Localizing the global semiconductor value chain

Strategizing for growth while building resilience in the rapidly evolving industry

Executive Summary

Semiconductors are the bedrock of modern information and communications technologies (ICT). Within a highly globalized yet specialized semiconductor value chain, seismic shifts are underway amid supply chain challenges stemming from geopolitical issues and demand-supply imbalances. Global interdependencies characterize the supply chain, highlighting vulnerabilities to environmental, geopolitical, economic, and technological risks. Consequently, governments must proactively anticipate and adeptly navigate global intricacies as they architect robust and efficient local semiconductor industries intertwined with the global value chain and yet sufficiently localized to ensure both local economic benefit and resilience against potential future chip shortages.

Recent global events, including natural disasters, geopolitical conflicts, and trade disputes, have stressed the semiconductor industry, leading to supply shortages and economic impacts. Environmental risks like droughts and pandemics disrupt supply chains, while economic risks such as demand surges strain production capacities. Technological risks, including cyberattacks, compromise operational efficiency and data security. Trade disputes, particularly between the US and China, further disrupt supply chains and market stability.

To address these challenges, governments are implementing various countermeasures to bolster semiconductor supply chains. Localization efforts aim to enhance industry resilience and reduce reliance on foreign suppliers. Initiatives like the US Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act and the European Chips Act incentivize domestic semiconductor manufacturing and innovation. Countries in regions around the globe are investing heavily in semiconductor development to secure supply chains and drive economic growth.

Scaling up the semiconductor industry requires fostering engineering talent, promoting end-application industries, and navigating geopolitical complexities. Governments must review fiscal measures, attract skilled talent, and support industries that rely on semiconductor technology. Collaboration between countries and strategic investments in emerging and frontier semiconductor technologies are essential for sustaining industry growth.

1

EMPOWERING ICT: THE CRUCIAL ROLE OF SEMICONDUCTORS

The semiconductor industry is of strategic importance to a country’s economic development, technology development, and security. Besides being critical building blocks for security and defense applications, semiconductors are also essential enablers for several industrial applications, numerous physical applications or products, and software-enabled technologies like the Internet of Things (IoT) and AI. These applications span industries, products, and functions.

Industry

-

Automotive. Semiconductors are essential in automotive technology and power electronics, driving crucial systems like engine management, safety features, and infotainment, enhancing both performance and safety in modern vehicles.

-

Aviation. Semiconductors power essential aviation functions, including flight controls, navigation, and communications, ensuring safety and efficiency in modern aircraft.

-

Energy. Semiconductors are the basis for renewable energies, such as solar power and wind turbine energy systems. They are used for essential processes like power conversion as well as transmission of power to the grid.

Products

-

Sensors. Semiconductors are used to create sensors that can detect light, heat, motion, and other physical phenomena.

-

Modern medical devices. Medical devices combine life sciences and semiconductors for wellness and healthcare. These can include wearable sensors for health monitoring, medical robotics, advanced imaging technologies for high-resolution ultrasound, neural interface technologies, and implantable devices for trauma intervention.

These technologies may rely on advanced semiconductors to assist with data collection and processing for actionable feedback or to help navigate within the body for appropriate treatment.

Functions

-

Computing. The semiconductor industry produces microprocessors and memory chips, which are the primary components in computers, servers, and data centers. These devices are used in various industries, from finance and healthcare to manufacturing and logistics.

-

Communications. Semiconductors are used to produce cell phones, satellite systems, and other communications devices. They are also used to create routers, switches, and other networking equipment that enable communications between devices.

-

IoT. Semiconductor chips are used in IoT devices to run both business and personal errands. As reliance on IoT devices grows, there will be a further increase in demand for sensors, memory, connectivity, and so on.

-

AI. Semiconductor chips are pivotal for high-tech manufacturing and are crucial for enabling AI. Semiconductor design improvements for AI focus on increasing the data speed of memory with more power efficiency.

The global top 30 technology equipment companies include semiconductor companies, such as NVIDIA, Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, Broadcom, and ASML, among others. These top 30 firms collectively represent ~85% of the total market capitalization (as of April 2024) of the top 100 technology equipment firms. All play a role in the global supply and demand of semiconductors and semiconductor equipment.

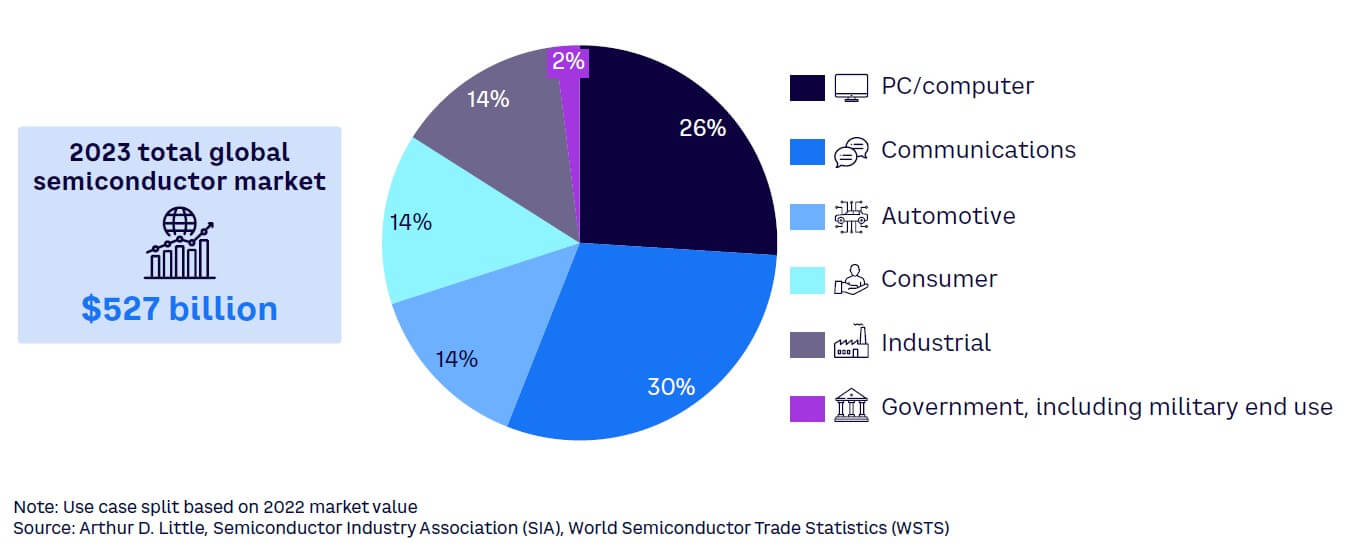

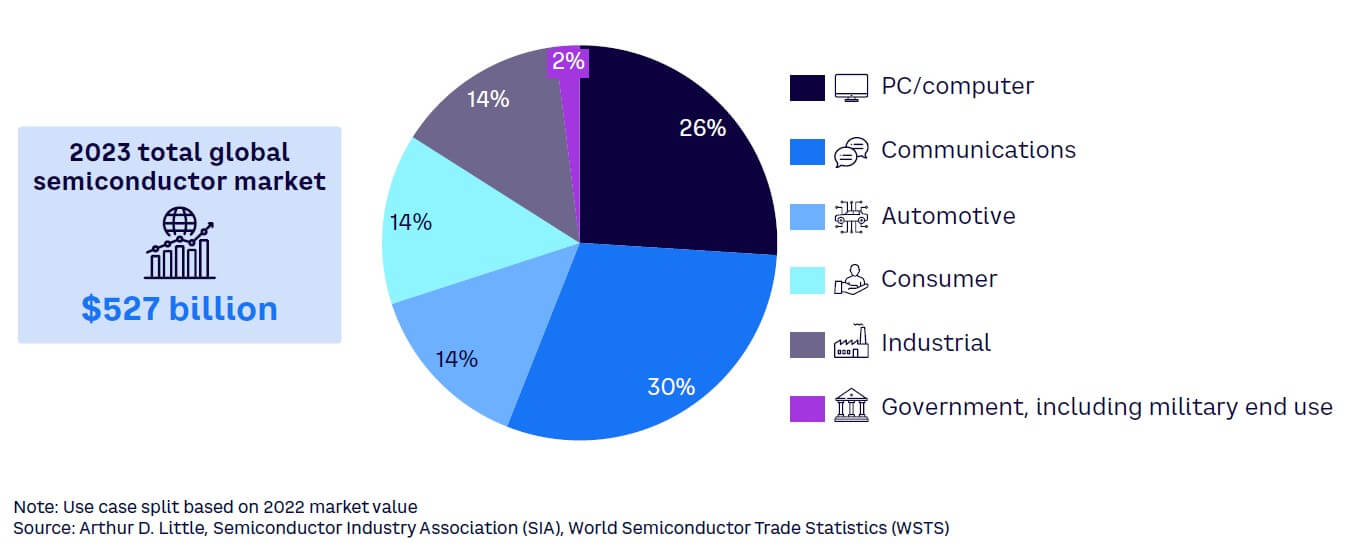

The global semiconductors market value was US $527 billion in 2023, with demand driven by end consumers spanning various industries, as shown in Figure 1.

