DOWNLOAD

DATE

Contact

Increased consumer engagement combined with growing availability of affordable, small-scale distributed energy resources (DERs), along with legislative changes, present opportunities for local energy community (LEC) initiatives, in which consumers can actively participate in optimizing their energy bills. These initiatives can protect consumers from high and extremely volatile energy prices. Moreover, opportunities are emerging for traditional and nontraditional market players to enable and facilitate these new community models. In this Viewpoint, we explore what it will take to move forward with LECs to realize the value they offer.

TRENDS IN ENERGY LANDSCAPE: NEW MODELS

The share of renewable energy sources is increasing globally — albeit at varying paces and configurations across markets. Consumers are a driving force behind the increasing demand and production of clean, sustainable, and small-scale DERs, which includes rooftop photovoltaics (PV), electric vehicles, and static behind-the-meter (BTM) batteries, along with smart controllable loads like thermostats, electric boilers, and so on. Consumers today are more engaged and continually looking for valorization opportunities for their asset investments to participate more fully in the energy market, while at the same time seeking ways to become less dependent on the energy market.

Simultaneously, the increasing amount of DERs brings unseen variability and congestion to the power grid. To temper the need for more grid investments resulting from this transition, grid operators are encouraged to look for alternatives.

Along those lines and stimulated by international events, external factors have had an enormous and negative impact on local gas supplies, with gas shortages creating a spike in electricity market prices. As as result, suppliers are up against a wave of challenges in honoring their fixed contracts with customers and have increased their prices significantly. These high prices are followed by customer dissatisfaction and potentially skyrocketing switch rates as customers look for long-term price stability and more participative governance.

Such market tension strengthens how devolution is reshaping the position of (local) governments. Indeed, the strategic and political role is shifting to more local authorities, like what we are observing in Germany, where hundreds of local municipal utilities, also known as “Stadtwerke,” operate the grid.

The current landscape and the changing needs of the players within it open the discussion to new, winning energy models that play on the market trends. One such model is a partnership model, where the supplier goes beyond commodity offerings and becomes a one-stop shop in providing energy services and related assets (e.g., cross-selling of small-scale and community batteries, smart [high load] appliances). This model also supports the emergence of energy communities.

Energy community will play increasing role in energy transition

LECs are gaining increased attention as an enabler in the energy transition, with various regions adapting legislation to facilitate setting up such communities.

An energy community is a group of participants interacting and trading with their local DERs (including generation, storage, and load) in an embedded (virtual or physical) ecosystem — as a subset of the wider power network. DERs have been around for a while, but new enablers and technological advancements (e.g., granular digital metering and the Internet of Things [IoT]) have opened the opportunity to turn these assets into new models for energy supply.

The LEC model, in particular, responds well to consumers’ willingness to be more active and represents an attractive opportunity for consumers not necessarily looking to make major investments and/or who lack the expertise to navigate the complexities of the energy sector.

“Energy sharing is a great opportunity to allow all citizens to contribute to the energy transition and a decarbonized future by consuming renewable and local energy at affordable prices. Also, it offers a solution for energy poverty, one of the biggest concerns in the Brussels Capital-Region. In addition, this innovative concept will foster investments in renewable sources that will be integrated in a smart and homogeneous way in the electricity distribution network. In the future, it will also represent a flexibility potential that could be used for grid needs. Lastly, Sibelga aims to support all actors involved in energy sharing in Brussels by installing smart meters on the one hand and providing neutral and efficient data management on the other.”

