pressure

COVID-19 has accelerated the pace of green investment. Many initiatives that link funding to sustainability have now been announced, such as the Net-Zero Banking Alliance3. Created by banks responsible for $28.5 trillion in assets, this has set 2030 and 2050 targets, essentially looking to ensure that all their clients are sustainable businesses. The EU Taxonomy4 has been developed to classify economic activities and show whether they are environmentally sustainable. It is being used to guide decisions on where money from the EU Green Deal will be invested. Further examples can be found in The Green Gambit – Investing for corporate strategic advantage in the post- COVID-19 world (Prism Issue 1, 2021).

Greater consumer demand for sustainability Consumers, particularly younger generations, are increasingly focused on sustainability and driving growth. This covers sectors as diverse as tourism (where the market is expected to grow by a CAGR of 14 percent between 2021 and 2027 to $334 billion) and consumer packaged goods (CPG). For example, a recent study by Stern found that between 2015 and 2019, sustainability-marketed CPG in the US grew over seven times faster than products not marketed as sustainable while enjoying a price premium of nearly 40 percent.

THE GROWING BENEFITS OF SUSTAINABILITY

The benefits to businesses of embedding sustainability have been often stated in the past, but have significantly increased in recent years.

1. Reduced risk/better risk management.

Embedding sustainability principles within risk management strategies facilitates their timelier identification, allowing them to be addressed consistently across the organization. Demonstrating this, many insurers and re-insurers have created Sustainability Risk Frameworks that they use to assess the social and environmental risks of their transactions, even refusing coverage in some instances (for example, German energy company RWE was dropped by insurer AXA over its coal operations6).

2. Greater attraction and retention of talent and partners.

Innovation, growth, and value generation rely on the skills of an organization’s people and partnerships within the wider ecosystem. An increasing number of potential staff choose their employers based on a clear sense of meaning and sustainable purpose and are more productive and loyal to such organizations. Morale has been shown to be typically higher in genuinely sustainable companies. The same principles apply to the partnering strategies. For example, Tesla won’t partner with firms it considers not to be committed to sustainability – and recently announced it would no longer accept bitcoin due to the environmental impact of mining the cryptocurrency.

3. Lower cost of attracting funding

Not only are there an increasing number of funds targeting sustainable opportunities, but sustainable businesses can also lower the cost of attracting capital due to investor demand. For example, energy company Enel, which adopted a sustainability business model in 2015, received a premium price for its sustainability bonds, saving itself a reported 20 basis points compared to a conventional bond.

4. Competitive advantage

Embracing sustainability enables organizations to create new, differentiated competitive positioning. Flavorings company McCormick is focusing on Purpose-led Performance to set itself apart from its rivals, which has resulted in it being ranked as the most sustainable food company in the Corporate Knights 2021 Global 100 Sustainability Index.

Benefits are not limited to the consumer space. Chemicals giant Solvay applies its Sustainable Portfolio Management (SPM) tool, which assesses comprehensive and forward-looking “sustainability performance” to all its products. This enables it to take strategic decisions that drive higher growth. It found that solutions that scored well on the SPM delivered a superior average annual growth rate of 9 percent, versus -3 percent below average for solutions with negative assessments.

WHAT HAS BEEN HOLDING COMPANIES BACK?

Despite the drivers and benefits, there have been multiple barriers preventing companies from making progress in sustainability.

- In the past, there has been a lack of knowledge within management teams and board members about the subject and where to start and a prevailing company culture that was not conducive to the sort of changes required.

- Companies and their shareholders have often been poor at taking a perspective beyond the short term. This is sometimes characterized by a fear of cannibalizing the incumbent business by moving “too fast” towards sustainability. For example, this was recently shown by BP’s board and shareholders rejecting a proposal from activists to publish more aggressive short-, medium, and long-term targets to reduce emissions.

- In some territories (such as Australia and parts of South-East Asia), governments have not set clear net-zero targets, which means companies operating in these markets lack regulatory incentives to change.

- Achieving a meaningful impact in terms of sustainability is not easy for companies in isolation. Today, large companies exist in often complex global value chains from raw material through to consumption and disposal. There are typically many interconnections, interactions, and unforeseen direct and indirect impacts with multiple parties involved. This means that solutions may be complex and difficult to realize in practice.

BECOMING SUSTAINABLE TODAY

Overcoming these barriers is the starting point for becoming truly sustainable. Despite the accumulated wisdom over decades and the more recent shared realization of the urgency to take action, for some companies there is still a need to educate the board and senior managers about what a sustainable mindset really means – looking beyond the next three to five years, rethinking the mission and setting concrete objectives.

It is vital to turn strategies and plans into action, building sustainability governance models that cover the wider ecosystem and supply chain, as well as the company, its products, and its operations, for example:

- Enel achieves this by embedding its Creating Shared Value (CSV) concept into its entire value chain, led by its central Innovability function.

- AENA, one of the largest airport operators in the world, recently published a Climate Change Action Plan that establishes an ambitious objective of reducing emissions per passenger by 94 percent by 2030, backed by a detailed set of measures, setting the basis for achieving net-zero by 2040. It has also strengthened its governance model to be more accountable for sustainable performance. Recognizing the need to influence the broader aviation ecosystem, the plan also includes measures for airlines and handling companies.