2

DECODING TODAY’S SEMICONDUCTOR VALUE CHAIN

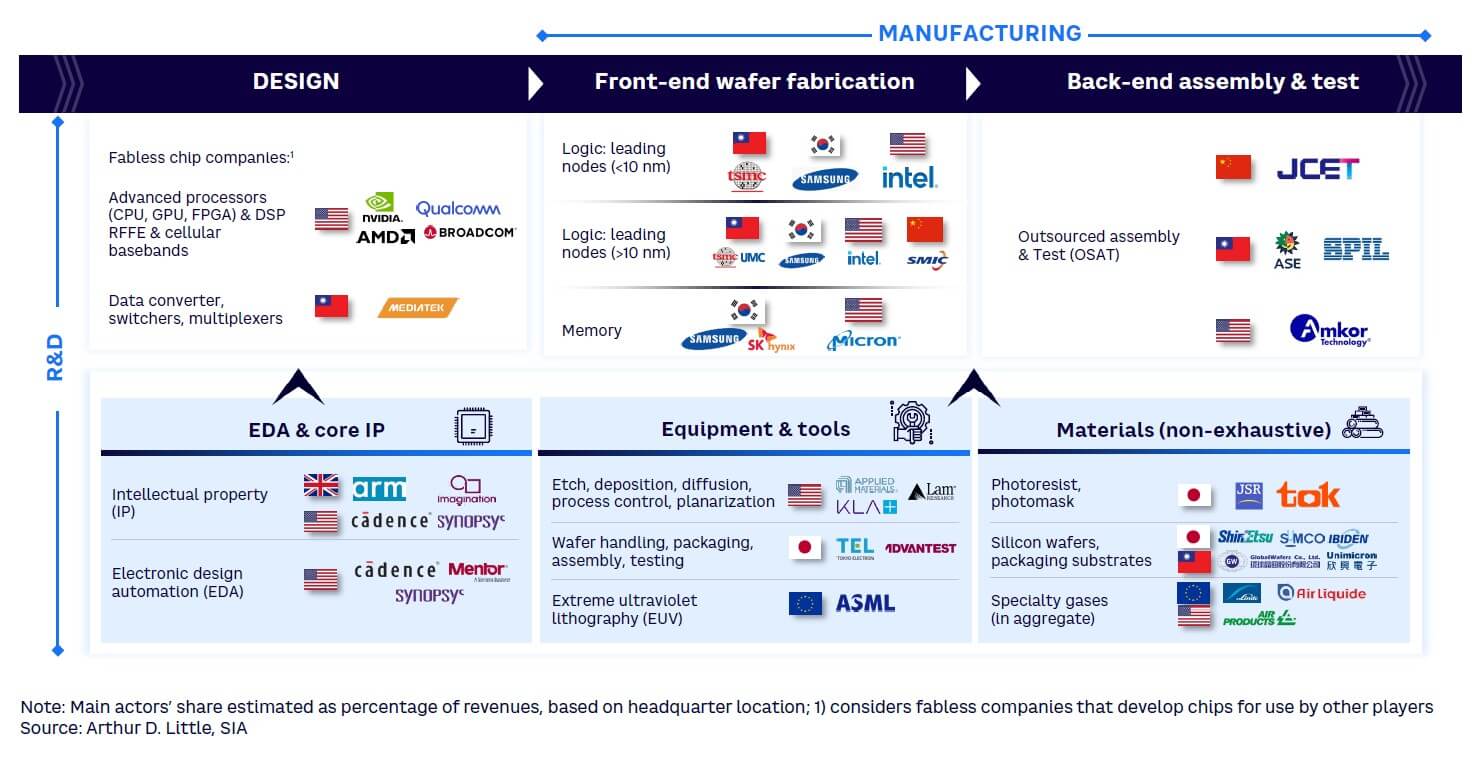

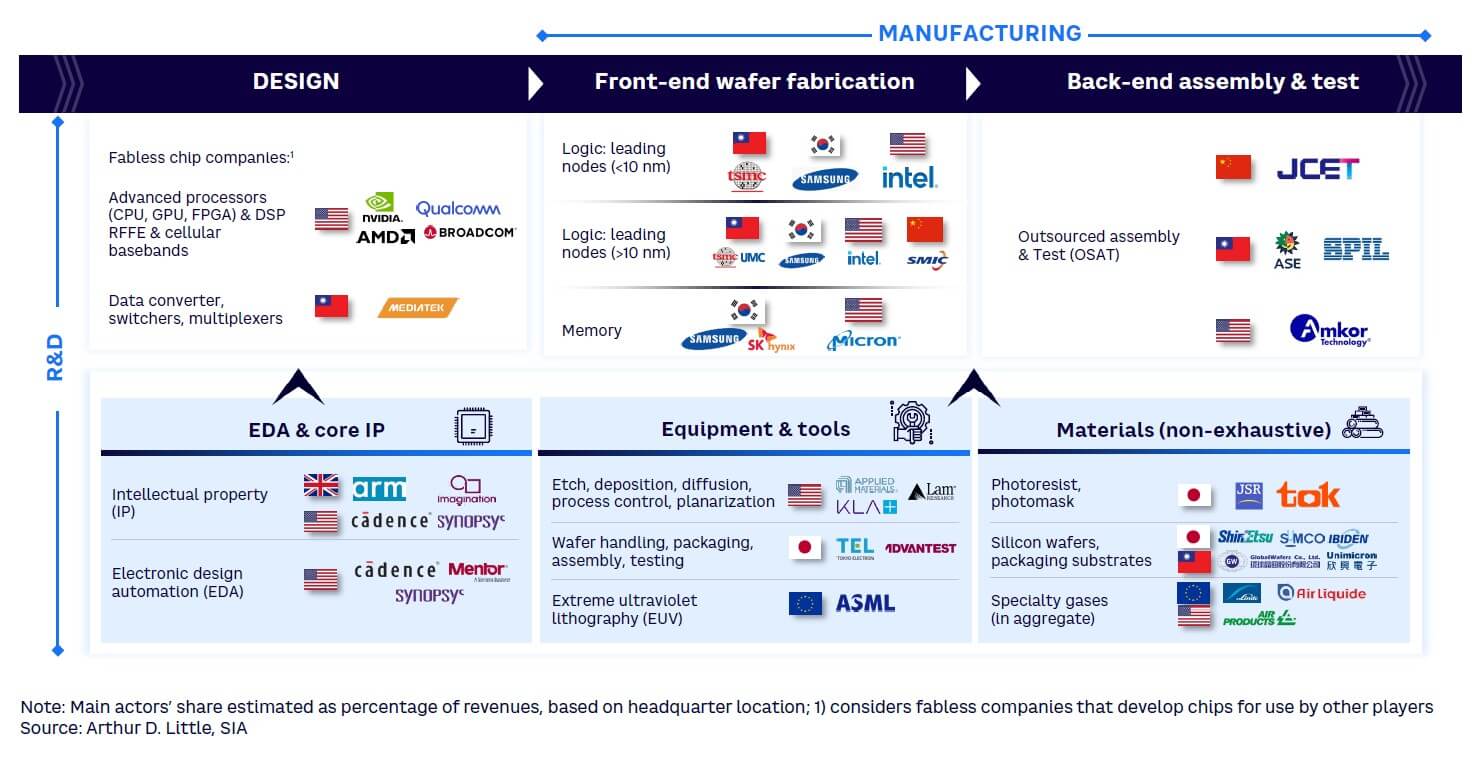

The semiconductor value chain is complex and truly global, with an interconnected network of geographically diverse companies that design, manufacture, and distribute semiconductors. The industry is characterized by high specialization spread across geographic areas, high barriers to entry due to significant R&D investment costs, large CAPEX, and volatile demand.

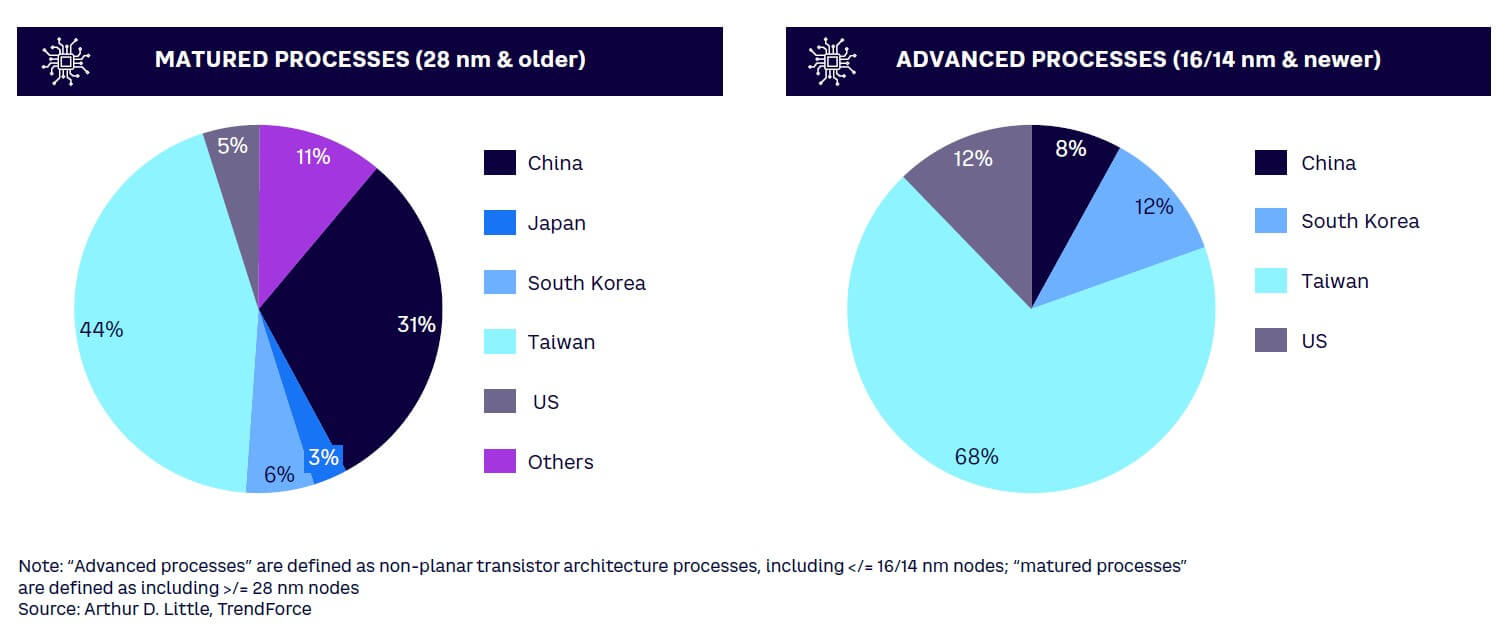

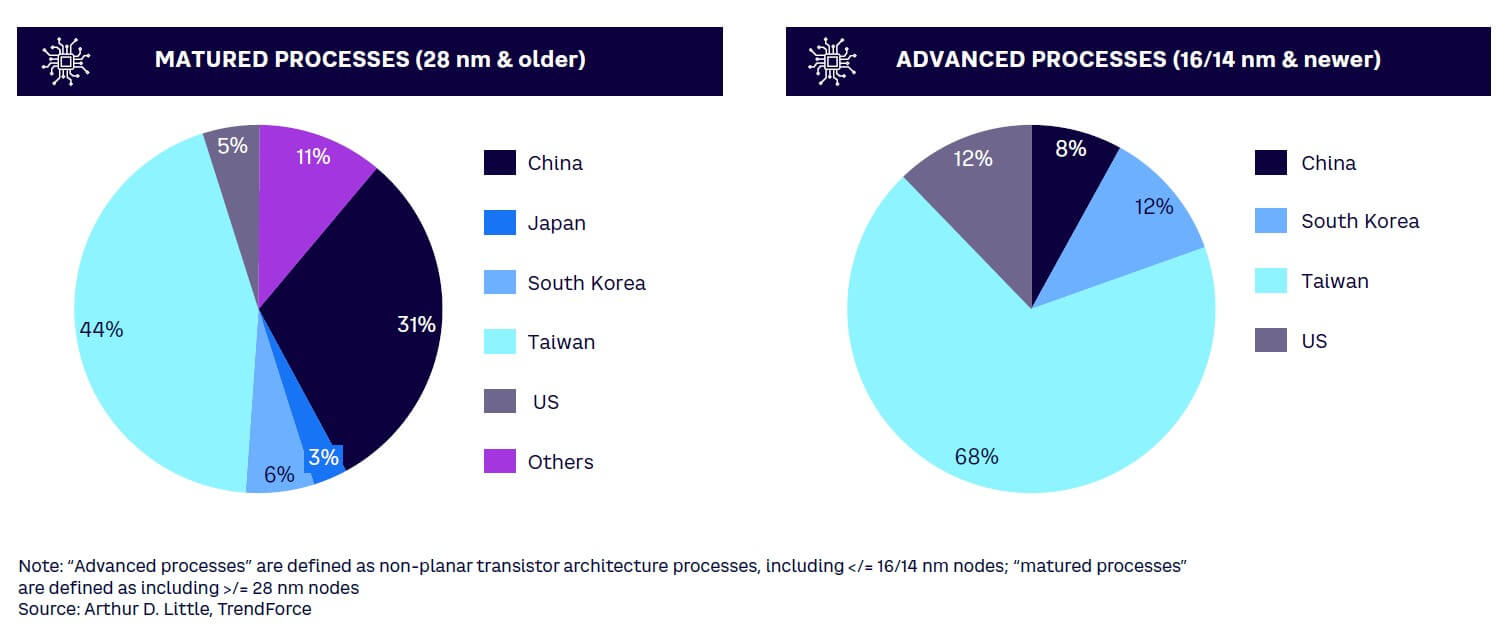

In the value chain (see Figure 2), there are a few regions that hold the majority of global market share. For example, more than 70% of the global semiconductor foundry capacity for mature process technologies (28 nanometers [nm] and older) is concentrated in China and Taiwan (see Figure 3), a region significantly exposed to high geopolitical tensions. In addition, close to 70% of the world’s advanced semiconductor manufacturing capacity (including 16/14 nm and more advanced technologies) is also currently located in Taiwan.