Inne Mertens, CEO, Sibelga

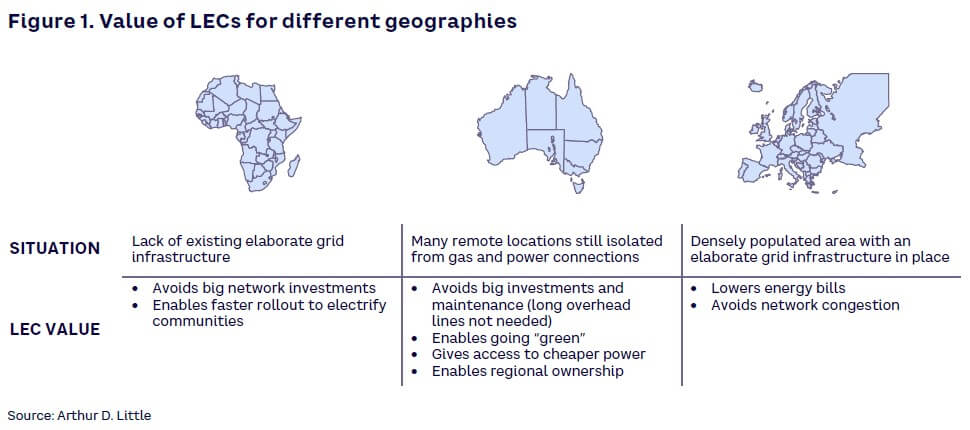

Depending on the geographical region, the value these LECs bring to the market differs strongly, as illustrated by the comparison of Africa, Australia, and Europe in Figure 1.

In the case of Europe, LECs bring value to both the consumers and the grid operators. In times when the energy market is extremely volatile from a price perspective, energy communities can act as locally managed hedging solutions, selecting the distributed generation asset that fits best with consumer needs, ideology, and risk-adversity profiles. This local investment in energy production can create a supply cheaper than the current market prices, lowering consumers’ energy bills. Additionally, increased self-consumption reduces pressure on the grid. This creates opportunities to reduce the overall grid cost and provide localized lower network fees as an incentive for avoided grid reinforcements. Furthermore, LECs can provide consumers a way to earn money by offering congestion and flexibility services to the market or by playing on market prices by selling excess energy when prices are high.

To enable and benefit from network services, small-scale and community battery storage is becoming essential. Renewable energy production units can be backed by battery storage to provide ancillary services to the local network, enabling the community to unburden the local grid and benefit from alternative revenue streams.

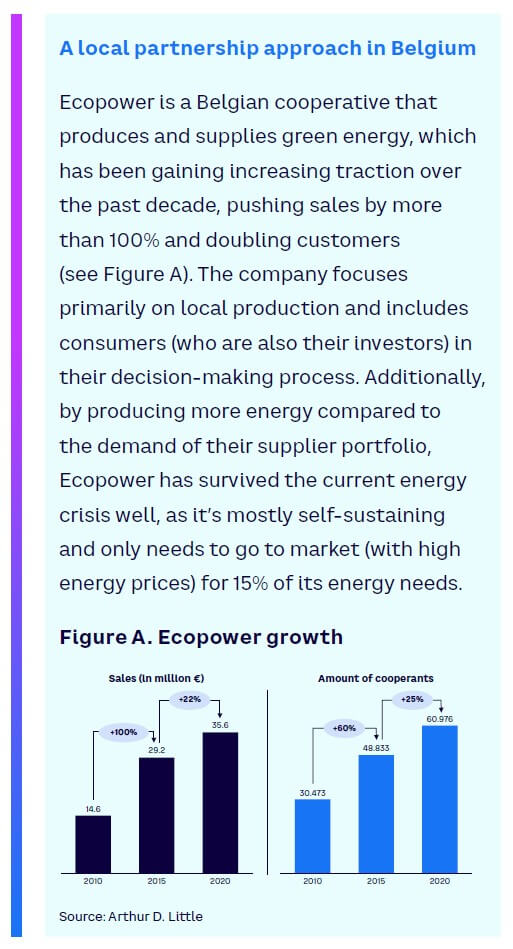

A closer look at the supplier partnership reveals a double win, as it enables community customers to stack value while benefiting from increasing customer loyalty (lower switch rates) and extra income streams by adding more services to the traditional portfolio. Additionally, in cases where the supplier owns the production assets of the energy community, the excess production can be a welcome alternative to sourcing expensive energy on the market. One such example benefitting from this setup during volatile and high energy prices is the cooperative Ecopower in Belgium (see sidebar “A local partnership approach in Belgium”).