- US carpet tile manufacturer Interface set out (and has already reached) a 25-year goal of having a net-zero impact on the planet.

To demonstrate the benefits that sustainability is delivering, organizations must ensure they are able to quantify and monitor the value they create, beyond simple savings in compliance costs. Metrics should be defined and monitored to show the business impact of being sustainable and highlight how the organization is going beyond compliance to differentiate itself.

Companies should build a strong culture around sustainability through a common sustainability “language” that is used by the entire organization. This enables management to engage the wider business, set parameters for what is acceptable, and make targets relevant and real for all employees, partners, and other stakeholders.

THE IMPORTANCE OF THE STAKEHOLDER SYSTEM

Apart from the above basic prerequisites, it is especially important today that in setting sustainability strategies, businesses take a wider ecosystem view based on understanding all stakeholders (see Figure 1), and go beyond engagement to enablement.

This means listening to current and target customers, investors, NGOs, local communities, employees, and supply chain partners to learn what is important to them and enable change. This may not just be reducing greenhouse gas emissions – it could be areas such as giving back to communities, lowering water consumption, reducing waste, or focusing on social issues such as child labor, bribery, and addressing the digital divide. Businesses must then use this information constructively as part of the strategy-setting process.

One good example of this in action is Ferrovie dello Stato, the Italian transport and infrastructure group.

Ferrovie dello Stato (FS) Italiane Group operates in four key sectors in Italy and across Europe – rail, road and sea transport of passengers and cargo; rail and road infrastructure and sea link services; real estate; and other services (finance, certification, ICT). It began its sustainability journey in 2008, following a three-step approach:

- Define the corporate ambition: To be a sustainability leader.

- Define the group vision: “To be the company to implement an integrated and sustainable mobility and logistics service that is safe, uses shared infrastructures and creates value in Italy and abroad.”

- Translate this vision into strategic areas of intervention, with goals and targets across economic, social, and environmental dimensions, and a longer-term roadmap up to 2050.

To help achieve its aims, FS Italiane Group worked extensively with stakeholders to define long-term goals, including carbon neutrality by 2050, as well as integrating the principles of social, environmental, and economic sustainability into its current business plan. This includes linking GHG emissions targets to senior management’s remuneration policies. The group was the first railway operator in Europe to issue green bonds, in order to invest in highly energy-efficient and recyclable trains. It has extended ideas of the circular economy across its assets – for example, turning over 300km of disused railway lines into cycle tracks and green routes. “FS Italiane Group’s vision – defining the long-term projection of the group’s role in the economic, social and environmental context in which it operates – incorporates the ambition of building transport works and services that create long-term value for the stakeholders by driving a shift towards intermodality” [Lorenzo Radice, Head of Sustainability for the FS Italiane Group]

INSIGHTS FOR THE EXECUTIVES

Taking a long-term, the ecosystem-focused approach is key to successfully managing the shift to sustainability in today’s new environment.

1. You cannot be sustainable alone

While species evolve or perish, ecosystems are intrinsically sustainable. Take an ecosystem approach that not only covers all of your activities (customers, processes, technology, and investments) but also involves your suppliers and start-ups. Ensure everyone around you thinks the same – to both learn from and pass on your own practices. For example, airports need to work towards the sustainability of aviation, even if they are only directly responsible for a small fraction of the industry’s total environmental impact.

2. Understand your position in your ecosystem

Your sustainability role and focus will depend on where you sit in the ecosystem, your size, and your activities. For example, if you are not a large emitter but rely on materials that are not produced sustainably, your role will be to educate suppliers and enforce the need for change, rather than leading overall efforts. Equally, companies that create products responsible for large-scale emissions will increasingly be held responsible for downstream usage of their products, as the recent successful legal challenge to Shell’s sustainability targets demonstrates.

3. Set a vision and translate it into a wider, long-term (30-/40-year) roadmap

Understand and plan for the long-term consequences of today’s actions/investments, rather than solely focusing on short-term business plans. This is a major change from existing business planning, but necessary to deal with the longer-term horizon for sustainability.

4. Set connected short-term and long-term (20-/30- /40-year) goals

Operationalize your vision in your goals. Balance the two and be ambidextrous – don’t settle for incremental targets alone.

5. Demonstrate the benefits of sustainability

Quantify and monitor the value you create – this increases buy-in and momentum within the organization, and hence accelerates the shift.

6. Be bold and move ahead fast to reap the benefits

Understand the pace of your own organization and investors to bring them with you. Always err on the side of the active – the pace of innovation means even the most seemingly ambitious goals can be suddenly within reach due to technological breakthroughs. Don’t use local government inactivity as an excuse. For example, although Australia has not committed to a net-zero target date, it is seeing renewable energy grow at a per capita rate 10 times faster than the world average.

As the world recovers from pandemics with a sharply renewed sense of mankind’s connectedness and vulnerability, sustainability is taking center stage. Taking a broad perspective that includes all the stakeholders in your ecosystem is the key to ensuring that your company’s sustainability efforts will really make a difference.