Despite this concentration, strong global interdependencies characterize the supply chain, with the US, Europe, and Japan upstream (equipment and tools); Taiwan and South Korea, where most advanced semiconductors are produced, in the middle; and China, which incorporates chips into final goods, downstream (back-end assembly and test).

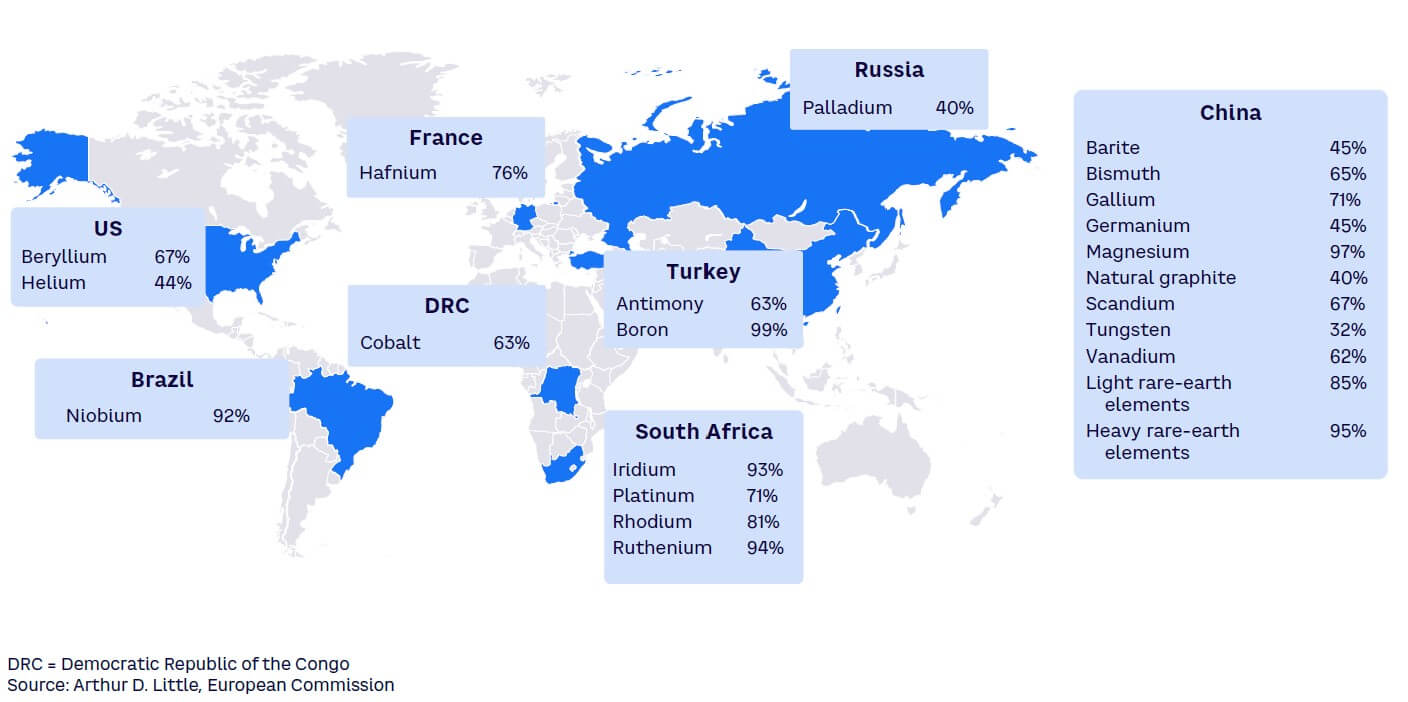

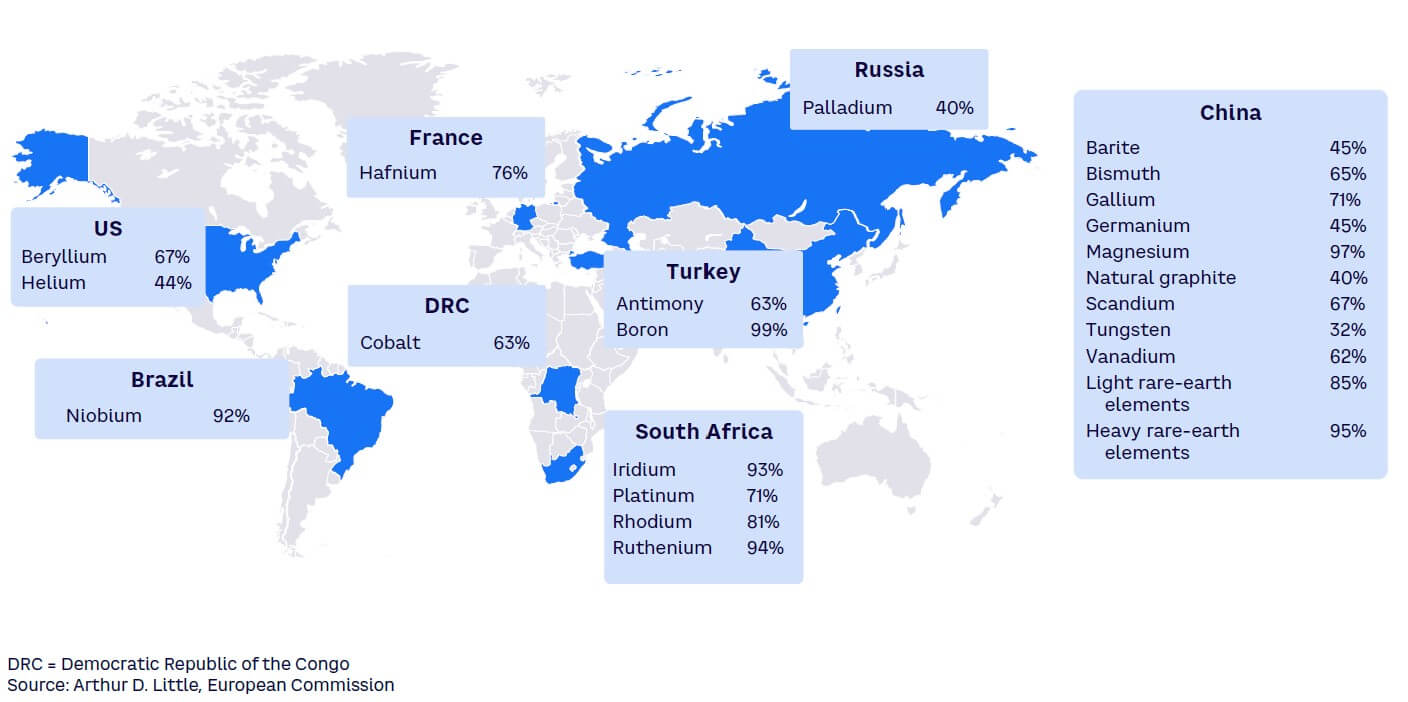

Semiconductor materials vary in price and availability, from abundant silicon to difficult-to-source rare-earth elements like gallium, germanium, and scandium. China dominates the raw materials production, such as for silicon, gallium, germanium, and scandium (see Figure 4).

Other countries that are key providers of raw materials for the semiconductor industry include Germany, the US, Russia, Japan, Malaysia, and France. Ukraine is also a key supplier of noble gases, such as neon, argon, krypton, and xenon, which are essential for use in semiconductor chip production processes. Without raw materials, chips cannot move off the drawing board into production.

In the global semiconductor supply chain, Figure 5 illustrates a typical journey of a smartphone application processor.

A complex and interconnected global network of partners remains essential for producing a single semiconductor chip. The supply chain for semiconductor production remains deeply interdependent on a global scale. International collaboration remains critical for the foreseeable future, in spite of deepening risk factors that threaten the stability of this supply chain.

3

TURBULENCE IN SEMICONDUCTOR INDUSTRY: RECENT EVENTS

The global structure of the semiconductor supply chain, which is highly specialized, has served the industry well through the boom cycles of innovation of end-user ICT and its consecutive adoption. However, over the last few years, several factors have induced stress on this well-functioning structure and have put this model at risk. Broadly speaking, there are four main risks the semiconductor industry faces: (1) environmental risks like natural disasters or extreme weather can disrupt semiconductor supply chains; (2) economic risks that result in demand spikes or supply gluts can impact sales and production; (3) technological risks, including cyber threats, can compromise manufacturing and data security in the semiconductor sector; and (4) geopolitical risks, including trade disputes and restrictions, may hinder the global flow of materials. Below, we break it down further:

- Environmental risks. Natural disasters, pandemics, and extreme weather events affect the supply of semiconductors due to disruptions in their operations. Recent examples include:

- Winter storms. In 2021, a winter storm in Austin, Texas, USA, led major players such as Samsung to shut down operations at least temporarily. These shutdowns affected older semiconductor facilities, possibly reducing smartphone output for Samsung.

- Droughts. The 2021 Taiwan drought raised manufacturing expenses for TSMC, a significant water-consuming semiconductor company. TSMC, using over 150,000 tons of water daily, faced challenges due to minimal rainfall. The company is said to have spent around $25 million on water trucks alone in that year, considerably exceeding its original budget planning. Water shortages continue to challenge Taiwan’s chip industry.

- Pandemics. The supply chain disruption in the semiconductor industry caused by the effects of COVID-19 is well-documented. Future pandemics and their potential disruption of the global semiconductor supply chain should not be ruled out.

Environmental risks can cause shortages, higher production expenses, and potential economic consequences for industries reliant on semiconductor technology. In response, the sector must employ resilience and contingency strategies to counter such risks.

-

Economic risks. Demand spikes, supply gluts, and other economic disruptors affect supply chains, induce market imbalances, and strain production capacities. Examples include:

-

Surge in semiconductor demand. In 2023, the global semiconductor supply-demand gap was projected to stand at 9%.[1] Closing this gap presents a significant challenge, particularly for the European automotive sector, which is forecast to experience the highest growth (11% CAGR) among all semiconductor segments until 2026. In contrast, consumer electronics is expected to grow by 4%, while smartphone growth is anticipated at just 2%.

-

Effects of demand shocks. Europe has been profoundly affected by the semiconductor shortage, with vehicle production falling by 2.3 million units in 2021, constituting 24% of global losses, making it one of the most impacted regions alongside North America, which accounted for 25% of losses.[2]

Overall, abrupt demand surges and fluctuations can catch businesses unprepared, possibly leading to supply shortages and difficulties in meeting consumer demands. Conversely, supply gluts are also possible, as seen in some semiconductor categories (e.g., with memory chips in the second half of 2023). Consequently, businesses face challenges in swiftly scaling up production, affecting their capacity to benefit from growth and fulfill orders, or reducing production and inventories in times of economic slowdown. The economic risk resides in the potential for these disruptions to trigger market instability and create broader economic imbalances.