Independent of geography, markets with favorable flexibility market conditions are more fruitful for LECs as these conditions also drive the viability of the business case in these communities.

MAKING COMMUNITY MODEL THRIVE

Governments need to make their commitment toward the energy transition clear and explicit by designing regulatory frameworks that support the development of LECs. In Europe, the revised Renewable Energy Directive (EU 2018/2001) is setting new rules to strengthen the role of renewables for self-consumers and renewable energy communities. On the flip side, European regulation prevents grid operators from owning, developing, or exploiting storage. Thus, incentives and mechanisms should be put in place to drive active investments further in those areas with high congestion, where storage and/or the energy community setup can relieve stress on the grid.

Despite lack of government support in some cases, however, many transmission grid operators have incentivized battery storage investments through adaption and by creating mechanisms that enable such assets to participate in the energy markets. One among many use cases in Australia is the pilot of United Energy, which is aimed at reducing grid pressure in an area characterized by soaring seasonal electricity demand over summer due to a high number of private holiday homes (see sidebar “DSO-driven battery initiatives in Victoria, Australia”).

There are several factors for success in enabling a transition to a community model, including:

- Through community services, players should support grid customers to take on this key role in the transition. Traditional market players like suppliers are well-positioned to take an active role in shaping the energy communities of tomorrow. To gain customer confidence, market players must position themselves as a partner and diversify their offerings beyond the commodity offering. Example items might encompass leasing DER assets to customers to reduce their investment need and offering small-scale or community storage, including energy services to enable the stacking of value. In addition to suppliers, other nontraditional players (e.g., construction companies, original equipment manufacturers [OEMs]) can also benefit from providing community services to consumers, increasing competition in this market.

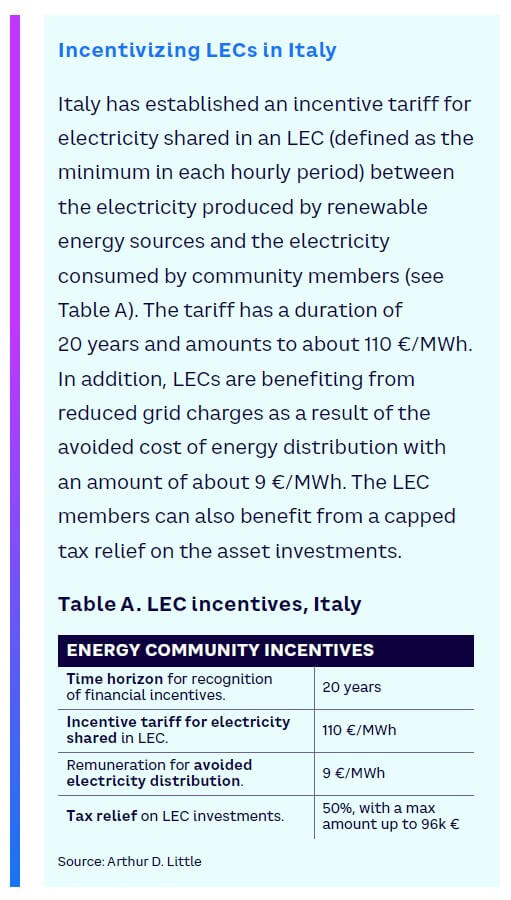

- Players should implement a new approach to energy allocation and tariffs to unlock the value potential of LECs. Grid operators can take a central position in the market design and facilitation of allocation and tariff models that best support energy communities. Putting in place the right incentives for consumers (e.g., local grid fee reduction) to make investments that relieve the pressure on the grid avoids expensive grid reinforcements. Italy is a leading example in incentivizing LECs; the country has established multiple economic benefits from electricity shared within a community (see sidebar “Incentivizing LECs in Italy”).

- Data is required for all interfaces — market, customer, and network — and optimization relies on superior forecasting capabilities and real-time price signals. Digital metering allows for the availability of granular consumption, injection, and voltage information. Together with the IoT of smart appliances, there is an abundance of data. A data governance structure must be put in place as a facilitation layer to enable access for all relevant market players to the (right format of) data and allow consumers to manage who has access to data.