-

-

Technological risks. Risks such as cyberattacks and ransomware attacks, impact the integrity of semiconductor products, operational efficiency, and consumer confidence. Recent examples include:

-

Cyberattacks. In 2023, Applied Materials, a leading global supplier of semiconductor manufacturing equipment, services, and software, experienced a decline in sales due to a cybersecurity attack on one of its suppliers, MKS Instruments. The attack resulted in a loss of $250 million in sales. The consequences of this attack extend to disrupted order processing, product shipments, and customer service. Such supply chain attacks exploit vulnerabilities within a company by targeting less secure elements like vendors.

-

Ransomware attacks. The semiconductor industry faced eight ransomware attacks from extortion groups in 2022. Prominent companies, such as NVIDIA, AMD, and Samsung, along with others, including Ignitarium, Diodes, SilTerra Malaysia Sdn. Bhd., Semikron, and Etron Technology were targeted. Ransomware groups perceive semiconductor firms as high-value targets and utilize media attention to coerce victims into ransom negotiations due to the sector’s critical role in the global economy. These groups employ malware to encrypt data, issue extortion threats, and even publish proprietary information like source code. Some threaten to sell stolen company data and plans to competitors or rival nations.

Given the interconnected nature of the industry and its pervasive applications, robust cybersecurity measures are imperative to mitigate risks and sustain the stability and expansion of the semiconductor sector.

-

-

Geopolitical risks. As semiconductors are crucial components in various technologies, including defense systems, communications, and consumer electronics, their availability and access can become contentious issues with geopolitical implications. Therefore, as economies compete to take the lead in the semiconductor industry, geopolitical risks must be considered. Risks stem from trade tensions and restrictions imposed by nations, potentially disrupting supply chains, restricting access to key markets, and affecting the global movement of materials and products. Geopolitical risks include:

-

Trade disputes. Trade between the US and China significantly influences the global semiconductor industry and its supply chain. The US-China trade dispute’s repercussions extend to various economies and companies within the sector. The stringent export controls imposed by the US, aimed at impeding China’s chipmaking progress, create formidable challenges for the Chinese semiconductor industry. These regulations restrict the export of chipmaking equipment and curtail the utilization of US-made tools for Chinese industries and customers. As a result, companies like Semiconductor Manufacturing International Corporation (SMIC) and Yangtze Memory Technologies encounter limitations on equipment procurement and support from their previous US and European suppliers, leading to a noticeable downturn in China’s semiconductor industry.

-

Respective security concerns of China and the US. In 2023, Japan and the Netherlands, following discussions with the US, agreed to restrict the export of advanced chip manufacturing equipment to China. This move supports the US’s strategy to limit China’s access to advanced technologies, especially in semiconductors. In response, China implemented export restrictions on key materials (gallium and germanium) crucial for various technical applications, including semiconductors. China justified these actions as safeguards to its security, and they involved a government-controlled licensing system, posing challenges for Western companies that rely on these materials. Consequently, the global supply chain is witnessing price hikes due to this geopolitical maneuvering. Additionally, China withheld regulatory approval for a $5.4 billion acquisition of an Israeli chip manufacturer by Intel, a response occurring amid escalating tensions between the US and China. The terminated deal reflects the broader context of the US imposing export controls and restrictions to dampen China’s access to advanced chip capabilities.

-

Competition over advanced semiconductors. Other economies are ensnared as well as a result of the trade dispute and geopolitical tensions. An example lies in the geographical semiconductor concentration in Taiwan, which plays a pivotal role by contributing nearly 90% of the world’s advanced chip production. Therefore, major economies like China have long sought to gain greater control over Taiwan’s semiconductor industry, seeing it as a strategic asset that could help it to become a leader in the global tech industry. Taiwan’s concentration of production amplifies supply-related vulnerabilities, primarily linked to the geopolitical tensions arising from this situation.

In summary, geopolitical risks exert profound effects on the semiconductor industry on a global scale. The stringent US export controls, for instance, hinder China’s progress in developing its local semiconductor industry. Simultaneously, Taiwan’s concentration of semiconductor production creates various supply risks, primarily originating from factors related to geopolitics.

-

4

ECONOMIC COUNTERMEASURES FOR SEMICONDUCTOR SUPPLY CHAIN SHOCKS

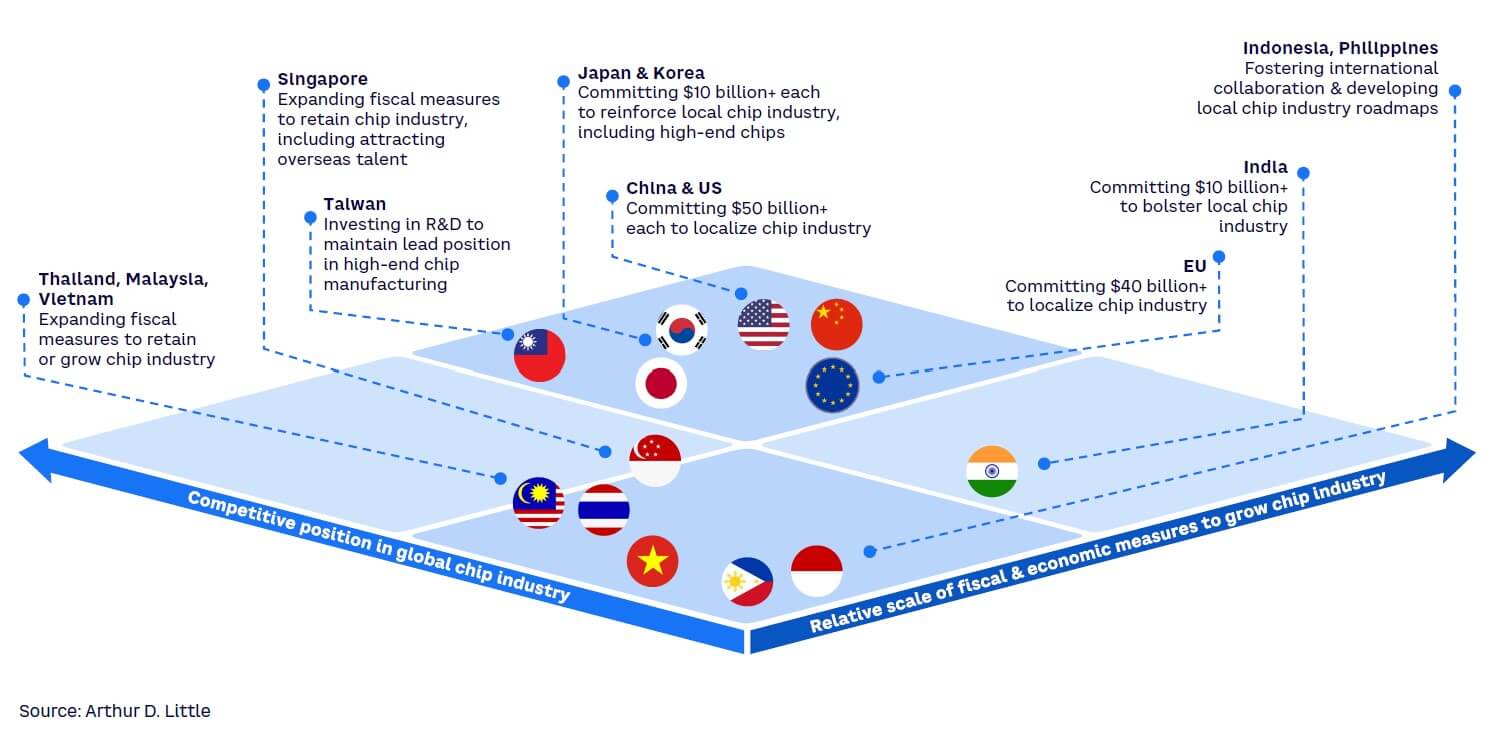

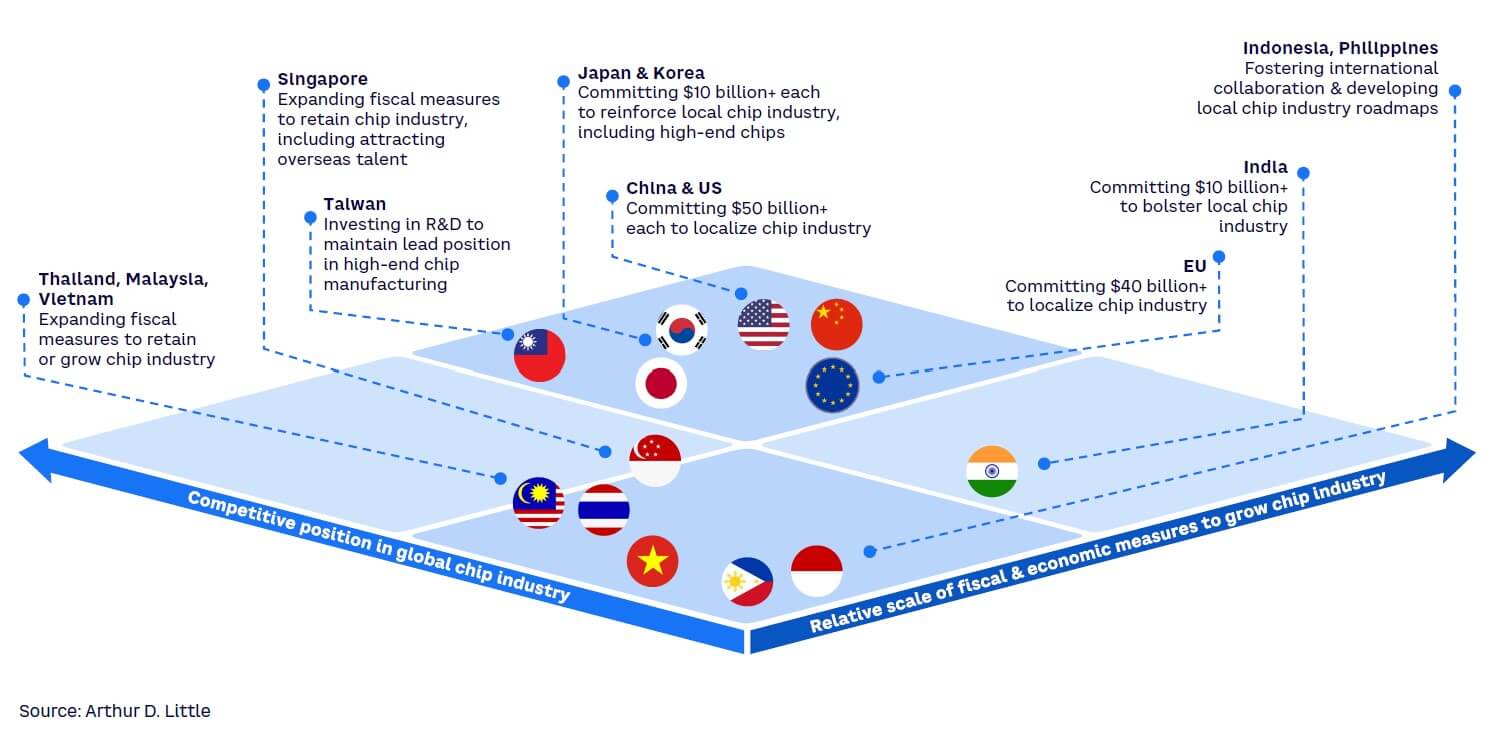

Localization of the semiconductor industry can help governments address some of the environmental and geopolitical risks highlighted thus far. As illustrated in Figure 6, countries are actively working to bolster the resilience of the semiconductor industry’s supply chain and ensure they have a role to play. Several governments are committing massive investments and gearing public policy toward localizing semiconductor design and manufacturing in-country. Several governments, especially those with existing semiconductor industries, are taking a nuanced approach in forming R&D and supply chain alliances with other countries to gain competitive advantage, while still taking significant fiscal measures and shaping public policies toward developing capabilities and know-how in higher-value emerging and frontier semiconductor technologies.

Some governments recognize the need to build up their engineering talent base and are investing in education and workforce development to ensure sustainable growth and innovation in their respective semiconductor industries.

Examples of these approaches are evident across various major economies globally, as described below.

The US passed the CHIPS Act in 2022 to incentivize domestic semiconductor manufacturing, drive sectorial innovation, and develop the workforce. It authorized over $52 billion in government incentives to increase the US domestic supply of computer chips and the construction of semiconductor fabrication facilities and equipment within the US.

The CHIPS for America fund will provide up to $39 billion in government loans and other financial assistance, including a 25% tax credit to semiconductor manufacturers within the US. In addition, it will provide $13 billion for semiconductor research and workforce training. Furthermore, the US is fostering collaborative efforts, exemplified by the Chip 4 Alliance, involving Japan, Taiwan, and South Korea. This initiative aims to stabilize supply chains and promote future cooperation while also strategically positioning itself amid the evolving dynamics of US-China trade, where China is rapidly advancing its chipmaking technology.

Similarly in Europe, the European Chips Act seeks to help the region secure its semiconductor supplies, ensure self-sufficiency, control more of its supply chain, reduce reliance on foreign companies, and compete with the US and Asia on tech. The EU Chips Act is a $47 billion package of public and private investments with an ambition of building large-scale capacity and innovation to ensure that Europe is self-sufficient — anticipating potential future supply crises. The goal of the act is to double the EU’s global market share in semiconductors from 9% to 20% by 2030. The EU Chips Act further acts as a figurehead for the empowerment of the European semiconductor ecosystem.

The Asia-Pacific region is emerging as a pivotal hub, as economies in this region have adopted significant semiconductor strategies to navigate the international political landscape and promote domestic semiconductor production and innovation.

For its part, China has implemented such measures as export controls and executed strategic initiatives to bolster the growth and autonomy of the local semiconductor sector, reducing reliance on foreign suppliers. The Big Fund, established in 2014 as China’s primary investment tool for the domestic semiconductor industry, encompasses two phases. The initial phase raised $19.63 billion, largely enhancing China’s semiconductor industry’s capacity and design capabilities. This phase aimed at expanding logic and memory foundries, boosting design firms, and fortifying the packaging sector. Phase II, valued at $28.9 billion, focuses on fostering key companies by investing in their upstream and downstream suppliers, often coinciding with industrial park establishment. Moreover, Big Fund II promotes applications in sectors like automotive, big data, and communications. China’s commitment to nurturing the domestic semiconductor industry underscores its drive for self-sufficiency and reduced dependence on foreign entities as showcased by the recent progress of SMIC in delivering 7 nm microchips despite sanctions on leveraging older deep ultraviolet (DUV) lithography equipment.

India has strategically committed $10 billion over the next decade to bolster electronics design and manufacturing, particularly focusing on chip design and manufacturing. Currently, nearly 80% of the funds remain to be allocated. Initiatives like the Modified Special Incentive Package Scheme (M-SIPS), Production Linked Incentive (PLI) Scheme, and the Design Linked Incentive (DLI) Scheme have been introduced to foster semiconductor ecosystem development. Responding to India’s efforts, Micron Technology, Foxconn Taiwan, and HCLTech are planning significant investments in semiconductor manufacturing facilities, reflecting India’s commitment to strengthening its semiconductor industry on a global scale. Micron Technology plans to invest $825 million in a new chip facility, Foxconn Taiwan is seeking approval for the establishment of a semiconductor unit, and HCLTech is in discussion with the Karnataka state government regarding a potential $400 million investment in an outsourced semiconductor assembly and test (OSAT) facility. HCLTech and Foxconn have also separately announced a joint venture for an OSAT facility.

Tower Semiconductor plans to seek Indian government incentives to build a $8 billion semiconductor manufacturing facility to manufacture 65 nm and 40 nm chips. Reliance Industries, Tata Electronics, and Vedanta Semiconductors are also said to be interested in entering the semiconductor manufacturing industry in India.

Taiwan remains committed to high-end chip manufacturing. Besides foundry market leadership in both mature process technologies (28 nm and older) and advanced manufacturing processes (including 16/14 nm and more advanced technologies), Taiwan is also the market leader when it comes to extreme ultraviolet lithography generation processes (known simply as EUV) — an innovative technology used in the semiconductor industry for manufacturing integrated circuits (ICs). Taiwan continues to invest heavily in R&D for cutting-edge 3 nm and 2 nm chips to secure technological leadership. Its 10-year chip program, starting in 2024 with a $375 million first-year budget, aims to continue supporting advanced IC process development and attract global semiconductor collaboration. Taiwan’s generous tax incentives include a 25% tax deduction for R&D expenditures and an additional 5% for advanced machinery spending. Major industry players like TSMC’s $2.9 billion chip-packaging plant and Fujifilm’s $110 million chip-polishing expansion underscore Taiwan’s dedication to semiconductor excellence.

Japan prioritizes chip production for economic security, committing $7.5 billion over five years to advance materials and equipment. A 10-year tax incentive program offers a 20% corporate income tax reduction for businesses in the semiconductor sector every fiscal year. Samsung and TSMC are investing significantly, with Samsung exploring a chip-packaging test line near its Yokohama R&D center, and TSMC planning a $7 billion chip plant on Kyushu Island for 12 nm, 16 nm, 22 nm, and 28 nm chip production. Micron Technology is also investing up to $3.5 billion in EUV technology with Japanese government support to pioneer EUV tech in Japan. Foundry start-up Rapidus — backed by the Japanese government and large conglomerates — broke ground on a chip fab in Chitose, Hokkaido, in September 2023 and plans to start pilot production in 2025 of its advanced 2 nm chip based on gate-all-around transistor technology.

South Korea is strategically investing to enhance value chain stability and drive global industry development through various large-scale funds and direct investments. In June 2023, a $229.25 million fund was announced to support fabless companies. In September 2023, additional investments of $301.66 million for next year and $1.8 billion over the next five years were announced. The recently approved K-Chips Act raises tax credits to 15% for major companies and 25% for smaller and medium-sized firms investing in manufacturing facilities. Samsung Electronics, in collaboration with ASML, will invest $230 billion to establish a state-of-the-art semiconductor processing technology plant in the greater Seoul area.

Singapore actively diversifies its value chain focus and attracts investment through incentives, offering a concessionary 5% or 10% tax rate for five years, tax exemption of up to 100% for fixed capital expenditure, and tax relief for automation projects. Singapore also encourages R&D initiatives and talent acquisition through an extended tax deduction of 250% for R&D until 2025 and provides 10 new Employment Passes per company for skilled overseas talent. GlobalFoundries has invested $4 billion in a semiconductor fabrication plant that is expected to produce 450,000 300 mm wafers annually at full capacity by 2025 to 2026.

Vietnam’s growing semiconductor industry receives support from the US, with $2 million allocated for workforce development. High-tech labor training is supported by a $17 million domestic fund. Samsung, Hana Micron, and Amkor Technology are investing, with Samsung committing over $2.6 billion to develop electronic components assembly facilities, Hana Micron planning a $1 billion investment by 2025 in chip packaging and memory products, and Amkor Technology opening a $1.6 billion advanced chip-packaging factory.

Thailand keenly focuses on drawing companies that engage in front-end processes, such as designing semiconductors and etching wafers, and offers extended corporate tax breaks of up to 13 years. Earlier this year, the Board of Investment (BoI) approved 20 new investment projects worth ~$870 million from Taiwanese electronics companies, aiming to establish Thailand as a new export base for the industry.

Malaysia’s incentives, including partial income tax exemptions and up to 10 years of full tax exemptions, make it a favorable destination for semiconductor investment. Chinese-controlled Nexperia expanded its Malaysian facilities and established a global R&D center, aligning with its global expansion. Infineon Technologies and Intel also have chosen Malaysia for expansion; both selected Malaysia as the destination for new semiconductor manufacturing and packaging facilities. Intel is constructing its inaugural advanced 3D chip–packaging factory in Penang, while Infineon is committing ~$5 billion over five years to develop the world’s largest 200-mm silicon carbide semiconductor plant.

Other Asia-Pacific countries, such as the Philippines and Indonesia, are also strategically investing in semiconductor industries to harness their advantages and integrate into the global value chain. The Philippines is fostering collaborative initiatives, exemplified by the US International Technology Security and Innovation (ITSI) Fund, announced last November, aimed at enhancing resilience and fostering mutual benefits. Furthermore, Indonesia, although trailing its counterparts, is actively developing a roadmap for its semiconductor industry, with anticipated completion by the end of 2024 to attract investment into the country moving forward.

While not covered extensively in this Report, countries in the Middle Eastern region, such as Saudi Arabia and the United Arab Emirates, have expressed great interest in diversifying their economies into semiconductor technology manufacturing and R&D. Israel remains an important link in the global semiconductor supply chain as a hub for advanced engineering talent and R&D. Israel’s government has also agreed to give Intel a $3.2 billion grant for a new $25 billion chip plant locally.

In the South American region, Mexico and the US have announced a strategic partnership to explore semiconductor supply chain opportunities.

5

SCALING UP THE SEMICONDUCTOR TECHNOLOGY INDUSTRY VALUE CHAIN

Countries that currently do not hold a significant position in the global semiconductor industry could take several measures to create an enabling regulatory environment to grow their local semiconductor industries. Countries with a meaningful position in the semiconductor industry could become even more serious global players in attractive product segments with the right mix of regulatory support, talent, and partnerships.