TRANSLATING REQUIREMENTS INTO REALIZABLE CONCEPTS

Arthur D. Little (ADL) has identified four essential requirements to enable LECs to bring their value to society, as described below.

1. Creating shared storage (batteries) for communities

New, enabling technologies are driving the increase and control of DERs. Together with the introduction of smart meters, battery storage is also seen as a key pillar for LECs to be (economically) viable. Batteries are extremely versatile in terms of available use cases, and they can theoretically change the application instantaneously. This opens the opportunity for multiuse applications — or stacking of value (i.e., seeking and valorizing multiple revenue streams from the battery). While the detailed use cases for value or revenue stacking will depend on country specifics and regulations, they can be summarized in three broad categories:

- Merchant value. Financial benefit from arbitrage trading, energy derivatives, or participation in balancing markets.

- Network value. Benefit from providing network support, mainly through participation to ancillary services, to distribution or transmission network service providers or market operators. The lines between merchant and network value are blurred and depend on market design (e.g., voltage, overload, or frequency services).

- Residential and commercial customer value. Benefit on electricity bill for customers that can use “storage service” (i.e., share of a battery) as an alternative to a single BTM battery. Financial benefits come from optimizing network charges and increasing PV self-consumption (i.e., retail tariff price arbitrage).

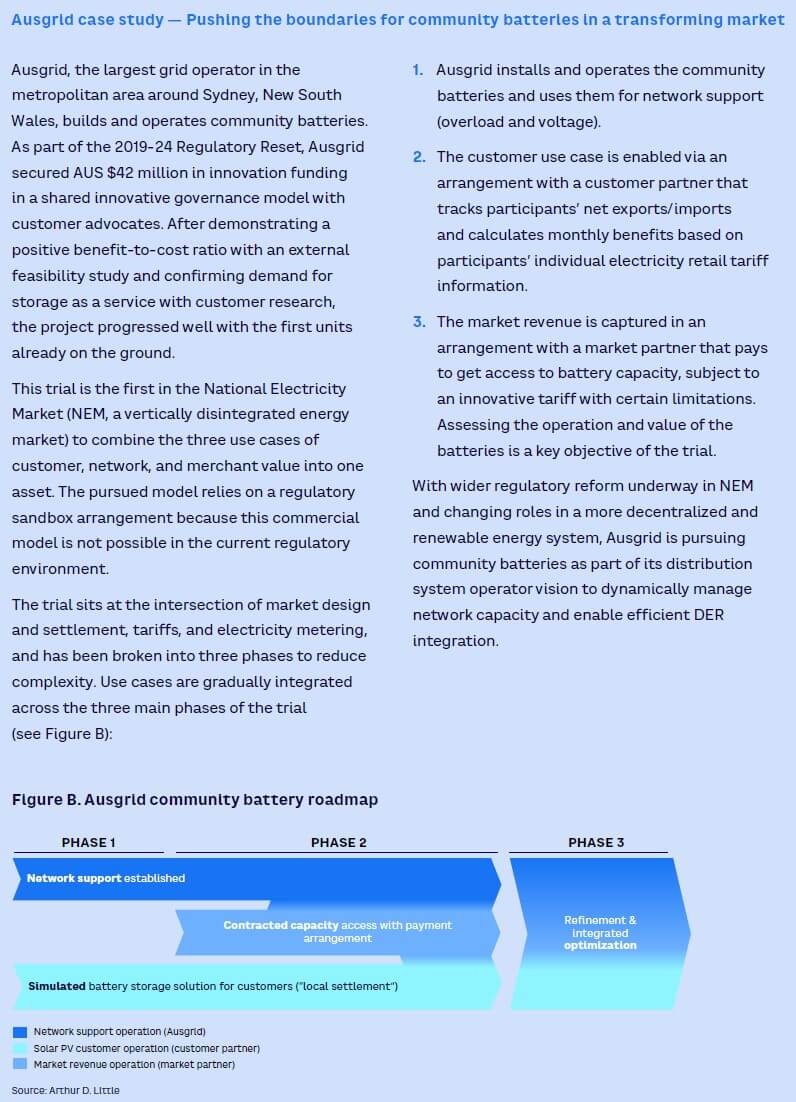

To test the setup of community batteries and value stream realization, Ausgrid (Australian TSO) has created a pilot to develop and operate community batteries in the Sydney region (see “Ausgrid case study” below).

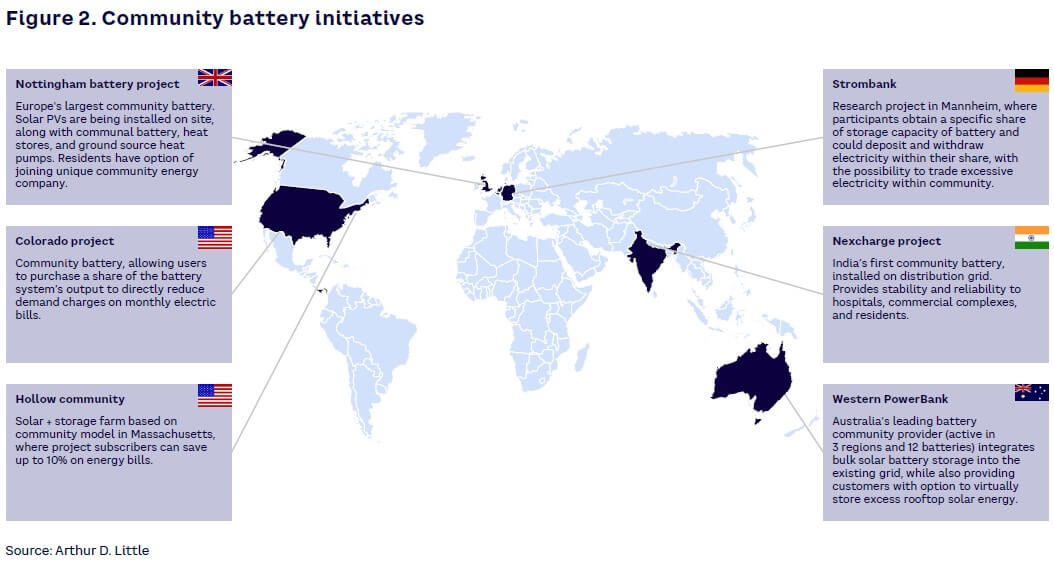

Looking at the global stage, we find a handful of markets that have been pursuing the concept of shared storage. Some more noteworthy ones include Australia, India, Germany, the UK, and the US (see Figure 2).

2. Offer win-win partnership models

Prosumers (energy consumers who also produce energy) traditionally receive a significantly lower price for their excess energy than the market price. This creates an incentive for prosumers to exchange energy within their community, since they have the opportunity to play on the spread between the price for the injected energy versus the price of the energy the grid consumes. As a result, communities can become significantly less dependent on their suppliers.