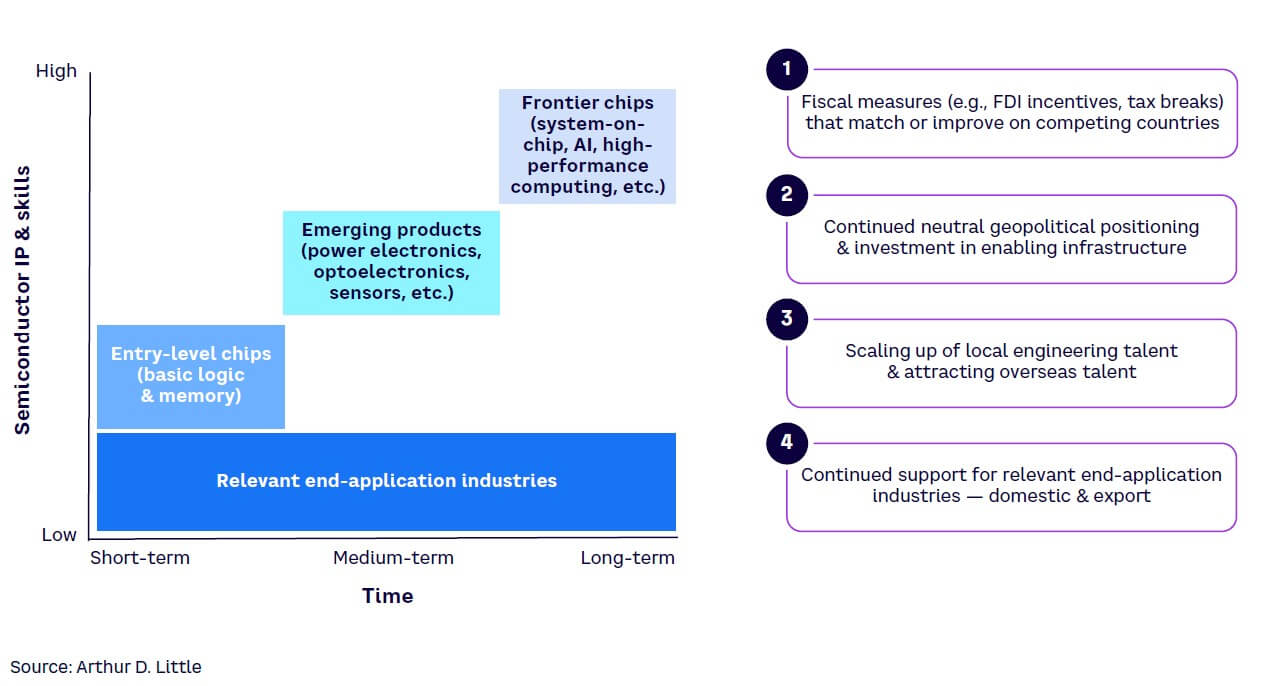

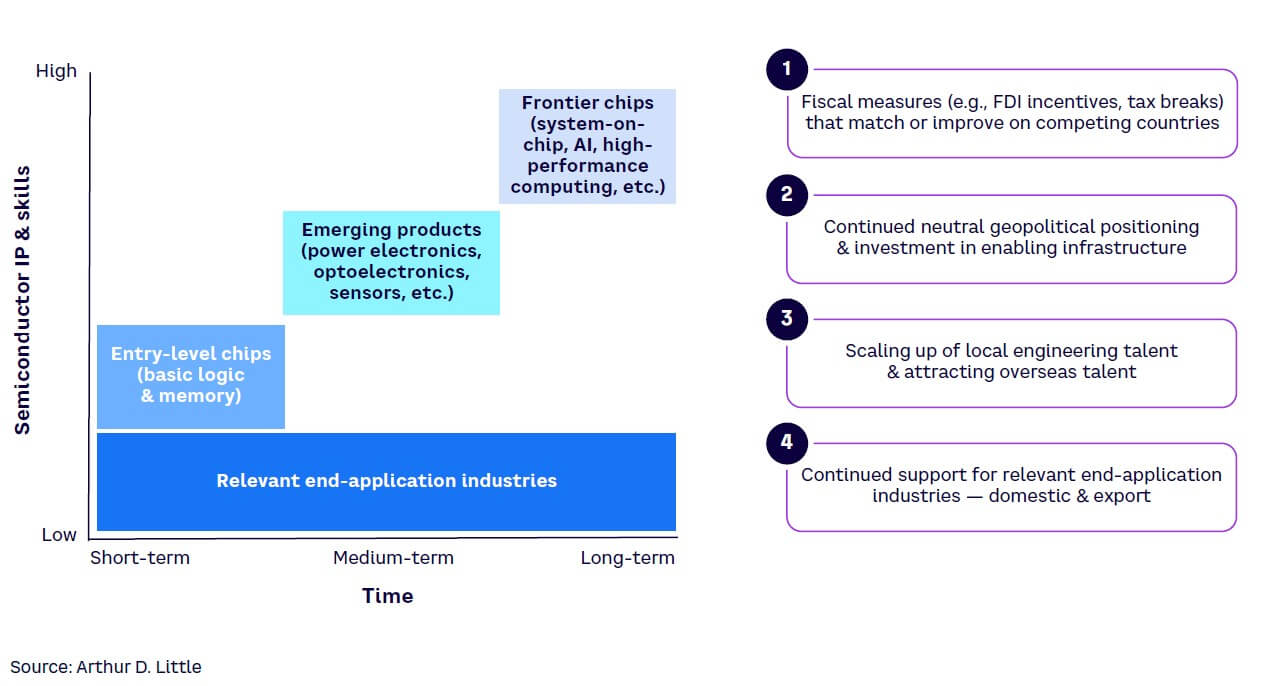

Having the right infrastructure, capabilities, and know-how to produce entry-level semiconductor technologies like basic memory chips and logic chips is a good foundation. Thereafter, additional measures could occur in a phased approach to gradually build up more advanced capabilities and enabling infrastructure to scale up into higher-value emerging and frontier technologies of the semiconductor industry over time, including the following (see Figure 7):

-

Fiscal measures. Governments could constantly review their foreign direct investment programs, tax incentives, and other fiscal measures to ensure that they match or improve on those of competing countries. Holistically examining the direct and spin-off benefits of fiscal measures in areas like job creation, creating end-user application industries, building semiconductor technology intellectual property, defending against future potential chip shortages, and so on, will enable the impact of fiscal measures to be viewed in the wider context of economic development, technological innovation, and security.

-

Neutral geopolitical positioning. Ongoing fluctuations in geopolitical positioning within different country alliances present opportunities for governments that are adept at navigating these intricacies to build up their local semiconductor capabilities as neutral brokers and sources of semiconductor raw materials, equipment, and/or chip supply.

-

Engineering talent. Semiconductor technologies are rapidly advancing in emerging areas like power electronics, optoelectronics, and sensors, as well as frontier technologies, such as system-on-chip, AI, and high-performance computing, among others. Such technologies require engineering talent not just for R&D but also to keep advanced manufacturing facilities in operation. Governments that can foster local engineering talent as well as attract overseas talent skilled in these emerging and frontier technologies will reinforce their competitive advantage as technology continues to evolve rapidly and impact the types of end-application industries that use semiconductors.

-

End-application industries for semiconductors. Continued support by governments to promote low/no-tariff trade and provide tax breaks and other export-oriented and domestic consumption–related fiscal measures for relevant end-user application industries will ensure a virtuous cycle of supply/demand to reinforce the return on massive investments needed to create or expand a local semiconductor industry. Examples of such end-user application industries closely intertwined with semiconductor demand include electronics, telecommunications, automotive, and healthcare, among others.

Conclusion

The semiconductor industry plays a pivotal role in driving economic development, technological innovation, and security. Its applications span critical sectors, including automotive, healthcare, communications, and AI. However, the industry faces numerous challenges, such as supply chain vulnerabilities, environmental risks, geopolitical tensions, and technological threats.

Recent events like natural disasters, trade disputes, and geopolitical conflicts have underscored the need for resilience and contingency strategies within the industry. Governments worldwide are looking toward various countermeasures to bolster supply chains and promote domestic semiconductor manufacturing. Scaling up the semiconductor industry requires a multifaceted approach, including:

-

Tracking, foresight, and analysis. Conduct a systematic analysis of emerging technologies to anticipate future sources of semiconductor demand to guide the investments and commitment required to build industry capabilities.

-

Stakeholder engagement. Actively engage with incumbent companies to foster equitable access into the global ICT/semiconductor value chain through fiscal measures and creating enabling supporting infrastructure.

-

Pursuing targeted capacity building. Develop an advanced engineering talent pool and a competitive advantage (e.g., by focusing on the application of emerging or frontier semiconductor technologies or on specific value chain activities like material and equipment supply).

By fostering a conducive environment for semiconductor innovation and production, countries can position themselves as key players in the global semiconductor value chain, driving economic growth and technological advancement in the process.

Notes

[1] Grishina, Diana, et al. “What Does the Semiconductor Shortage Mean for Europe?” Automotive World Magazine, 6 January 2023.

[2] Ibid.

DOWNLOAD THE FULL REPORT

Localizing the global semiconductor value chain

Strategizing for growth while building resilience in the rapidly evolving industry

DATE

Executive Summary

Semiconductors are the bedrock of modern information and communications technologies (ICT). Within a highly globalized yet specialized semiconductor value chain, seismic shifts are underway amid supply chain challenges stemming from geopolitical issues and demand-supply imbalances. Global interdependencies characterize the supply chain, highlighting vulnerabilities to environmental, geopolitical, economic, and technological risks. Consequently, governments must proactively anticipate and adeptly navigate global intricacies as they architect robust and efficient local semiconductor industries intertwined with the global value chain and yet sufficiently localized to ensure both local economic benefit and resilience against potential future chip shortages.

Recent global events, including natural disasters, geopolitical conflicts, and trade disputes, have stressed the semiconductor industry, leading to supply shortages and economic impacts. Environmental risks like droughts and pandemics disrupt supply chains, while economic risks such as demand surges strain production capacities. Technological risks, including cyberattacks, compromise operational efficiency and data security. Trade disputes, particularly between the US and China, further disrupt supply chains and market stability.

To address these challenges, governments are implementing various countermeasures to bolster semiconductor supply chains. Localization efforts aim to enhance industry resilience and reduce reliance on foreign suppliers. Initiatives like the US Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act and the European Chips Act incentivize domestic semiconductor manufacturing and innovation. Countries in regions around the globe are investing heavily in semiconductor development to secure supply chains and drive economic growth.

Scaling up the semiconductor industry requires fostering engineering talent, promoting end-application industries, and navigating geopolitical complexities. Governments must review fiscal measures, attract skilled talent, and support industries that rely on semiconductor technology. Collaboration between countries and strategic investments in emerging and frontier semiconductor technologies are essential for sustaining industry growth.

1

EMPOWERING ICT: THE CRUCIAL ROLE OF SEMICONDUCTORS

The semiconductor industry is of strategic importance to a country’s economic development, technology development, and security. Besides being critical building blocks for security and defense applications, semiconductors are also essential enablers for several industrial applications, numerous physical applications or products, and software-enabled technologies like the Internet of Things (IoT) and AI. These applications span industries, products, and functions.

Industry

-

Automotive. Semiconductors are essential in automotive technology and power electronics, driving crucial systems like engine management, safety features, and infotainment, enhancing both performance and safety in modern vehicles.

-

Aviation. Semiconductors power essential aviation functions, including flight controls, navigation, and communications, ensuring safety and efficiency in modern aircraft.

-

Energy. Semiconductors are the basis for renewable energies, such as solar power and wind turbine energy systems. They are used for essential processes like power conversion as well as transmission of power to the grid.

Products

-

Sensors. Semiconductors are used to create sensors that can detect light, heat, motion, and other physical phenomena.

-

Modern medical devices. Medical devices combine life sciences and semiconductors for wellness and healthcare. These can include wearable sensors for health monitoring, medical robotics, advanced imaging technologies for high-resolution ultrasound, neural interface technologies, and implantable devices for trauma intervention.

These technologies may rely on advanced semiconductors to assist with data collection and processing for actionable feedback or to help navigate within the body for appropriate treatment.

Functions

-

Computing. The semiconductor industry produces microprocessors and memory chips, which are the primary components in computers, servers, and data centers. These devices are used in various industries, from finance and healthcare to manufacturing and logistics.

-

Communications. Semiconductors are used to produce cell phones, satellite systems, and other communications devices. They are also used to create routers, switches, and other networking equipment that enable communications between devices.

-

IoT. Semiconductor chips are used in IoT devices to run both business and personal errands. As reliance on IoT devices grows, there will be a further increase in demand for sensors, memory, connectivity, and so on.

-

AI. Semiconductor chips are pivotal for high-tech manufacturing and are crucial for enabling AI. Semiconductor design improvements for AI focus on increasing the data speed of memory with more power efficiency.

The global top 30 technology equipment companies include semiconductor companies, such as NVIDIA, Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, Broadcom, and ASML, among others. These top 30 firms collectively represent ~85% of the total market capitalization (as of April 2024) of the top 100 technology equipment firms. All play a role in the global supply and demand of semiconductors and semiconductor equipment.