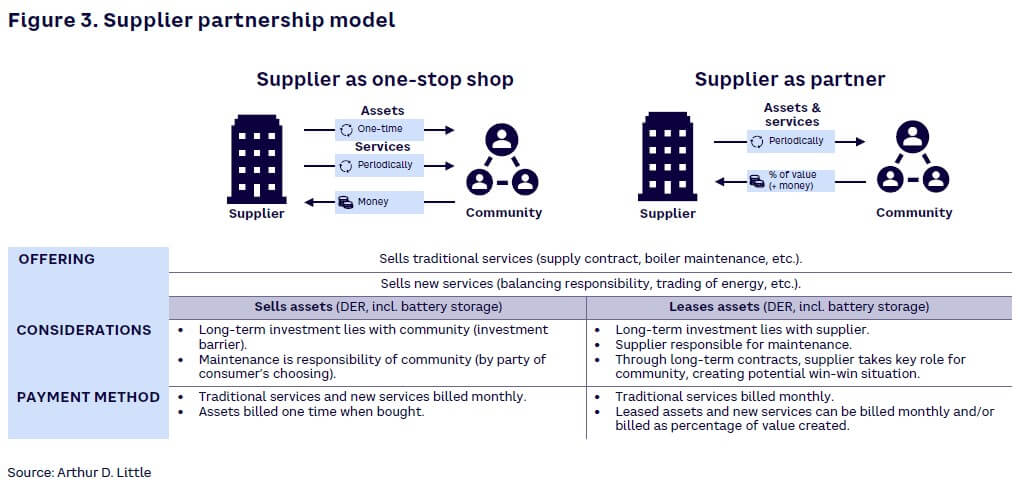

However, setting up and operating an LEC has more complex requirements than a regular consumer. Energy exchange and contracts within the community must be managed and the use, storage, and trading of energy at times of shortage/excess must be optimized for full benefit. Trading with the grids also brings with it a balancing responsibility for these communities, which must ensure that the consumed energy equals the produced energy. To stay relevant in the market and to increase earnings, existing suppliers should add more services to the traditional offering, organizing themselves as a one-stop shop and unburdening the communities through a complete offering, both on the activity side and the regulatory requirement side.

Even these efforts may not be sufficient to successfully compete, as the needed market knowledge could also be offered by new, nontraditional players. For example, construction companies can install and lease storage assets when building new communities, electric mobility providers have the opportunity to provide aggregation services, and OEMs are increasingly exploring opportunities to bundle the loads of their (smart home) appliances. Therefore, it will be important for suppliers to create a partnership with the communities, where a win-win situation is created by optimizing the stacking of value for the community (see Figure 3). In return, suppliers could take a percentage of the realized value while also increasing customer loyalty and thus maximizing customer lifetime value.

Small-scale batteries are an important enabler to realize customer value in energy communities. There are, however, some key barriers for end-consumer investment in shared storage, including:

- Reluctance to take on merchant risk due to policy uncertainty, increasing storage pipelines facing risk of “shallow markets” (where value is limited).

- The need for value stacking to get a positive business case with cost of storage remaining high.

- Structural complexity from bespoke fit-for-purpose arrangements with multiple parties requiring close IT integration.

The delivery of these shared distribution-level batteries could theoretically occur in different commercial models, with varying degrees of services provided by DSOs versus a competitive market. The ownership of these batteries can lie in different hands, depending on the commercial model considered.

To determine the IRR and payback period (PP) for LEC configurations, ADL has constructed a financial model that takes into account key parameters, such as (self-)consumption, storage and production curves, asset investment expenditures, available incentives, and so on. Having these insights on a local level is key for both end customers and commercial players to step into the LEC market. As an example, an IRR between 10%-12% and PP of 8-10 years was determined for a configuration consisting of six buildings and 50 access points.