The global semiconductors market value was US $527 billion in 2023, with demand driven by end consumers spanning various industries, as shown in Figure 1.

2

DECODING TODAY’S SEMICONDUCTOR VALUE CHAIN

The semiconductor value chain is complex and truly global, with an interconnected network of geographically diverse companies that design, manufacture, and distribute semiconductors. The industry is characterized by high specialization spread across geographic areas, high barriers to entry due to significant R&D investment costs, large CAPEX, and volatile demand.

In the value chain (see Figure 2), there are a few regions that hold the majority of global market share. For example, more than 70% of the global semiconductor foundry capacity for mature process technologies (28 nanometers [nm] and older) is concentrated in China and Taiwan (see Figure 3), a region significantly exposed to high geopolitical tensions. In addition, close to 70% of the world’s advanced semiconductor manufacturing capacity (including 16/14 nm and more advanced technologies) is also currently located in Taiwan.

Despite this concentration, strong global interdependencies characterize the supply chain, with the US, Europe, and Japan upstream (equipment and tools); Taiwan and South Korea, where most advanced semiconductors are produced, in the middle; and China, which incorporates chips into final goods, downstream (back-end assembly and test).

Semiconductor materials vary in price and availability, from abundant silicon to difficult-to-source rare-earth elements like gallium, germanium, and scandium. China dominates the raw materials production, such as for silicon, gallium, germanium, and scandium (see Figure 4).

Other countries that are key providers of raw materials for the semiconductor industry include Germany, the US, Russia, Japan, Malaysia, and France. Ukraine is also a key supplier of noble gases, such as neon, argon, krypton, and xenon, which are essential for use in semiconductor chip production processes. Without raw materials, chips cannot move off the drawing board into production.

In the global semiconductor supply chain, Figure 5 illustrates a typical journey of a smartphone application processor.

A complex and interconnected global network of partners remains essential for producing a single semiconductor chip. The supply chain for semiconductor production remains deeply interdependent on a global scale. International collaboration remains critical for the foreseeable future, in spite of deepening risk factors that threaten the stability of this supply chain.

3

TURBULENCE IN SEMICONDUCTOR INDUSTRY: RECENT EVENTS

The global structure of the semiconductor supply chain, which is highly specialized, has served the industry well through the boom cycles of innovation of end-user ICT and its consecutive adoption. However, over the last few years, several factors have induced stress on this well-functioning structure and have put this model at risk. Broadly speaking, there are four main risks the semiconductor industry faces: (1) environmental risks like natural disasters or extreme weather can disrupt semiconductor supply chains; (2) economic risks that result in demand spikes or supply gluts can impact sales and production; (3) technological risks, including cyber threats, can compromise manufacturing and data security in the semiconductor sector; and (4) geopolitical risks, including trade disputes and restrictions, may hinder the global flow of materials. Below, we break it down further:

- Environmental risks. Natural disasters, pandemics, and extreme weather events affect the supply of semiconductors due to disruptions in their operations. Recent examples include:

- Winter storms. In 2021, a winter storm in Austin, Texas, USA, led major players such as Samsung to shut down operations at least temporarily. These shutdowns affected older semiconductor facilities, possibly reducing smartphone output for Samsung.

- Droughts. The 2021 Taiwan drought raised manufacturing expenses for TSMC, a significant water-consuming semiconductor company. TSMC, using over 150,000 tons of water daily, faced challenges due to minimal rainfall. The company is said to have spent around $25 million on water trucks alone in that year, considerably exceeding its original budget planning. Water shortages continue to challenge Taiwan’s chip industry.

- Pandemics. The supply chain disruption in the semiconductor industry caused by the effects of COVID-19 is well-documented. Future pandemics and their potential disruption of the global semiconductor supply chain should not be ruled out.

Environmental risks can cause shortages, higher production expenses, and potential economic consequences for industries reliant on semiconductor technology. In response, the sector must employ resilience and contingency strategies to counter such risks.

-

Economic risks. Demand spikes, supply gluts, and other economic disruptors affect supply chains, induce market imbalances, and strain production capacities. Examples include:

-

Surge in semiconductor demand. In 2023, the global semiconductor supply-demand gap was projected to stand at 9%.[1] Closing this gap presents a significant challenge, particularly for the European automotive sector, which is forecast to experience the highest growth (11% CAGR) among all semiconductor segments until 2026. In contrast, consumer electronics is expected to grow by 4%, while smartphone growth is anticipated at just 2%.

-

Effects of demand shocks. Europe has been profoundly affected by the semiconductor shortage, with vehicle production falling by 2.3 million units in 2021, constituting 24% of global losses, making it one of the most impacted regions alongside North America, which accounted for 25% of losses.[2]

Overall, abrupt demand surges and fluctuations can catch businesses unprepared, possibly leading to supply shortages and difficulties in meeting consumer demands. Conversely, supply gluts are also possible, as seen in some semiconductor categories (e.g., with memory chips in the second half of 2023). Consequently, businesses face challenges in swiftly scaling up production, affecting their capacity to benefit from growth and fulfill orders, or reducing production and inventories in times of economic slowdown. The economic risk resides in the potential for these disruptions to trigger market instability and create broader economic imbalances.

-

-

Technological risks. Risks such as cyberattacks and ransomware attacks, impact the integrity of semiconductor products, operational efficiency, and consumer confidence. Recent examples include:

-

Cyberattacks. In 2023, Applied Materials, a leading global supplier of semiconductor manufacturing equipment, services, and software, experienced a decline in sales due to a cybersecurity attack on one of its suppliers, MKS Instruments. The attack resulted in a loss of $250 million in sales. The consequences of this attack extend to disrupted order processing, product shipments, and customer service. Such supply chain attacks exploit vulnerabilities within a company by targeting less secure elements like vendors.

-

Ransomware attacks. The semiconductor industry faced eight ransomware attacks from extortion groups in 2022. Prominent companies, such as NVIDIA, AMD, and Samsung, along with others, including Ignitarium, Diodes, SilTerra Malaysia Sdn. Bhd., Semikron, and Etron Technology were targeted. Ransomware groups perceive semiconductor firms as high-value targets and utilize media attention to coerce victims into ransom negotiations due to the sector’s critical role in the global economy. These groups employ malware to encrypt data, issue extortion threats, and even publish proprietary information like source code. Some threaten to sell stolen company data and plans to competitors or rival nations.

Given the interconnected nature of the industry and its pervasive applications, robust cybersecurity measures are imperative to mitigate risks and sustain the stability and expansion of the semiconductor sector.

-

-

Geopolitical risks. As semiconductors are crucial components in various technologies, including defense systems, communications, and consumer electronics, their availability and access can become contentious issues with geopolitical implications. Therefore, as economies compete to take the lead in the semiconductor industry, geopolitical risks must be considered. Risks stem from trade tensions and restrictions imposed by nations, potentially disrupting supply chains, restricting access to key markets, and affecting the global movement of materials and products. Geopolitical risks include:

-

Trade disputes. Trade between the US and China significantly influences the global semiconductor industry and its supply chain. The US-China trade dispute’s repercussions extend to various economies and companies within the sector. The stringent export controls imposed by the US, aimed at impeding China’s chipmaking progress, create formidable challenges for the Chinese semiconductor industry. These regulations restrict the export of chipmaking equipment and curtail the utilization of US-made tools for Chinese industries and customers. As a result, companies like Semiconductor Manufacturing International Corporation (SMIC) and Yangtze Memory Technologies encounter limitations on equipment procurement and support from their previous US and European suppliers, leading to a noticeable downturn in China’s semiconductor industry.

-

Respective security concerns of China and the US. In 2023, Japan and the Netherlands, following discussions with the US, agreed to restrict the export of advanced chip manufacturing equipment to China. This move supports the US’s strategy to limit China’s access to advanced technologies, especially in semiconductors. In response, China implemented export restrictions on key materials (gallium and germanium) crucial for various technical applications, including semiconductors. China justified these actions as safeguards to its security, and they involved a government-controlled licensing system, posing challenges for Western companies that rely on these materials. Consequently, the global supply chain is witnessing price hikes due to this geopolitical maneuvering. Additionally, China withheld regulatory approval for a $5.4 billion acquisition of an Israeli chip manufacturer by Intel, a response occurring amid escalating tensions between the US and China. The terminated deal reflects the broader context of the US imposing export controls and restrictions to dampen China’s access to advanced chip capabilities.

-

Competition over advanced semiconductors. Other economies are ensnared as well as a result of the trade dispute and geopolitical tensions. An example lies in the geographical semiconductor concentration in Taiwan, which plays a pivotal role by contributing nearly 90% of the world’s advanced chip production. Therefore, major economies like China have long sought to gain greater control over Taiwan’s semiconductor industry, seeing it as a strategic asset that could help it to become a leader in the global tech industry. Taiwan’s concentration of production amplifies supply-related vulnerabilities, primarily linked to the geopolitical tensions arising from this situation.

In summary, geopolitical risks exert profound effects on the semiconductor industry on a global scale. The stringent US export controls, for instance, hinder China’s progress in developing its local semiconductor industry. Simultaneously, Taiwan’s concentration of semiconductor production creates various supply risks, primarily originating from factors related to geopolitics.

-

4

ECONOMIC COUNTERMEASURES FOR SEMICONDUCTOR SUPPLY CHAIN SHOCKS

Localization of the semiconductor industry can help governments address some of the environmental and geopolitical risks highlighted thus far. As illustrated in Figure 6, countries are actively working to bolster the resilience of the semiconductor industry’s supply chain and ensure they have a role to play. Several governments are committing massive investments and gearing public policy toward localizing semiconductor design and manufacturing in-country. Several governments, especially those with existing semiconductor industries, are taking a nuanced approach in forming R&D and supply chain alliances with other countries to gain competitive advantage, while still taking significant fiscal measures and shaping public policies toward developing capabilities and know-how in higher-value emerging and frontier semiconductor technologies.

Some governments recognize the need to build up their engineering talent base and are investing in education and workforce development to ensure sustainable growth and innovation in their respective semiconductor industries.

Examples of these approaches are evident across various major economies globally, as described below.

The US passed the CHIPS Act in 2022 to incentivize domestic semiconductor manufacturing, drive sectorial innovation, and develop the workforce. It authorized over $52 billion in government incentives to increase the US domestic supply of computer chips and the construction of semiconductor fabrication facilities and equipment within the US.

The CHIPS for America fund will provide up to $39 billion in government loans and other financial assistance, including a 25% tax credit to semiconductor manufacturers within the US. In addition, it will provide $13 billion for semiconductor research and workforce training. Furthermore, the US is fostering collaborative efforts, exemplified by the Chip 4 Alliance, involving Japan, Taiwan, and South Korea. This initiative aims to stabilize supply chains and promote future cooperation while also strategically positioning itself amid the evolving dynamics of US-China trade, where China is rapidly advancing its chipmaking technology.

Similarly in Europe, the European Chips Act seeks to help the region secure its semiconductor supplies, ensure self-sufficiency, control more of its supply chain, reduce reliance on foreign companies, and compete with the US and Asia on tech. The EU Chips Act is a $47 billion package of public and private investments with an ambition of building large-scale capacity and innovation to ensure that Europe is self-sufficient — anticipating potential future supply crises. The goal of the act is to double the EU’s global market share in semiconductors from 9% to 20% by 2030. The EU Chips Act further acts as a figurehead for the empowerment of the European semiconductor ecosystem.

The Asia-Pacific region is emerging as a pivotal hub, as economies in this region have adopted significant semiconductor strategies to navigate the international political landscape and promote domestic semiconductor production and innovation.

For its part, China has implemented such measures as export controls and executed strategic initiatives to bolster the growth and autonomy of the local semiconductor sector, reducing reliance on foreign suppliers. The Big Fund, established in 2014 as China’s primary investment tool for the domestic semiconductor industry, encompasses two phases. The initial phase raised $19.63 billion, largely enhancing China’s semiconductor industry’s capacity and design capabilities. This phase aimed at expanding logic and memory foundries, boosting design firms, and fortifying the packaging sector. Phase II, valued at $28.9 billion, focuses on fostering key companies by investing in their upstream and downstream suppliers, often coinciding with industrial park establishment. Moreover, Big Fund II promotes applications in sectors like automotive, big data, and communications. China’s commitment to nurturing the domestic semiconductor industry underscores its drive for self-sufficiency and reduced dependence on foreign entities as showcased by the recent progress of SMIC in delivering 7 nm microchips despite sanctions on leveraging older deep ultraviolet (DUV) lithography equipment.

India has strategically committed $10 billion over the next decade to bolster electronics design and manufacturing, particularly focusing on chip design and manufacturing. Currently, nearly 80% of the funds remain to be allocated. Initiatives like the Modified Special Incentive Package Scheme (M-SIPS), Production Linked Incentive (PLI) Scheme, and the Design Linked Incentive (DLI) Scheme have been introduced to foster semiconductor ecosystem development. Responding to India’s efforts, Micron Technology, Foxconn Taiwan, and HCLTech are planning significant investments in semiconductor manufacturing facilities, reflecting India’s commitment to strengthening its semiconductor industry on a global scale. Micron Technology plans to invest $825 million in a new chip facility, Foxconn Taiwan is seeking approval for the establishment of a semiconductor unit, and HCLTech is in discussion with the Karnataka state government regarding a potential $400 million investment in an outsourced semiconductor assembly and test (OSAT) facility. HCLTech and Foxconn have also separately announced a joint venture for an OSAT facility.

Tower Semiconductor plans to seek Indian government incentives to build a $8 billion semiconductor manufacturing facility to manufacture 65 nm and 40 nm chips. Reliance Industries, Tata Electronics, and Vedanta Semiconductors are also said to be interested in entering the semiconductor manufacturing industry in India.

Taiwan remains committed to high-end chip manufacturing. Besides foundry market leadership in both mature process technologies (28 nm and older) and advanced manufacturing processes (including 16/14 nm and more advanced technologies), Taiwan is also the market leader when it comes to extreme ultraviolet lithography generation processes (known simply as EUV) — an innovative technology used in the semiconductor industry for manufacturing integrated circuits (ICs). Taiwan continues to invest heavily in R&D for cutting-edge 3 nm and 2 nm chips to secure technological leadership. Its 10-year chip program, starting in 2024 with a $375 million first-year budget, aims to continue supporting advanced IC process development and attract global semiconductor collaboration. Taiwan’s generous tax incentives include a 25% tax deduction for R&D expenditures and an additional 5% for advanced machinery spending. Major industry players like TSMC’s $2.9 billion chip-packaging plant and Fujifilm’s $110 million chip-polishing expansion underscore Taiwan’s dedication to semiconductor excellence.

Japan prioritizes chip production for economic security, committing $7.5 billion over five years to advance materials and equipment. A 10-year tax incentive program offers a 20% corporate income tax reduction for businesses in the semiconductor sector every fiscal year. Samsung and TSMC are investing significantly, with Samsung exploring a chip-packaging test line near its Yokohama R&D center, and TSMC planning a $7 billion chip plant on Kyushu Island for 12 nm, 16 nm, 22 nm, and 28 nm chip production. Micron Technology is also investing up to $3.5 billion in EUV technology with Japanese government support to pioneer EUV tech in Japan. Foundry start-up Rapidus — backed by the Japanese government and large conglomerates — broke ground on a chip fab in Chitose, Hokkaido, in September 2023 and plans to start pilot production in 2025 of its advanced 2 nm chip based on gate-all-around transistor technology.

South Korea is strategically investing to enhance value chain stability and drive global industry development through various large-scale funds and direct investments. In June 2023, a $229.25 million fund was announced to support fabless companies. In September 2023, additional investments of $301.66 million for next year and $1.8 billion over the next five years were announced. The recently approved K-Chips Act raises tax credits to 15% for major companies and 25% for smaller and medium-sized firms investing in manufacturing facilities. Samsung Electronics, in collaboration with ASML, will invest $230 billion to establish a state-of-the-art semiconductor processing technology plant in the greater Seoul area.

Singapore actively diversifies its value chain focus and attracts investment through incentives, offering a concessionary 5% or 10% tax rate for five years, tax exemption of up to 100% for fixed capital expenditure, and tax relief for automation projects. Singapore also encourages R&D initiatives and talent acquisition through an extended tax deduction of 250% for R&D until 2025 and provides 10 new Employment Passes per company for skilled overseas talent. GlobalFoundries has invested $4 billion in a semiconductor fabrication plant that is expected to produce 450,000 300 mm wafers annually at full capacity by 2025 to 2026.

Vietnam’s growing semiconductor industry receives support from the US, with $2 million allocated for workforce development. High-tech labor training is supported by a $17 million domestic fund. Samsung, Hana Micron, and Amkor Technology are investing, with Samsung committing over $2.6 billion to develop electronic components assembly facilities, Hana Micron planning a $1 billion investment by 2025 in chip packaging and memory products, and Amkor Technology opening a $1.6 billion advanced chip-packaging factory.

Thailand keenly focuses on drawing companies that engage in front-end processes, such as designing semiconductors and etching wafers, and offers extended corporate tax breaks of up to 13 years. Earlier this year, the Board of Investment (BoI) approved 20 new investment projects worth ~$870 million from Taiwanese electronics companies, aiming to establish Thailand as a new export base for the industry.

Malaysia’s incentives, including partial income tax exemptions and up to 10 years of full tax exemptions, make it a favorable destination for semiconductor investment. Chinese-controlled Nexperia expanded its Malaysian facilities and established a global R&D center, aligning with its global expansion. Infineon Technologies and Intel also have chosen Malaysia for expansion; both selected Malaysia as the destination for new semiconductor manufacturing and packaging facilities. Intel is constructing its inaugural advanced 3D chip–packaging factory in Penang, while Infineon is committing ~$5 billion over five years to develop the world’s largest 200-mm silicon carbide semiconductor plant.

Other Asia-Pacific countries, such as the Philippines and Indonesia, are also strategically investing in semiconductor industries to harness their advantages and integrate into the global value chain. The Philippines is fostering collaborative initiatives, exemplified by the US International Technology Security and Innovation (ITSI) Fund, announced last November, aimed at enhancing resilience and fostering mutual benefits. Furthermore, Indonesia, although trailing its counterparts, is actively developing a roadmap for its semiconductor industry, with anticipated completion by the end of 2024 to attract investment into the country moving forward.

While not covered extensively in this Report, countries in the Middle Eastern region, such as Saudi Arabia and the United Arab Emirates, have expressed great interest in diversifying their economies into semiconductor technology manufacturing and R&D. Israel remains an important link in the global semiconductor supply chain as a hub for advanced engineering talent and R&D. Israel’s government has also agreed to give Intel a $3.2 billion grant for a new $25 billion chip plant locally.

In the South American region, Mexico and the US have announced a strategic partnership to explore semiconductor supply chain opportunities.

5

SCALING UP THE SEMICONDUCTOR TECHNOLOGY INDUSTRY VALUE CHAIN

Countries that currently do not hold a significant position in the global semiconductor industry could take several measures to create an enabling regulatory environment to grow their local semiconductor industries. Countries with a meaningful position in the semiconductor industry could become even more serious global players in attractive product segments with the right mix of regulatory support, talent, and partnerships.

Having the right infrastructure, capabilities, and know-how to produce entry-level semiconductor technologies like basic memory chips and logic chips is a good foundation. Thereafter, additional measures could occur in a phased approach to gradually build up more advanced capabilities and enabling infrastructure to scale up into higher-value emerging and frontier technologies of the semiconductor industry over time, including the following (see Figure 7):

-

Fiscal measures. Governments could constantly review their foreign direct investment programs, tax incentives, and other fiscal measures to ensure that they match or improve on those of competing countries. Holistically examining the direct and spin-off benefits of fiscal measures in areas like job creation, creating end-user application industries, building semiconductor technology intellectual property, defending against future potential chip shortages, and so on, will enable the impact of fiscal measures to be viewed in the wider context of economic development, technological innovation, and security.

-

Neutral geopolitical positioning. Ongoing fluctuations in geopolitical positioning within different country alliances present opportunities for governments that are adept at navigating these intricacies to build up their local semiconductor capabilities as neutral brokers and sources of semiconductor raw materials, equipment, and/or chip supply.

-

Engineering talent. Semiconductor technologies are rapidly advancing in emerging areas like power electronics, optoelectronics, and sensors, as well as frontier technologies, such as system-on-chip, AI, and high-performance computing, among others. Such technologies require engineering talent not just for R&D but also to keep advanced manufacturing facilities in operation. Governments that can foster local engineering talent as well as attract overseas talent skilled in these emerging and frontier technologies will reinforce their competitive advantage as technology continues to evolve rapidly and impact the types of end-application industries that use semiconductors.

-

End-application industries for semiconductors. Continued support by governments to promote low/no-tariff trade and provide tax breaks and other export-oriented and domestic consumption–related fiscal measures for relevant end-user application industries will ensure a virtuous cycle of supply/demand to reinforce the return on massive investments needed to create or expand a local semiconductor industry. Examples of such end-user application industries closely intertwined with semiconductor demand include electronics, telecommunications, automotive, and healthcare, among others.

Conclusion

The semiconductor industry plays a pivotal role in driving economic development, technological innovation, and security. Its applications span critical sectors, including automotive, healthcare, communications, and AI. However, the industry faces numerous challenges, such as supply chain vulnerabilities, environmental risks, geopolitical tensions, and technological threats.

Recent events like natural disasters, trade disputes, and geopolitical conflicts have underscored the need for resilience and contingency strategies within the industry. Governments worldwide are looking toward various countermeasures to bolster supply chains and promote domestic semiconductor manufacturing. Scaling up the semiconductor industry requires a multifaceted approach, including:

-

Tracking, foresight, and analysis. Conduct a systematic analysis of emerging technologies to anticipate future sources of semiconductor demand to guide the investments and commitment required to build industry capabilities.

-

Stakeholder engagement. Actively engage with incumbent companies to foster equitable access into the global ICT/semiconductor value chain through fiscal measures and creating enabling supporting infrastructure.

-

Pursuing targeted capacity building. Develop an advanced engineering talent pool and a competitive advantage (e.g., by focusing on the application of emerging or frontier semiconductor technologies or on specific value chain activities like material and equipment supply).

By fostering a conducive environment for semiconductor innovation and production, countries can position themselves as key players in the global semiconductor value chain, driving economic growth and technological advancement in the process.

Notes

[1] Grishina, Diana, et al. “What Does the Semiconductor Shortage Mean for Europe?” Automotive World Magazine, 6 January 2023.

[2] Ibid.

DOWNLOAD THE FULL REPORT