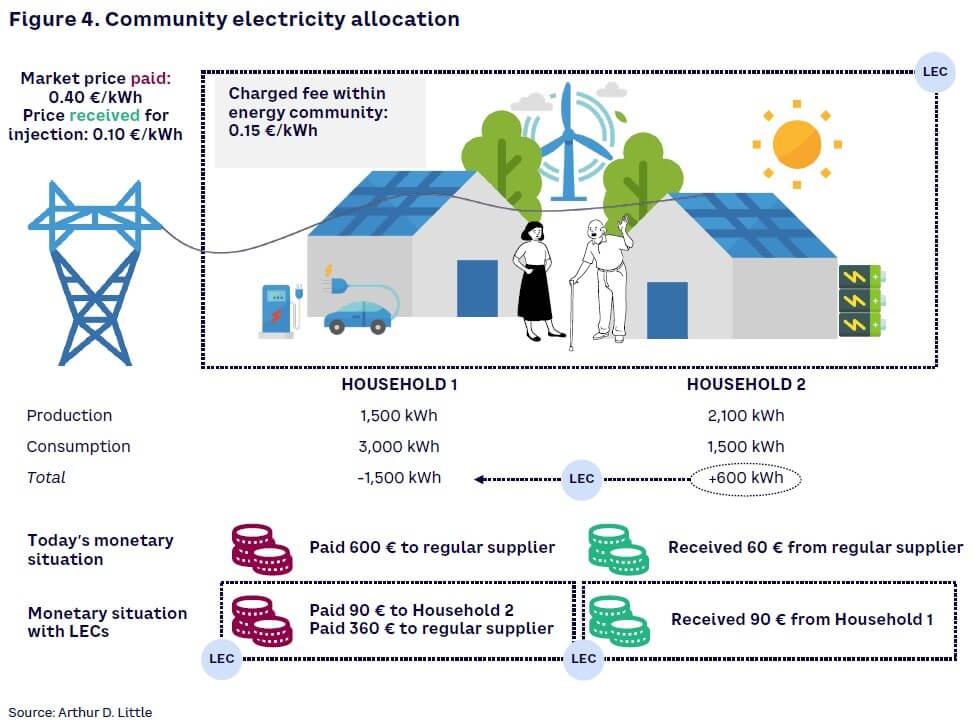

3. Design allocation process for complexity

The traditional allocation process must be reformed, so consumers can play in this market and handle more complex use cases, such as exchanging energy within a community. In short, the excess energy that someone in the community produces should first be allocated to the members of that community (see Figure 4). On the one hand, when at any given time the total demanded energy of the community is greater than the total energy injected by the community, the energy from the traditional supplier must equal the total of the energy demanded by the members minus the supply already generated in the community. On the other hand, when at any given time the total energy demand of the community is lower than the energy produced, the community will be a net exporter.

The setup of this market model is key to making energy communities profitable and can be enabled by including allocation mechanisms based on community participants’ digital meter registers. Moreover, when prosumers want to offer their excess energy to the market (at a fee), there is a balancing responsibility required. Typically, a regular supplier will still handle these responsibilities. Grid operators also should be allowed to reward LECs, as they are helping to unburden the grid and prevent grid reinforcement by optimizing energy supply and demand locally.

4. Governance framework should create access to needed data & formats

To allow consumers to create further value through extra grid services offerings, data exchange between traditional and new market parties on the lower levels of the grid must be facilitated. (Europe puts this responsibility on the system operator[s].) This data needs to be granular and available in a timely manner so consumers can offer value-added services. To successfully identify, develop, and facilitate relevant cross-sectoral market use cases, data governance is required where all concerned parties can jointly discuss, make decisions, and implement these use cases together. In the Netherlands, DSOs and TSOs jointly founded MFFBAS to steer energy data governance on a national level between all market actors (see sidebar “Netherlands energy market governance framework enables energy transition”).

Conclusion

Key takeaways

The LEC is a key enabler in realizing the energy transition from an economic perspective, while also helping with major challenges like local congestion. To succeed will require effort, investments, and collaboration across the utility value chain. Understanding where and how to play is critical to gain a unique position in helping shape this new market and valorize the opportunities:

- Consumers increasingly are looking for stable and affordable energy bills and opportunities to valorize investment made in DERs.

- The LEC model is an emerging enabler for the ambition of end consumers.

- Different market characteristics will lead to different feasibility potential of LECs, with those markets with mature energy flexibility being fruitful grounds for large-scale rollouts.

- To enable the LEC model, the battery asset and a range of traditional and nontraditional market players have vital roles. A timely analysis on how best to play is essential to stay relevant and compete.

- The traditional supplier is well-positioned to take a key role to support the consumer. However, a one-stop shop — or preferably a partnership with the consumer — will be needed to cover all the needs an LEC brings and to move toward a win-win situation in which the extra value the grid services provides becomes a shared realization of consumer and supplier.

- Both regulators and grid operators need to put new market and incentive mechanisms in place. The main building blocks required include revising grid fee pricing, enabling network-owned DER investments, and creating an allocation model of the energy balance for communities.

- To develop use cases in which consumers can create value by offering grid services, concerned stakeholders must jointly decide how to realize the needed data governance constructs that support the implementation of these use cases.